Shopify: Beware Of Deceleration

by Taylor DartSummary

- Shopify is up 160% year-to-date, crushing the S&P 500's year-to-date performance.

- While the company continues to put up record revenue each quarter, there are signs that we're seeing even more material deceleration in revenue growth on the horizon.

- This deceleration is not helped by the fact that the valuation is getting lofty, currently sitting at a forward P/E ratio of nearly 400.

- Based on this, I would view any rallies back to the $370.00 area as an opportune time to book some profits.

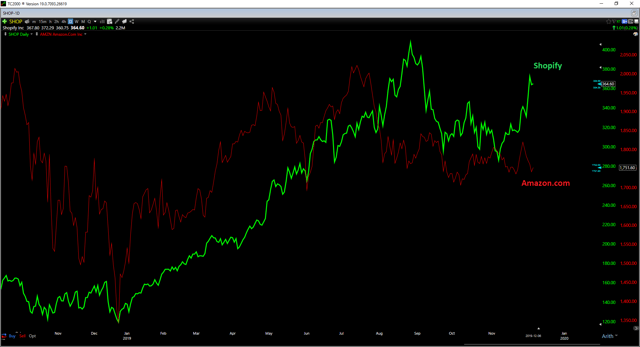

While online retailer Amazon (AMZN) has had a sluggish year, underperforming the S&P 500 (SPY) by nearly 1000 basis points, Shopify (SHOP) has had a massive year, putting up a triple-digit return year-to-date. Shopify's strong performance has been tied to continued high double-digit revenue growth in the 50% range, while Amazon has finally seen its growth rates come under pressure this year. Even more impressive for Shopify, the company recently celebrated 1 million merchants on its platform in the most recent quarter and raised guidance yet again, expecting a strong finish to 2019. While the company's growth rates are exceptional, I believe we're likely to see more material deceleration on the horizon and a drop below 40% sales growth in 2020. Based on this slowdown and a valuation that's priced just shy of perfection, I would view any further strength in the stock as an opportunity for investors to book some profits.

(Source: TC2000.com)

Shopify's Q3 results released in late October included tons of great news for investors, with the most exciting news being the company's achievement of reaching the 1 million merchant mark, up from 377,000 at the end of 2016. This represents outstanding growth, with a compound annual growth rate in total merchants above 70%. In addition to this milestone, the company is now the first commerce platform to roll out both 3D and Augmented Reality [AR] shopping experiences. Finally, Shopify Capital had a massive quarter, with merchant cash advances of over $140 million. This remains an important growth driver for Shopify, as it allows merchants the funds they need to build their businesses faster without the financial constraints some small businesses might typically see otherwise.

(Source: Company Website)

While there's certainly a lot to like when it comes to business highlights, financial highlights for the quarter were just as impressive. Total revenue came in at $390.6 million for Q3, up 45% year-over-year, and this is helping to drive the trend high in bottom line estimates. FY-2020 annual EPS estimates have been revised higher from $0.84 in April to $0.96 as of last week. This is now forecasting 384% growth in earnings year-over-year, after the 50% drop-off we see in FY-2019 tied to much higher spending this year on capacity and service offerings. In addition, the company announced that it had acquired 6 River Systems, which comes with a fleet of collaborative mobile robots to drive massive efficiency in order-picking. Notably, the robots, known as 'Chuck,' can work 24/7, as they charge automatically. This acquisition will drive efficiency and speed when it comes to fulfilling orders for thousands of different businesses.

(Source: 6River.com)

Not surprisingly, with the new milestones reached this quarter in total merchants and Shopify Capital, Shopify has raised its full-year 2019 guidance provided in Q1 from $1.495 billion at the mid-point to $1.55 billion at the mid-point. This is a bump of nearly 3% and should lead to further earnings revisions higher if the company manages to eke out a beat over these estimates. Let's take a closer look at the company's growth metrics below:

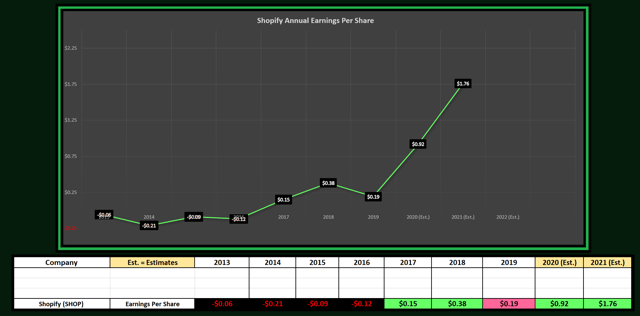

As we can see from the below chart of annual earnings per share [EPS], Shopify's earnings continue to grow at a rapid pace. FY-2018 annual EPS grew over 100% from $0.15 to $0.38, FY-2019 EPS stalled out and is expected to finish the year at $0.19, but we are expecting a surge in earnings growth for FY-2020. FY-2020 annual EPS estimates are currently sitting at $0.92, and this is forecasting growth of over 380% next near. Even more impressive, analysts now have FY-2021 estimates pegged at $1.76, predicting yet another year of nearly triple-digit growth (91%). Therefore, while the current trailing P/E ratio of over 1000 may look insanely expensive, it's important to note that earnings are expected to grow by nearly 400% next year alone, and offset any drop-off in FY-2019 earnings, a transition year for the company.

