Big share sale target in FY21? AI, BPCL, CCRI plus some more

Dalal Street analysts expect disinvestment proceeds to touch Rs 50,000 crore in FY20.

by Amit Mudgill

NEW DELHI: Dalal Street analysts largely expect the unfulfilled disinvestment targets for FY20 to be carried forward into FY21, which may result in a Rs 1 lakh crore-plus divestment target for another year.

They expect disinvestment proceeds to touch Rs 50,000 crore in FY20, less than half of the Budget target of Rs 1.05 lakh crore. This would still be much higher than Rs 18,094.59 crore raised so far.

Nomura India, which pegged the FY21 disinvestment target at Rs 1.5 lakh crore, said the clubbing of FY20 and FY21 disinvestment agendas promise to set an “overly ambitious target for the government.”

Motilal Oswal Securities feels though the government has failed to divest BPCL this year, it will certainly be budgeted for next year.

That may imply the disinvestment target for FY21 to be much higher at Rs 1,00,000 crore, if not more, compared with an expected realisation of Rs 60,000 crore this year, it said.

This year’s share sale so far included two IPOs -- namely Rail Vikas Nigam (Rs 475.89 crore) and IRCTC (Rs 637.97 crore) -- an OFS by RITES amounting Rs 730 crore, CPSE ETF worth Rs 10,000 crore and Bharat 22 ETF at Rs 4,368.80 crore. The government also sold enemy shares worth Rs 1881.21 crore, as per Dipam.

On Thursday, the government launched another tranche of CPSE ETF, looking to raise at least Rs 10,000 crore.

Besides, the government has moved forward with plans to sell Air India for the second time in less than two years. It has already issued the preliminary bid document for 100 per cent stake sale in the debt-laden airline.

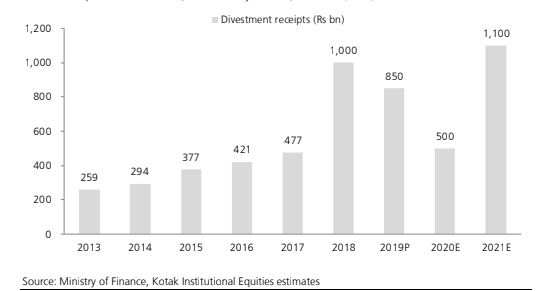

Kotak Institutional Equities said the government would aim to complete the ongoing privatisation of Air India, BPCL and CCRI in FY2021. So the disinvestment target for FY2021 would be meaningfully higher than the divestment revenues raised in last few years.

“We are not clear about the divestment revenues for FY2020. We have modeled Rs 50,000 crore. We doubt the government can achieve even this amount without resorting to intra-PSU stake sales. In this context, NTPC will acquire the government’s stake in Neepco and THDC India. The government may resort to more such sales in FY2020 to bolster divestment revenues. However, forced M&As between PSUs may result in a further de-rating of multiples of the PSU stocks, which already trade at low multiples,” Kotak warned.