Technically Speaking For 12/9: The Weekly Charts Are Bullish

by Hale StewartSummary

- Hedge fund activity might be a partial reason for the spike in money market yields this fall.

- Tech companies face increasing pressure.

- The weekly charts are positive.

A report from the BIS argues that hedge funds contributed to the spike in money markets earlier this year (emphasis added):

Shifts in repo borrowing and lending by non-bank participants may have also played a role in the repo rate spike. Market commentary suggests that, in preceding quarters, leveraged players (eg hedge funds) were increasing their demand for Treasury repos to fund arbitrage trades between cash bonds and derivatives. Since 2017, MMFs have been lending to a broader range of repo counterparties, including hedge funds, potentially obtaining higher returns.

Here's the thumbnail version: QE moved large banks to the side of the money market, allowing non-traditional players to fill the void. Hedge funds saw an opportunity to goose returns by buying Treasuries and selling a corresponding derivative contract. This exacerbated the situation.

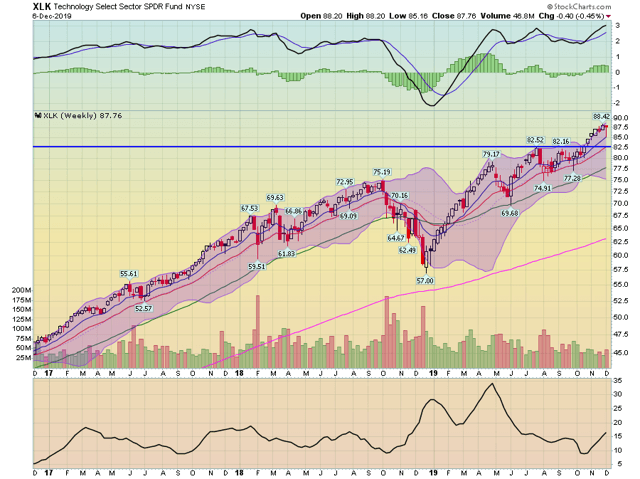

The pressure continues to build on tech companies. The European competition commissioner has sent a questionnaire to news companies asking how they share information with tech companies. Beijing has ordered government agencies to be stripped of foreign technology in five years. Additionally, Congress is investigating the sector and several presidential candidates have proposed to break-up Facebook and Google. So far, this hasn't hurt the XLK's performance; it's up 14% in the last six months and 31% during the last year. But at some point, that might change. Considering technology is the most important sector for the major indexes -- comprising 22% of the SPY and 46% of the QQQ -- weak tech performance could seriously hurt future returns.

Here are the top five performing Dividend Aristocrats from last week (data from Finviz.com):

- (TNC) +6.41% (Big move on Tuesday)

- (TR) +3.96% (gapped higher on Friday; no major news)

- (TDS) +3.75%: hedge funds are accumulating ("At the end of the third quarter, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 4% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards TDS over the last 17 quarters.")

- (HP) +2.91% (Strong move on Friday)

- (PPG) +2.87%: Stronger outlook: ("Better-than-expected earnings performance in the third quarter and healthy growth prospects has contributed to the gain in PPG Industries’ shares.")

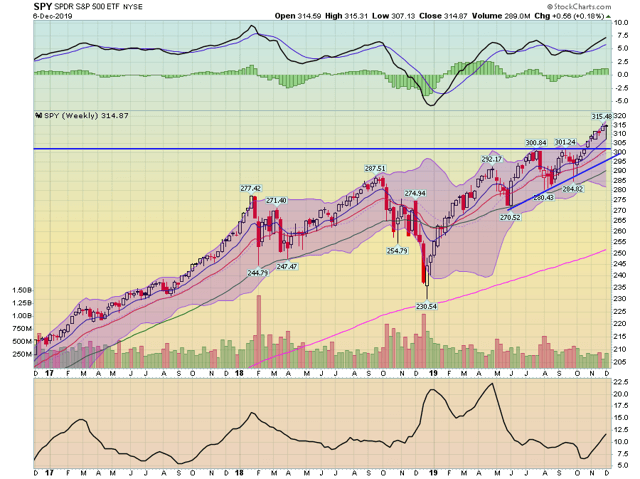

Today I wanted to "pull the camera back" and take a look at the weekly charts from the major ETFs that I track because they show that the markets are in very good long-term shape.

