My 10-Year-Old Picks Starbucks For Her Dividend Duchess Portfolio

by Blue Chip DRiPSummary

- My 5th grade daughter chose Starbucks as the 2nd purchase for her "Dividend Duchess" portfolio.

- We fund this custodian account exclusively with my Seeking Alpha Contributor earnings. All dividends will be reinvested.

- Each month she learns a little more and I can see the wheels turning in her mind. Investing is fun!

Say Hello To My Daughter

Lucy is 10 years old and in 5th grade. She's keen on skiing, mountain biking, parkour, dancing, art, knitting, cooking, and most recently... investing in dividend growth stocks. I must admit, I'm jealous of her 40+ year time horizon. Last month, we started a specific custodian account for her to manage, which is kept separate from the college savings account that I tend to. She promptly named it the Dividend Duchess Portfolio and made her first purchase - Coca-Cola (KO).

This is the second installment of the Dividend Duchess series. To get up to speed, and learn more about our goals, I recommend reading the first article if you haven't already. I try not to bombard her with too many concepts at once, but Lucy has been grasping everything so far, and asking thoughtful questions in return. As a dad, it sure is exciting to see her interest and understanding of compounding and passive income blossom.

Portfolio Funding Update

For fun, I decided to fund Lucy's portfolio exclusively with my earnings as a Seeking Alpha Contributor. That way, she gets a small amount of money to invest each month, and I can simultaneously report on my slowly growing (hopefully) SA contributor earnings. This might be of interest to any of you that already contribute to SA, or are considering it. I'm still new to this, but find the interaction with you guys (and gals) quite educational and inspiring. With that said, here are my contributor stats as of 12/5/19:

| # of Articles Written | Income Received to Date | Avg. Income per Article |

| 8 | $343.31 | $42.92 |

Last month, Lucy paid $104.46 for 2 shares of Coca-Cola. Some quick math reveals that she has $238.85 burning a hole in her pocket this month. So, how is she going to invest it?

The Stock Selection Process

After a chat about the risks of "putting all your eggs in one basket", Lucy is versed in the principle of diversification. The egg talk morphed into a goal of growing her portfolio into a dozen stocks over the next year. With that in mind, we decided to use this month's loot to purchase shares in a new company, rather than adding to KO. Hmm... what to buy?

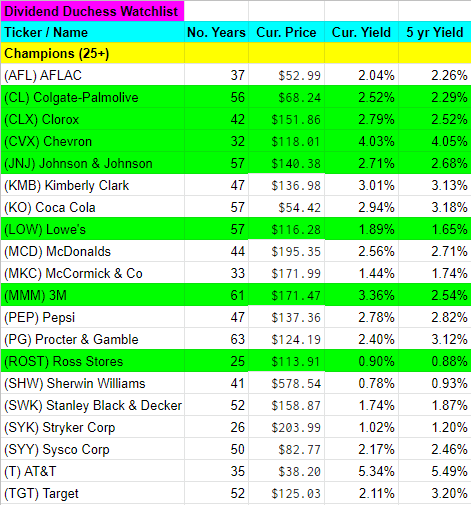

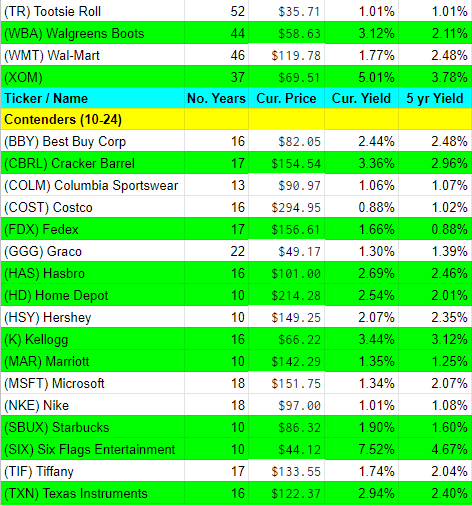

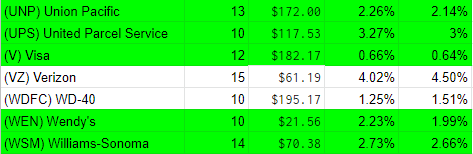

We needed a "by the numbers" selection process. Lucy grasps the concept of businesses building a track record of consistently increasing their dividends over time and why that's an important consideration when choosing potential companies to invest in. So I familiarized her with the CCC list. We then decided to use Dividend Champions (increasing dividends for 25+ years) and Dividend Contenders (increasing dividends for 10-24 years) as the first criteria for our watch list.

