Gladstone Land: It's Economics 101

by Brad ThomasSummary

- Farmland is the perfect asset class because the lower supply of arable land leads to higher profitability for the most fertile farm.

- In turn, that leads to steady appreciation of value and rental growth.

- Due to high fragmentation (only 13% institutionally owned) there’s an enhanced opportunity for the REIT to capitalize on sale-leasebacks within the $2.4 trillion industry.

When I was in college, I remember writing a research paper on golf driving ranges. I wish I could locate the report, because it would be useful in explaining my rationale for investing in Gladstone Land (LAND).

You see, golf driving ranges are similar to farms, because there’s very little upfront money to start one up, and more important, both serve as incubators for future vertical development.

In other words, whether it’s hitting golf balls or plowing fields, these two businesses are low barrier to entry businesses that allow the landowner to utilize the real estate (hopefully for a modest profit) until such time as there’s a higher and better use.

In addition to the concept of business incubators, I also learned a valuable lesson in college, specifically in my Economics 101 class. Whether you attended college or not, almost everyone understands the concept of supply and demand – the law that explains the interaction of supply and demand. For a refresher:

The law of demand says that at higher prices, buyers will demand less of an economic good. The law of supply says that at higher prices, sellers will supply more of an economic good. These two laws interact to determine the actual market prices and volume of goods that are traded on a market. Several independent factors can affect the shape of market supply and demand, influencing both the prices and quantities that we observe in markets.

Now when it comes to investing in real estate, I always like to see property sectors in which the supply and demand laws are on my side.

For example, one reason I remain bullish as it related to Tanger Outlets (SKT) is because there are a limited number of outlets in the US. Comparatively, there’s an over-supply in malls, thus as more and more department stores close over the next few years, we believe the demand for retail space will be advantageous for outlet owners.

Another example exists in the prison sector: we believe Geo Group (GEO) and CoreCivic (CXW) are well positioned, regardless of the political headwinds, to benefit based upon the increased prison population and limited number of safe prison facilities (that we consider "critical mission infrastructure").

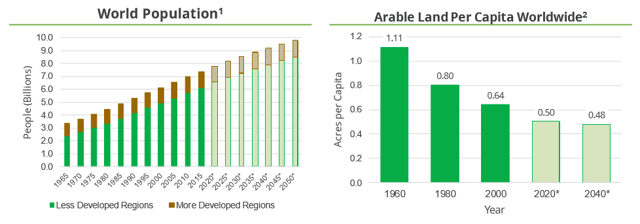

That brings us back to farming, where I believe there are the best supply and demand fundamentals. As available farmland to feed the world’s growing population continues to decline, U.S. cropland has steadily appreciated in value.

Source: LAND Investor Presentation

Meanwhile as supply increases, the amount of available farmland in the U.S. continues to decrease (as illustrated above). This makes farmland a perfect “incubator” asset class as large amounts of vacant land are converted to suburban uses, such as housing subdivisions, schools, shopping centers, office buildings, government buildings, and industrial buildings.

Quite simply, farmland is the perfect asset class because the lower supply of arable land leads to higher profitability for the most fertile farms, and in turn, that leads to steady appreciation of value and rental growth.

Why Gladstone Land?

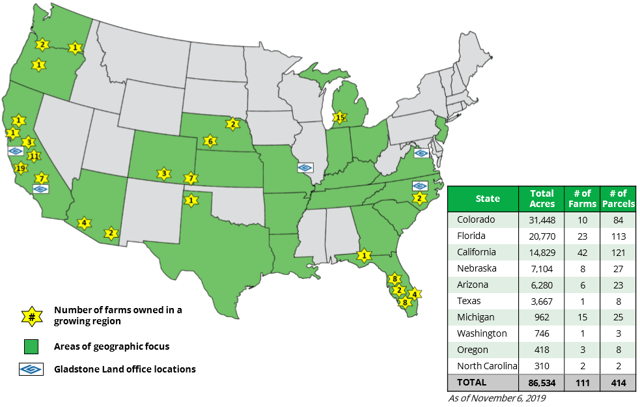

Gladstone Land (LAND) owns 111 farms with 86,534 total acres in 10 states, valued at approximately $876 million. As of Q3-19 the acreage is currently 100% leased, and most farms are leased on a triple-net basis, meaning the farmer pays rent, insurance, maintenance, and taxes.

