TCG BDC: The Case Of The Unattractive High Yield

by Michael A. Gayed, CFASummary

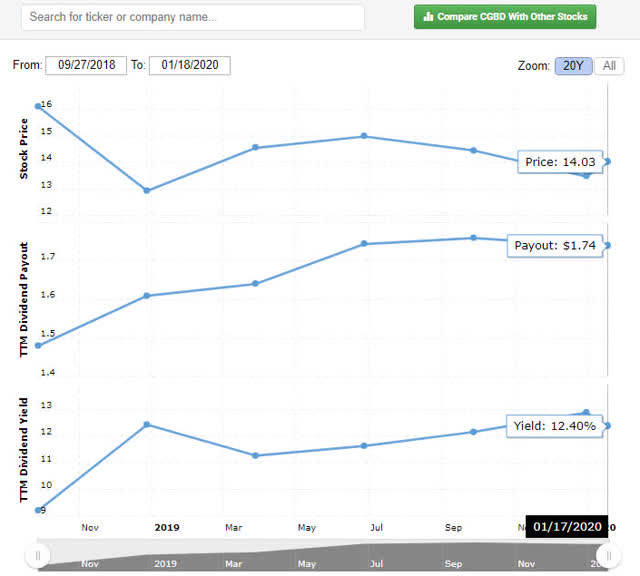

- Sporting a high dividend yield of 12.40%, TCG BDC stock may be on many investors’ watch list.

- The company regularly pays dividends and repurchases shares every quarter, but funds for these activities are not sourced from its operating cash flows.

- Legacy issues related to its JV with Madison Capital are thorns, and once resolved, the company could see better days.

All loans, in the eyes of honest borrowers, must eventually be repaid. All credit is debt. Proposals for an increased volume of credit, therefore, are merely another name for proposals for an increased burden of debt. They would seem considerably less inviting if they were habitually referred to by the second name instead of by the first

- Henry Hazlitt, Economics in One Lesson

Specialty finance company TCG BDC (CGBD) looks good at first glance: 77% of the company’s loan book is graded as Stable Risk, its earnings are decent, and the company seems cheaply valued. In Q3 2019, it earned $0.45 per share and distributed $0.37 as dividend.

The TCG BDC stock has been primarily dragged down because of its legacy issues, and it does not merit a Buy rating at this time. Regular dividends and share repurchases look good on paper but are facilitated by additional debt. Despite these niggles, I’d rate it as Neutral and suggest putting it on a watch list. Here are the reasons why.

Prospects in 2020

The following analysis is based on TCG BDC’s Q3 2019 earnings call transcript and events after the call:

- Though the company had stopped investing in its JV with Madison Capital since 2017, the hangover continues and legacy issues are yet to be sorted out. The management team is working on a plan to sell, restructure or manage the residual exposure. CGDB’s NAV declined from $17.06 to $16.58 in Q3 because it was offset by realized and unrealized losses due to these issues. A $17 million worth of share repurchase during the quarter caused an increase of $0.14 in NAV, absorbing losses to that extent. As 70% of the company’s loan book is secured (first lien), and each sector accounts for no more than 12% of its portfolio, the management team believes that the company’s loan book is well-diversified and safe.

- CGBD earned $0.45 per share in Q3 2019 and distributed $0.37 as dividend. However, a small bump-up in the earnings per share was because of share repurchases. The company declared a Q3 2019 dividend of $0.37 at the time of the earnings call, and later followed it up with another $0.18 special payout on December 20, 2019, taking the total dividend for the year to $1.74 and the dividend yield to 12.50% (market price $13.89 as of January 29, 2020). Management expects the dividend distribution trend to continue going forward and remains focused on this goal. This should get the attention of dividend investors.

- (Image Source: Macro Trends)

- Management opines that the stock price is below the company’s intrinsic value and it will continue to repurchase shares, which spells good news for the stock price and NAV. This may sound good on paper, but there is a joker in the pack that’s discussed in the next section.

- CGBD has beefed up its team on both the underwriting side and the senior management side. It expects sharper performances going ahead.

- On December 30, 2019, CGBD issued $115.0 million 4.75% Notes that will mature at par in 2024. The company intends to use the funds to reduce debt and repurchase shares. Debt reduction will boost margins, while share repurchases will boost the price. This can be some more good news for stockholders.

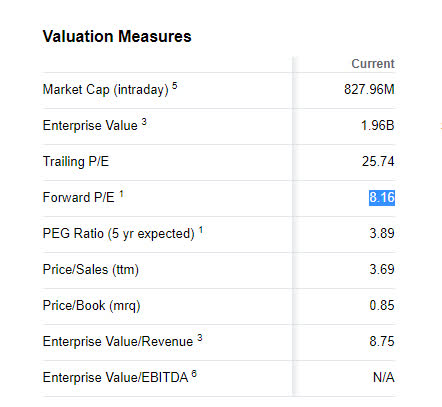

Valuation

CGBD sports an attractive valuation. A forward P/E ratio of 8.16 and a 5-year forward-looking PEG ratio of 3.89 look good. The PB too is very low at 0.85, and if you take into account the funds raised partly for share repurchases, it does seem that the company will buy its stock until its market valuation stands on par with its intrinsic value.