This gave us a daunting scroll of almost 400 companies. Way too many to navigate without dying of boredom. So, out came the highlighters and a new game. Lucy, Molly (6 year-old sister), and I sat at the dining table while mom made soup. Pink for Champions, yellow for Contenders. One question - "Do you recognize this company - yes or no?" Sure, I helped with some. Bring me your toothpaste - Procter & Gamble (PG). Grab my tape measure from my tool box - Stanley Black & Decker (SWK), etc. Next thing you know, we're rummaging through Kellogg (K) cereal in pantry, talking like the Aflac (AFL) duck and looking up the thousand uses of WD-40 (WDFC). Molly mistook Graco (GGG) for Draco Malfoy (from the Harry Potter books) and we all had a laugh. Lucy remembered Stryker (SYK) because grandpa just had his knee and hip replaced and he "wishes it paid a higher dividend". Learning + having fun = Winning!

After the recognition game, we were down to 48 companies. Next, we made a spreadsheet and plugged in one more filter. After highlighting the companies sporting a current yield higher than their 5-year average, we were quickly down to 23 solid dividend growers to choose from. Here's the list:

From there, it was time for Lucy to pick. With a 40+ year investing horizon, I figure pretty much any company in green is free game. It didn't take long before she made her choice for this month.

Definitely Starbucks, Dad

No surprise - she chose Starbucks (SBUX) right away. Instantaneous excitement and brand recognition. But I wasn't going to let her off the hook just because she's allowed a green tea frappuccino once in a while. Before logging into Schwab and making the purchase, answer me this: "Lucy, why do you think Starbucks will make a good addition to your portfolio?" First came the obligatory answers:

- They've been raising their dividends for 10 years and the current yield is higher than the 5-year average.

Classic spewing out the answers she knows the teacher wants to hear. But eventually, her "real" thoughts came out, and it's refreshing to hear it in her words:

- They have yummy drinks and yummy food.

- There's always cool art on the walls and it's never the same.

- Never empty. People are always in line and hanging out on their laptops.

- A bunch of stores all over the place. (She even mentioned the word "moat"!)

- The drinks don't get boring. They change it up seasonally.

The Magic Green Button

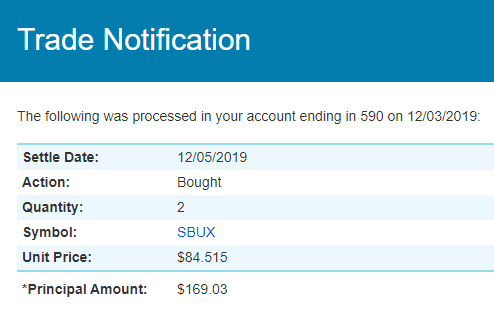

Now to the best part! Log in to Schwab with $238.85 to make the purchase. With a pencil and paper, she figured she could buy two shares and save the remaining cash for next month. Navigate through the trade screens, and click the magic green button:

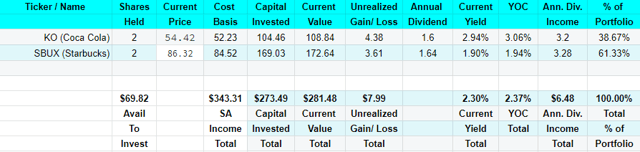

With the purchase of 2 shares of SBUX for $169.03, the Dividend Duchess added $3.28 of passive income. This brings her estimated forward annual dividend income up to $6.48 and she has $69.82 left in cash to roll over into her next purchase. Here's a snapshot the portfolio as of 12/5/19:

Conclusion

I'm having a blast working with Lucy on her Dividend Duchess Portfolio. She's already mulling over next month's potential candidates. The underlying message is: Start 'em young. It's never too early to teach and implement a disciplined savings and investment strategy with your kids. Especially if it's woven into some games, messing around on the internet, and explaining that they're now making $6.48 a year without even lifting a finger!

I hope you'll stick around for this journey by clicking the orange "Follow" button up above.

Have any tips for teaching kids about saving/investing? What else would you like me to include in these updates? What's on your watchlist? Do tell!

As always, best of luck on your quest for financial emancipation!

Disclosure: I am/we are long SBUX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not stock advice. These are purely my opinions. I'm not a professional. Do your own research. Best of luck in your investing journey!