Clovis Oncology: Best In Class

by BioSci Capital PartnersSummary

- From the fundamental front, Rubraca is procuring about $147.0M in annual sales even as a second-line drug. That robust growth is powered by a 38.7% year-over-year sales growth.

- Not satisfied with good, Clovis is advancing Rubraca into the first-line drug indication for ovarian cancer with Bristol-Myers Squibb's Opdivo. I strongly believe the results will trump competitors.

- That aside, Rubraca has the best data among competing drugs for prostate cancer with BRCA mutations. And, the upcoming label expansion will boost Clovis' true worth by multiple folds.

When it's raining gold, reach for a bucket, not a thimble. - Warren Buffett

If you've been following my work, you'd notice that Clovis Oncology (CLVS) is one of the most groundbreaking stories in late 2019. As we're heading into the New Year, the market is less concerned about the China Trade War and drug pricing concerns. As such, Phillip Fisher's growth equities like Clovis are embarking on mega rallies.

Despite the fact that investors took profits, Clovis still logged in 237.6% returns. In my view, the robust fundamental developments, coupled with a drastic change in market sentiment, powered the said phenomenon. Now my gut feeling (i.e. instinct) is telling me that there are more rallies ahead. In this article, I'll feature a deep-dive analysis into Clovis and share with you my forward expectations.

Figure 1: Clovis chart (Source: StockCharts)

About The Company

As usual, I'll present a brief corporate overview for new investors. If you are familiar with the firm, you should skip to the next section. Headquartered in Boulder, Colorado, Clovis is engaged in the innovation and commercialization of medicines to serve the unmet needs in cancer treatment. The company is currently focusing on ovarian, prostate, breast, and bladder cancers.

The flagship molecule, rucaparib (Rubraca) is FDA approved back in April 2018. As an oral, small-molecule inhibitor of poly (ADP-ribose) polymerase (“PARP”), Rubraca is marketed as second-line maintenance for recurrent ovarian cancer. Because it is a second-line drug, sales have been gradual. In my view, the most aggressive revenue growth occurs when Rubraca goes into first-line. That is to say, it'll become a blockbuster.

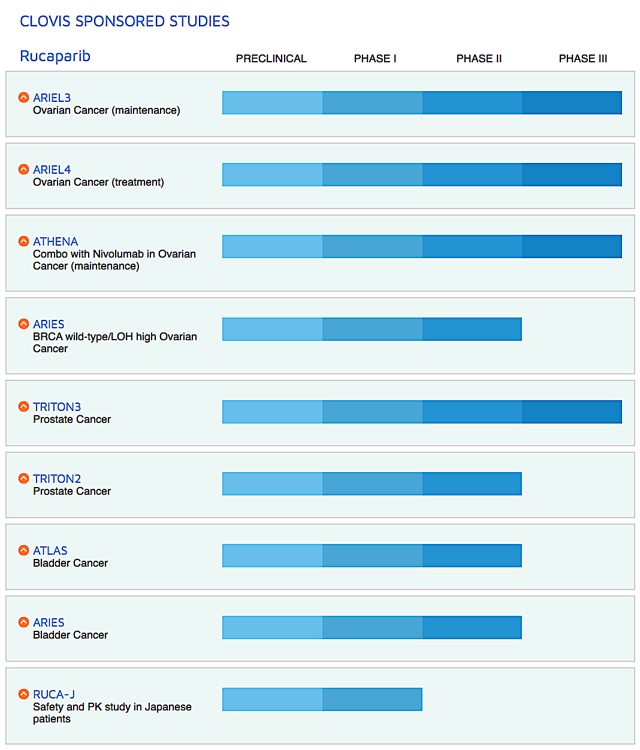

Figure 2: Therapeutic pipeline (Source: Clovis)

That aside, Clovis is assessing different combinations treatment of Rubraca either with immune checkpoint inhibitors and other drugs (lucitanib and rociletinib) for various cancers. Just recently, the firm in-licensed the rights to a radiopharmaceutical targeting drug known as FAP-2286. I expect it to file an investigational new drug ("IND") application for FAP-2286 by 2H2020.

Rubraca Is The Best In Class PARP

Shifting gears, I'd like to point out a fact that financial news can be fickle. For instance, you see a bullish story one day only to witness several bearish articles the next day. Hence, you must check the data for yourself and thereby come to your own conclusion. Don't let your fear and self-doubt deter you away from the Promised Land of mega-profits. You need to trust your gut feelings (i.e. instinct).

