SailPoint: Potential Tailwind Ahead, But Expect Some Sales Execution Issues

by Tech and GrowthSummary

- The broader data privacy trends in particularly US and Europe will drive growth for SailPoint going into FY 2020.

- We see SailPoint's platform as a painkiller for enterprises to navigate the complexities when complying with new regulations such as GDPR, CCPA, and others.

- We also foresee challenges overseas, where sales execution issues can arise anytime. Pricing in the mix of the tailwinds and challenges, we set a price target of ~$27 per share.

Overview

We believe that the broader data privacy trends will drive growth for SailPoint (SAIL) going into FY 2020. The last two years have seen some key data breaches among some of the largest technology companies such as Facebook (NASDAQ:FB), which has shed some light on how user data is handled and managed by these companies. As a result, we have seen an increasing focus on data privacy worldwide, which has included new government regulations such as GDPR and CCPA. We see SailPoint's platform as a critical tool that serves as a painkiller for enterprises to navigate the complexities when complying with these new regulations to avoid the excessive legal liabilities that may arise.

Our view on the stock remains bullish. Since its IPO in 2017, SailPoint's price per share has increased by almost twice as much to ~$24 per share as of today. In the last few quarters, we notice how SailPoint has still shared some common challenges with typical late-stage venture companies, primarily along the lines of go-to-market and market segmentations. On the flip side, we view the company as having similar potential upside as well.

Data privacy tailwinds in the US and Europe

SailPoint had a great Q3. The company's $75.9 million Q3 revenue beat its guidance by $5.4 million, which represented a 15.5% YoY growth. Much of the growth came from its strong US business, which grew 23% YoY and made up 74% of the overall business. Driven by the data privacy compliance trends in the US and Europe, we think that the chance for more long-term outperformance is reasonably high. We see pockets of opportunities through the demand for automation and streamlining of the user's data management. Along the way, though, we foresee some challenges in overseas markets, which we will discuss at the later point. As it stands, we believe that the company's offering and go-to-market remain in-sync and competitive.

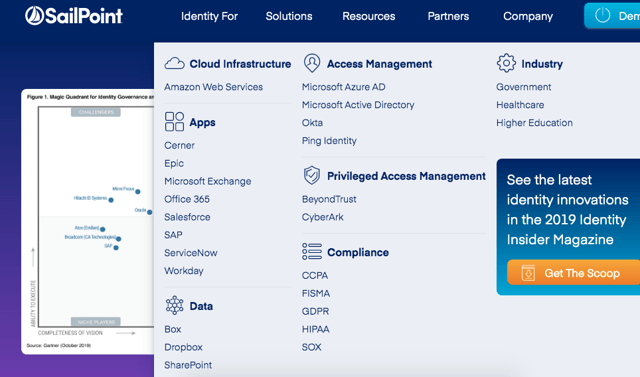

(Source: SailPoint website)

SailPoint's solutions aim to tackle all these data access and management problems across multiple layers of complex enterprise applications and infrastructures, ranging from CRM to cloud services. In Q3, the management also particularly highlighted some of the key automation use cases for the company's core products, such as IdentityIQ and IdentityNow, which somehow validated our thesis:

For example, this quarter's largest deal in the Americas was with an existing IdentityIQ customer that extended their IdentityIQ deployment to help them streamline and automate their provisioning efforts. Previously, they manage compliance for their 300,000 identities manually. In another example, we're seeing more customers take a holistic approach to their identity governance programs by extending SailPoint into new areas of their business. For example, a midsized accounting and advisory firm chose IdentityNow as the foundation for their identity program. They needed a solution that would ensure proper governance across all of their users and their access to both applications and data

The US business also became more dominant compared to the same time last year, wherein it contributed only 70% of the overall business as of Q3 2018 compared to 74% this Q3. The 34% YoY increase in subscription revenue to $37 million also pointed to its strong SaaS adoption, where there is a potential for the company to trade at more premium once Subscription revenue surpasses the License revenue.

Risk and Valuation: Possible sales execution issues to some extent

In Q4 and beyond, we will expect SailPoint to explore the overseas market further. However, based on SailPoint's progress in the last few quarters, we believe that unlocking opportunities outside the US and Europe will serve as a key challenge. In our opinion, the process of unlocking such opportunities will require a more in-depth understanding of what drives buying decisions in overseas markets where the necessity for data governance varies among the clients. In that sense, the discovery of the effective go-to-market strategy will also mean that other sales execution issues can potentially happen at some point in FY 2020. Despite the fast-growing potential, the company's underperformance in EMEA and APAC market last quarter eventually also calls into question the readiness of Identity Management and Data Governance markets there.

With a TTM P/S ratio of ~7.95, the company trades approximately in between the average of its 52-week highest and lowest TTM P/S. Pricing in both the anticipated challenge and the continuation of data privacy tailwinds in the US and Europe, we set a base-case TTM P/S of 7.3, which is the average between the forward P/S of 6.72 and current P/S of 7.95. In the end, a revenue target of $328.60 million in FY 2020 and an estimated ~89 million shares gives us a price target of ~$27 per share, which represents a ~12.5% upside.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.