U.K.: The Page Has Turned

by Maximilian Magnacca SanchoSummary

- Elections are providing outlet for Brexit uncertainty.

- GDP forecasted to grow and stabilise.

- UK has fiscal space for mitigating negative Brexit outcomes.

The United Kingdom is currently in the final stretch of a general election to confirm a parliamentary majority to push through the first Brexit deal before moving into trade negotiations. The uncertainty regarding Brexit outcomes will remain, but the page has turned in terms of what the major political parties desire from Brexit. Britain is now a viable investment opportunity due to the decreasing uncertainty regarding Brexit or no Brexit, and with a potential upside or downside depending on the future trade deal agreed. Britain also has relatively strong macroeconomic fundamentals that could help prevent a major backlash from negative Brexit outcomes.

Some historical context, Brexit was a tremendous shock to the international community and immediately prompted many forewarnings from economists regarding its strongly negative impact on the British economy. These early warnings were not seen to be accurate, as the British economy continued to grow at a respectable pace. This has started to shift as the deadline of Article 50 approached, and the British Parliament consistently rejected the withdrawal deal negotiated between the European Union and the British Government, previously headed by Theresa May and now led by Boris Johnson. Brexit is seen by Leavers’ to be an opportunity for the British economy to throw off, what they view, as unnecessary regulations, and for Remainers it is seen as the worst economic mistake the UK could have made in its history. This question remains to be answered and will be answered after the December 12th, 2019 election depending on the composition of parliament.

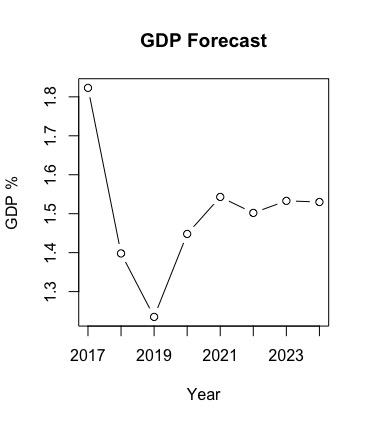

Moving on to macroeconomic fundamentals, the United Kingdom is forecasted to increase the rate of growth in the GDP over the next 4 years to a respectable 1.5% or thereabouts rate (See graph below). This is a healthy rate for a developed economy, especially one facing so much uncertainty such as Britain is, and could be helpful in mitigating some of the damages from Brexit such as the loss of future foreign direct investment (NYSE:FDI) from firms looking to set up a European wide base.

Source: (IMF Economic Outlook, graphing by author in RStudio)

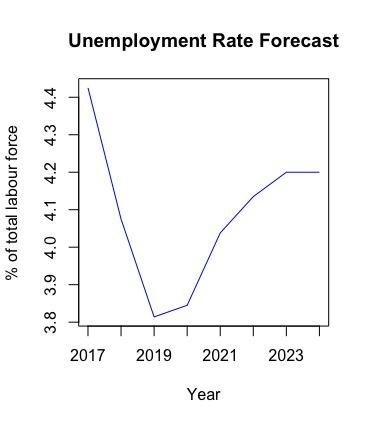

Speaking to the strength of the United Kingdom’s macroeconomy is its unemployment rate which has recently been hitting record lows with an unemployment of just above 3.8% (see graph below) with the unemployment rate expected to increase slightly to just above 4.1% and plateauing there for the foreseeable forecast. This is a very positive signal for the United Kingdom as its estimated NAIRU is approximately 4.5% (OBR). This unemployment rate is demonstrating the resilience of the UK’s economy even after a dramatic shock to the international and domestic community in their Brexit vote, and the subsequent political deadlock. The rate shows business going on as usual until it won't.

Source: (IMF Economic Outlook, graphing by author in RStudio)

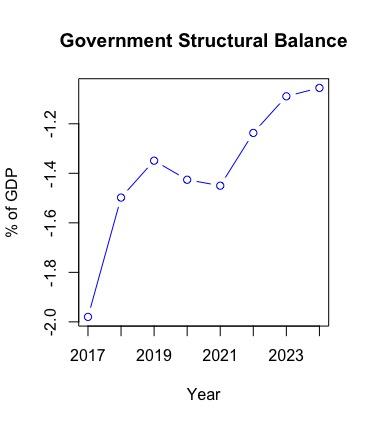

The situation regarding Britain’s public finance remains positive with the structural balance of the Government’s budget forecasted to being decreasing in terms of deficit size from a position of around -1.40% to -1.10% by 2021 (see graph below). While this deficit is still not an extreme positive, it does display there is some room for fiscal measures in the United Kingdom if there is an extreme negative outcome from poor Brexit negotiations. The reduction of the structural fiscal deficit is positive as well for the reason of the British government living more within its means, especially after the impact of the financial recession of 2008 and its subsequent austerity measures.

Source: (IMF Economic Outlook, graphing by author in RStudio)

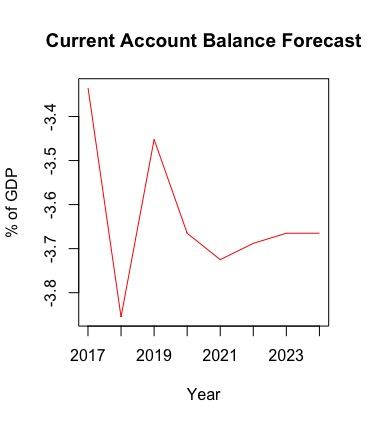

The United Kingdom’s Brexit decision upended its closest trading relationship which professional economists assumed would greatly affect the UK’s exports, however, as can be seen the current account balance has not greatly shifted in the United Kingdom, which still runs a slight deficit. It is forecasted to increase slightly to a rate of -3.7%. This is the statistic to take with the greatest suspicion towards due to the highly uncertain nature of the future trading relationship that the UK will have with Europe, which presumably will continue to be their largest partner for a variety of factors explained in the gravity theory of trade amongst others.

Source: (IMF Economic Outlook, graphing by author in RStudio)

As has been discussed throughout this brief overview of the British economy in the lead to the general election on December 12, 2019 between Boris Johnson’s Conservatives and Jeremy Corbyn’s Labour, the British economy has been resilient in the face of many challenges. It is now turning a page with the Brexit issue soon to be clarified politically. It also has the economic resilience to mitigate any short-term effects from Brexit gone wrong. Britain is now a viable medium-term investment due to reduced uncertainty on its economic prospects with greater variation in the magnitude of the effect due to composition of parliament in the near future.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.