Buy Ollie's Ahead Of The Q3 Report

by Josh ArnoldSummary

- Ollie's is due to report Q3 earnings next week.

- With shares languishing, I think they represent compelling value.

- The key risk for Q3 is margin performance, but I see a lot of bad news priced in already.

Off-price retailer Ollie’s (OLLI) has seen some enormous moves in its stock in recent years. I’ve been covering Ollie’s since right after its IPO, and while it was very cheap for a long time, for much of last year and this year, it wasn’t. However, with the pummeling shares took after the Q2 report back in August, I’m back on the Ollie’s bull train. Ahead of the Q3 report that is due out early next week, I think the stock is a buy.

Margin gains and revenue growth fuel a higher share price

The Ollie’s story is about a combination of revenue gains and margin expansion that has been going on for years, and originally attracted me to the stock. The company’s laser focus on controlling costs at every step of the way has seen its profitability increase steadily over time, improving the profit per dollar of revenue. In addition to that, a much larger store base and comparable sales gains have combined to send revenue a lot higher.

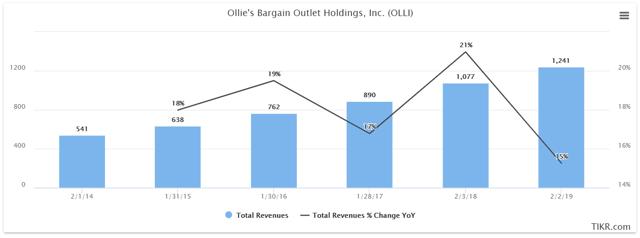

Source: TIKR.com

This chart shows Ollie’s journey as a public company in terms of revenue generation and growth. The company produced $541 million in revenue in fiscal 2014, which roughly corresponded with calendar 2013. Today, six years later, Ollie’s is slated to produce over $1.4 billion in revenue. Growth rates have been in the mid-teens or better every year since the company came public, with that sort of performance expected to repeat this year, as well as the next two years.

When the company reports Q3 results, I’ll be looking in particular at comparable sales as that is the sexy headline number investors love to pick apart. Irrespective of how the comparable sales number comes out, keep in mind that the bulk of Ollie’s growth will continue to accrue from new stores. Thus, so long as the company doesn’t downgrade its store base growth outlook – there is no reason to think it would – the long-term story is intact. Of course, if comparable sales tank 5% or something, that’s a separate issue, but that seems outlandish to even suggest at this point.

While I’m less concerned about comparable sales, Q3 should shed some light on a significant issue from the Q2 report, with that being the company’s margin picture.

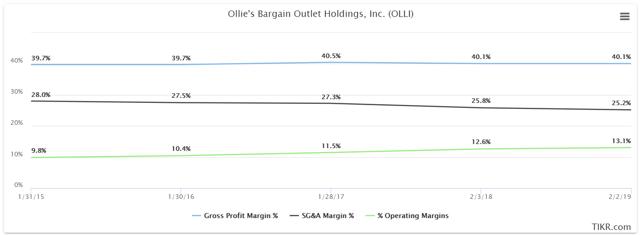

Source: TIKR.com

As you can see, Ollie’s has produced outstanding margin growth in the past few years, seeing its operating profit as a percentage of revenue rise from under 10% to more than 13% in a relatively short period of time. Virtually all of the gains have come from SG&A cost leverage as gross margins have remained virtually flat. However, in Q2, gross margins declined 190bps to 37.2% of revenue, negatively impacted by the deleveraging of supply chain costs – driven by higher labor costs – and lower merchandise margins – attributable to reduced markup percentages, as well as mix. This is a bit uncharacteristic for Ollie’s, and yet more damage was done via higher SG&A costs.

That line item grew as a percentage of revenue by 90bps in Q2 to 26.2%. The increase was driven by the number of new stores, so it should be transitory. As those new stores ramp up, those SG&A costs should be leveraged down over time. However, given the weak nature of gross margins in Q2, as well as higher SG&A spending, investors were spooked and dumped the stock.

I’m certainly not ready to give up on Ollie’s because of one hiccup, but the company has to deliver something better for Q3. If margins are weak again in Q3, all bets are off and we could see Ollie’s a lot lower. I don’t think that will happen, but it is a risk given the ugly Q2.

Positioned for growth

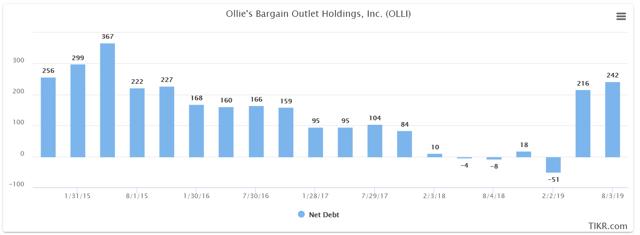

Ollie’s has been very profitable for a long time, and as a result, has been able to deleverage its balance sheet in a big way. The company had net debt of $367 million in 2015 at the peak, but rather quickly paid that down to a negative net debt position by 2018.

Source: TIKR.com

There is a big spike higher beginning in 2019, but that isn’t debt in the traditional sense. Rather, it is long-term operating lease liabilities, in accordance with ASU 2016-02, which requires lessees to recognize right-of-use assets and lease liabilities on the balance sheet. So, while this represents liabilities for leases, it isn’t debt in the traditional sense.

All of this is to point out that Ollie’s has built a pristine balance sheet that will not only afford it the ability to borrow should the opportunity present itself – for an acquisition, general corporate purposes, or a buyback program, for instance – but it also means that if Ollie’s does hit some sort of hard times, it has plenty of financial flexibility to weather the storm. I think the way Ollie’s has built its balance sheet is a huge advantage for long-term holders because the company has so many options now with financing.

A much cheaper stock creates an opportunity

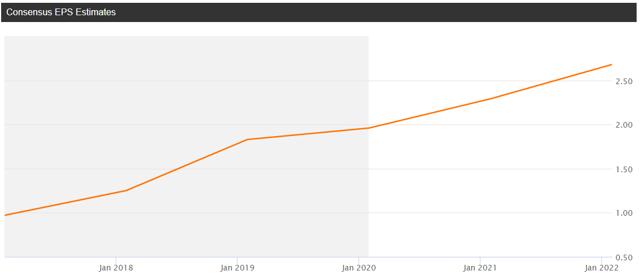

Looking forward, Ollie’s is slated to produce right at $2 in EPS this year, and ~17% annual growth in the next two years, culminating in ~$2.70 of EPS in fiscal 2022.

Source: Seeking Alpha

This will be driven by new stores and what should be some measure of margin expansion, but keep in mind this is the key risk for Ollie’s moving forward, and why shares are relatively cheap at this point. If Q3 results show weak margins again, estimates for the next year or two will almost certainly come down. That will lead to lower forward PE estimates, which will sink the stock. Again, I don’t think Ollie’s story is dead by any means, but if Q3 is another dud, I have to think investors will mercilessly sell the stock.

Source: Seeking Alpha

While shares are still trading near 30 times earnings, as you can see above, that is quite cheap relative to the company’s recent valuations. With EPS growth in the mid-teens annually, 30 times earnings isn’t egregious by any means. The current valuation is pricing in the ugly Q2 report, so if Q3 shows a rebound in margins, I have to think we’ll see the multiple reflate. That’s the opportunity with Ollie’s, and heading into the Q3 report, I think shares are a buy.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.