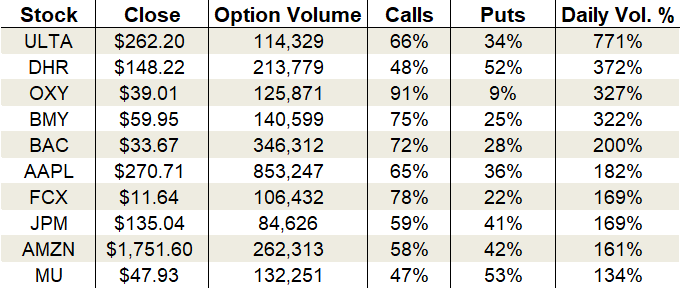

Monday’s Vital Data: Bank of America, Apple and JPMorgan Chase

Options activity provides a look at expectations on BAC, AAPL and JPM stock

U.S. stock futures are trading slightly lower this morning. Thus far, the selling pressure is minimal, and the technical posture of the indexes remains healthy after last week’s rally.

Ahead of the bell, futures on the Dow Jones Industrial Average are down 0.11% and S&P 500 futures are down by 0.12%. Nasdaq Composite futures have lost 0.17%.

Friday’s movement in the options pits saw a notable uptick in call volume, while overall activity pushed above recent average levels. Specifically, about 21.5 million calls and 16.4 million puts changed hands on the session.

The boom in call trading sank the CBOE Volatility Index (VIX) single-session equity put/call volume ratio to one of its lowest readings of the year at 0.53. At the same time, the 10-day moving average continued its rollover with a drop to 0.60. With the S&P 500 closing in on another record high, complacency is ruling the roost.

Options traders took aim at financial stocks and technology on Friday. Bank of America (NYSE:BAC), Apple (NASDAQ:AAPL) and JPMorgan Chase (NYSE:JPM) were among the most actively traded.

Let’s take a closer look.

Bank of America (BAC)

Bank stocks have emerged as one of the big winners from the budding fourth-quarter rally. The gains continued coming on Friday with Bank of America shares popping 1.8% on above-average volume. 50.9 million shares traded on a day that saw BAC stock rise to a new 11-year high.

The weekly chart is just now clearing the resistance zone of a two-year base and looks ready for launch. Turning to the daily view reveals a powerful trend rising above 20-day, 50-day and 200-day moving averages.

On the options trading front, calls dominated the session. Total activity grew to double the average daily volume, with 346,312 contracts traded. 72% of the trading came from call options alone.

Implied volatility fell to 25% or the 17th percentile of its one-year range. Premiums are pricing in daily moves of 53 cents or 1.6%, so set your expectations accordingly. The lower implied volatility, cheap price tag of the stock, and mildly bullish trend make bull call diagonals a good trade idea here.

The Trade: Buy the Feb $31 call and sell the Jan $35 call for around $2.80.

