How global cities are promoting sustainability and helping to fight climate change - CityAM

by Ben ForsterThe 2016 Paris Agreement gave the world a sense of hope that politicians could work together to limit temperature rises to 2 degrees centigrade. However, much has changed since the milestone agreement. More frequent extreme weather events, increasing political nationalism and growing economic inequality are making the goal of a carbon neutral world by 2050 harder to achieve. Schroders’ Climate Progress Dashboard is currently indicating that global temperatures are likely to rise by 3.8 degrees by 2025

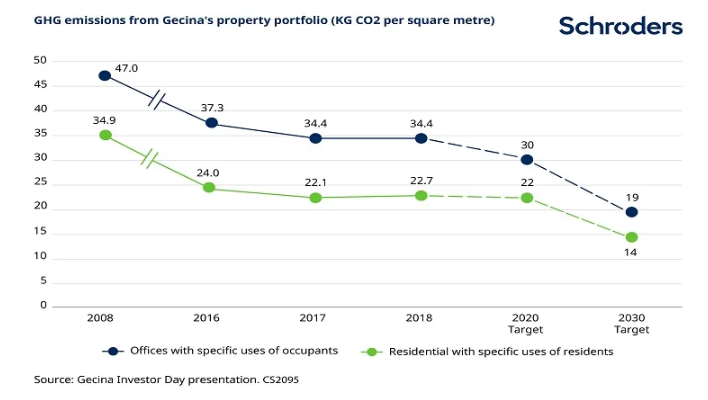

As investors in global cities, we seek to ensure that each holding is analysed on its sustainability credentials during the investment process, including its impact on the environment. On a recent visit to Paris we learnt more about how the publicly listed French commercial and residential landlord Gecina is demonstrating leadership in the transition to a more sustainable city. Paris is ranked 17th in our Global Cities Index and 90 per cent of Gecina’s portfolio is located within the Paris region (as of the end of 2018). Their ambition to own sustainable urban assets is a key reason for our interest in the company.

Global cities lead the charge

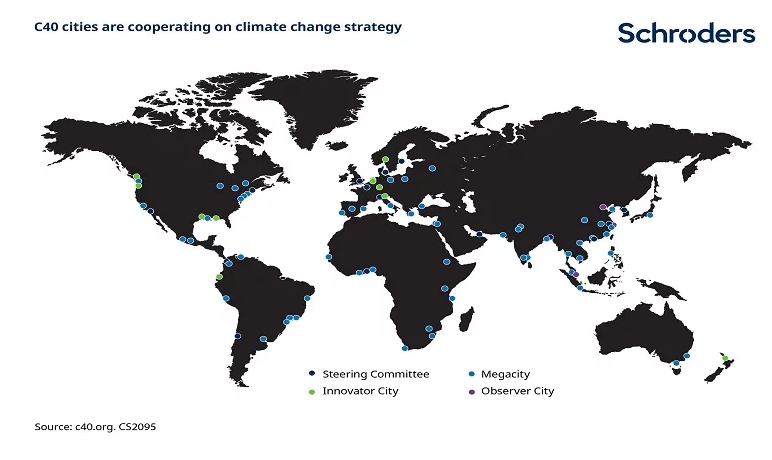

With control over local planning, taxes and energy supply, the mayors of leading global cities are setting ambitious climate action plans to meet the targets set by the Paris Agreement. Paris has its own climate agency to deliver theirs and sits on the steering committee of the C40 Cities group that is sharing sustainability best practice globally.

Local real estate owners will play an important role in achieving these plans, as buildings and the construction industry account for around 40 per cent of global carbon emissions.

Eight ways real estate owners can achieve a more sustainable portfolio

- Define ambitious vision

Ambitions are agreed at executive level and structured around the UN Sustainable Development Goals. Getting these targets approved by third parties, such as the Carbon Trust and Science Based Targets initiative, adds validity to this process.

Gecina has committed to becoming carbon neutral by 2050 and has cut its emissions by 32 per cent since 2008, half way to its 2030 target.

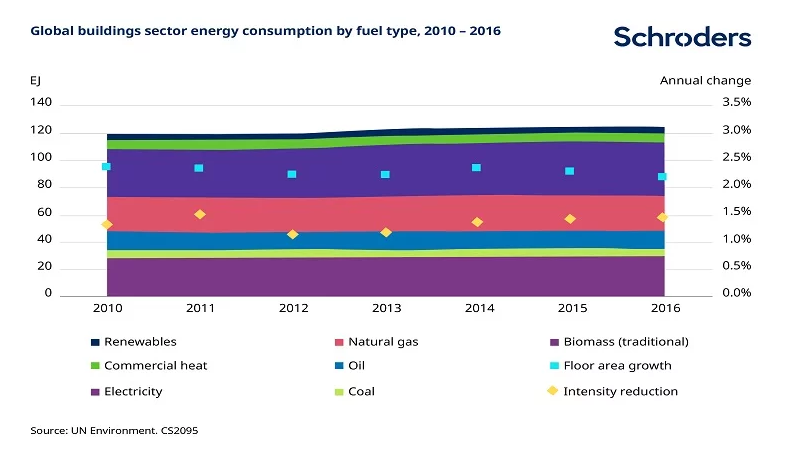

2. Using renewable energy

Energy consumption is a key contributor to overall carbon emissions from buildings, with around 80 per cent still supplied by fossil fuels globally.

