Hormel: Great Dividend Grower, But Significantly Overpriced

by Nicholas WardSummary

- HRL is a dividend aristocrat, with 50+ consecutive years of annual dividend increases.

- However, the company posted negative EPS growth in 2019 and analysts expect that trend to continue into 2020.

- HRL has significantly underperformed the market year-to-date, but shares still remain equity expensive, with a 25x+ ttm P/E multiple.

The last article that I wrote was focused on McCormick (MKC), an extremely high quality, yet equally overpriced, dividend growth stock. Well, with fond memories of turkey still lingering fresh in my mind from Thanksgiving meals last week, I decided to dedicate some time to write another article on a high quality, but very expensive food stock. In this piece, we'll be taking a look at Hormel (HRL) (owner of the popular Jennie-O turkey brand), which like MKC, has generated massive wealth for shareholders over the years. Unlike MKC, I don't own any shares of HRL. Hormel has been on my watch list for years, but I've never pulled the trigger because of valuation concerns. Today, I'll discuss HRL's dividend history, its recent dividend increase, and my fair value estimate for the stock.

The Dividend

To me, the best part of the Hormel investment thesis is the company's dividend. HRL has increased its annual dividend for 53 years in a row now. Simply put, that's an incredible streak. To me, any company with a 50+ year dividend increase streak deserves serious consideration for ownership in my DGI portfolio. That sort of longevity proves that HRL has successfully navigated a wide variety of economic environments successfully. To me, this points towards top-notch management, which is something that I want to partner with as a long-term shareholder, and a suite of products and services that continue to benefit from strong consumer demand.

What's more, HRL isn't just providing its shareholders with token increases to keep that massive streak alive. On the contrary, this company is well known for double digit dividend growth, which as we've discussed many times before, leads to fantastic compounding in a relatively short period of time.

HRL's 10-year dividend growth rate is 15%. The company's 5-year DGR is 17.1%. HRL's most recent dividend increase came last week, on November 25th, as management announced a 10.7% quarterly increase.

This 10.7% increase is well below the recent rate of growth; however, it's still quite generous considering that EPS fell 5% on the year. This increase in the face of a negative growth year shows that management is confident about the continued long-term growth trajectory that HRL remains on. It also highlights historical prudent capital management and shows the strength of the company's balance sheet. Over the years, management has grown HRL's dividend at an abnormally high rate, while still maintaining a conservative payout ratio. Right now, on a ttm basis, HRL's dividend payout ratio sits at roughly 51.6%. This is the company's highest payout ratio in some time; however, it isn't stretched by any means due to the company's strong cash flows.

Hormel has produced consistent free cash flows in the $700-$800m range for the last 5 years and as it stands, the company appears to be on the hook for roughly $465m in dividend payments over the next 12 months (assuming there isn't a significant share count reduction via buyback between now and then). And, HRL isn't known for big share buybacks (which is why many investors love this company; it isn't known for using cash flows or debt to repurchase shares), instead, it has rewarded shareholders with cash in their pockets, via dividends.

And while we're on the subject of buybacks, cash flows, debt, and the dividend, I think it's important to note that not only does the current yield appear to be safe, with future growth prospects intact because of the cash flows, but also, this company's strong balance sheet. HRL only has $250m in long-term debt on the balance sheet (this figure is down from $625m at the beginning of the year). And, Hormel had $653m of cash on hand at the end of the most recent quarter, up from $459m of cash on hand at the start of 2019. All in all, this company is managed conservatively, and while this may seem boring to some, reliable cash flows and a safe, growing dividend is just what the doctor ordered for others.

Valuation, Recent Underperformance, and Fair Value Estimate

Simply put, HRL is one of the most attractive names in the entire market from a dividend growth perspective. But, to me, it's never just about the dividend, but also the valuation that the market is forcing me to pay for exposure to the equity.