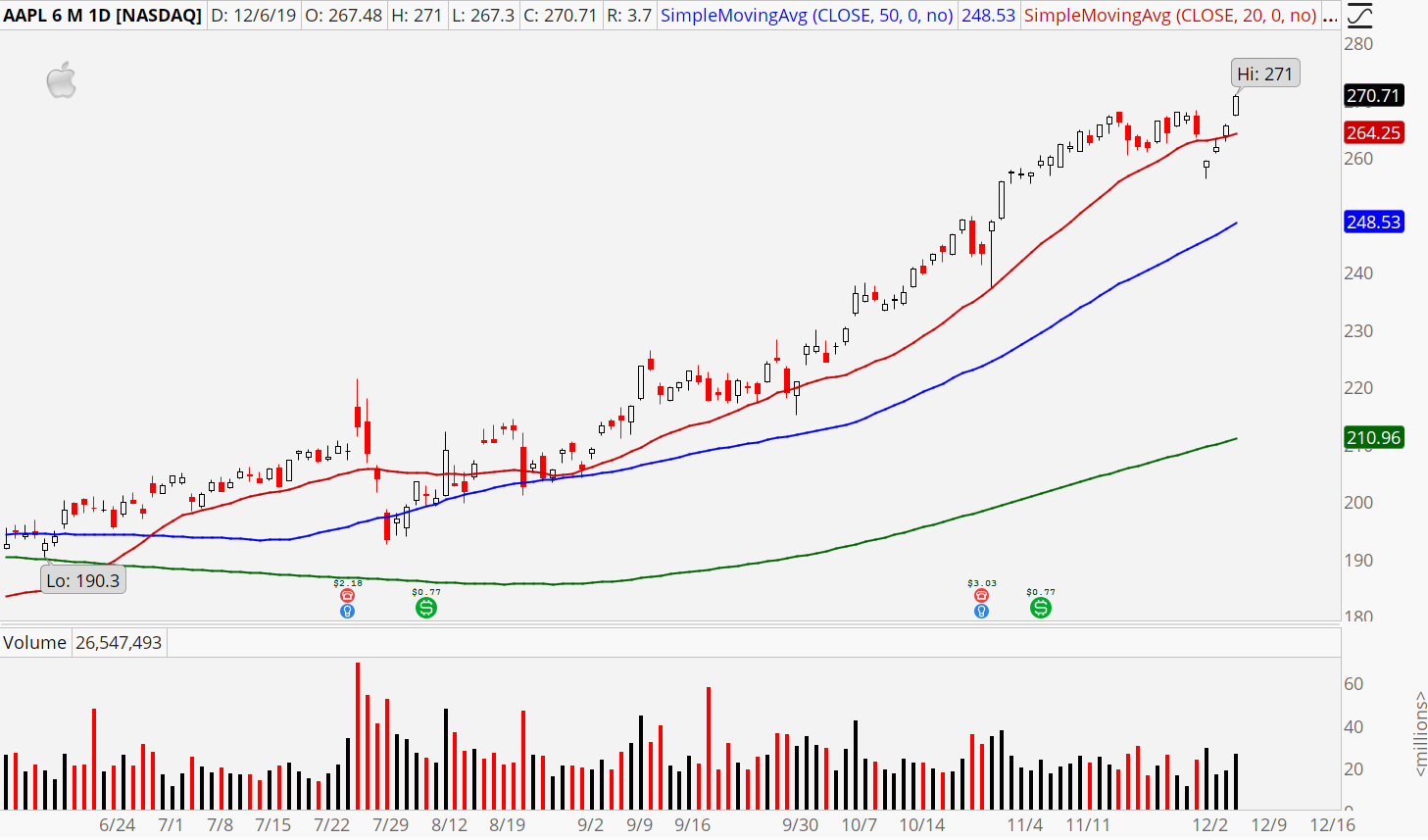

Apple (AAPL)

The speed with which Apple shares recovered from Tuesday’s big down gap has been impressive. The three-day snap back ended with a powerful rally on Friday, driving AAPL stock up 1.9% to a record high. Its year-to-date gains now stand at a mouthwatering 72%.

As you would expect for such a big winner, its price trend is firing on all cylinders. The weekly time frame is flashing strong increasing momentum on the last advance, and the daily is rising dutifully above the 20-day, 50-day and 200-day moving averages. Distribution days have been sparse since October showing a lack of selling aggression in volume.

Until the evidence changes, Apple is a stock to be bought.

Options traders certainly agree. Friday saw large inflows into the call side of the aisle. Activity swelled to 182% of the average daily volume, with 853,247 total contracts traded. Calls accounted for 65% of the session’s sum.

Implied volatility continues to languish in the lower quartile of its range. It ended the day at 24% or the 16th percentile. Premiums are baking in daily moves of $4.08, or 1.5%.

Ever since August, long calls and call verticals have provided excellent profits. If you think the gains continue and want a cheap way to play it, then consider this trade.

The Trade: Buy the Feb $270/$280 bull call spread for around $4.60.

