Yellow Cake Is A Lower Risk Investment In The Uranium Industry

by Bang For The BuckSummary

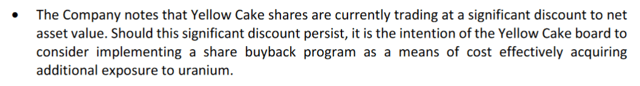

- Yellow Cake is trading at a discount to net asset value and the company has communicated it will rely on share buy-backs if the discount persists.

- The annual holding cost is expected to be relatively low compared to net asset value.

- The tax sheltered location makes the upside more attractive than competitors.

Investment Thesis

Yellow Cake (OTCPK:YLLXF) is a lower risk investment in the uranium industry. The company buys uranium directly and is a good way to get exposure to the price of uranium without the mining related risks accompanied by many other investments in the industry.

Figure 1 - Source: TradingView

Supply / Demand

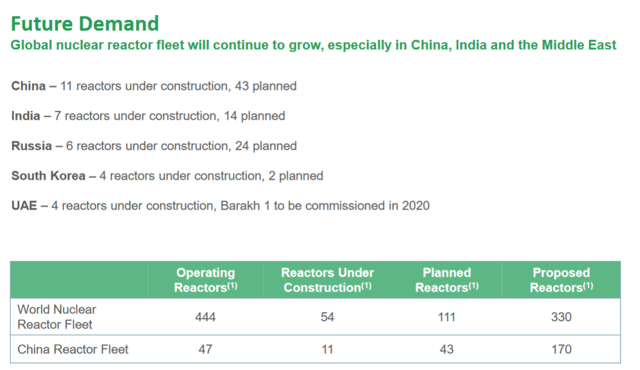

According to the World Nuclear Association, there are 444 operating reactors globally. 54 reactors are under construction and many more planned in the future. Some of the operating reactors will be closed due to age or political reasons.

However, I have a hard time seeing demand decreasing going forward, short of another Fukushima style event. Planned closures have often been delayed as there are few good alternatives for carbon free base load energy.

Figure 2 - Source: Yellow Cake September 2019 Presentation

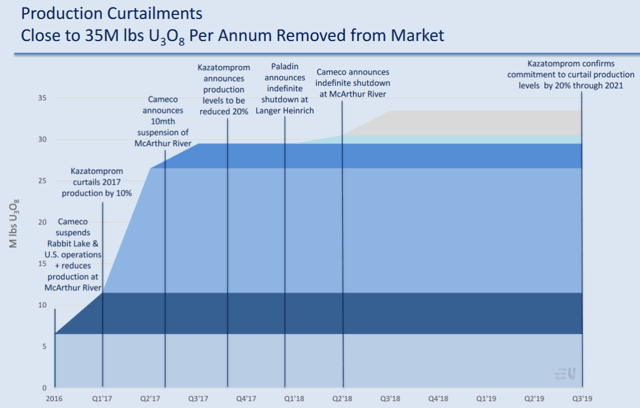

Over the last few years, we have also seen significant supply reduction best illustrated by the below slide from Uranium Participation Corp (OTCPK:URPTF). Unless the price of uranium recovers to levels where at least the low cost producers can earn a decent margin, additional supply is very unlikely to come to the market. I also think the longer the uranium price remains at this level, the higher the probability is that we see an overshoot once the recovery arrives.

Figure 3 - Source: Uranium Participation Corp. November 2019 Presentation

Net Asset Value

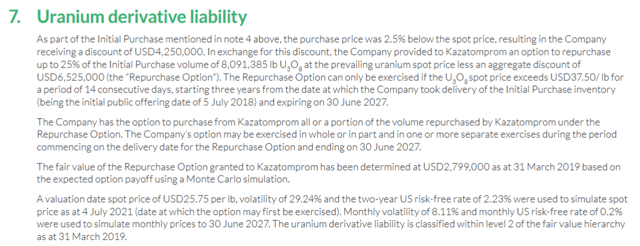

Yellow Cake owns 9.62M lbs of uranium as of the end of September, valued at $246.7M given a $25.65/lb of uranium. The company also had $8.2M in other net assets which is mostly cash and a $2.7M liability on the books. The liability represents a short position in a put option with some barrier characteristics on 25% of the initial uranium purchase (8.1M lbs). Even if that option is exercised, it will be at a significantly higher price than the price of uranium today.

Figure 4 - Source: Latest Yellow Cake Annual Report

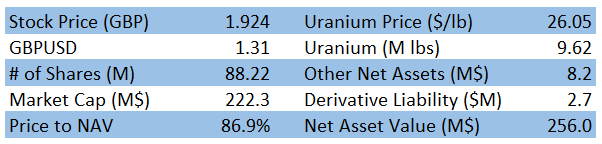

I will assume other net assets and the derivative liability are unchanged from the end of September. Use the latest numbers for the stock price, uranium and GBP/USD FX rate.

Figure 5 - Source: Yellow Cake September 2019 Update

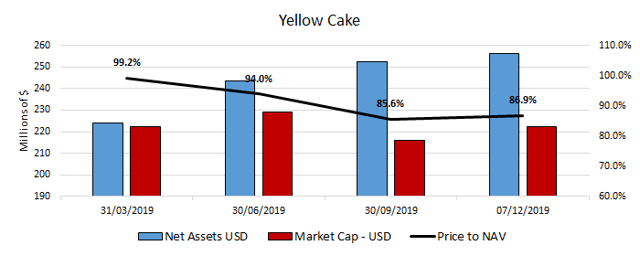

The net asset value of the company is $256.0M compared to a market cap of $222.3M, which represents a 13.1% discount to NAV. The discount is at the higher end of what we have seen during 2019.