Based on my minimum metrics for growth stocks, I want to see annual EPS growth of 12% or higher every single year. Given that Shopify is likely to grow earnings by 350% or more even if it misses estimates next year, it's in a small group of the highest growth companies on the US Market. Wiliam O'Neil found through his CANSLIM criteria that the best growth stocks with the strongest advances grow earnings at over 40% each year, and Shopify certainly fits in this group currently. Therefore, while the FY-2019 hiccup may look negative, it can be discounted due to the immense growth in earnings expected in FY-2020.

(Source: YCharts.com, Author's Chart)

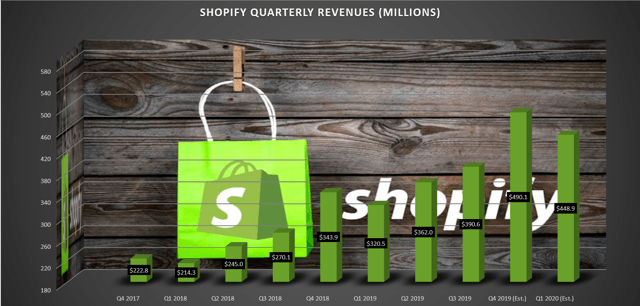

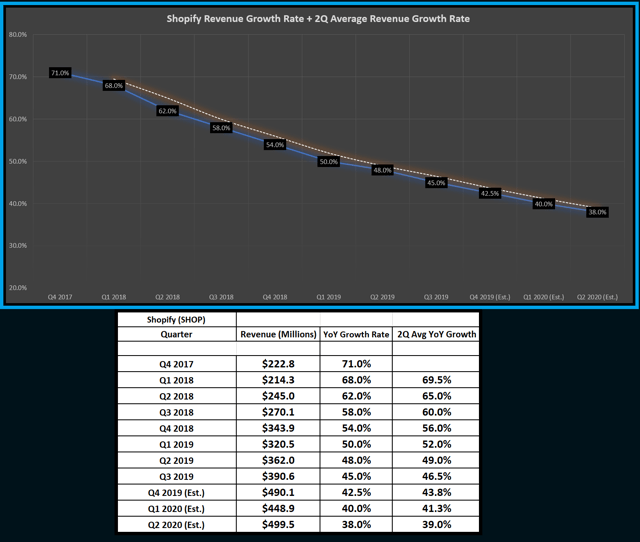

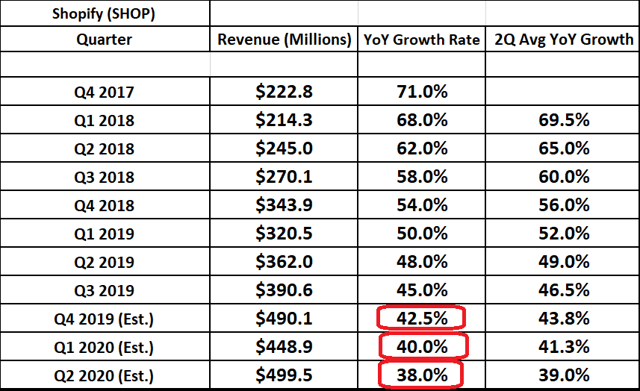

If we move over to quarterly revenues, we can see that Shopify continues to grow revenues at a brisk pace. Quarterly revenues have grown from $222.8 million in Q4 2017 to $390.6 million in the most recent quarter. Based on Q4 2019 estimates, we should see yet another new record next quarter, with analysts currently forecasting $490.1 million in revenues. While this is an exceptional figure that translates to 42.5% growth year-over-year, this will mark yet another quarter of sequential deceleration for Shopify.

It's certainly worth noting that revenue growth rates have been decelerating moderately for several quarters now, but the difference this time is that this slowdown is occurring below the 50% level. Based on my criteria, which separates hyper-growth companies from high-growth companies, the cut-off is 50% revenue growth. Based on this, Shopify's deceleration as we head into 2020 is transitioning the company from hyper-growth to high-growth, a demotion that can sometimes lead to a contraction in the company's multiples.