Gecina recently developed an office building called “Be Issy”, which produces more energy than it consumes using 960 square metres of photo-voltaic cells and geothermal heat pumps. However, sufficient renewable energy cannot be generated on site in all cases. Much rests on tenants once buildings are occupied, with “green leases” one way to incentivise good practice.

Cities such as Paris are also introducing district urban heat and cooling networks that can improve energy efficiency by 50 per cent. With occupiers seeking to achieve their own sustainability goals, developers hope that such innovations will strengthen tenant demand and landlord pricing power.

3. Reducing embodied carbon in the development process

The vast majority of emissions come from inefficient older buildings. One of Gecina’s most ambitious projects to date is the redevelopment and consolidation of two former office buildings on Rue De Courcelles, also targeting a carbon neutral design. This includes using wood in the structure to store carbon (and reduce concrete emission intensity), a greenhouse on the roof and renewable energy production.

4. Reducing waste and recycling old materials

Landlords are seeking to avoid sending waste to landfill by integrating so-called circular economy design principles into their projects. This involves reusing existing property, plant and equipment. For example, two-thirds of the existing marble façade at Gecina’s other major redevelopment – L1ve – is to be reused as flooring in the new building entrance, saving money and cutting waste.

5. Providing access to low emission transport

Locating new developments near major transport hubs promotes sustainable travel and cuts indirect portfolio carbon emissions. Developers are also increasingly including electric vehicle charging stations in their developments as global cities prepare for a future free of petrol and diesel-powered vehicles.

6. Reintroducing biodiversity and green space

Maintaining existing and integrating new green spaces helps to sustain biodiversity and remove carbon from the atmosphere. Gecina’s L1ve office redevelopment will include 2,800 square metres of gardens and terraces within the building’s footprint.

7. Accessing sustainable financing

Green bonds are subject to reporting on environmental and social obligations, with the funds often used to invest in sustainable properties and projects. This new source of capital is growing rapidly. Gecina has structured 20 per cent of its borrowing as “sustainable improvement loans”.

8. Certifying buildings to “grade A” standards

Financial conditions for Gecina’s sustainable loans are indexed against the group’s corporate social responsibility performance. This includes certifications such as GRESB, which provides ESG benchmarking for real assets. Building certification gives investors, lenders and occupiers confidence that developers’ ambitions around building standards can be achieved. Tracking these standards across a portfolio can demonstrate improvements in energy efficiency, health and well-being, accessibility, connectivity and biodiversity. These attributes are also becoming increasingly important to occupiers seeking happy and productive staff.

Gecina is demonstrating global leadership in its transition to a more sustainable real estate portfolio, seeking to contribute to the ambitious goals of the Paris Climate Agreement. A more environmentally friendly portfolio should benefit from reduced operating costs, better access to capital and stronger tenant demand, thereby also creating an inherently more sustainable business model. We believe this transition is therefore not only the right thing to do from a social perspective, but also makes financial sense for investors.

Gecina is one of the core holdings in the Global Cities Real Estate Fund (as of October 2019) and is used above for illustrative purposes of how a sustainable portfolio can be achieved. The information is not an offer, solicitation or recommendation to buy or sell any financial instrument or to adopt any investment strategy.

- Discover more about Global Cities from Schroders’ Global Cities investment team

Global Cities Fund – Risk Considerations

Changes in China’s political, legal, economic or tax policies could cause losses or higher costs for the fund. The counterparty to a derivative or other contractual agreement or synthetic financial product could become unable to honour its commitments to the fund, potentially creating a partial or total loss for the fund. The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses. A derivative may not perform as expected, and may create losses greater than the cost of the derivative. Emerging markets, and especially frontier markets, generally carry greater political, legal, counterparty and operational risk.

Equity prices fluctuate daily, based on many factors including general, economic, industry or company news. The fund uses derivatives for leverage, which makes it more sensitive to certain market or interest rate movements and may cause above-average volatility and risk of loss.

In difficult market conditions, the fund may not be able to sell a security for full value or at all. This could affect performance and could cause the fund to defer or suspend redemptions of its shares.

Failures at service providers could lead to disruptions of fund operations or losses.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.