Airbus Logs $18B Mega Orders

by Dhierin BechaiSummary

- Big orders from Emirates and Air Arabia announced at Dubai Airshow have been logged.

- Delivery profile not fully satisfactory.

- Airbus book-to-bill ratio approaches 1.

For a couple of years, AeroAnalysis has been tracking the monthly order inflow for Boeing (BA) and Airbus (OTCPK:EADSY) aircraft. The monthly coverage is not so much there to invoke any Boeing vs. Airbus rhetoric, but it gives us some valuable insights in order trends.

A single month does not make a trend, but by closely tracking the order and cancellations activity, we always will be a step earlier in detecting trends and will have detailed insight into customers' appetite to order and take delivery of aircraft, and we can even track it by type as well as the jet maker's ability to reach any set sales target. Looking at the orders, we can see a combination of willingness to commit with pricing, product, and availability coming together. Special attention will be paid to the mix of single-aisle aircraft and wide-body aircraft, knowing that a single-aisle aircraft costs roughly half or a third of a wide-body aircraft, depending on the model.

In this report, we will have a look at the orders and deliveries as well as cancellation activity for Airbus during the month of November. What should be kept in mind is that, while this seems to be like a simple summarizing piece, I spent a considerable amount of time to get all data right and present it in a useful way, including graphics. Next to the monthly values for orders, we also have a tally for cumulated cancellations just like last year, but starting this year, we also will put a value on the cancellations. If you are interested in reading Airbus' monthly overview for October, you can check it out here.

Orders in November

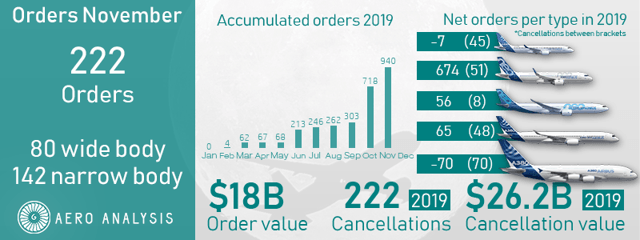

Figure 1: Orders Airbus November 2019 (Source: AeroAnalysis)

Airbus started the year very weak. After booking 67 orders in the first four months, of which 58 were in March, May saw an order inflow of just one aircraft. June looked a lot better, helped by the launch of the Airbus A321XLR, followed by order inflow that was below the average for the current year. In August and September, we saw modest order activity while order inflow skyrocketed in October.

In November, we saw Airbus booking another strong month with 222 orders, 142 for its single-aisle product and 80 wide-body orders:

- Paris Airshow 2019 order; Cebu Pacific Airways firmed an order for 16 Airbus A330-900s.

- CIT Leasing ordered 10 Airbus A330-900s.

- An undisclosed customer ordered 4 Airbus A330-800s.

- Dubai Airshow 2019 order; EasyJet firmed options for 12 Airbus A320neos.

- Dubai Airshow 2019 order; FlyNas ordered 10 Airbus A321XLRs

- Dubai Airshow 2019 order; Air Arabia ordered 73 Airbus A320neos, 27 Airbus A321neos and 20 Airbus A321XLRs.

- Dubai Airshow 2019 order; Emirates ordered 50 Airbus A350-900s.

During the month, the following changes and cancellations took place:

- Thomas Cook Scandinavia, which had no outstanding orders with Airbus, is now identified under its rebranded named Sunclass Airlines.

- Air China (1), China Eastern Airlines (2), China Southern Airlines (1), Shenzhen Airlines (2), Sichuan Airlines (1) were disclosed as customer for 7 Airbus A320neo aircraft.

- Aviation Capital Group converted 1 Airbus A320neo order to an order for the Airbus A321neo.

- Avolon converted 14 Airbus A321neo orders to orders for the Airbus A320neo.

- Viva Aerobus converted 2 Airbus A320neo orders to orders for the Airbus A321neo.

- Volaris converted 6 Airbus A320neo orders to orders for the Airbus A321neo.

- GECAS was revealed as the customer for 12 Airbus A330-900s and 13 Airbus A321XLRs, while converting existing orders for 7 Airbus A320neos to the Airbus A321XLR.

- Avolon cancelled orders for two Airbus A330-900s.

- BOC Aviation cancelled orders for one Airbus A330-900s.

- One Airbus A330-900 order has been transferred from CIT Leasing to TAP Air Portugal.

- CIT Aviation cancelled orders for four Airbus A350-900s, the order for nine Airbus A330-900s and two cancellations Airbus A330-900s from Avolon are likely all interconnected.

- Emirates cancelled orders for 39 Airbus A380s swapping its order to the Airbus A350-900.

Last year, Airbus booked 43 orders in November, indicating a 179-unit increase in gross sales compared to last year. Obviously, this is caused by the 120 aircraft ordered by Air Arabia and the Emirates order for 50 Airbus A350-900s. In the previous three years, Airbus received 103 orders combined in November or 33 orders on average. So, Airbus had an above-average month.