That being said, let's assess Rubraca's mechanism of action and see how it performs in clinical studies. As a PARP1, 2, 3 inhibitor, Rubraca is special! In other words, the drug knocks out all three PARPs that are crucial for cancer's growth. Specifically, Rubraca suppresses the proteins responsible for DNA restoration. By deterring cancer cells from repairing their DNA, that forces these rogue cells to commit suicide (i.e. apoptosis).

Aside from the three PARPs, the said drug also hits two other DNA repair enzymes dubbed BRCA1/2. These are enzymes notorious for driving resistant cancers. By suppressing many targets at once, Rubraca significantly limits the time cancer cells have to evolve for escaping immune detection.

Of note, cancer cells divide rapidly and thereby evolves at a rapid pace. As such, the cornerstone of cancer management, i.e. combination therapy, aims to stop cancers before they mutate their genes. To carry out combination treatment, patients are usually given multiple cancer drugs (i.e. chemo). In my view, the best combo is one that is built into one molecule like Rubraca.

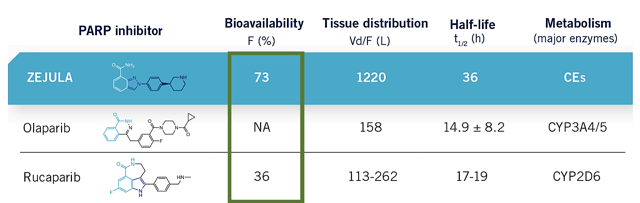

Rubraca, Zejula And Lynparza For Ovarian Cancer

Now that you revisited how Rubraca works, let's see how it sizes up against competitors. Asides from Rubraca, the other PARP inhibitors include niraparib (Zejula) and olaparib (Lynparza). They are already launched as maintenance therapies for cancers of the ovaries and women's reproductive tracts. For simplicity, I'll just group all related indications as ovarian cancer.

Looking at this niche, Lynparza is currently crowned as the first-line medicine. Notice how I used the word "currently." That's because I doubt monotherapy is best for an aggressive cancer like ovarian. Specifically, you need to treat the patient with a combo regimen. Else, the cancer will evolve and thereby causes treatment relapse. That's why Clovis and Bristol-Myers Squibb (BMY) teamed up to develop the Rubraca and nivolumab (Opdivo) combo as a first-line regimen for ovarian cancer.

If the cornerstone of cancer treatment is true, a combo treatment like Rubraca/Opdivo will post superior outcomes versus Lynparza monotherapy. But how? Well, Opdivo relieves the brake on the immune system that cancer exerts. At the same time, Rubraca presses on the gas pedal. The outcome is a speedy recovery due to treatment synergy.

In my view, no single molecule (be it Rubraca, Lynparza, or Zejula) can accomplish that feat alone. As such, I ascribed the Phase 3 ATHENA trial for Rubraca/Opdivo a 75% (i.e extremely favorable) chance of success. As I use a highly conservative system, my 75% equates to other's 95%.

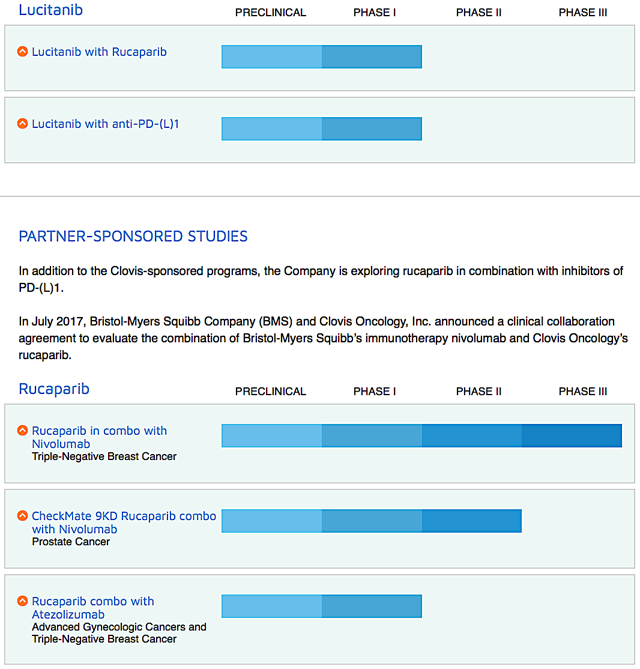

Now even as a monotherapy, Rubraca already takes care of patients whose ovarian cancer worsens after two or even three chemotherapies. In contrast, Lynparza and Zejula can only handle those who failed one chemo alone. Amid these facts, you don't even need to run head-to-head comparisons to figure out which drug is the reigning champion.

