Subprime lender Amigo’s chief executive and chairman quit

Departures follow move by founder James Benamor to reassert control of the business

by Nicholas MegawThe chief executive and chairman of Amigo, Britain’s dominant provider of guarantor loans, have resigned in the latest sign of tumult at the high-cost credit provider that once commanded a stock market valuation of more than £1bn.

James Benamor, a self-confessed former petty criminal who founded Amigo in his twenties and briefly became an on-paper billionaire after its initial public offering, reasserted control of the business.

Chief executive Hamish Paton announced his resignation on Monday, less than two weeks after he declared the company was making good progress in its turnround efforts. Chairman Stephan Wilcke will also step down ahead of the company’s next annual meeting, and Clare Salmon — chair of the remuneration committee — will leave “at the first suitable opportunity”.

One person close to the company said the resignations followed a disagreement about strategy.

John Cronin, analyst at Goodbody, said: “The chair and CEO shared a view on Amigo’s strategic direction and there seems to be some disagreement with the founder.”

He added that Mr Benamor was “clearly unhappy with the share price performance in recent months and feels he needs to take more control”.

Amigo’s shares have lost about three-quarters of their value since the company went public in June 2018, but rose 13 per cent on Monday to 68.2p. The company’s market capitalisation has fallen from £1.3bn at its IPO to £325m.

Amigo and Richmond Group, Mr Benamor’s investment vehicle, declined to comment.

Mr Benamor, who owns 61 per cent of Amigo, quit the board shortly after the IPO, but will rejoin as a non-executive director immediately, subject to the completion of legal formalities. Kelly Black, an executive at Mr Benamor’s investment vehicle Richmond Group, will also join Amigo as a non-executive director.

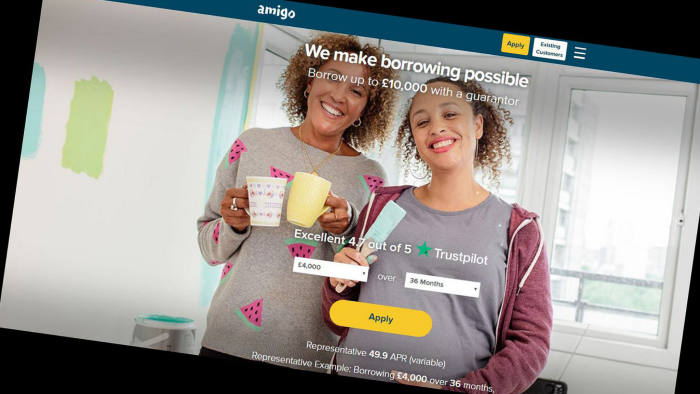

Amigo lends to borrowers with bad credit histories if they have a friend or family member who can step in if they fail to repay. It controls the vast majority of the guarantor lending market and has grown rapidly in recent years due in part to a clampdown on alternatives such as payday loans. However, the FCA has questioned whether guarantors fully understand the risks they take on, whether the lender’s 49.9 per cent interest rates are too high, and whether it traps customers into persistent debt.

Mr Paton said shortly after he became chief executive that the company would overhaul its model to reduce its reliance on repeat borrowers and tighten its credit checking policies. The announcement, in August, caused Amigo’s share price to halve in a single day, but Mr Paton said the changes were essential to put the company on “firmer foundations”.

Amigo had also been considering further changes such as reducing interest rates for borrowers who have more creditworthy guarantors.

Speaking after the group reported its interim results last month, Mr Paton said Amigo was in a “better place in terms of clarity and business going forward”, but cautioned that “the FCA are continuing to look at a number of different areas across the alternative finance space”.

Mr Benamor’s Richmond Group declined to comment. Amigo said Mr Wilcke decided it would be “more appropriate” for the company to have a new chair, but declined to comment further on the reasons for the departures. Mr Paton declined to comment.