During the month, cancellations increased quite a bit driven by what should be the final cancellations on the Airbus A380 program and some cancellations on the Airbus A330 and Airbus A350 program. Looking at the 11-month figures, gross orders increased by 501 units and net orders increased by 338 units. Earlier in the year Airbus suffered a decline in the order book, driven by the termination of the A380 program, Germania and Jet Airways ceasing operations, and Avianca’s (AVH) and Etihad’s fleet plan restructuring. However, after the Paris Air Show and the order inflow that came with it, Airbus now has a positive net order tally, indicating that Airbus booked more orders than it had to cancel, and after the IndiGo order, the European jet maker is now seeing year-over-year growth in net orders.

Deliveries in November

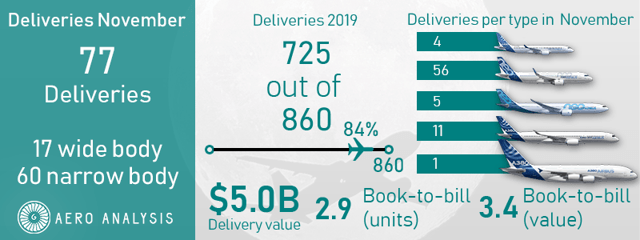

Figure 2: Deliveries Airbus November 2019 (Source: AeroAnalysis)

For 2019, Airbus initially set a delivery target of 880-890 units, which would be an increase of at least 10% year-over-year. However, the jet maker has lowered its delivery target to 860 units. The updated delivery target marks the third time Airbus lowered the delivery target in October since 2017.

In November, the company delivered 77 aircraft:

- Four Airbus A220 deliveries occurred.

- Airbus delivered 56 Airbus A320 aircraft, one Airbus A320ceo family aircraft and 55 Airbus A320neo family aircraft. The number of deliveries was in line with the production rate, but the improvement in the delivery volumes comes little too late.

- Airbus delivered five Airbus A330 aircraft, more or less in line with the production rate of 50 aircraft per year.

- 10 Airbus A350-900s and 1 Airbus A350-1000 were delivered.

- One A380 delivery occurred.

Compared to November last year, deliveries declined by 12 units. Year-over-year deliveries increased by 52 units, primarily driven by higher A220 deliveries (+28), A320 deliveries (+4), Airbus A350 deliveries (+15) and Airbus A330 (+8) deliveries, while A380 deliveries decreased (-3).

Previously we already concluded that Airbus’ increases in deliveries were realized earlier in the year and the second half of the year was more or less flat making it challenging to reach the delivery target. With Airbus reducing the full year delivery target, this concern has shown to be justified. What we are seeing is that the Airbus A220 and Airbus A330/A350 make up for the biggest part of the increase in the deliveries, while Airbus A320 deliveries are really coming in below expectations.

Book-to-bill

The book-to-bill ratio typically is expressed in gross unit terms by jet makers. This also is the number we show in the infographic. However, it should be taken into account that cancellations and conversions also take place. For November, the gross ratio is 2.9 in terms of gross units and 4.7 in terms of value. For the first 10 months, these numbers are 1.30 and 1.35, indicating that booked orders and value are higher than delivered units and delivery value.

If you go to a net basis for the orders year to date, it would be 1 on a unit basis, indicating that net orders and deliveries are balanced and 0.8 on a value basis (slightly worse if you take into account that the A220 is part of a joint venture), indicating that the net order value is 20% smaller compared to the delivery value.

Conclusion

In November, we saw deliveries remain stable month over month. The recovery in the delivery profile comes little too late and Airbus had to lower its full-year delivery target in October. Order inflow for November increased year-over-year by 179 units and up 338 when comparing the year-to-date numbers.

In the first 11 months, we saw a sharp increase in deliveries (52), reflecting a recovered delivery profile on the A320 program (compared to last year), the addition of the A220 to Airbus deliveries compared to last year and higher Airbus A350 deliveries. The surge, however, is not big enough for Airbus to maintain its delivery target of 880-890 and at this point I have doubts about Airbus’ ability to deliver 135 jets in the final month of the year to reach the revised delivery target.

Pressure on net orders was caused by cancellations from Etihad Airways, Germania, Avianca, Republic Airways and the cancellation of the Airbus A380 program.

For Airbus investors, the first half of the year was good, but the second half of the year has been bumpy. Obviously the strong uptick in order activity is most welcome, but we are seeing that rolling out Cabin Flex on the Airbus A321neo has proven to be more difficult than expected.

Looking at orders, many of the cancellations already were anticipated, and we saw the Airbus net order tally surge during the month. Possibly, the only points where we would like to see improvement is consistency in wide-body sales and reduction in delivery delays for the A320neo program. The single-aisle program is in much better shape than it was last year, but there still are delays that are impacting customers. Airbus has one month left to deliver 135 aircraft to meet its delivery target, so it’s going to be challenging. While the delivery profile is looking better, the jet maker needs to show delivery numbers comparable to last year to reach its delivery target.

*Join The Aerospace Forum today and get a 15% discount*

The Aerospace Forum is the most subscribed-to service focusing on investments in the aerospace sphere, but we also share our holdings and trades outside of the aerospace industry. As a member, you will receive high-grade analysis to gain better understanding of the industry and make more rewarding investment decisions.

Disclosure: I am/we are long BA, EADSY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.