Orchid Island Capital: In A Coma

by Michael A. Gayed, CFASummary

- Orchid Island Capital (ORC) has paid $10.705 as total dividend per share since its IPO in 2013.

- The company reported a disappointing Q3 2019 and was hit by analyst downgrades.

- For now, it’s a risky risk-off stock.

Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't ... pays it. ~Albert Einstein

The good news is that Orchid Island Capital (ORC) has been paying a consistent dividend. The bad news is that dividend payouts are diminishing, and the ugly news is that the stock price has been in deep coma since the last few years.

So, should you consider it as a dividend play? Does the stock have potential to bounce up? Should you hold on to it or exit? Here’s my analysis:

A Benign Business Model

ORC invests in RMBS (Residential Mortgage-backed Securities), which is a safe model because the principal and interest are guaranteed by the mortgage associations (Fannie Mae, Freddie Mac and Ginnie Mae).

While this sounds good and secure on paper, the problems with the RBMS business is that it involves borrowing short-term and buying long-term mortgage securities to take advantage of the interest differential (logic: short-term rates are lower, long-term rates are higher).

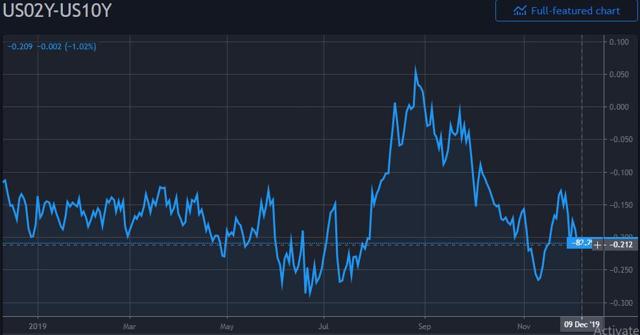

Now, when the yield curve inverts or flattens, the margins get slaughtered, and this scenario has started playing out over the past few months:

The company’s margins have started dipping and the future seems uncertain, because despite the Fed cutting rates, the yield curve has plunged after every bump up.

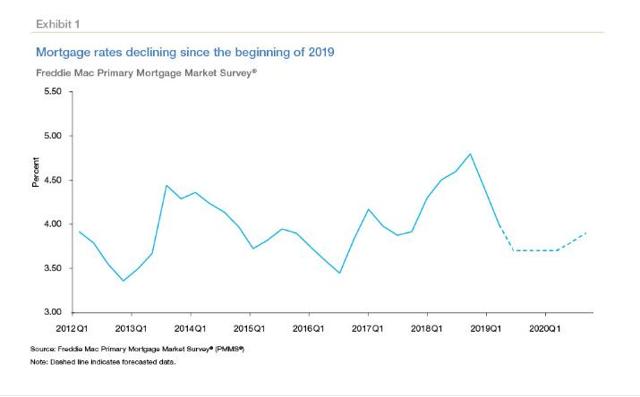

Residential Mortgage Interest Rates Outlook 2020

Freddie Mac is of the opinion that mortgage rates will remain muted in 2020. It expects the 30-year fixed-rate mortgage rate to average 3.8% in 2020, which is near the current rates (Dec 2019).

For Q3 2019, ORC suffered a net loss on GAAP basis of $0.14 per share. Earnings per share were $0.18 and $0.32 was lost because of net realized/unrealized gains and losses on financial instruments. We can reasonably expect that the company will report similar figures (per quarter) in 2020.

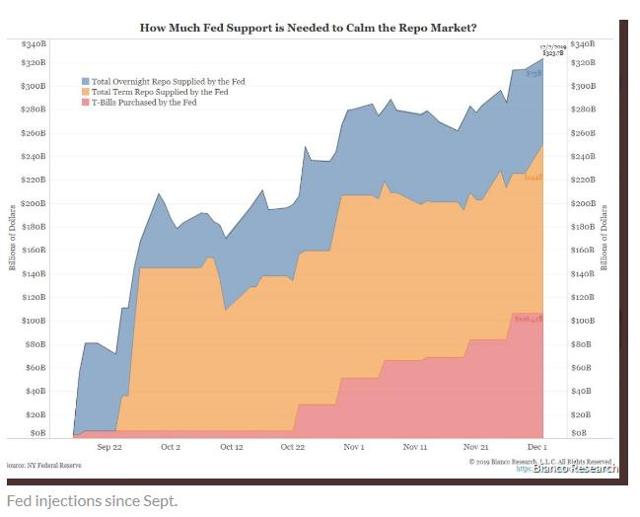

The Dependence of the Short-Term Money Markets on the Fed

Since Sep 2019, the Fed has been pumping in billions of dollars to keep the short-term money markets afloat.

If it weren’t for the Fed, the short-term money markets would have been in trouble. The ORC management team is of the opinion (in its Q3 2019 earnings call) that “They (FED) are not appearing to take steps like they did during the financial crisis to get very much in front of this. And so going forward, there is still some doubt in terms of just how effective they'll be … I would say that it was very much a tough quarter for mortgage investors, especially if you are levered and dynamically hedged.”

Now what happens if the Fed continues with the daily monetary doses without resolving the issue structurally? The short-term interest rates will rise and ORC’s margins will start becoming thinner, which is not good news for its shareholders.

The Trade War and Economy Issues

The U.S. –China trade war has taken a toll on the economy, and it is uncertain what the endgame could be. There are positive noises one day and saber rattling the next. Plus, the U.S. has threatened tariffs on Latin American and European countries.

The trade war and protectionism is knifing the economy, and it is natural that if economic indicators droop, the residential housing market will get adversely impacted. And if this were to happen, the yield will get inverted and it would take many months to get it out of the inverted-flat zone. This possibility is hanging like a sword over all RMBS REITs.

Summing Up

Orchid Island Capital has been hit by downgrades from ValuEngine and Zacks Investment Research in the recent past, and, any which way you look, you draw a blank. Whether it is the challenges that its business model faces, or the economic outlook, or the trade war, or the fund issues in the short-term money markets – everything sounds negative for the company in 2020.

On a side note, the company issued a public offering of 7M shares in Aug 2019 at $6.55. The stock price today (6 Dec 2019) is $5.62. It says a lot about the investor interest in the stock.

Orchid Island Capital is a risk-off stock that must be bought to earn dividend income in a booming economy. Even in a risk-off situation, the stock will see dull days as the yield curve inverts or flattens during such times.

I’d avoid this stock and consider it as a dividend play when the economy starts to recover.

*Like this article? Don’t forget to hit the follow button above!

How To Avoid the Most Common Trading Mistakes

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.