For Growth Stocks, Profits Are The New Normal

by AllianceBernstein (AB)Summary

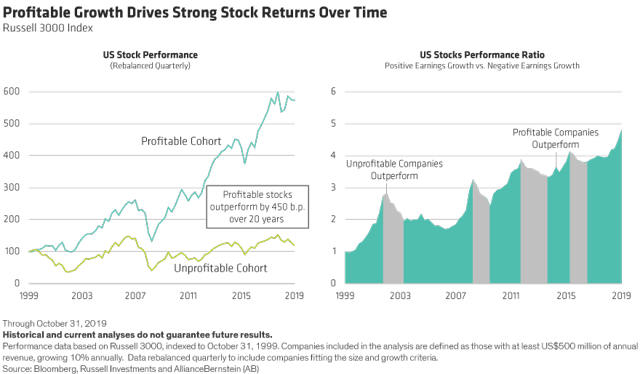

- Profitable companies outperform by a wide margin over time, even among high-growth companies, which often post losses early in their lifecycles.

- This year's equity market landscape is littered with high-profile IPO disappointments.

- The message is clear: profitable companies outperform unprofitable ones over the long term - by nearly 450 percentage points since 1999.

By Michael Walker, James T. Tierney, Jr.

After a series of disappointing initial public offerings (IPOs), private and public equity investors are becoming more discerning about earnings. And for good reason. Profitable companies outperform by a wide margin over time, even among high-growth companies, which often post losses early in their lifecycles.

This year's equity market landscape is littered with high-profile IPO disappointments. WeWork's (WE) aborted offering in September came amid post-IPO weakness of unprofitable companies, including Uber (NYSE:UBER), Lyft (NASDAQ:LYFT), and Peloton (NASDAQ:PTON). The market's fresh focus on profits in recent weeks has hit a swath of companies that were widely considered to be disrupters but have little or no earnings to show.

Profitable Growth Produces Long-Term Returns

Profits always matter, but sometimes investors seem to forget that, especially when it comes to innovative and disruptive growth companies. To reaffirm this truism, we looked at the relative performance of medium to large US companies with revenue growth exceeding 10%, split into profitable and unprofitable cohorts, over a 20-year period, rebalanced quarterly. By focusing on 10% growers, we stripped out the effect of companies in decline, which would have unfairly dragged down the unprofitable cohort. It also more closely aligned the analysis to high-growth tech stocks that often induce FOMO - fear of missing out when stocks are surging.

The message is clear: profitable companies outperform unprofitable ones over the long term - by nearly 450 percentage points since 1999 (Display, left). Of course, money-losers do outperform sometimes, especially in the early parts of bull markets, like 2002-2003 and 2009-2010 (Display, right). But over time, profits ultimately drive stock performance. In fact, the unprofitable cohort still hasn't surpassed levels reached at the top of the last cycle 12 years ago.

Why has the market become more rational recently? Valuations for money-losing and barely profitable companies looked very expensive by midyear. For example, the price/sales ratio for Zscaler, an information security company, reached 35x in August before falling to about 18x in mid-November. Interest rates may also be playing a part; much of the carnage has taken place since the US 10-year Treasury yield bottomed at about 1.4% in early September. Rising rates hit money-losing companies in two ways: financing growth becomes more expensive and higher discount rates compress valuations.

Healthy Rationalization Under Way

Veteran investors might find the roller coaster in high-growth stocks to be uncomfortably reminiscent of the dotcom bubble in the late 1990s/early 2000s. In fact, we believe this is a healthy rationalization. And the good news is that, so far, it's taking place without disrupting the broader market, which is near record highs.

To be sure, some loss-making companies have a clear path to profitability. But beware of tantalizing tech moon shots, especially when stocks are surging disproportionately. Sticking with more mature, solidly profitable growth companies that have the staying power to ride out economic cycles is a more prudent investment strategy, in our view, especially in today's uncertain environment. Investors who focus on quality companies with sustained profitability drivers should ultimately be rewarded for holding on.

Michael Walker is Senior Research Analyst and Portfolio Manager for Concentrated US Growth at AllianceBernstein

James T. Tierney, Jr., is Chief Investment Officer for Concentrated US Growth at AllianceBernstein

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.