Even though HRL shares have experienced a strong rally in recent weeks, rising some 12.5% over the last month or so, they're still drastically underperforming the market thus far on the year. Year-to-date, they're up 6.5%, whereas, the S&P 500 is up roughly 25%.

Although I generally try not to over simplify the forces determining share price movement because there are usually too many variables at play to do so, I think it's safe to say that this company's recent underperformance is two-fold.

Although management has done a great job of re-structuring the company and revitalizing its product portfolio, making nutritious items and fresh protein front and center, which is on-trend in terms of what the modern consumer wants to see, HRL continues to face trade war headwinds as the U.S. agriculture space struggles.

The company is also forced to justify its high valuation, which is tough to do when posting negative EPS growth. In short, HRL is being priced like a growth stock when in reality, that's far from the case. Market trends have driven defensive, income seeking investors into equities like HRL, which is understandable in the short term due to the low yields available in the bond market, but over the medium to long term, I don't believe that the valuations associated with this T.I.N.A. trend are sustainable.

The company saw its EPS fall 5% during fiscal 2019 and many of the same headwinds persist moving into 2020, which is why analyst consensus for 2020 EPS currently points towards another -3% year. In the event that we see a major trade deal and the ag space perks up, I suspect that HRL would be a beneficiary (both in terms of top/bottom-line growth as well as share price appreciation). But, to me, speculating about a trade agreement is the wrong way to go about investing in this market.

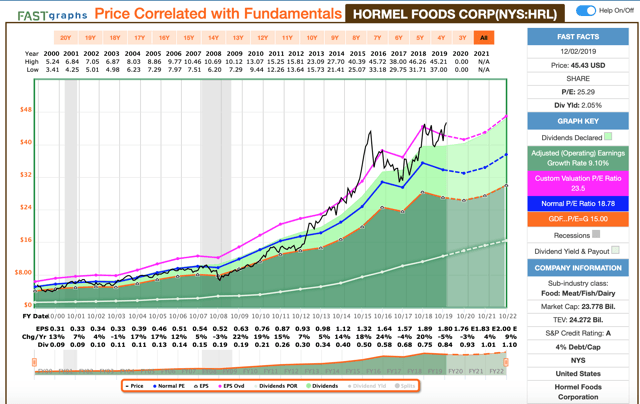

As you can see on the F.A.S.T. Graph below, HRL experienced a nice uptick in late 2018 when it came to multiple expansion, pushing its ttm P/E ratio to 23-24x level, which has served as a relatively reliable resistance level during the past 5 years or so.

Source: F.A.S.T. Graphs

During 2016, HLR's valuation shot up to nearly 30x, though historically, that has proven to be a major outlier. And today, we see shares trading in the 25.3x range, though that's due to the share price holding up relatively well in the face of falling EPS rather than rampant bullish sentiment causing shares to spike higher.

Either way, it appears that HRL shares are historically expensive and I think this premium valuation will continue to serve as a major hurdle for the share price to overcome. Without strong growth performance and near-term potential, it simply doesn't make sense to pay such higher premiums for HRL shares. Sure, this company is a blue chip name in the meat/fish/dairy area of the food space, but ultimately, I don't see the point in paying 25x for HRL when you can expect to receive a 2% dividend yield and sales and earnings growth in the flat to low single digit growth range over the medium term.

I could pay ~25x and receive exposure to strong, secular growth trends in the big-cap technology space with well known, cash cow type names like Alphabet (NASDAQ:GOOG) (GOOGL), Facebook (FB), Apple (AAPL), or Microsoft (MSFT) (though, I may have to forfeit the ~2% dividend yield to do so in certain cases). Or, I could pay a similar yield, staying in the blue chip realm of the food and beverage space, buying shares of companies like Coca-Cola (KO) or PepsiCo (PEP) and receive a ~3% dividend yield (which is ~50% higher than HRL's).

