DocuSign: Time To Lock In Profits

by Gary AlexanderSummary

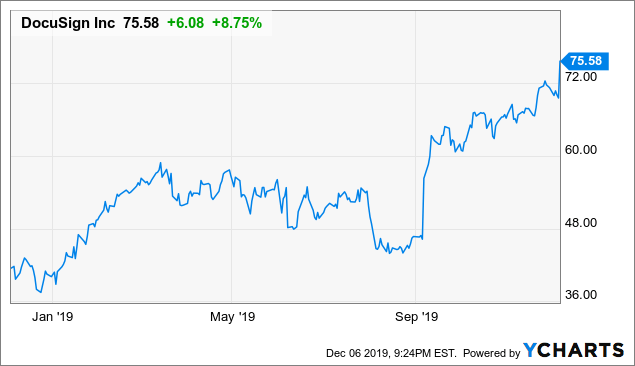

- Shares of DocuSign soared nearly 10% after reporting Q3 results, extending a recent win streak ever since the company warned of sales execution issues in Q1.

- Revenue growth of 35% y/y beat Wall Street's estimates by three points, while EPS came in ahead of consensus as well.

- However, DocuSign's billings growth slowed down to 36% y/y - somewhat of a red flag as we approach FY21.

- DocuSign shares have rallied more than 30% since last quarter, reverting the stock to the double-digit forward revenue valuation and likely capping further upside.

At various points in the year, e-signature leader DocuSign (DOCU) has been both one of the most loved and one of the most hated stocks in the software sector. Earlier this year, DocuSign moved swiftly to the "penalty box" for highlighting sales execution issues and a Billings slowdown. Over the past two quarters, however, DocuSign has managed to speedily reverse its fate and deliver both the growth and profit expansion that investors are looking for. After reporting strong third-quarter results, shares of DocuSign have rallied another ~10%, hitting fresh all-time highs:

Data by YCharts

The question for investors now: does the DocuSign rally have more steam, or is it time to lock in gains?

Personally, I've divested off my position in DocuSign after the earnings rally. Though I was encouraged by the company's second-quarter results and liked the stock at $58 three months ago, I'm apprehensive of staying long at a share price that's 30% richer. As such, I'm moving to a bearish position on DocuSign - I no longer think this stock has an attractive risk-reward profile for investors at current levels.

The good news - growth is exceeding expectations, while operating margins are ticking higher

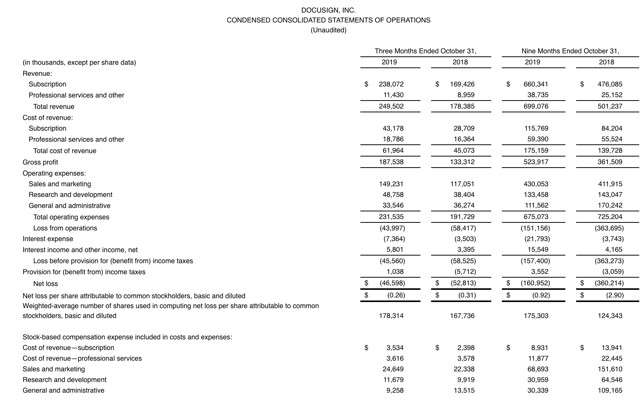

Let's dive into DocuSign's latest update with the good news first. The company's earnings summary is shown below, and DocuSign performed quite well on the growth front:

Figure 1. DocuSign 3Q20 earnings resultsSource: DocuSign 3Q20 earnings release

Revenues grew 40% y/y to $238.1 million, decelerating only one points relative to last quarter's 41% y/y revenue growth and squashing Wall Street's estimates of $229.0 million (+35% y/y) by a solid five-point margin. The company grew total customers by 24% y/y in the quarter, ending with a total of 562,000 customers. Its penetration into the enterprise space was even more pronounced, with enterprise and commercial customers growing 30% y/y to 69,000.

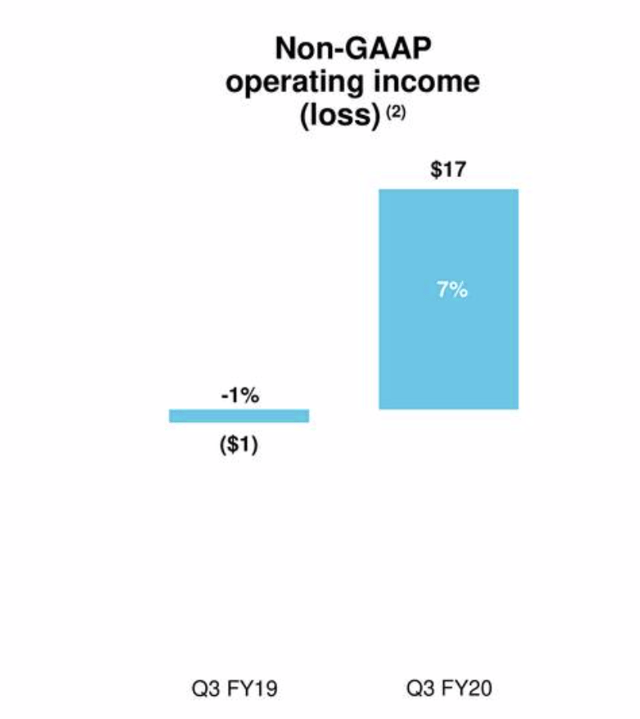

At the same time as DocuSign's growth overachievement, the company was also able to pare down its expenses to improve operating margins - which is incredibly critical at a time of fresh market records when investors are looking more for profitable, steady names rather than all-out growth stocks. As shown in the chart below, DocuSign was able to turn a pro forma operating loss margin of -1% in the year-ago quarter to a positive 7% this quarter:

Figure 2. DocuSign operating margin trendsSource: DocuSign 3Q20 earnings deck

All key components of DocuSign's expenses shrank as a percentage of revenues - most notably sales and marketing, DocuSign's largest expense category (as with most other enterprise software companies), which fell from 52% of revenues in 3Q19 to 48% of revenues in 3Q20. As a result, DocuSign's pro forma EPS of $0.11 also crushed Wall Street's expectations of $0.04.