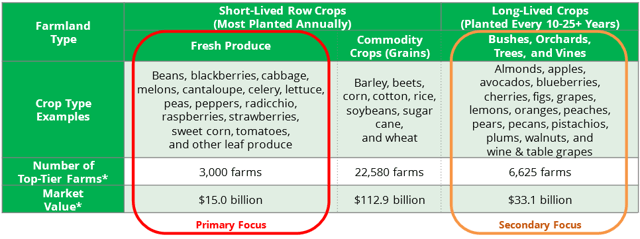

Source: LAND Investor Presentation

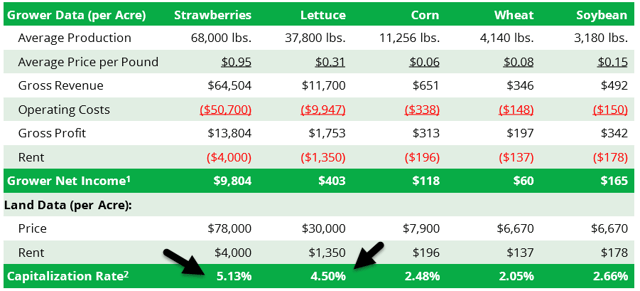

Gladstone primarily buys land used to grow healthy foods, such as annual fresh produce (i.e. fruits and vegetables) and certain permanent crops (i.e. blueberries and fruits). The company believes that these “specialty crops” are superior to commodity crops (i.e. corn, wheat, and soy) due to higher profitability and rental income (as viewed below):

Source: LAND Investor Presentation

In addition to higher rental income, specialty crops have lower price volatility and are less reliant on the government. They are also typically closer to major urban areas, which means they have higher development potential (i.e. the “incubator” effect).

Source: LAND Investor Presentation

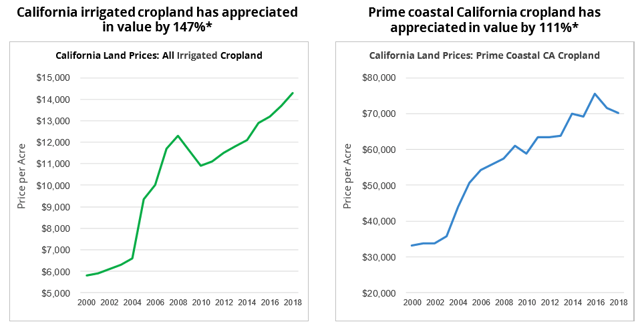

As you can see (above), Gladstone has extensive exposure in California and Florida because these markets command premium rents (for crops such as strawberries). From 2000 through 2018, California irrigated cropland and prime coastal cropland have both been among the strongest performers of any real estate asset class.

Source: LAND Investor Presentation

One of the compelling arguments to own Gladstone Land is because of the company’s small size. Due to high fragmentation (only 13% institutionally owned) there’s an enhanced opportunity for the REIT to capitalize on sale-leasebacks within the $2.4 trillion industry.

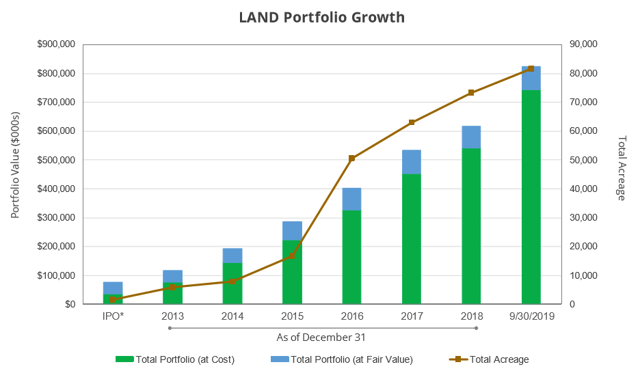

Approximately 62% of U.S. farm operators are over 55 years of age, and many will be looking for succession plans in which Gladstone Land offers shares of operating partnerships to allow for a 1031 tax-free exchange. Since the IPO in 2013, Gladstone Land has purchased over $796 million of new farm assets.

Source: LAND Investor Presentation

The Business Model

As referenced earlier, Gladstone Land leases most of its properties using triple net contracts, which means that the tenant is responsible for most of the operating expenses (taxes, insurance, and maintenance). Also, the portfolio is 100% leased today.

