Vector - Still Not Covering Dividend, Current Share Price Is A Gift To Longs, Sell

by Fishtown CapitalSummary

- Even after a 50% dividend cut, Vector is still not covering its dividend. Don't take my word for it - the CFO just admitted it!

- Bond holders are getting paid over 10.5% while equity investors will be getting paid under 6% going forward at the current share price.

- As if 10.5% interest rate on the recently issued debt wasn't high enough, these notes were priced at 98.5 cents on the dollar!

- Recent share price strength - longs looking for "one more 40 cent dividend" before selling?

I've been bearish on Vector Group (VGR) for some time. In my first article ever published on SeekingAlpha in August 2018, I predicted "a 50-75% dividend reduction and for the share price to fall to $10-12 in the next 18 months." I hit all 3 parts of my prediction: they cut 50% on November 5th (month 15) and the stock closed at $11 that day.

But since then, the stock has been very strong, rallying past $14 despite issuing more debt at deep junk levels, before dropping back in the past couple of days on strong volume. I believe the recent weakness has to do with what the CFO just admitted, and Vector longs would be smart to use this opportunity to exit the shares.

Vector is STILL not covering their dividend even after reducing it by 50%

I'll admit, I'm disappointed here. I had worked through the math on this myself, but Bryant Kirkland, Vector's CFO, completely stole my thunder when he full on admitted they were still not covering their dividend and even broke down the math at the latest Morgan Stanley Global Consumer and Retail Conference! Mr. Kirkland is asked to discuss the board's decision to cut the dividend at 27:15. I encourage all investors to listen to the entire presentation because I believe Mr. Kirkland sounds uncomfortable and evasive through much of it.

Regarding the dividend:

As most people in this room know, Vector had paid a 40 cent quarter cash dividend since the 3rd quarter of 2000 and an annual 5% stock dividend since 1999. Over time, that dividend had grown where it significantly exceeded operating earnings. That number would have been $140-150 millions a dollar a year if that had continued.

Turns out I was spot on with the negative 150 million 2019 estimate in my previous article on Vector.

Mr. Kirkland continues:

We have some debt that we're repaying in the next 6 months, but after that is repaid, our cash interest will be reduced to $110 million. So if you do that, you take $260 (in EBITDA) minus 110 million, you get $150 million. Taxed at 30% and that leaves you with $105 million in free cash flow a year. We pay dividends on 152 million (shares) so 152 million times what will be now 20 cents a quarter or 80 cents a year, so $120 million. There will still be a $15 million or so shortfall from pure operations

He then continues to explain how they'll continue to sell off real estate assets to make up the shortfall. That will work, for only for a while.

Recent Debt Offering and Debt Covenants

Vector continues to issue debt at deep junk levels. The latest offering priced at 98.5 cents on the dollar despite the double digit yield.

The reason they raised debt was to repay their 5.5% Variable Interest Senior Convertible Notes due 2020. These notes pay significantly more than 5.5%, because they're entitled to a share of the dividend payment as well.

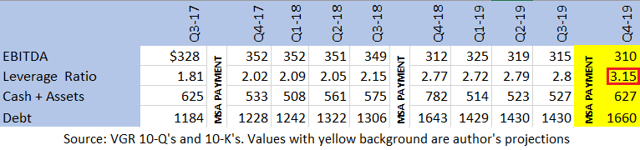

I believe the needed to raise now, because doing so after the Q4 results were in would likely have put them in violation of the debt covenants in their 6.125% Senior Notes, that restricts the leverage ratio to be below 3. Once the $150 million MSA payment is paid in December, they would have been in violation and could have been restricted from raising new debt.

In any case, the above is a nice illustration of the value destruction that happens when you're overpaying a dividend by $100+ million a year and funding it with 10.5% debt.

Outlook and Conclusion

Tobacco is a business in terminal decline that seems to be accelerating, with tail risks that can speed it further. The best case scenario for Vector equity investors going forward would be flat EBITDA, with price increases balancing out volume declines.

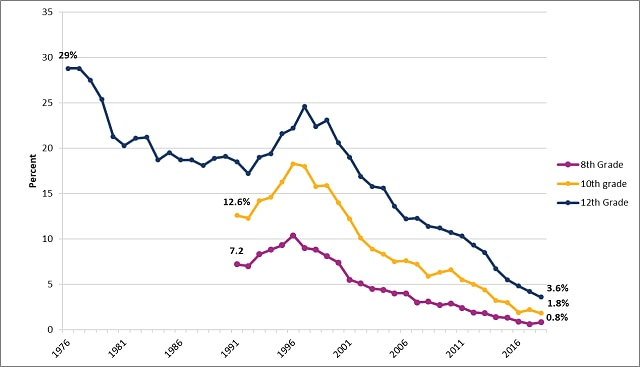

I believe domestic tobacco usage will remain under pressure. 18 states have raised the smoking age to 21, 13 just in the past year. States like Oregon are voting on large tobacco tax increases, and looming FDA regulation on nicotine levels, on hold for now, could be revived at any time. But even without these tail risk occurring, youth tobacco usage is in free fall, as seen below in the 30 Day Prevalence of Daily Use of Cigarettes 1976-2018 (Source: HHS.gov). It's fallen 50% in the last 5 years alone. This is fantastic news.

After the final 40 cent payment, Vector will be paying out ~115% of its operating cash flow for equity holders to earn under 6%, while debt holders are getting paid almost double that. Meanwhile, Altria is paying out only 80% of its operating cash flow and its shareholders are getting paid almost a full percentage point higher.

I'm expecting for Vector to sell off over the next year, as longs realize there are much safer ways to earn 6%, especially once they learn the new half sized dividend is almost fully taxable (because Vector paid out so much more than their free cash flow, much of their previous payout was considered a return of capital and was tax exempt.) I would be surprised to see Vector trading in the double digits by this time next year, and believe longs are passing up a gift to get out at these levels.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in VGR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.