This is the issue that Hormel shareholders will continue to face until the company can return to a growth level that outpaces the larger food and beverage names. In 4 out of the last 6 years, we've seen HRL produce strong, double digit EPS growth that would justify a premium over names like KO or PEP. However, HRL's growth outlook has diminished and therefore, the multiple being applied to shares should have as well. Yet, while HRL has underperformed the S&P 500 by a wide margin in 2019, the stock's multiple has yet to compress. To me, this points towards continued downside, which is why I'm not interested in buying shares of this name (yet, at least).

HRL's long-term average P/E ratio is 18.8x. To me, this ~19x premium seems about right for a blue chip in this industry. I suppose that in today's low yield environment, I could even feel fine about bumping up that fair value multiple to 20x or so. However, any way I slice it, the ~25x multiple currently placed on shares seems irrational.

One reason that investors are so willing to pay such a high premium for HRL is the resiliency that its business has shown in the past. On the F.A.S.T. Graph above you'll see that HRL barely missed a beat during the Great Recession, with EPS down only 3% in 2008, only to rebound impressively, posting growth of 22%, 19%, and 15%, in 2009, 2010, and 2011, respectively.

Admittedly, it's difficult to put a price on peace of mind. In the equity space there is always risk, but HRL's operations make this stock an easy one to hold for risk averse investors. In the T.I.N.A. environment, this reliable performance has driven yield seeking investors into the equity because it's one of the closest things that you're going to find to a fixed income investment in the equity space.

But, I want to hammer home the idea that there is so much thing as a "bond-equivalent". Equities are always at risk of going to $0.00. Dividends are as well.

But, if I had to guess, I'd say that HRL's business isn't going anywhere anytime soon. Humans still love to consume protein and HRL is one of the best in the world at supplying that need.

Because of HRL's illustrious history, I'd even be willing to give the company the benefit of the doubt and use that multiple on a forward basis when attempting to arrive at a fair value estimate. Right now, analysts are calling for 2020 EPS of $1.76. Slapping a 20x multiple on those earnings brings us to the $35 area. This is where I think fair value lies when it comes to HRL, meaning that to me, shares are currently ~23% overvalued.

And, what's more, when making initial purchases in the market, I rarely try and pay full price. Generally, I like to initiate positions at a ~10% discount to my fair value estimate and then average down from there. This means that we're quite a ways away from the price point where I'd like to be buying shares.

Conclusion

Overvaluation is what has kept me out of the stock for years. For a while now, I've been saying that eventually, interest rates will normalize and when that begins to happen, those investors who were forced into the equity space by the T.I.N.A. environment will rotate back into fixed income. This rotation will result in multiple compression in the defensive space, which is why I continue to believe that it's important to use growth potential to price stocks and not just dividend yield.

I sincerely hope that one day, HRL is a part of my portfolio. I'd love to have exposure to this dividend. I suspect that this is a name capable of producing a lot of wealth for long-term shareholders. However, to me, the risk simply isn't worth the reward here with a 25x multiple being applied to shares.

Attractive values are hard to come by in today's market. That's for sure. But, that doesn't mean that I'm willing to chase momentum and potentially overpay for equities, just because I like their dividends. If I know one thing about the market, it's that eventually, all great assets go on sale. It's been about 6 years since HRL last traded at a significant discount to my current fair value estimate. But, I'm a patient man. HRL remains on my watch list and if/when the stock trades down to the ~17-18x range, I'll certainly be a buyer. Until then, I'll happily continue to search out value elsewhere.

This article was previously published for members of The Dividend Growth Club.

If you enjoyed this content and want to see more like it, please check out my Marketplace service: The Dividend Growth Club.

DGC members have access to sample portfolios spanning different dividend yield thresholds, weekly Nick's Picks articles, highlighting the best DGI values I see in the market, real-time access to Nick's Portfolio and trade updates, and a vibrant chat room where an income oriented community has come together to share ideas.

DGC members also receive early access to all other content that I post on Seeking Alpha

Feel free to take advantage of a free trial offer!

Disclosure: I am/we are long AAPL, GOOGL, KO, MKC, MSFT, PEP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.