Figure 3: Differentiating strengths (Source: Rubraca)

Rubraca, Zejula And Lynparza For Prostate Cancer

Asides from ovarian cancer, I strongly believe that Rubraca's blockbuster prospect resides in its label expansion for metastatic castration-resistant prostate cancer (i.e. mCRPC) with BRCA.

On this front, Rubraca recently published the stellar Phase 2 (TRITON) data. Notably, there was an unprecedented 43.9% confirmed objective response rate (ORR) in 57 patients afflicted by mCRPC having the BRCA1/2 mutation. More importantly, Rubraca's efficacy is confirmed by monitoring the prostate-specific antigen (i.e. PSA) reduction.

Of note, PSA is a blood marker to follow whether prostate cancer is in remission. Therefore, you want to see the PSA lowers with treatment. Specifically, 52.0% of the 98 evaluable patients witnessed their PSA trended down. Since a PSA reduction means the drug works, Rubraca's ORR should be higher than 43.9%. I believe that its actual value is around 52.0%, i.e. the same as the PSA response rate.

Regarding Lynparza, its Phase 3 trial revealed a 33% ORR in 162 patients. Similarly, Zejula delivered a 41.0% ORR in its Phase 2 study of 46 subjects. Both of these ORRs are lower than Rubraca's. But do the differences tell another story? Let me share with you my interpretation...

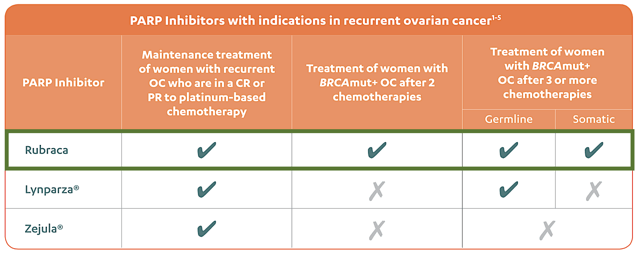

If you look at it from the combo therapy viewpoint, Zejula should have posted a much lower ORR. That's because Zejula only attacks only two PARP targets (i.e. PARP 1 and 2). As a result, Zejula's response rate should be 2/3 of Rubraca (i.e. 28.9%). And yet, it lags behind Rubraca by only 2.9% (i.e. at 41.0%). As shown in the figure below, the bioavailability explained it all. In other words, Zejula has twice the bioavailability as Rubraca (i.e. 73% vs. 36%, respectively).

Figure 4: Bioavailability comparison (Source: Zejula)

Simply put, Zejula is inferior to Rubraca from a combination therapy viewpoint. But it made up for the subpar mechanism of action by having excellent bioavailability.

So do you think bioavailability is more important than hitting multiple targets? According to the cornerstone of cancer treatment, it's best to knock out as many targets as possible (i.e. it's better to suppress three PARPs instead of two). But why? Again, that's to reduce the chances of treatment relapses. That aside, a drug with a lower bioavailability yet superior mechanism (i.e. Rubraca) can always be given a higher dosage.

Though there is no data for Lynparza, I bet its bioavailability is lower than Rubraca. Since Lynparza posted only a 33% ORR, that put it out of the race. After all, a 10.9% difference between Rubraca and Lynparza would deter most physicians from prescribing Lynparza. As docs practice evidence-based medicine, Rubraca is the most logical choice here.

Third Quarter 2019 Earnings Highlight

Just as you would get an annual physical for your well-being, it's important to check the financial health of your stock. For instance, your health is affected by "blood flow" as your stock's viability is dependent on the "cash flow." Because I already analyzed Clovis' 3Q2019 earnings report, I'll just do a quick assessment.

