What To Remember From Ulta Beauty's Q3 Earnings

by Robbe DelaetSummary

- Ulta Beauty reported numbers that exceeded expectations and show that the growth deceleration is stabilizing.

- Ulta is outperforming its competitors significantly by improving customer satisfaction and disrupting the retail business via its strong loyalty program.

- When the US cosmetic market returns to normality, Ulta beauty should again become a strong growth company, which will be rewarded by the market.

- The company is currently trading around 20x earnings, which is around half of its historical average. Together with its strong free cash flow generation, it's an interesting opportunity.

In September, I pointed out that the Ulta Beauty (ULTA) sell-off was overdone, focusing on its long term growth trajectory and valuing the company at $455/share. Investors were pessimistically extrapolating the weak performance too much in the future. In such cases, contrarian investors like me buy the stock in order to achieve abnormal returns. During the Q3 conference call, CEO Mary Dillon confirmed to investors that the US make-up deceleration is stabilizing and that things should improve in the medium term, which is also visible in their Q4 guidance of 3.66-3.76 EPS (midpoint +3% YoY). Meanwhile, the company is focusing on strategic improvements, such as benefiting from growth in the skin care industry, which I will discuss as well in this article. The numbers and management comments from this quarter support my vision about Ulta Beauty as a company with high long term growth potentials, but some short term market troubles. At a P/E of 20 and with very strong cash flow generation, I find this a very attractive opportunity in anticipation of market growth acceleration.

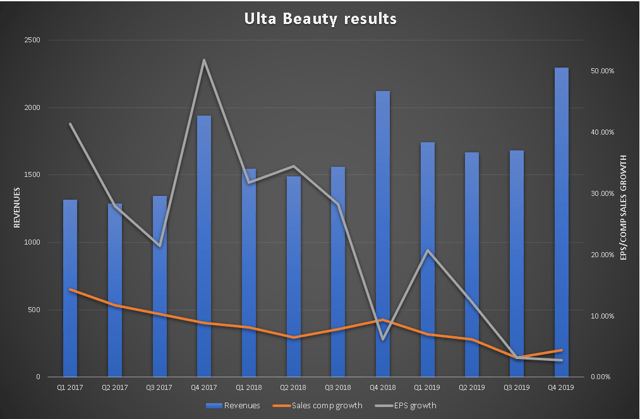

Ulta Beauty Q3 financial results

The Q3 financial numbers were just fine as Ulta beat estimates and revised their full-year guidance slightly from $11.86-12.06 to $11.93-12.03. Comparable sales are doing better than expected with a 3.2% gain in Q3 and guidance actually implies a strong bounce to around 4.4% growth in Q4. Furthermore, EPS is still growing in this very tough environment as gross margins are going up, but are partially offset by higher marketing expenses and investments. Another important number is free cash flow, which the company normally uses to buy back its own shares. Free cash flow grew by 10.7% in the first 9 months of 2019 to $316mln, which is a very good result.

(Source: author based on company numbers)

Yes, growth numbers are a lot lower compared to the past years, but this is a consequence of the tough make-up environment in the US, as CEO Dillon discussed thoroughly in the conference call:

After several years of robust growth, the category began to decelerate in 2017, and turned negative in late 2018 resulting from a lack of engaging newness and incremental innovation. This negative trend has continued through 2019 with further deceleration in the most recent quarter.We know it will take time to bring newness and innovation to the category, but we're confident that the makeup category will emerge from this down cycle and return to growth.

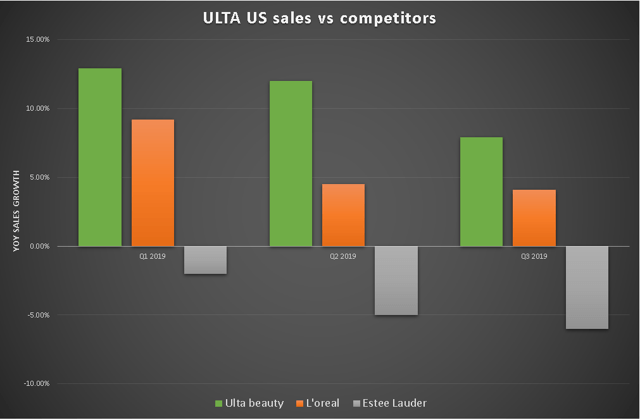

Competitors are feeling this tough market environment as well. In fact, Ulta Beauty is gaining a lot of market share in the US. As you can see below, competitors like L'Oreal (OTCPK:LRLCF) and Estee Lauder (EL) are seeing a stronger deterioration in sales. The chart shows US total sales growth (including new stores). If you would take same-store sales growth, Ulta would have an even stronger comparison against L'Oreal (negative SSS for them), but Estee Lauder unfortunately does not provide these numbers.

(Source: author based on company numbers)

Long term strategic initiatives

The most important reason why I am invested in Ulta, apart from valuation, is its very capable management. CEO Mary Dillon and her team are strategically outperforming competitors, growing sales and earnings even during tough times. In my opinion, every Ulta investor should really read the Q3 earnings call transcript, where Dillon thoroughly explained Ulta's strategic initiatives. Ulta is diversifying and innovating very well to improve its numbers. At first, they are taking a number of actions to ensure they fully capture the opportunity of the skincare trend, especially with Gen Z customers. For example, this year they have added more than 30 new skincare brands to their assortment. Second, newness drove about 25% of our total comp, driven primarily by new brands and products in skincare and haircare. Ulta is making tactical strides by aggressively partnering with brands to develop incremental innovation. Third, their loyalty program is still growing very rapidly, now having 33.9 million active members in their ultimate rewards loyalty program, an increase of 11% versus the third quarter last year. This is a very important factor for market share gains.

Investor takeaway

Ulta management is once again proving that they can create a lot of shareholder value. By focusing more on skin care and improving customer satisfaction, they can keep growing during a very tough US make-up environment, as I expected them to do. While CEO Dillon pointed out that this negative environment will probably stay in the medium term, management is strategically preparing for another big growth cycle in the US, but also for worldwide expansion. Financial numbers were a lot better than competitors and also exceeding my expectations. Particularly free cash flow is growing very strongly, which in my opinion is the most important number out there. This case shows once again that contrarian investors can make very strong abnormal returns as long as the underlying fundamentals are solid. I still believe the company is undervalued at 20x earnings, which is half of its historical average. This is an extraordinarily well-run company with a lot of growth ahead. Soon, I will update investors about its international expansion possibilities, which are important to take into account.

Disclosure: I am/we are long ULTA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.