3 Healthcare Stocks to Buy Before the End of 2019

Healthcare has awoken and each of these stocks are among the best to buy now within the space

Healthcare stocks have awoken, and many are rocketing to record highs. Today we’ll breakdown this hot sector and spotlight three of the best stocks to buy within the space.

Some traders focus on the fundamentals and technicals of individual stocks without regard to which sector they live in. This so-called “bottom-up” analysis puts a premium on the merits of a specific company while largely ignoring the health of the broader market or sector.

The alternate approach is known as “top-down” analysis and focuses first on the broad market. Then it moves through sector and industry group performance to try and find the best stocks in the areas that are leading. Engaging in this analysis right now reveals the healthcare sector is hot as a pistol.

I zeroed in on the space to identify the most compelling charts and today I’m unveiling three of the best healthcare stocks to buy.

Healthcare Stocks to Buy: Amgen (AMGN)

Year-to-Date Gain: 20%

Although Amgen’s (NYSE:AMGN) gain for 2019 isn’t as eye-popping as some high-flying tech stocks, keep in mind that all the upside has come over the past two months. It’s as if AMGN stock has been sleeping through this year’s bull run and finally woke up. And it’s certainly making up for the lost time.

The past two earnings announcements were the catalysts needed to shake AMGN out of its stupor. Volume patterns reveal accumulation aplenty coming in after October’s report. Its latest run gave way to a high base pattern that continues to form. While some backing and filling may yet be needed before the gains are fully digested, I want to be a buyer of the next breakout.

Resistance at $236 is the level to use for your trigger. If you want confirmation, wait until AMGN stock rises above it before deploying bull trades.

The Trade: Buy the April $240/$250 bull call spreads for around $3.80

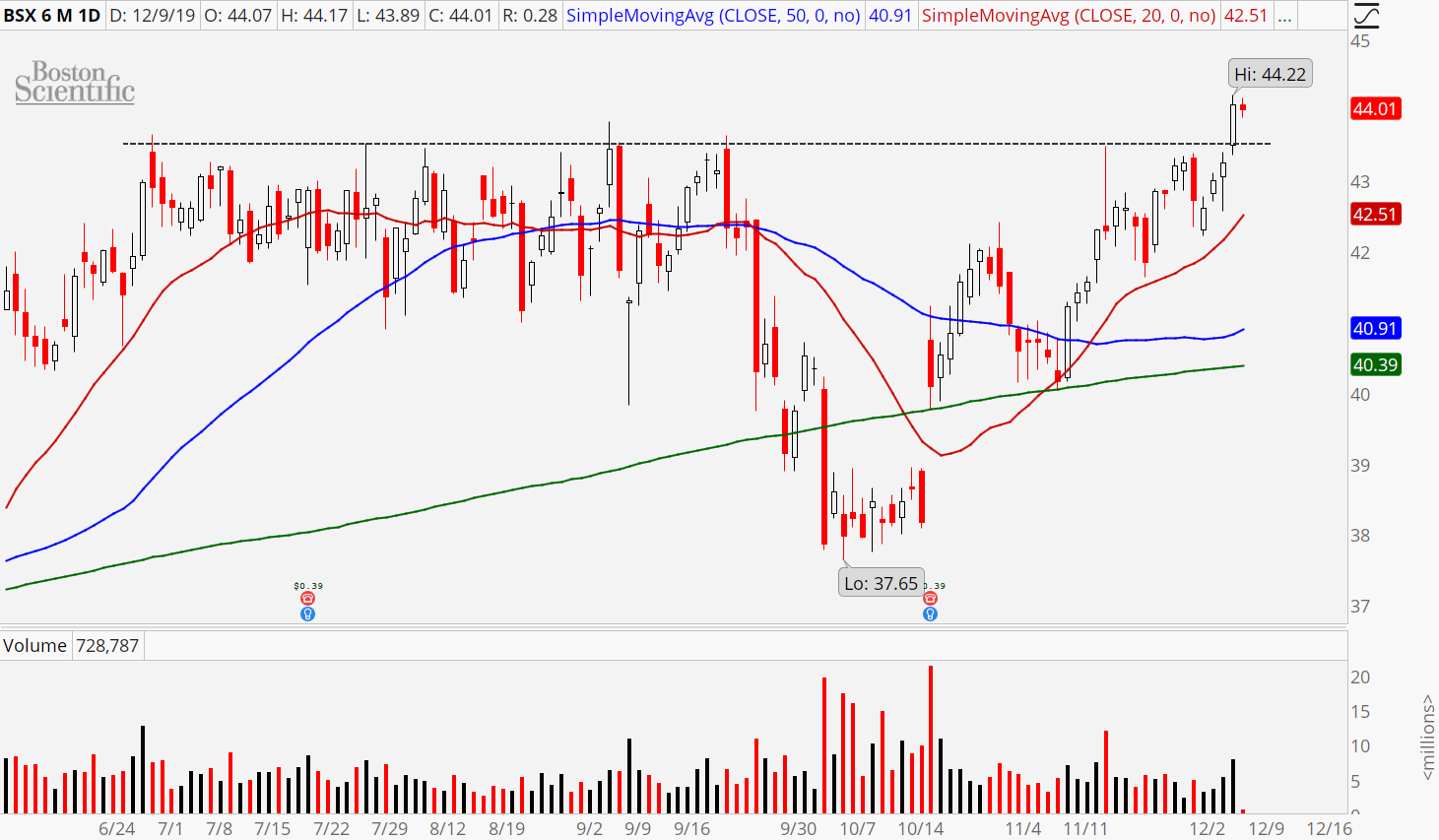

Boston Scientific (BSX)

Year-to-Date Gain: 29%

Boston Scientific’s (NYSE:BSX) breakout arguably already happened on Friday. The large volume surge carried BSX stock to its highest levels since 2004. The resistance zone ($43.50) that previously killed over a dozen rally attempts through the summer finally melted away.

And that sets the stage for what could be a nice year-end run. November’s rally was strong enough to pull the 50-day moving average higher finally. It joined the 20-day and 200-day moving averages in pointing northward to signal buyers control the trend across all time frames.

Implied volatility is extremely low right now, and that makes long calls or call spreads an attractive trade.

The Trade: Buy the Feb $44/$48 bull call spread for around $1.50. Your risk is $1.50, and the reward is $2.50.

United Health Group (UNH)

Year-to-Date Gain: 17%

United Healthcare Group (NYSE:UNH) rounds out today’s trio with a chart that looked like garbage heading into October. But as is often the case, better-than-expected earnings sparked an epic turnaround that has carried UNH stock to its now lofty perch.

Along the way, all major moving averages turned higher and are supporting the bulls’ bid to return the company’s shares to record highs. All that stands in the way is last December’s peak at $287.94.

The recent pause has allowed UNH to work through overbought conditions by creating a high base pattern. A break above $283 will signal that the next advance has begun. I suggest waiting for it before pulling the trigger.

The Trade: Buy the March $280/$290 bull call spread for around $5.

As of this writing, Tyler Craig didn’t hold positions in any of the aforementioned securities. For a free trial to the best trading community on the planet and Tyler’s current home, click here!