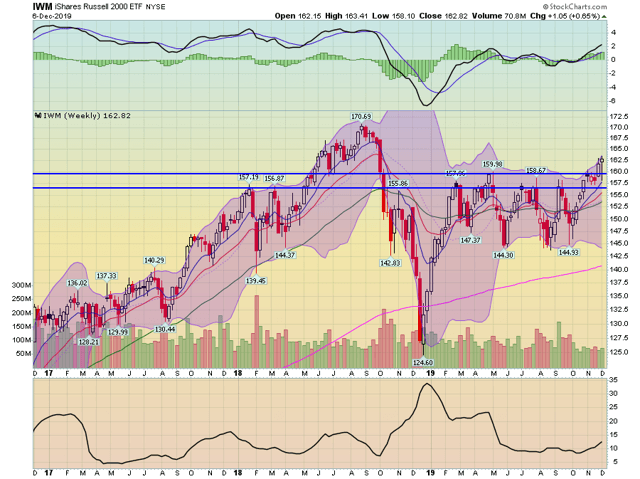

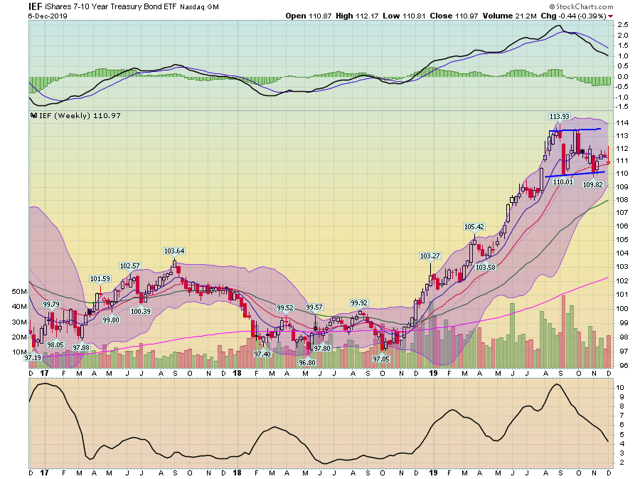

Let's start with the SPY:The SPY has broken through key areas of resistance in the lower 300s. All the EMAs are rising as is momentum. Small-caps have also moved through key resistance areas in the upper 150s. Momentum is also rising while the EMA alignment is bullish.Treasuries are consolidating gains at the top of a long rally.

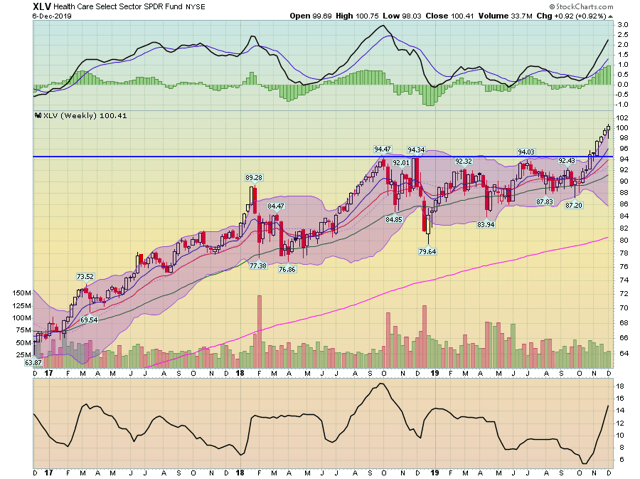

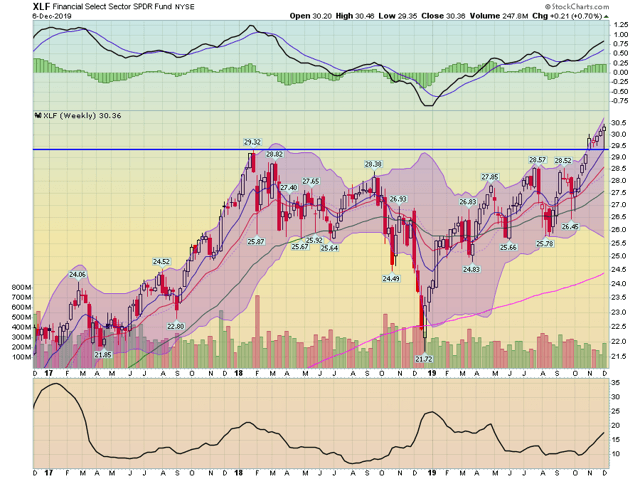

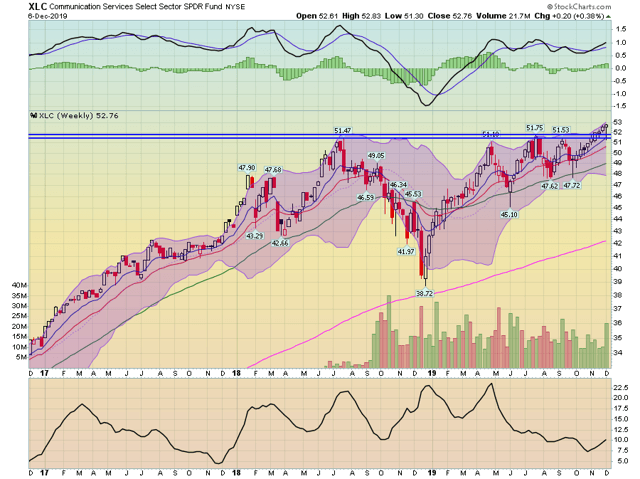

Next, let's turn to the four largest sector components of the SPY, accounting for about 60% of the index:Tech moved through resistance in the lower 80s and has rallied about 10% since. Momentum is strong.Healthcare has made a strong move through the mid-90s, which had contained the ETF for the better part of a year. EMAs are bullishly aligned. Financials moved through resistance in the upper 20s and have been in a rally since the beginning of August.Communication services have moved through resistance in the lower 50s.

The long-term chart picture is extremely positive:

- Large-caps are making new highs

- Small-caps are moving higher, although they're underperforming larger-caps

- The largest sector components of the SPY are moving higher after breaking through resistance levels.

We only have a few weeks left in the trading year. During this time, managers typically move assets around in an attempt to goose returns. There's no reason to expect anything different this time around. So, unless there's a major economic development over the next few weeks, I'd expect the long-term picture to hold until next year. And that's a very positive picture.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.