Make no mistake - the headline metrics were solid all around this quarter, so it's not a shocker that DocuSign's shares went up.

Billings slowdown

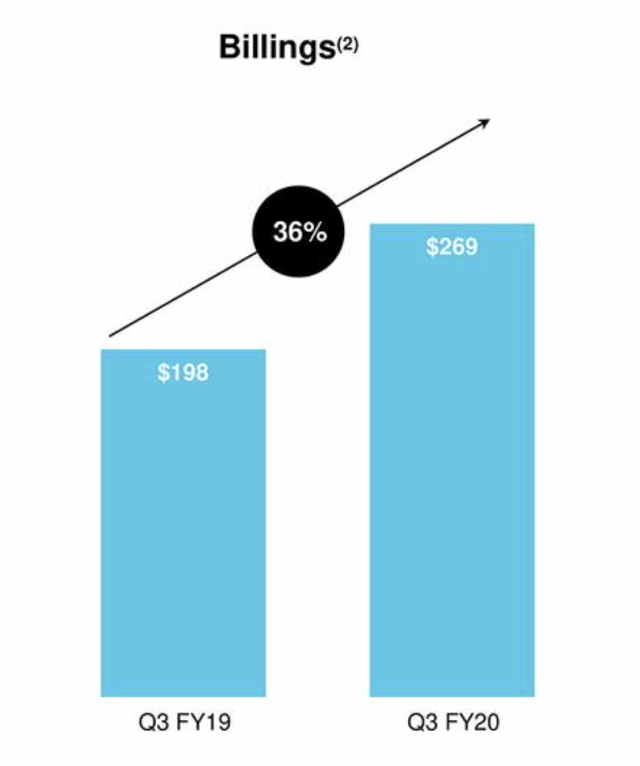

Outside of key revenue and EPS beats, however, there was potentially one blemish on DocuSign's results that may have implications for future quarters. DocuSign's billings growth has been an open question all year, accelerating to 47% y/y last quarter after dipping below 30% in Q1 (when DocuSign shares slunk to their lowest levels all year).

Unfortunately, billings growth wavered again this quarter, slowing to 36% y/y (implying eleven points fo sequential deceleration relative to Q2, and three points relative to first-half billings growth of 39% y/y):

Figure 3. DocuSign billings trendsSource: DocuSign 3Q20 earnings deck

Here's some helpful commentary from CFO Mike Sheridan on the Q3 earnings call on this quarter's billings and sales trends:

Total billings increased 36% year-over-year to $269 million, on a four-quarter rolling average basis billings growth was 35%. Strong demand from our core eSignature solutions coupled with growing adoption of our broader portfolio of Agreement Cloud products continued this quarter. We added approximately 25,000 new customers this quarter, 5,000 of which were direct customers. This drove a 30% year-over-year increase in our commercial and enterprise installed base. This brings our total customer base to 562,000 with roughly 69,000 direct customers worldwide. We saw notable strength in upsells into our installed base with particularly strong contribution from our North American business. We also continue to see progress in upsells of DocuSign CLM into our installed base. The combination of these factors increased our dollar net retention to 117% this quarter, within our historical range of 112% to 119%."

Despite the company touting its performance as strength, what DocuSign's continued billings slowdown means is that its current pace of ~40% y/y revenue growth isn't sustainable - because it's not piling in enough deals into its pipeline to support current revenue growth levels in FY20. And if DocuSign's growth rates are slated to take a step-function down next year, it's unclear if the stock can maintain its current valuation levels.

Valuation and key takeaways

Make no mistake - DocuSign's current stock price levels have already priced in all the outperformance that the company achieved in Q3, and then some. I worry that DocuSign's implied deceleration into FY20 (as indicated via its slowdown in Billings) will limit the stock's appreciation potential next year.

At current levels around $75, DocuSign trades at a market cap of $13.30 billion. After netting off the $911.5 million of cash and $458.6 million of convertible debt on DocuSign's balance sheet, we're left with an enterprise value of $12.85 billion.

For the next fiscal year, per Yahoo Finance, Wall Street analysts are expecting consensus revenues of $1.19 billion (+25% y/y), implying that DocuSign currently trades at a hefty 10.8x EV/FY21 estimated revenue valuation. This is several turns higher than where DocuSign had traded earlier in the year, hinting that there may not be much room left for further multiples expansion. After all, why should DocuSign merit a further valuation increase when its billings growth is on a decelerating trajectory?

In my view, investors should take advantage of DocuSign's currently lofty share prices to lock in gains and invest elsewhere. Buy back into this stock when it reaches a more reasonable price in the mid-$60s.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.