3 Big Stock Charts for Monday: Hanesbrands, Canada Goose, and Ball Corporation

Monday's big stock charts feature three names that could break out if the market rally continues

The sell-off in U.S. stocks that began the day after Thanksgiving increasingly looks like a blip. All three major indices have regained most of their losses and trade just off all-time highs.

The quick reversal off an admittedly modest decline supports hopes that the rally can continue into year-end, and potentially beyond. The external risks facing U.S. equities — trade, valuation, impeachment — don’t seem capable of doing more than briefly rattling investors. Every dip going back to this summer has been bought, and bought relatively quickly.

If that stays the case, it’s obviously good news for the market. And it could be particularly positive for Monday’s three big stock charts. All three big stock charts show stocks struggling to find direction. All three stocks, however, have a path to a rally with a little bit of help — and that help could come from a market that reaches new all-time highs.

Hanesbrands (HBI)

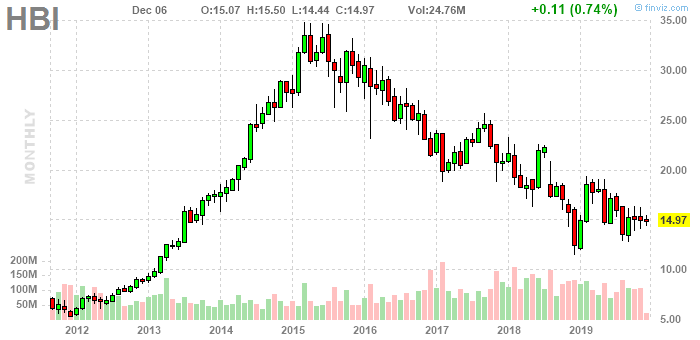

Hanesbrands (NYSE:HBI) stock has been stuck for several months. Another move seems imminent, but the first of Monday’s big stock charts leaves the direction unclear:

- HBI stock has established a sideways triangle pattern. Volume has been relatively average. Shares are hugging near-term moving averages. A decision point looms, but in the meantime Hanesbrands stock drifts.

- Sideways triangles usually lead to a breakout at some point, with gains or losses accelerating from the exit point. In that context, the chart looks modestly bearish. An upside move has stumbling blocks beyond the triangle: resistance has held repeatedly at $16, and the 200-day moving average follows. Still, any kind of momentum in either direction should accelerate. Hanesbrands options are priced accordingly. Straddle pricing at the January expiration suggests a move over 8% over the next six weeks.

- The lack of conviction on the chart makes some sense in the context of the fundamentals. HBI stock certainly looks cheap, at 8.5x this year’s consensus earnings per share estimate. A 4% dividend yield adds to the case for value, and could provide support to the stock as has been the case for larger stocks like IBM (NYSE:IBM) and Exxon Mobil (NYSE:XOM). Impressive growth at the Champion brand underpins hopes for a return to growth — growth which simply isn’t priced into Hanesbrands stock at the moment.

Source: Provided by Finviz But there are risks here. The long-term chart still looks concerning. Hanesbrands has over $3 billion in net debt. Overall sales growth has been minimal — revenue is guided to increase less than 3% this year — and margins remain a weak spot. There’s a clear “value trap or value play?” argument when it comes to Hanesbrands stock, and its chart reflects that fact.

Canada Goose (GOOS)

Few stocks have more sensitivity to macroeconomic factors than Canada Goose (NYSE:GOOS). Canada Goose needs a strong economy to sustain demand for its high-priced parkas. GOOS stock needs an optimistic market willing to pay big earnings multiples. And so few stocks could benefit more if the broad market rally accelerates, as the second of Monday’s big stock charts shows:

- GOOS stock has established a relatively firm range over the past six-plus months, with support at $34 and resistance at $45. The double bottom established by the recent rally looks bullish, as does a move past near-term moving averages. But shares have stalled out, and resistance looms even if the upward trend resumes.

- Here, too, the sideways trading makes some fundamental sense. Canada Goose has an excellent product and a committed customer base. There’s room to expand into new markets with new products. But even 41% below the 52-week high, GOOS stock isn’t close to cheap, at 61x fiscal 2021 (ending March) consensus EPS. Investors still are paying up for quality.

- And so the near-term hinge might be broad market strength. With growth stocks more broadly rallying again, GOOS might look more attractive by comparison at such a discount to its highs. But if markets stumble before year-end or in early 2020, it seems likely that Canada Goose will be brought down as well.

Ball Corporation (BLL)

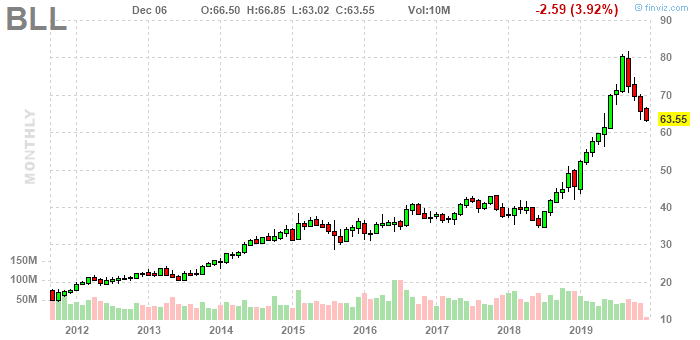

A 3.9% decline on Friday made packaging products manufacturer Ball Corporation (NYSE:BLL) the biggest loser in the S&P 500 on Friday. But as the last of our big stock charts shows, it raises more near-term risk to BLL stock from a technical perspective:

- The decline pushes BLL to the low end of a narrowing descending wedge. That pattern often creates the possibility for a bullish reversal, but with a three-month downtrend confirmed and BLL at a six-month low, such a reversal seems unlikely in the near-term.

- Fundamentally, it does seem like the pressure can continue. At 21x forward earnings, Ball stock isn’t yet cheap. The dividend still yields less than 1%. Ball stock isn’t necessarily overpriced, and the average analyst target sits above $76, but an industrial at over 20x earnings at this point in the cycle hardly seems like a steal on its face.

Source: Provided by Finviz The monthly chart also suggests potential for downside. BLL stock had been quiet for several years before making a massive breakout in the middle of last year. A 150% rally simply may have run too far. And barring a significant, quick change in sentiment, the reversal in that rally may well continue.

As of this writing, Vince Martin has no positions in any securities mentioned.