Figure 6 - Source: Yellow Cake Quarterly Updates & Own Calculations

Liquidity

The company has been very clear in several interviews and in the most recent update, that if the discount to NAV persists, the company will consider buy-backs. This is something that always frustrates me, when companies valued on assets and trades at discount to NAV, don't buy-back more often.

Figure 7 - Source: Yellow Cake September 2019 Update

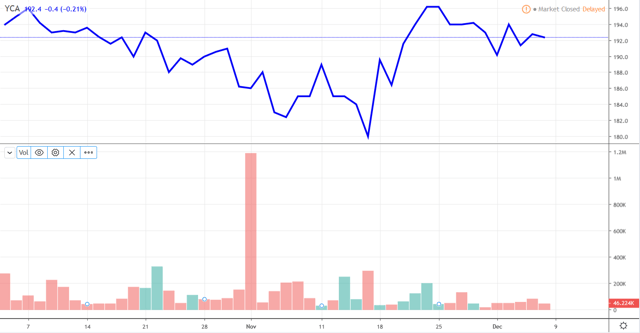

The reason we haven't seen any significant share buy-backs for Yellow Cake yet, is likely related to low liquidity. The daily volume is on some days very low and the bid/offer spread can be between 0.5% and 2%. So, caution is warranted when purchasing Yellow Cake shares and this is also limiting the company from significant share buy-backs.

Having said that, there is likely a floor somewhere just above a 15% discount to NAV where I think the company will step in. Buying back shares at a 15% discount to NAV effectively offers the company or potential investor the ability of purchasing exposure to uranium at $22-23/lb of uranium compared to the latest spot price of $26.05/lb.

Figure 8 - Source: TradingView

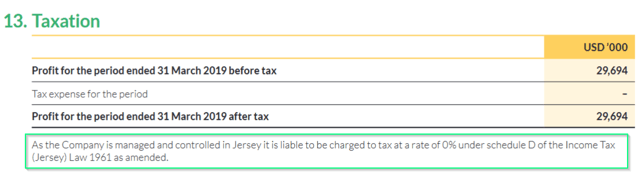

Tax

Yellow Cake is very similar to Uranium Participation Corp. However, there are two primary reasons why I like Yellow Cake better. The discount to NAV is more attractive for Yellow Cake presently, but that can naturally change very quickly.

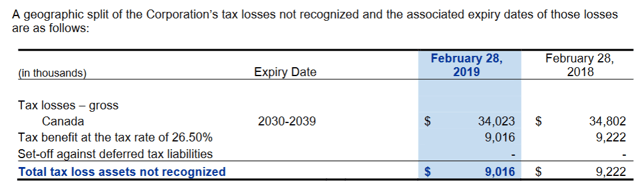

The other more fundamental reason I prefer Yellow Cake is the fact that the company is registered in Jersey, UK where the corporate tax rate is 0. Uranium Participation Corp. has some tax losses it can recover. So, the difference might be minor in some scenarios, but the tax arbitrage makes Yellow Cake more attractive compared to Uranium Participation Corp., at least in my view.

Figure 9 - Source: Latest Yellow Cake Annual Report

Figure 10 - Source: Uranium Participation Corp. Annual Report

Costs

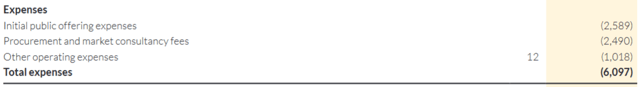

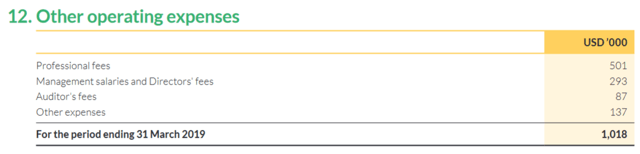

During the last fiscal year, the company had $6.1M in total expenses, which is 2.4% compared to current net asset value. However, the better part of those costs is likely to be one-off costs. Other operating costs are only about 0.4% of current net asset value. I do expect reoccurring operating costs for Yellow Cake to be around the 0.8% costs to NAV that Uranium Participation Corp. has.

Figure 11 & 12 - Source: Latest Yellow Cake Annual Report

Conclusion

Yellow Cake will not have the same leveraged exposure to the price of uranium that many uranium mining companies have. On the other hand, the company will have a lower downside if the recovery takes longer to materialize.

An investment in Yellow Cake is a lower risk investment to the uranium industry. The stock has allowed me to continue to increase my exposure to the entire industry without taking on more mining related risk. There are few if any commodities that can remain below the average cost of production for very long periods.

I think a recovery is moving closer, which I discussed in a recent article about Cameco (NYSE:CCJ). Regardless, Yellow Cake is a good lower risk option to get additional exposure, less dependent on the timing of a recovery.

Disclosure: I am/we are long YLLXF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long Yello Cake PLC on London Stock Exchange.