EUR/CHF Could Find Upside In 2020

by Hedge InsiderSummary

- The euro has fallen against the Swiss franc over the majority of its life.

- However, the EUR/CHF interest rate differential remains in a positive position (on a central bank rate basis, the spread is positive at +0.75% in favor of the euro).

- The ECB is unlikely to raise rates any time soon, just as the SNB is unlikely to. Nevertheless, the SNB is less likely to be subject to U.S. retaliation.

- Therefore, the SNB is more likely to either lower rates further (to fight domestic deflationary pressure) and/or employ "alternative" monetary policy tools through active intervention (such as through the accumulation of foreign currency reserves by actively selling Swiss francs).

- Even if the euro remains weak globally, the Swiss franc is likely to show greater weakness, and hence EUR/CHF may find some upside through 2020 and even 2021. The 1.20 level, at the top of the current long-term trading range, could be one possible target going forward.

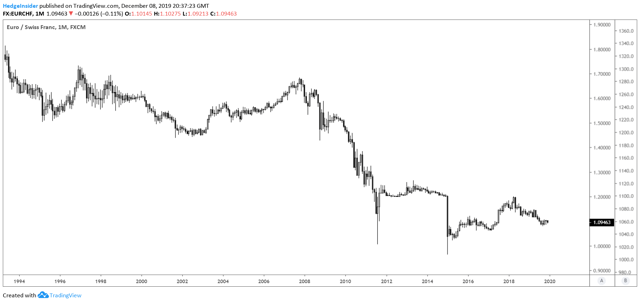

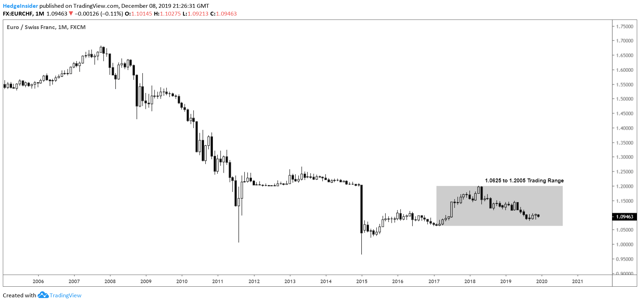

The euro has seemingly been in a lifelong bear market against the Swiss franc. Per the chart below, we can see that while the EUR/CHF pair has risen during certain long periods of time (most notably from January 2003 through October 2007), the overall trend is clearly negative.

(Chart created by the author using TradingView. The same applies to subsequent candlestick charts presented herein.)

The long-term price chart above uses monthly candlesticks. As we can see, the long-term trend is clearly bearish.

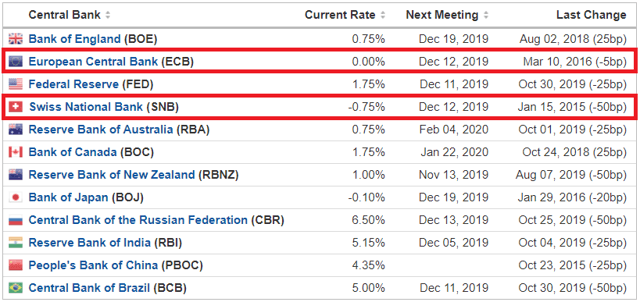

It is important to note that while Switzerland is part of continental Europe, the country is not a member state of the European Union, and maintains its own monetary policy. The Swiss National Bank sets its own central bank rate, independent of the European Central Bank. In the table below, we can see that while the European Central Bank (or ECB) and the Swiss National Bank (or SNB) both have low rates, the Swiss rate is lowest (in negative territory).

(Table source: Investing.com.)

The ECB's short-term rate (the interest rate on the main refinancing operations) is 0.00%, whereas the Swiss counterpart (the SNB policy rate) is negative at -0.75%. The 'delta', or difference, is therefore simply +0.75% (i.e., 0.00% minus -0.75%, a double-negative, which is positive +0.75%). With the ECB rate remaining at 0.00% since March 10, 2016, and the Swiss rate remaining at -0.75% since January 15, 2015, it would seem that the EUR/CHF should enjoy some level of stability going forward.