(Image Source: Yahoo Finance)

Major Concerns

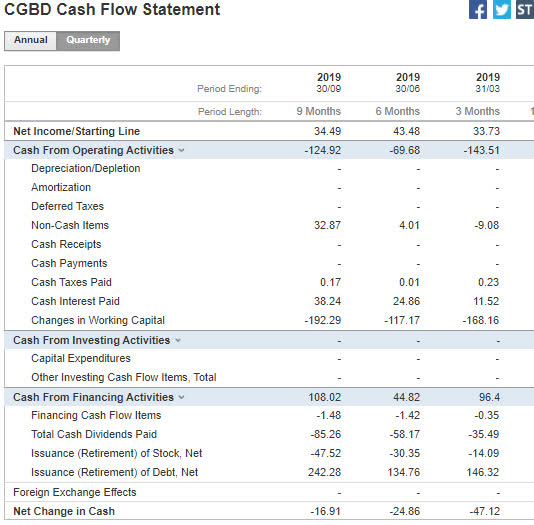

Here comes the first big black swan: negative operational cash flow.

(Image Source: Investing.com)

(* In millions of USD (except for per share items)

Operating cash flows have been negative in every quarter of 2019, and share repurchases and dividends have been facilitated by the issuance of debt. The company is borrowing to please its shareholders and support its NAV. This is a major disappointment.

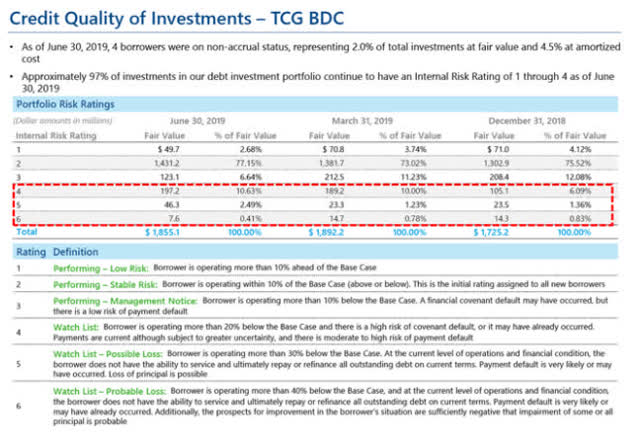

The second black swan is credit quality.

(Image Source: BCD Buzz)

As of June 2019, about 13.5% of CGBD’s investments amounting to about $250 million were graded as “on watch list” category, indicating that these could turn bad going forward. 77% of its investments were graded “Stable Risk”, which is the rating that gets assigned to new borrowers.

Stable Risk gets assigned to borrowers that operate within 10% of the base case (the expected case assumed by CGBD’s risk model). Well, the company’s risk model has faltered in the past. Therefore, assuming that all its Stable Risk loans are good loans may be a fallacy. However, 70% of its portfolio is backed by first-lien instruments, and that is a sigh of relief.

Summing Up

CGBD is a Regulated Investment Company (RIC) that receives flow-through tax treatment and is not taxed at the investment company level. This regulatory concession enables the company to distribute higher dividends to shareholders. One independent analyst recommends TCG BDC as a retirement portfolio play because its dividend yield is high and the business of BDCs is highly transparent and regulated by the SEC, states and regulators. Another analyst is bearish on the stock because of its increasing expenses and depreciating NAVs. Opinion is divided here.

TCG BDC’s legacy issues are causing a drain on operating cash flows, and the company has borrowed in every quarter of 2019 to finance its dividend payouts and share repurchases. On December 30, 2019, the company borrowed some more to retire old debt and repurchase stock.

A comparison with two peers reveals that TCG BDC is performing at par with CIT Group (CIT) and better than Alerus Financial Corp. (OTC:ALRS). But that is not enough reason to get bullish on the stock.

(Image Source: Seeking Alpha)

The quarter-over-quarter borrowing by the company and the fact that it is using debt to finance dividends and share repurchases are not healthy signs. Though the negative operating cash flow phase may be temporary, there is no clarity on when it will get sorted out. The risky loans are worrying too.

I am Neutral on the stock at this moment, but will track it to figure out when it starts generating positive operating cash flows and/or stops borrowing every quarter to fund shareholder-friendly activities. At that point it will be worth considering as a dividend play, all other things being equal.

*Like this article? Don't forget to hit the "Follow" button above!

How To Avoid the Most Common Trading Mistakes

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.