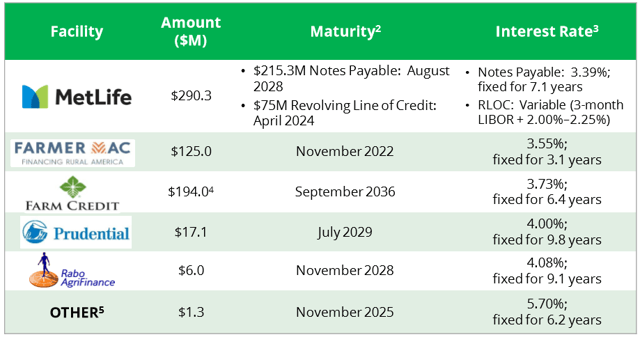

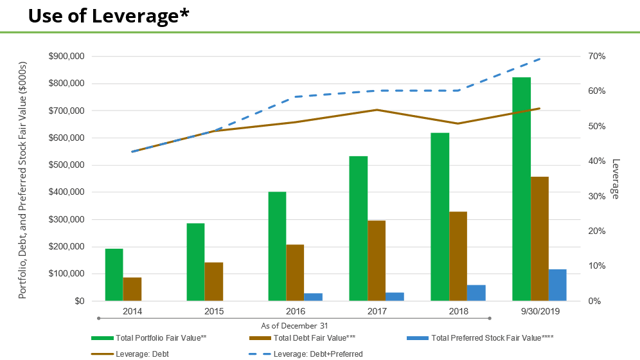

The security and stability of farmland allows the company to utilize more leverage than most REITs and to borrow at lower rates than most other farmland owners. Specifically, the company utilizes farmland lenders such as MetLife (NYSE:MET), Farmer Mac (NYSE:AGM), Farm Credit, and Prudential (NYSE:PRU), among others:

Source: LAND Investor Presentation

As you can see below, Gladstone Land borrows at levels that enhance returns to while maintaining the security provided by a strong and stable asset base. The company’s loan-to-value (or LTV) was around 55% as of Q3-19 and 97% of borrowings are at fixed rates (average rate of 3.6% and weighted average maturity of 11 years). This means the company is well positioned for the next recession.

Source: LAND Investor Presentation

During the third quarter, the company acquired seven farms for $153 million that grow a variety of crops. The initial net cash yield on these acquisitions was about 6.4% and all of the leases contain certain provisions such as annual escalations or participation rents.

Participation rents are like “icing on the cake” and on the earnings call the company said that during 2018 it had $1.2 million of participating rents, and it “expects to have a lot more, well, a little bit more in 2019”…and “expects to be able to recognize the significant amount of additional participation rents during the fourth quarter that we're in right now.”

We decided to put together a “back of the napkin” weighted average cost of capital (WACC) model to arrive at a basic understanding of Gladstone Land’s profit margins. Here’s our snapshot:

Equity Cost AFFO per sh/ Current Price $.54/$13.09 = 4.13% x 45% (equity) = 1.86% Debt Cost 10-year rate of 4.0% x 55% (debt) = 2.2% WACC 1.86% + 2.2% = 4.06%

As noted above, Gladstone Land has recently closed on deals with a going-in cap rate of 6.4% and the company’s “back of the napkin” WACC is 4.1%, which translates into healthy profit margins of 230 basis points. Keep in mind that this does not include the ~$100 million of 6% preferred shares (Series B). The company’s CEO recently said,

We passed the 50% mark just a short while ago and now we’re already beyond the $100 million milestone. With less than $50 Million remaining in our Series B Preferred Stock offering, we’re excited to see the offering fully subscribed in the near term. Since we rolled out this preferred offering in May of 2018, we’ve used the proceeds to grow our farmland portfolio to approximately 87,000 acres worth about $876 million. We have now acquired more than $250 million worth of farmland so far in 2019.

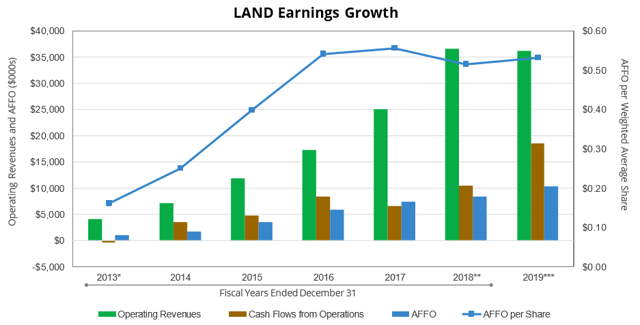

In Q3-19 Gladstone Land generated net income of $523,000 and adjusted FFO increased by about $657,000 or 29%. On a per-share basis, AFFO increased by $0.018 per share from $0.123 per share in Q2-19 to $0.141 per share in Q3-19.