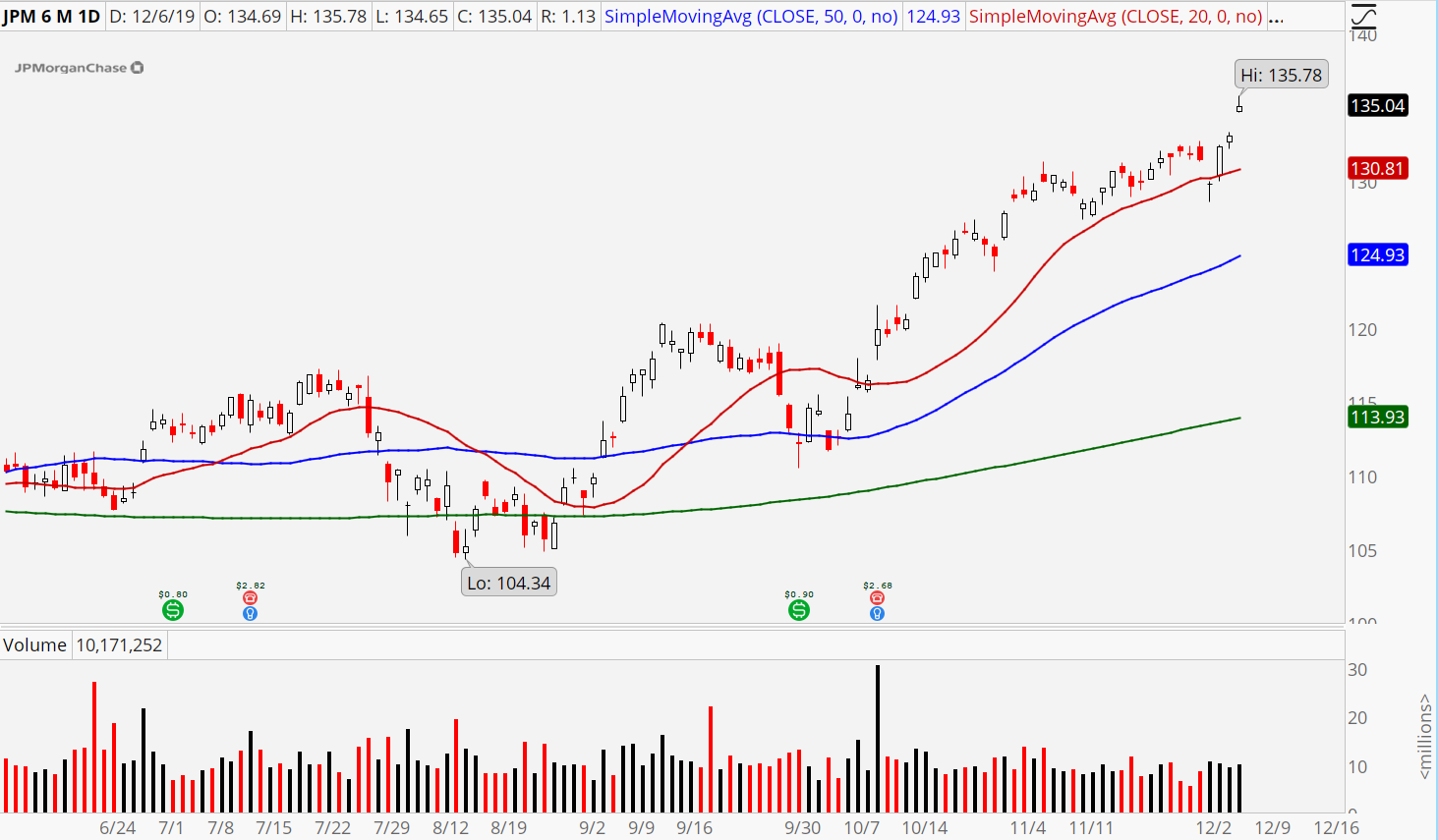

JPMorgan Chase (JPM)

JPMorgan Chase joined Bank of America with a robust rally ahead of the weekend. Its shares climbed 1.5% to an all-time high. Its price trend is as bullish as AAPL across all time frames. Moving averages, volume and momentum all point to higher prices.

In the short run, JPM stock has become slightly overbought, so some consolidation wouldn’t be surprising. Nonetheless, the strength of its trend demands viewing short-term weakness as buying opportunities for now.

On the options trading front, traders flocked to calls on Friday, driving overall activity to 169% of the average daily volume. By day’s end, 84,262 contracts changed hands with calls creating 59% of the take.

Implied volatility slipped to 21% or the 17th percentile of its one-year range. Premiums are pricing in daily moves of $1.80 or 1.3%. My analysis of JPM mirrors BAC with one exception. The higher price of JPM makes bull call verticals more attractive than diagonals. It will help you better contain the cost.

The Trade: Buy the Mar $135/$140 bull call spread for around $2.25.

As of this writing, Tyler Craig didn’t hold positions in any of the aforementioned securities. For a free trial to the best trading community on the planet and Tyler’s current home, click here!