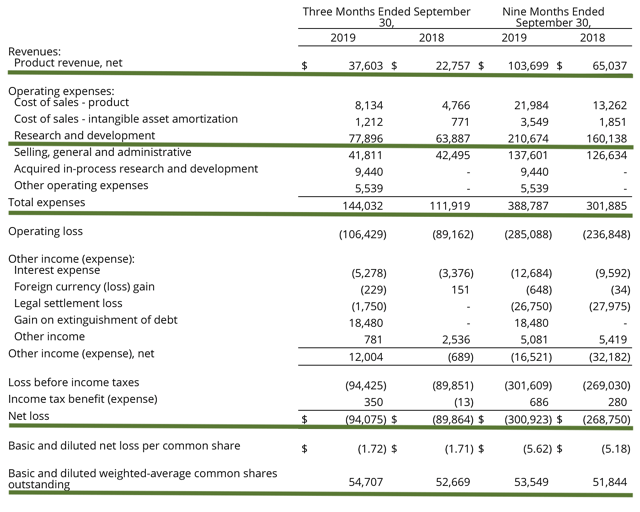

Accordingly, Clovis procured $37.6M in Rubraca sales versus $22.8M for last year. This represents a 65% year-over-year (YOY) increase. Riding strong sales growth, I expect Clovis to easily reach its fiscal 2019 revenue estimates of $141M to $147M. Moreover, the research and development (R&D) investments for the respective periods registered at $77.9M and $63.9M. Furthermore, there were $94.1M ($1.72 per share) net losses versus $89.9M ($1.71 per share) declines for the same comparison.

Figure 5: Key financial metrics (Source: Clovis)

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are "growth-cycle dependent." At this point in its life cycle, the main concern for Clovis is whether Rubraca sales will continue to increase. The other concern is if the management can continue to keep the cash burn at a reasonable rate.

That aside, the other risk is if Rubraca and other pipeline assets can deliver positive clinical outcomes. As I forecasted the "extremely favorable" (i.e. 75%) chances of clinical success, there is a corresponding 25% chance of failure.

Conclusion

In all, I maintain my buy recommendation on Clovis Oncology, and I upgraded the stock to a five out of five stars. Despite the ongoing concerns relating to the China Trade War and drug pricing, I believe that they are lessening their grip. In my view, the worse is said and done. As such, fundamentally robust companies will rally most vigorously. This puts Clovis as a prime candidate for further rally. Make no doubt, Clovis is a powerful turnaround growth stock.

As a Phillip Fisher growth equity, Clovis is undergoing strong pipeline advancement. After checking all the data for Rubraca versus Lynparza and Zejula, it became apparent that Clovis is the best in class for prostate cancer. Hence, it's highly like that this Rubraca franchise will become a blockbuster. As for ovarian cancer, sales growth is occurring at a remarkable pace. The cash position is also strengthening.

As an investor, you should continue to monitor the progress of the ATHENA trial. It's also important to keep tabs on the cash burn reduction and Rubraca's sales progress. You should also follow the new drug application ("sNDA") submission of Rubraca for mCRPC with BRCA1/2. It should occur by year-end. That catalyst can spark a huge rally. Last but not least, the difficulties are passing. And, it'll lead to an era of prosperity. Stay ahead of the market with IBI!

Thanks for reading! Please hit the orange "Follow" button on top for more. Don't miss out on the most profitable content (i.e. higher level intelligence) inside IBI. Here's what members said:

Dr. Tran's analyses are the best in the biotech sphere, well worth the price of subscription.

Very professional, extremely knowledgeable, and very honest … I would highly recommend this service, and his stock picks have been very profitable.

Not satisfied? See countless testimonies here.

I'm so confident in the value of my service that I'm giving you a 2-week FREE trial, money-back guarantee.

Disclosure: I am/we are long CLVS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: As a medical doctor/market expert, I’m not a registered investment advisor. Despite that I strive to provide the most accurate information, I neither guarantee the accuracy nor timeliness. Past performance does NOT guarantee future results. I reserve the right to make any investment decision for myself and my affiliates pertaining to any security without notification except where it is required by law. I am also NOT responsible for the actions of my affiliates. The thesis that I presented may change anytime due to the changing nature of information itself. Investment in stocks and options can result in a loss of capital. The information presented should NOT be construed as a recommendation to buy or sell any form of security. My articles are best utilized as educational and informational materials to assist investors in your own due diligence process. That said, you are expected to perform your own due diligence and take responsibility for your actions. You should also consult with your own financial advisor for specific guidance, as financial circumstances are individualized.