(Source: Author's Chart)

If we take a closer look at revenue growth rates below, we can see that revenue growth rates are expected to come in at 42.5% in Q4 2019, 40% in Q1 2020, and 38% in Q2 2020. This is a negative sign. The blue line in the below chart represents the quarterly growth rate, while the white line represents the two-quarter average. I like to use a two-quarter average for revenue growth rates as it helps to smooth out any lumpy quarters and better dictates the overall trend. As we can see from the below chart, this deceleration is not a one-quarter anomaly but is part of a pattern of meaningful deceleration. If the company can only meet these current estimates, Shopify's two-quarter average revenue growth rate should slip from 46.5% in the most recent quarter to 39% in Q2 2020. This would mark a deceleration of over 600 basis points and is quite significant.

(Source: YCharts.com, Author's Chart)

While revenue estimates are not set in stone and can be beaten, the company certainly has its work cut out for it to trounce these estimates. In order to prevent deceleration, Shopify will need to report $498.7 million in revenues for Q4 2019 and $464.7 million in revenues for Q1 2020. The Q4 figure is just $8 million above current estimates and is therefore potentially attainable, but the Q1 2020 figure is going to require a miracle to beat. To keep revenue growth rates stable at 45%, Shopify will need to beat current estimates of $448.9 million by $15.8 million, or about a 4% revenue beat.

Some investors may argue that deceleration is normal, and is not a reason to ever consider selling a stock. While I would argue this is entirely true on the first point, I would strongly disagree on the latter point. Companies that transition from hyper-growth to high-growth often go through some growing pains, and this can shock the stock, leading to a choppy range, or a decent correction. We have seen this occur in Amazon for the past 18 months, as revenue growth rates finally decelerated to a point where growth fund managers decided to park money elsewhere. Therefore, barring a Q1 report with revenue above $464.7 million in Q1 2020, I believe that Shopify will struggle to make new highs next year above the $411.00 mark.

(Source: YCharts.com, Author's Table)

Therefore, while there's a lot to like about Shopify's earnings growth for FY-2020, there's just as much to dislike about the deceleration in revenue growth rates. This deceleration has made it more difficult for the company to beat earnings estimates, and we saw one of the smallest beats yet on revenue last quarter. Given the combination between a forward P/E ratio of roughly 400 using FY-2020 earnings, as well as a consistent deceleration in growth rates, I see Shopify as finally beginning to get slightly overvalued at current levels. Given this overvaluation, the stock is more susceptible to a correction of 15-25% than it's been in the past.

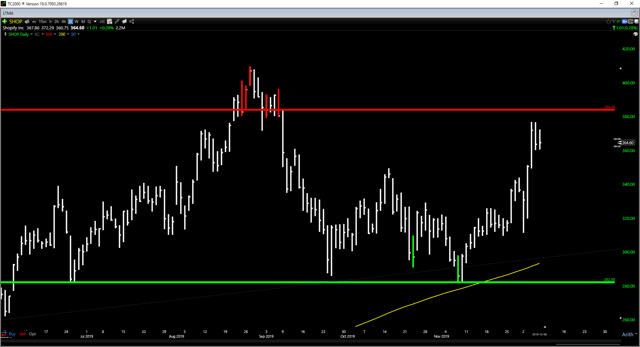

If we move over to the technical picture, we can see that Shopify saw its first signs of distribution in over three years show up in August. While this distribution, which can be characterized as abnormally weak price action. These distribution bars do not predict tops, but they do warn of them, and the stock promptly corrected following this. Since that drop, the stock now has resistance at the $384.00 level, and I would consider rallies that can't get through this level on a weekly close to be noise.

Based on this, I would view any further strength in the stock above the $370.00 level as an opportunity for investors to book some profits. This does not mean one should exit their full position as the long-term trend remains up, but it does mean that risks are elevated if we head back above $370.00. For me, I prefer to trade-off reward to risk metrics, and the reward to risk on Shopify is poor above $370.00.

(Source: TC2000.com)

If we take a closer look at the chart, we can see that Shopify found strong support at its 200-day moving average (yellow line), and also printed two accumulation bars near this level. This suggests that there are eager buyers at the $282.00 level, and this would be a much wiser spot for investors to add exposure if they do want to get in the name. As long as Shopify remains above its 200-day moving average, the bulls will stay in control. However, it's important to note that valuation is not what it was the past three years, and the stock is getting expensive up here unless growth rates can re-accelerate.

While Shopify could certainly continue higher over the next few months, I see risks as elevated as the stock trades at a forward P/E ratio near 400, while growth continues to decelerate. Based on this, I would view any rallies above the $370.00 level as opportunities to book some profits. In addition, I see no reason to be putting new money to work at current levels. Unless Shopify can put up $464.7 million or higher in revenues for Q1 2020, I have a hard time seeing the stock making new highs above the $411.00 level next year.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.