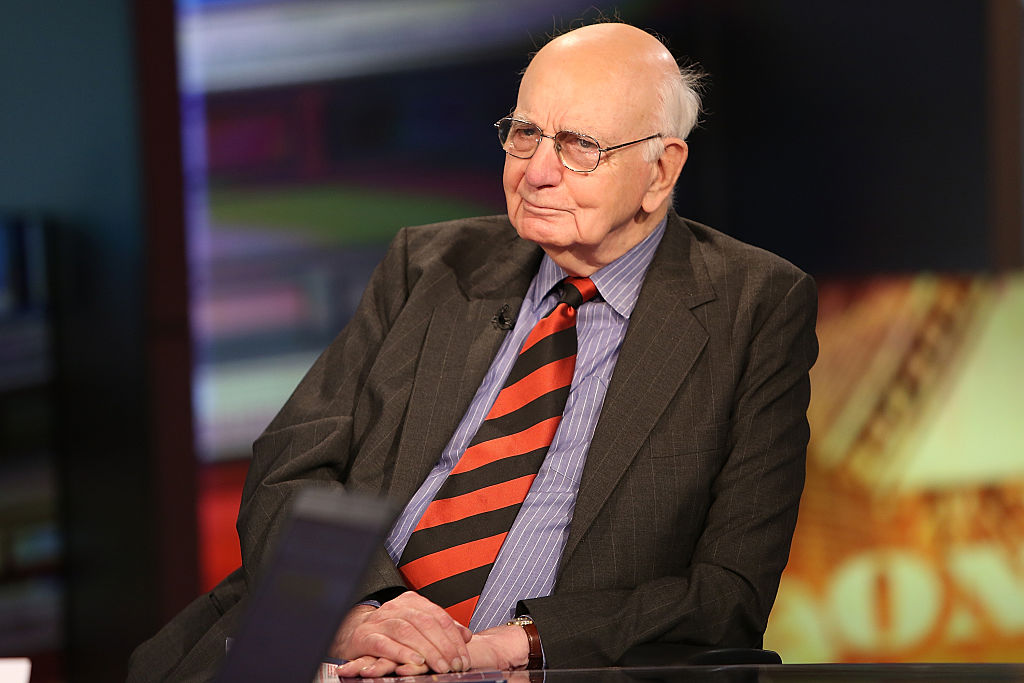

Former Federal Reserve chairman Paul Volcker dies aged 92

by Harry RobertsonPaul Volcker, the Federal Reserve chairman who slayed rampant US inflation in the 1970s and 1980s, has died aged 92.

The towering figure of international finance passed away on Monday, his daughter told the New York Times. He had reportedly been suffering from prostate cancer.

Read more: The economy is slowing – can central bankers fight the next downturn?

As Fed chairman from 1979 to 1987, the New Jersey-born Volcker was instrumental in helping the US economy adapt to the age of floating currencies and globalisation, first under President Jimmy Carter and then under Ronald Reagan.

Carter, a Democrat, charged the Princeton, Harvard, and London School of Economics-educated Volcker with tackling the double-digit inflation that was plaguing the US economy.

Volcker took the unprecedented step of pushing interest rates to as high as 20 per cent, sending the US spiralling into recession, bringing inflation under control but at massive cost.

At 6ft 8in, Volcker could be an intimidating figure. Nonetheless, he drew widespread wrath from various sections of US society in the 1980s. One senator furiously said he should take his “boot off the neck of the economy”.

Developing countries were particularly hard-hit by his draconian rate hike, with many economies falling into recession as they were forced to default on large US loans.

As the US economy recovered in the 1980s, however, Volcker’s prestige in financial circles grew further than any other Fed chairman before him. He was reappointed by the Republican Reagan for a second term.

Post-Fed career

More recently, Volcker worked as an adviser to President Barack Obama in the wake of the financial crisis. He proposed the so-called Volcker Rule, which stopped banks from gambling with depositors’ money.

Other post-Fed jobs included investigating the Iraqi oil-for-food programme for the UN, resolving the claims of Holocaust victims to Swiss bank deposits, and looking into World Bank corruption cases.

Volcker advocated tougher regulations than his successor at the Fed, Alan Greenspan. Later in life he expressed concerns about the direction of the US government and economy.

He told the New York Times last year: “The central issue is we’re developing into a plutocracy”.

“We’ve got an enormous number of enormously rich people that have convinced themselves that they’re rich because they’re smart and constructive,” he said. “And they don’t like government and they don’t like to pay taxes.”

Read more: US Federal Reserve lowers rates again but signals it is done cutting

More recently, Volcker advised current Fed chair Jay Powell to ignore President Donald Trump, who had called him “crazy”.

Volcker’s wife of 44 years, Barbara, died in 1998 after a long illness. They had two children.