Allakos Does It Again; bluebird And Sunesis Data: The Good, Bad And Ugly Of Biopharma

by Avisol Capital PartnersSummary

- Allakos has spiked on sales chatter, despite being only in Phase 2 stage.

- bluebird bio reported positive data from the KarMMa trial.

- Vecabrutinib, a BTK inhibitor from Sunesis, produced disappointing data in a Phase 1/2 trial.

Allakos (ALLK) was up a whopping 40% in a day's trading on 8x surge in volume on Friday on what has been called "sales chatter." I covered ALLK in August in a mostly bearish article after it almost tripled overnight after results from a Phase 2 study of lead candidate AK002 was published. I said that "While the trial was good, neither the market potential nor the current stage of development should indicate such a high valuation as at present." I now see I was right on all counts except the critical one - market sentiment. Somehow, in some way, this Phase 2-only company targeting a disease with moderate market potential is being valued at nearly $6bn.

AK002 works as an eosinophil depletion treatment therapy, and Fasenra, from AstraZeneca (AZN), is the gold standard in this arena. Fasenra is priced at about $38,000, although it is approved for a different indication than what AK002 is currently targeting, but has a similar MoA - eosinophilic depletion. As I said:

The EGIDs that include EoE (esophagus), EG (stomach), EGE (duodenum and small intestine) and EC (colon) collectively affect up to 300,000 patients in the U.S. The estimated prevalence of EG in the U.S. is approximately 20,000-25,000 patients, and the estimated prevalence of EGE in the U.S. is approximately 25,000 patients. It is possible, however, that these diseases are significantly underdiagnosed.

Out of these, AK002 is currently targeting EG, which has 25,000 patients in the US. If AK002 could be priced like Fasenra, at $40,000 a pop, then the total market potential for the drug in EG alone would be $1bn. For all indications, William Blair & Co. analysts led by Tim Lugo wrote in a note to clients in October, the drug could have a market potential of $2.5bn.

Now, I also said:

No other company or organization is conducting clinical trials of a product candidate that targets both eosinophils and mast cells, or that specifically targets Siglec-8 like AK002. Currently, no therapies have been approved by the FDA specifically for EG, EGE or EoE.

AK002 is conducting clinical trials in 3 other indications, whose exact market potential I have not investigated. However, what has to be kept in mind is that success in Phase 2 is not an absolute guarantee of Phase 3 success - we have often seen Phase 2 success going nowhere in a larger trial. So, the company's valuation at this stage is discounted by a large factor while doing simple valuations. If it is currently valued at $6bn at Phase 2 in one indication, then I could imagine it being fully valued in approval phases of all 4 indications at no less than $20bn. If $2.5bn is the market potential for the drug in all current indications, then actual sales would be just a fraction of this - say $500mn. Even if we push it to $1bn, we still have a company that's being valued at 20x its future sales for all indications currently pursued by the lead candidate - some in Phase 1, and one which has declared positive results in Phase 2.

The sales chatter, whose source was Bloomberg, did not name names; however, we said the following in our previous coverage:

It seems that the principal support behind ALLK has been its proximity to Roche (OTCQX:RHHBY), which owned around 13% of the company last year and whose research arm has certain synergies to what Allakos does. I refer to Roche’s drug Xolair’s connection with AstraZeneca's (AZN) Fasenra, the gold standard in eosinophil depletion, and ALLK’s lead drug AK002’s immediate competition. Xolair, in combination with Fasenra, is used in asthma. So, it stands to reason that Roche would be interested in a similar drug.

The sales chatter does mention about discussions with "global pharmaceutical companies" so Roche could indeed be one of the suitors. However, we still fail to understand the logic behind this current valuation. For comparison, Amarin (AMRN), with a drug approved in 2012 that many think could reach multibillion-dollar blockbuster potential after label expansion this month, is still valued at a "mere" $8bn.

bluebird bio reports positive KarMMa

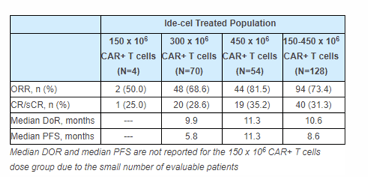

bluebird bio (BLUE) reported positive top line results from its Phase 2 clinical trial, KarMMa. The trial is designed to evaluate CAR T therapy idecabtagene vicleucel (ide-cel) (bb2121) in patients suffering from treatment-resistant multiple myeloma. The study’s overall response rate was 73.4 percent across three doses. The dose-dependent response rate was 50.0% in the lowest, 68.6% in the middle and 81.5% in the highest. The complete response rate were given at 25%, 28.6% and 35.2%, respectively. Median duration of response has been reported at 10.6 months while median progression-free survival was 8.6 months.

The study met the primary as well as key secondary endpoints and the safety profile was consistent with the Phase 1 CRB 401 trial. The rate of serious neurotoxicity events stood at 3.1% (n=4/128). The trial also reported the rate of serious/life-threatening/fatal cytokine release syndrome (CRS) at 5.5% (n=7/128) including one death.

Ide-cel is a CAR T cell therapy targeting B-cell maturation antigen (BCMA), which is expressed on the surface of normal and malignant plasma cells. ide-cel was granted Breakthrough Therapy Designation (BTD) by the U.S. Food and Drug Administration in November 2017.

Sunesis BTK inhibitor vecabrutinib disappoints in Phase 1/2

Sunesis Pharmaceuticals suffered a major setback as its Phase 1/2 clinical trial produced disappointing data about BTK inhibitor vecabrutinib for treating patients with B cell blood cancers. The treatment failed to show any response across cohorts 1 to 5 and while 10 patients showed stable cancer the remaining had to withdraw due to cancer progressing further. The pharma company had to disclose the data due to an unauthorized disclosure of the poster on social media.

Despite negative data, the interim CEO of Sunesis, Dayton Misfeldt said, “The data are encouraging, with vecabrutinib showing evidence of clinical activity in high-risk patients resistant to covalent BTK inhibitors, in both wild-type and C481-mutated BTK disease.” He also added, “Vecabrutinib is very well tolerated at the dose levels studied thus far, with patients now being treated in the 400 mg cohort. We are prepared for Phase 2 expansion, which will focus on BTK inhibitor-resistant CLL/SLL patients and those with prior intolerance to other BTK inhibitors.”

The trial was conducted on 29 relapsed/refractory patients divided in Cohorts 1 to 5 (25 mg to 300 mg). The patients included 23 patients with CLL, three suffering with Waldenstrom macroglobulinemia, two with mantle cell lymphoma (MCL), and one with marginal zone lymphoma (MZL). 61 percent of the CLL patients had a BTK C481 mutation. All the patients had progressed on prior BTK inhibitor therapy and on an average had received 4 lines of prior therapy.

Thanks for reading. At the Total Pharma Tracker, we do more than follow biotech news. Using our IOMachine, our team of analysts work to be ahead of the curve.

That means that when the catalyst comes that will make or break a stock, we’ve positioned ourselves for success. And we share that positioning and all the analysis behind it with our members.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.