Falling Rail Traffic Makes Union Pacific A Sell

by Shock ExchangeSummary

- UNP warned Q4 rail traffic could fall by double digits. Revenue could decline slightly less.

- UNP expects its 2020 operating ratio to remain below 60%, which is stellar.

- Cost cutting may not fully protect the bottom line amid falling rail traffic.

- Sell UNP.

Source: Forbes

Last week Union Pacific (UNP) presented at the Credit Suisse Industrials Conference and the company delivered a bit a bad news. Management expects Q4 volume to decline by at least 10% Y/Y:

Union Pacific says it expects Q4 volumes to decline by at least 10% from the prior-year quarter and revenue to drop by a "similar" but slightly lower percentage than volumes, but the stock is poised to snap a five-session losing streak.

Management also expects the decline in revenue to be similar to the decline in traffic. The trade war between China and the U.S. is taking its toll. The lack of exports to China has hurt rail traffic. Trade tensions have also had knock on effects. Businesses may be reticent to invest in property and equipment until trade tensions subside. Industrial production fell by 0.8% in November, the largest decline in 17 months. Weak industrial production and manufacturing are likely leading to fewer goods and services being shipped cross country via railroads. That could portend even less rail traffic going forward.

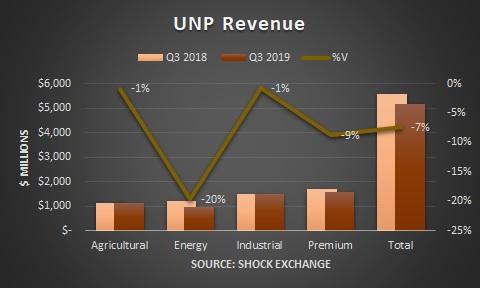

Combined U.S. carload and intermodal originations for the month of November were down over 7%. In Q3 2019 Union Pacific generated $5.1 billion in freight revenue, down 7% Y/Y. Total carloads fell 8% while average selling price ("ASP") increased 1%.

Each of the company's major product categories experienced declines. Energy (down 20%) was particularly hard hit as sand carloads cratered and coal and coke volume fell by double digits. Industrial represented 29% of total revenue; the country's industrial production remains weak and it could be one of Union Pacific's worst-performing sectors in Q4.

Union Pacific's ASP rose slightly in Q3, yet the company may not be able to rely on price hikes over the long term. If volume falls 10% and Union Pacific cannot hike prices then who far can revenue fall? Can UNP longs stomach a potential double digit decline in revenue?

UNP Expects A Sub-60% Operating Ratio In 2020

In reaction to the slow down in rail traffic, U.S. railroads have been cutting costs. Union Pacific has been gradually cutting costs, while improving its workforce productivity. Its Q3 workforce was down 13%. Compensation and benefits expense of $1.1 billion fell 10% Y/Y, yet management was able to improve its service product. Purchased services fell 9% on reductions in repair costs and contract services. Fuel costs fell another 24% as the decline in rail traffic resulted in less fuel consumption.

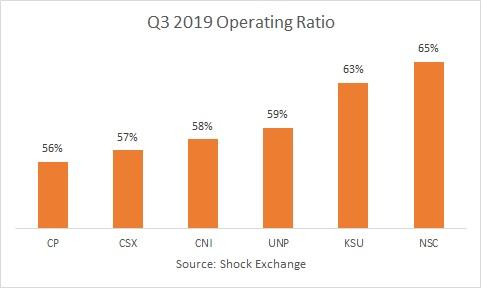

As a result, Union Pacific cut its expense ratio to around 59%, down 300 basis points versus the year earlier period. EBITDA of $2.8 billion fell 1%, but the EBITDA margin of 51% was 300 basis points higher than the year earlier period. An expense ratio sub-60% puts the company in the same category as CSX (CSX), Canadian National (CNI) and Canadian Pacific (CP).

Management expects to produce an operating ratio below 60% for full-year 2020. This could help buttress EBITDA amid declining rail traffic and revenue. I believe we are at peak economy. Even if the trade war with China ends I expect the economy to decline over the long-term. That does not bode well for future rail traffic.

Will Union Pacific's Valuation Hold Up?

UNP is up 20% Y/Y. Cost cuts may not fully protect its bottom line if rail traffic and revenue fall by double digits. With an enterprise value of $144 billion, UNP trades at 13.3x run-rate EBITDA (last three quarters annualized). Its robust valuation reflects an incessant melt up in financial markets. The Fed has cut interest rates amid a lingering trade war, and has added trillions to financial markets to ensure the market is flush with liquidity. I believe Fed actions have fueled markets. The question remains, will UNP's robust valuation hold up amid falling rail traffic?

Conclusion

Union Pacific's warning could be one of many. Economic expansion cannot last in perpetuity. The trade war may have exacerbated the downturn. Sell UNP.

I also run the Shocking The Street investment service as part of the Seeking Alpha Marketplace. You will get access to exclusive ideas from Shocking The Street, and stay abreast of opportunities months before the market becomes aware of them. I am currently offering a two-week free trial period for subscribers to enjoy. Check out the service and find out first-hand why other subscribers appear to be two steps ahead of the market.

Pricing for Shocking The Street is $35 per month. Those who sign up for the yearly plan will enjoy a price of $280 per year - a 33% discount.

Disclosure: I am/we are short UNP, CSX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.