The Saudi Aramco IPO Overvaluation Is Overblown

by Nicholas KitonyiSummary

- The Saudi Aramco IPO will surpass Alibaba's as the biggest in history.

- Analysts had made valuation estimates for the company that ranged from $1.1 trillion to $2.5 trillion.

- The company settled on a valuation of about $1.7 trillion, which foreign investors bulked at citing overvaluation.

- However, Saudi Aramco is the most profitable company in the world and some of the key valuation multiples suggest it might not be overvalued.

- The company's stock will be listed at Saudi's Tadawul Stock Exchange but foreign brokerage platforms have also made it available to traders.

The Saudi Aramco (ARMCO) IPO continues to dominate headlines in the oil and gas industry as we move closer to the date the public trading of the company's shares begins at the Tadawul Stock Exchange.

Saudi Aramco is the crown jewel of the Kingdom of Saudi Arabia. The oil-rich nation relies heavily on oil and gas. Based on the latest statistics, the petroleum sector accounts for about 87% of the Saudi budget revenues, 90% of export earnings, and roughly 42% of its GDP.

Aramco is the primary oil and gas company in the country with an output of about 10 million barrels of crude oil per day.

Saudi Arabia is the largest producer of crude oil in the world and this is part of the reason why it is the de facto leader of the OPEC cartel, which controls oil prices by cutting or increasing supply. The body is currently holding a meeting in Vienna, Austria where Saudi Arabia will try to convince OPEC members to cut oil supply in a bid to boosting the oil price ahead of a projected slowdown in demand next year.

The IPO valuation

According to sources cited by Bloomberg, Saudi Aramco has reportedly settled on the higher end of the IPO price guidance that was used in the first tranche when institutional investors placed orders for 2 billion shares of the company. Earlier, the company had guided that the IPO pricing would range between 30-32 Saudi riyals, but now it seems to have settled on the top end of that guide. Some online brokerage platforms like eToro had already added Saudi Aramco to the list of tradable assets in anticipation of the IPO. However, they had adopted the lower end of that price guidance, so this could change once the final price is confirmed.

And on Wednesday, reports emerged saying that the company had settled for the 32 Saudi riyals per share, which ultimately made the IPO the biggest ever, in history with $25.6 billion worth of company stock offered to the public. Overall, that valued the company at about $1.7 trillion. When the initial price guidance was provided, foreign investors bulked at the valuation of the company, which is why they boycotted the offer, altogether. Nonetheless, initial reports indicate that between November 17 and December 4, institutional investors placed orders for Saudi Aramco shares worth more than $39 billion, which is more than twice the 1% allocated to them.

The company had indicated that of the 1.5% shares offered to the public, 0.5% would be sold to retail investors. Therefore, it looks like Saudi Aramco is not short of investors with local asset managers and banks looking capable of buying all the shares on offer.

Last year, the company reported net cash flow from operations of about $121 billion based on the IPO prospectus while free cash flows stood at about $85.8 billion.

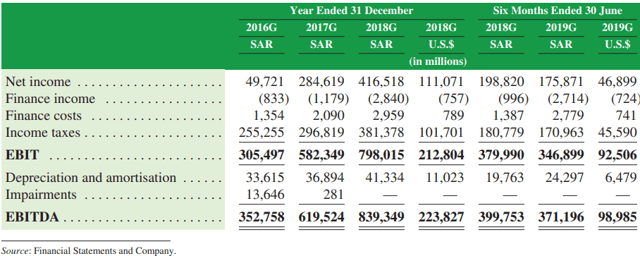

Saudi Aramco IPO net income taken from the company's financial statements.

Ideally, at a market value of about $1.7 trillion, shares of Saudi Aramco are valued at about 14x price to operating cash flows (P/OCF) and about 19.8x price to free cash flows (P/FCF). The company reported a net income of $111.1 billion last year, which again values the stock competitively at a P/E ratio of about 15.3x. For reference, shares of Exxon Mobil (XOM) trade at a P/E ratio of about 20x while the UK based BP Plc trades at about 26x in price to earnings ratio.

The average for the oil and gas drilling industry stands at about 36.6x according to estimates provided by Zacks, which again shows that Saudi Aramco might not be overvalued as some analysts have suggested. Some reports claimed that by valuing the company at $1.7 trillion, the IPO could be overvalued by as much as 35%. Earlier valuation estimates from some of the top investment banks including Goldman Sachs (GS), Morgan Stanley (MS) and Bank of America (BAC) had floated valuations ranging from as low as $1.1 trillion to as high as $2.5 trillion, while the Saudi Crown Prince Mohammed bin Salman had weighed in with a prospective value of $2 trillion.

Clearly, it looks like the mean market valuation is skewed towards $2 trillion which again, seems to suggest that the claim about overvaluation might as well be a myth.

Saudi is taking countermeasures to justify the valuation

Those who believe the IPO to be overvalued have pointed to the expected decline in demand next year in their thesis. This could result in a significant fall in oil prices thereby affecting the performance of Saudi Aramco in the foreseeable future. However, Saudi Arabia, which heads OPEC meetings, is on course to counter this by asking the member states of the petroleum exporting companies to cut supply through the year 2020 in a bid to boosting oil prices.

In the ongoing meeting, Saudi Arabia will reportedly ask member countries to cut crude oil supply by as much as 400,000 barrels per day in a bid to squeeze supply. This could result in millions of barrels worth of supply reduction if extended to non-OPEC members that form the OPEC+ list.

In March this year, the company also acquired 70% ownership in the locally-based Saudi Basic Industries Corporation (SABIC), which is currently valued at about $60 billion. The company operates in petrochemicals, chemicals, industrial polymers, fertilizers, and metals. It will augment Saudi Aramco's revenue streams especially in the downstream segment of the oil and gas industry.

Conclusion

In summary, while there are genuine risks attached to investing in the Saudi Aramco IPO, the company appears to be taking measures to counter some of these risks. Furthermore, as demonstrated in the valuation comparisons, shares of the company are valued at relatively lower valuation multiples than those of its peers. Therefore, given the magnitude of this IPO, Saudi Aramco might be worth another look before completely dismissing it on the grounds of overvaluation.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.