However, with U.S.-China trade relations still uncertain, and with the potential for trade wars to (or continue to) spill into Europe (for example, U.S. President Donald Trump previously stated that "[Europe] treats us [the United States] worse than China"), the ECB may struggle to justify lowering rates (much) further.

This is because lower rates tend to weaken a country's economy (since it becomes costlier to hold the currency in question, relative to other currencies, and provides an incentive for carry trades). If the ECB is viewed as trying to manipulate their currency lower (with even lower rates), in particular in relation to the U.S. dollar, this could risk ratcheting up global trade tensions between Europe and the United States.

Switzerland, on the other hand, is a far smaller country than the European Union as a collective. The country's annual gross domestic product in 2018 was about $706 billion, representing about 1.14% of the global economy. The eurozone, meanwhile, generated $13,670 billion (about 22.05% of the world economy).

The smaller size of Switzerland, relative to broader Europe collectively, could mean that it effectively has more bargaining power; it can lower rates (and therefore likely devalue its currency) with a far lower risk of U.S. backlash. This would weaken the global price of goods and services provided by the Swiss. And per 2017 numbers, Switzerland's main export partners were Germany and the United States (representing 15.2% and 12.3% of their exports, respectively).

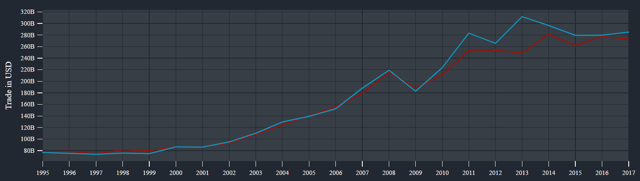

Data from the World Bank show that Switzerland's trade balance with Germany is deeply negative (to the tune of about $8.3 billion), although there is already a positive trade surplus with the U.S., and the country's overall trade balance was positive with $12 billion in net exports (see chart below from The Observatory of Economic Complexity).

The chart above shows that exports in 2017, at $285 billion (green line), exceeded imports of $273 billion (red line); despite an export surplus, however, the country is currently experiencing deflationary pressure (see chart below).

The country is therefore likely to be very keen on increasing the cost of its imports (to reduce imports), and also generating greater aggregate demand by way of cheapening its exports (to increase exports). The Swiss franc must ultimately fall for this to occur.

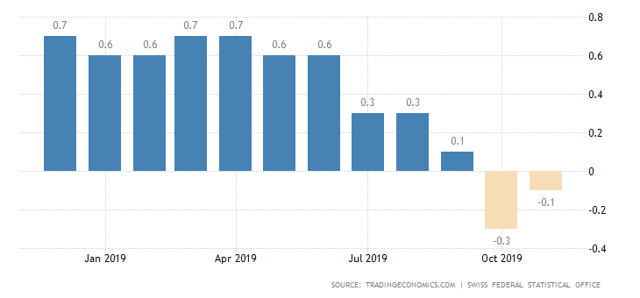

(Chart provided by TradingEconomics, showing year-over-year consumer price deflation of -0.3% in October 2019 and -0.1% in November 2019.)

However, as the SNB policy rate is already deeply negative at -0.75%, the SNB may use alternative monetary policy tools to intervene (such as by selling the Swiss franc to accumulate further foreign currency reserves). In any case, we can assume that the rate will remain negative, while the ECB rate is unlikely to go as deeply negative as the SNB policy rate, not only due to the sheer distance of the 75 basis-point delta, but also the potential for U.S. backlash.

Therefore, the EUR/CHF pair could in fact see some upside, on the basis that the Swiss franc will likely prove to show greater weakness than the euro (and not because of euro strength). However, the ECB is about as unlikely to raise rates as the SNB, and so any upside is likely to be limited. We would probably be wise to anticipate continued consolidation within the current trading range (with some possible upside in the medium term, to the top of the range).

As shown in the chart above (again, using monthly candlesticks), the current trading range spans from approximately 1.0625 to 1.2005. We should not rule out medium to long-term upside, given the risk of prolonged weakness in the Swiss franc. Therefore, 1.20 could be the next long-term target for EUR/CHF, although the pair must first break the midpoint of this range (at approximately 1.1380) which is likely to find resistance, at least at first.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.