On a year-to-date basis, AFFO per share was $0.399 versus dividends declared of $0.401 per share. On the earnings call management pointed out,

…this equates to a shortfall of about $29,000. Our current expectation is that the earnings from our recent acquisitions and the participation rents we anticipate recording during Q4, will be more than enough to cover this shortfall.

Source: LAND Investor Presentation

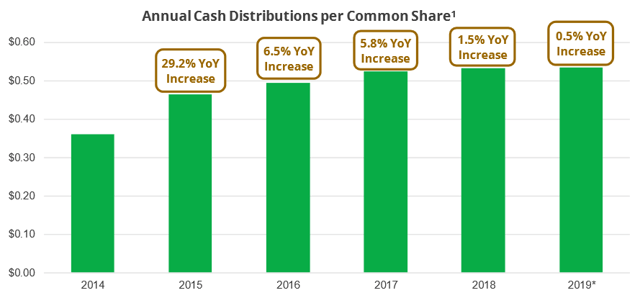

Since the IPO in 2013, Gladstone Land has made 81 consecutive monthly cash distributions (on the common shares) and over the last 58 months the company has increased the distribution rate 16x for a total increase of 48.7%.

Source: LAND Investor Presentation

But Wait, I’m Getting Paid 4.2% Waiting On Land To Incubate?

That’s right.

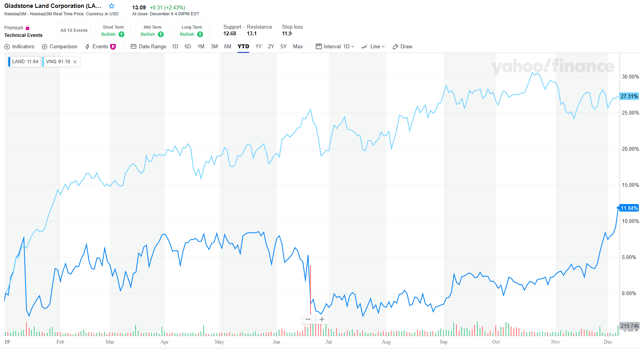

Shares in Gladstone Land yield 4.2% today, and as viewed below, they have under-performed Vanguard Real Estate ETF (VNQ): LAND +11.8% YTD and VNQ +27.3% YTD.

Source: Yahoo Finance

Although I’m not generally a fan of external management, one must consider the fact that there’s considerable insider ownership (14% of common owned by insiders) and the management team has deep experience (the CEO has 30 years of experience in the farming industry). On the latest earnings call the CEO explained the rationale for the preferred shares:

And folks, one reason we like selling the preferred stock is to avoid the dilution of the common stock. Most common stockholders don't want the dilution either. And as a shareholder, I don't like it diluting the common stock either. So please also note that the preferred stock does not count as equity and the calculation of the fees paid to the advisor selling the Series B does not increase the fee to the advisor. I want everybody to get that clear. Prior to the third quarter, 100% of the management fee attributable to the preferred stock has always been credited back to Gladstone Land. That is, we didn't make any money over that even when it was part of the calculation. And with the amendment to the advisory agreement, we finally said to our Board, why are we doing this. We changed the advisory agreement that was executed in early July, 2019. The preferred stock is now excluded from any fee calculation, so I hope everybody gets that straight.

So, while this sleepy REIT that pays monthly dividends may be downright boring, we consider it an essential part of our monthly dividend portfolio. Gladstone Land “strives to increase distributions to shareholders at a rate that outpaces the annual rate of inflation” and we believe that the “incubation” characteristics make this pick an attractive way to gain access to real estate with some of the best supply & demand fundamentals.

As I said at the outset, it all boils down to supply and demand or Economics 101:

Gladstone Land Stats

Price: $13.09

P/FFO: 25.87x

Dividend Yield: 1.36

YTD TR: 18.3%

P/FFO Variance: 1.61%

R.I.N.O. Score: 3.000

iREIT Recommendation: BUY

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Managing Risk Is What We Do Best

iREIT on Alpha is one of the fastest-growing marketplace services with a team of five of the most experienced REIT analysts. We offer unparalleled services including five customized portfolios that are doing extremely well in the moment - but are built to stand the test of time too.

Disclosure: I am/we are long LAND. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.