Winds Might Be Changing For Vestas

by Samu WilhelmssonSummary

- The company has grown fast in a favorable market environment, having a 5-year CAGR if 8%.

- Despite the record-high order backlog in Q3/2019, the company identified the impact of tariffs and increased execution costs for its profitability.

- I would recommend investors to stay cautious with the stock.

Introduction

Image courtesy of Vestas Wind Systems A/S

Vestas Wind Systems A/S (OTCPK:VWDRY, OTCPK:VWSYF) is a Danish manufacturer, seller, installer, and servicer of wind turbines. The company operates manufacturing plants in Denmark, Germany, India, Italy, Romania, the United Kingdom, Spain, Sweden, Norway, Australia, China, and the United States. Vestas employs more than 24,400 people globally and is the market-leading supplier of wind turbines. The company was founded in 1945 and is listed in the NASDAQ Copenhagen with a market cap of 110bn DKK.

The segment of power solutions currently contributes nearly 80% of the annual revenue, followed by the service segment and offshore segment which is an established joint venture with Mitsubishi (OTCPK:MSBHY). The largest market for Vestas in terms of revenue is the North American market, contributing 44% of the annual revenue, followed by the EMEA market with a 42% share of the annual revenue.

The main players in the global wind turbine industry and competitors of Vestas are Siemens Gamesa, GE Wind, Enercon, Nordex, Senvion, Suzlon, and Goldwind, for instance.

The company currently enjoys the beneficial market environment for the production of renewable energy and has grown very rapidly during the past years.

Investment case

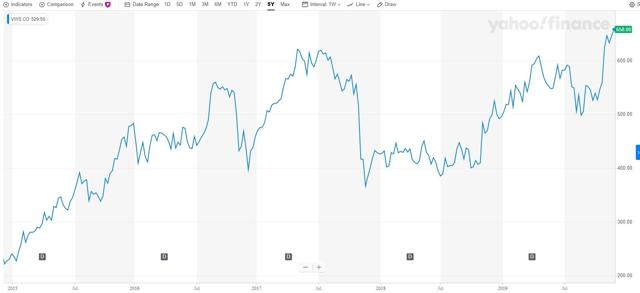

Source: Yahoo Finance

Vestas has positioned itself in a strong position in the market. The company reclaimed the lead as the top global wind-turbine manufacturer in 2018, followed by the Renewable Energy-division of GE (NYSE:GE). Chinese manufacturers have been reported to invest less outside their domestic market, so the future focus of the industry is to shift market shares in other countries where for example Vestas has established a strong competitive position.

Vestas introduced very strong numbers in its Q3 interim report and especially the jump in orders increased confidence into the business. Revenue grew 30% and the EBIT-% increased from 9.8% to 11.8% during the third quarter. Despite the record-high order backlog, the company identified the impact of tariffs and increased execution costs for its profitability.

The company has grown fast in a favorable market environment, having a 5-year CAGR of 8%. The company has also managed to keep its profitability stable and its adjusted EBIT-margin around 10-12%. I would see that the revenue growth would still exist, but the margin pressure would start to decrease the company profitability during the next few years. The company itself expects 10% growth in its revenue for 2019 with an EBIT-% of 8-9%.

The uncertainties in the political environment, decreased margins for Wind power business and possible competition from alternative sources of energy production can introduce headwinds for the Vestas' business. I would see the market situation challenging for the business of Vestas especially when new tariffs for wind turbine business have been introduced by the United States. The stock of Vestas is now +35% YTD.

Valuation

I would expect the company to achieve an annual revenue growth of 10-12% during the following years. Due to the challenging market situation I would presume an EBIT-% of 10% for the full year 2019 and 9-11% in the next five years. With these metrics my forward P/E would be 23x and EV/EBITDA 10x.

My DCF-based valuation with this outlook suggests a fair value per share of 568 DKK. I would thus give the stock an "underperform" recommendation. It is worth noting that the terminal growth value used in the Gordon Growth Model for the terminal FCF is 5%, since slower growth after 2023 would seem unlikely in the case for Vestas. However this causes a slight overestimation for the terminal value.

| 2018 | 2019e | 2020e | 2021e | 2022e | 2023e | TERM | |

| 5 % | |||||||

| EBIT | 959.0 | 1059.0 | 1237.4 | 1524.4 | 1715.0 | 1929.4 | |

| + D&A | 458.0 | 503.8 | 559.2 | 626.3 | 704.6 | 792.7 | |

| - Tax | 227.0 | 252.0 | 296.6 | 368.4 | 416.0 | 469.6 | |

| - Change in NWC | 838.0 | -153.7 | -20.0 | 113.2 | -80.0 | -295.6 | |

| OCF | 2028.0 | 1157.1 | 1480.0 | 1895.6 | 1923.6 | 1956.9 | |

| - CAPEX | 529.0 | 635.6 | 718.7 | 819.4 | 929.9 | 1046.2 | |

| FCF | 1499 | 521.5 | 761.3 | 1076.2 | 993.7 | 910.7 | 19125.3 |

| Discounted FCF | 474.1 | 629.2 | 808.5 | 678.7 | 565.5 | 11875.3 | |

| EV | 15031.3 | ||||||

| - Net debt | 2915.0 | ||||||

| + Cash | 3462.0 | WACC: 10% | |||||

| Fair value | 15578.3 | ||||||

| Shares outstanding | 205.0 | ||||||

| Fair value per share in € | 75.99 | ||||||

| In DKK | 567.66 |

Author based on company data

Risks

One of the key risks for Vestas is the political environment. The recent political environment especially in the United States hasn't been favorable for renewable energy production. Energy as an industry in general is highly volatile to any changes in regulative framework and political environment. Also the company is dependent on government subsidies in many markets, and any changes in these could have significant effects to the future growth path of Vestas. However, subsidies in most countries are now being reduced and removed and thus the dependency is significantly less than before.

According to the industry association WindEurope, new wind power installations in Europe dropped by almost one-third last year to 11.7 gigawatt, mostly due to more competitive contract tenders. For example in Germany and in the Netherlands zero-subsidy bids have been attracted from wind project developers, which introduces margin pressure on the wind turbine makers.

Competition from the suppliers of renewable energy forms remains fierce and Vestas could face future competition from other forms of renewable energy, such as solar. In 2018, global installed wind power capacity decreased year-to-year from 52 to 50.6 GW, due to increased competition from solar energy.

Conclusion

Due to the political instability and the expected margin pressure for Vestas' business, I would see the wind change for the company at this point. Vestas has enjoyed record-breaking earnings in a favorable market environment, but there are signs that indicate investors to stay cautious with the stock and keep an eye on the development of future earnings.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.