Starwood Property Trust: The Election Means Everything

by Michael A. Gayed, CFASummary

- Barry Sternlicht’s Starwood Property is a professionally managed company and a consistent dividend payer.

- Of late, the stock has been hit by news of its regional malls not doing well and the possibility of its WeWork loan going bad.

- The election will likely determine future prospects.

It’s tangible, it’s solid, it’s beautiful. It’s artistic, from my standpoint, and I just love real estate. ~ Donald Trump

Real estate mogul Barry Sternlicht’s Starwood Property Trust reported solid earnings of $153 million ($0.52 per share) for Q3 2019. Of this, $109 million was contributed by the company’s Commercial and Residential Lending unit.

This event has passed, and though Starwood (STWD) looks bullish on the monthly charts, every investor would be keen to know what the future holds because 2020 is expected to be a volatile year, full of surprises.

Here’s my analysis of what 2020 has in store for Starwood:

The WeWork Lord & Taylor Building Financing Deal

WeWork paid $850M for the entire Lord & Taylor 660K SF building (424, Fifth Avenue, NY). The rent agreed on was $105 per SF, way over the existing $80 per SF in the area. Starwood Property along with a couple of other lenders financed the deal. Starwood financed $229 million (of the $500 million first mortgage loan), and the entire $150 million senior mezzanine loan. There's also a $250 million junior mezzanine loan, that’s subordinated to Starwood.

Now what will happen if WeWork declares bankruptcy in 2020? That’s the question haunting investors.

Here’s the possible outcome:

- Starwood is covered with a 15-year corporate guarantee from WeWork, and it’s going to be tough to walk away from it.

- Andrew Sossen, Starwood’s COO, opines that there’s a solid demand for the space and that the company has already been approached to buy their note. Starwood is still deciding whether it wants to sell or not.

- Jeff DiModica, Starwood’s President, says that even if the tenant stops being a going concern, and the office has to be re-let at $30 lower, Starwood would still walk away with a near-70% loan-to-value and a debt yield of almost 7%.

The reasoning assures us that the loan will remain good even if WeWork goes bankrupt. This should soothe shareholder’s frayed nerves.

The Dems are Coming?

Barry Sternlicht’s very nervous about the Democrats winning 2020. If it plays out, he fears that tax rates on the wealthy will rise, making them leave cities like San Francisco and New York. With the moneybags gone, and with the population shrinking, it’s going to be a tough ask running properties profitably. He also cites the removal of deductions from the blue states as a red alert.

Starwood has already started factoring in this risk into its lending plans. If the Democrats win, Starwood will lie low – there’s no other option.

Trouble in Store

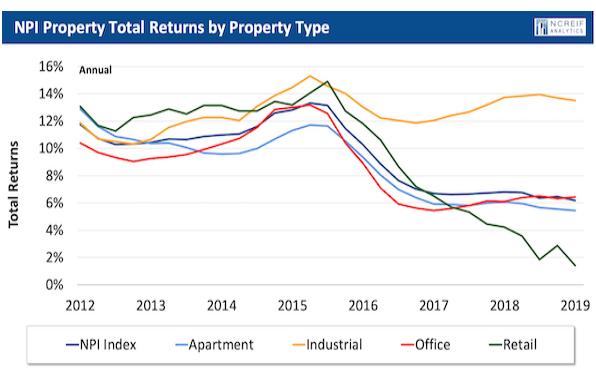

eCommerce has spread its tentacles and is choking the physical retail industry. Returns are down to 1.75% in 2019 from 13.7% in 2014.

And, well, Starwood is majorly into commercial real estate lending and retail represents a nice little chunk of business. However, Starwood’s current yields are majorly diverging from the industry average: its wholly owned assets enjoy a blended cash yield of 13% (for Q3 2019), and the average occupancy this year was steady at 97%. Looks good, but shareholders must track this space.

The LIBOR Advantage

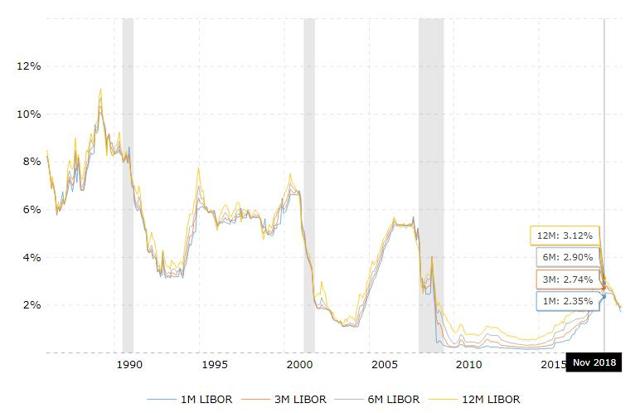

Starwood’s lending is benchmarked to the LIBOR rate. The company makes money with every move in the LIBOR rate. If the rate moves up, Starwood makes a little money, and when it moves down, the company makes a lot of money.

LIBOR rates have dropped from 3.12% to 2.35% in the last 12 months, and the momentum is towards south. This is incrementally profitable news for the company.

Unrealized Gains of $800 Million

Per Starwood’s internal valuation, their property portfolio (currently valued at $3 billion) has an embedded gain of $800+ million over its carrying value. That’s good to know because if a black swan lands, the company’s asset prices will keep it going.

The Mall at Wellington Green

Starwood Capital Group’s Starwood Retail Partners bought the mall in 2014 for $341.1 million and Starwood Property Trust owns a part of it. In 2019, one of its key anchor tenants (Nordstrom) exited and the property value has since dropped to $170 million.

Starwood Property Trust has proposed redevelopment tweaks to bring back the buzz. Building a crystal lagoon, multifamily units, restaurants, entertainment space, hotel, and a beach around the lagoon has been proposed. It’s a complicated situation and it’s still up in the air. As I write this piece, there are reports that the loan has been sent for special servicing.

Summing Up

There’s good news and there’s bad news.

Low interest rates, an embedded gain of $800 million in owned properties, greater participation by Middle East investors after the Aramco IPO, risk planning, the LIBOR rate benchmarking, and a careful lending program - all look good.

On the flipside, risks to the retail industry because of ecommerce, The Wellington Mall issue, the absence of Chinese (due to the on-going trade war) are the negatives.

Contingent events such as the Democrats or Republicans winning 2020 will impact the company negatively or positively, respectively.

So, should you buy Starwood Property Trust (STWD) now? I'll let you know in 2021.

*Like this article? Don't forget to hit the follow button above!

How To Avoid the Most Common Trading Mistakes

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.