González anticipates new dialogue between the federal and local governments

Washington Resident Commissioner Jenniffer González thinks the end of the tax benefit should be negotiated

by By José A. Delgado

Washinton– Although she says the end of the federal tax credit for Controlled Foreign Corporations operating in Puerto Rico is “imminent,” Resident Commissioner Jenniffer González anticipates that before the Treasury Department makes an official announcement, there will be new conversations with the Puerto Rican government.

“What is imminent? Is it that there will be changes? Yes, I personally believe, those changes have to modify the structure of the tax on income contribution,” said the commissioner in an interview.

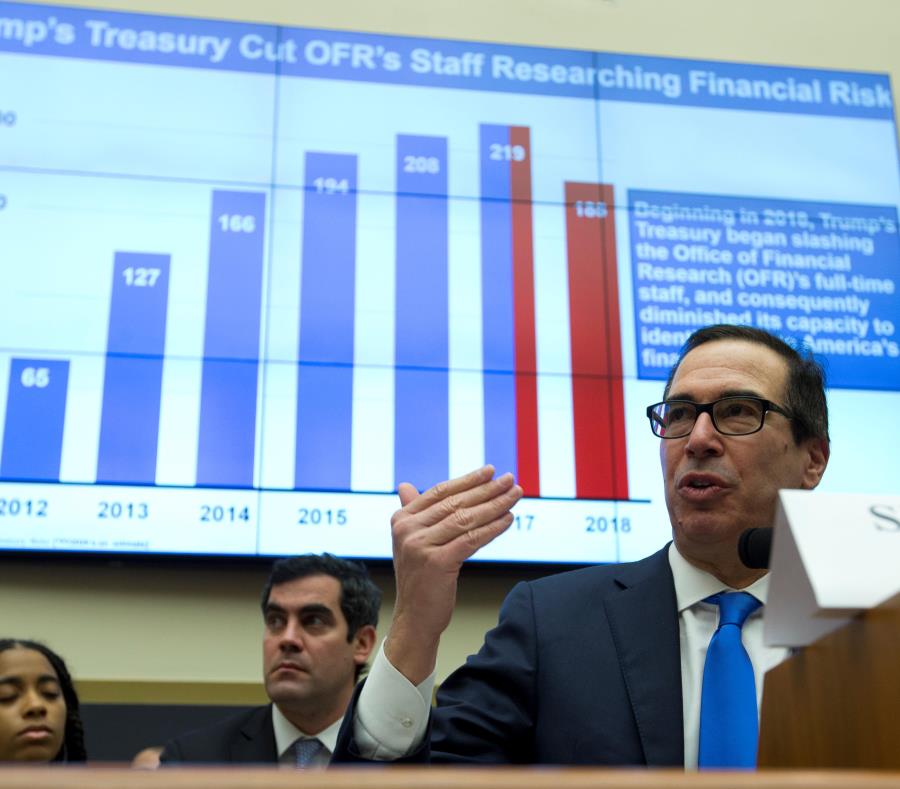

Since July 2018, the Treasury Department and the Treasury Secretary, Steve Mnuchin, have been warning the Puerto Rican government that they are determined – especially after the federal tax reform – to end the temporary credit granted by the Internal Revenue Service (IRS) for the 4 percent tax on the sales of Controlled Foreign Corporations (CFCs) under Law 154-2010.

This tax brings $2 billion annually to the Puerto Rican Treasury, more than 20 percent of the General Fund revenues.

On Wanda Vázquez Garced´s first official trip to Washington D.C. in September, Secretary Mnuchin and his team made it clear to the governor that the federal credit would be eliminated and that it was an issue that they wouldn´t like to deal with in six months.

A few days ago, Treasury officials told El Nuevo Día that they were considering ending the tax credit by January 2020 and that they are evaluating an announcement on this by Christmas.

However, sources close to this debate have warned that the Treasury Department's announcement may have a "low profile," as it they tried to do in the U.S. when the temporary tax credit was granted under Law 154.

González said that, about two weeks ago, Puerto Rican government officials working on this issue – including Puerto Rico Chief Financial Officer Omar Marrero; Treasury Secretary Francisco Parés; and the government representative to the Oversight Board Elí Díaz – told her that Treasury Department officials are going to talk with Vázquez Garced administration “to try to reach a joint determination” before implementing a change.

“This matter has to be negotiated. The most important thing is to provide certainty,” said Commissioner González, who added that although she has spoken with Treasury officials, the issue is in the hands of the Vázquez Garced government.

As González points out, island authorities have already said indicated that if the IRS credit is finally eliminated, the Puerto Rican government’s main option is to transform the tax into an income tax that CFCs could deduct up to 80 percent.

This change may also involve the revision of tax decrees granted to these corporations.