Golden Ocean Group: Very Strong Results Despite The Trade War

by Power HedgeSummary

- Golden Ocean Group delivered a phenomenal quarter despite the mixed headline numbers.

- The dry bulk trade set new records during the third quarter in spite of the escalating trade tensions between China and the United States.

- Spot dayrates for the company's ships surged upward and the number of voyage fixtures increased.

- This might be as good as it gets as there are signs that China will begin lowering its imports of raw materials.

- The company's two new ships could provide some growth or at least steady cash flow going forward.

On Thursday, November 21, 2019, dry bulk shipping giant Golden Ocean Group Limited (GOGL) announced its third-quarter 2019 earnings results. At first glance, these earnings were mixed as the company beat the expectations of its analysts in terms of top-line revenues, although it did fail to meet their earnings expectations. With that said though, the earnings miss was not an especially large one. A closer look at the actual earnings report though shows something of a different story as the company showed considerable improvement compared to the second quarter as well as took some steps that will likely help to stimulate its forward growth.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company's earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Golden Ocean Group's third quarter 2019 earnings report:

- Golden Ocean Group reported total operating revenues of $219.335 million in the third quarter of 2019. This represents an increase of 15.89% over the $189.257 million that the company reported in the third quarter of 2018.

- Net operating income was $53.438 million in the most recent quarter. This represents a slight improvement over the $50.851 million that the company reported in the prior year quarter.

- Golden Ocean Group took delivery of two chartered-in 103,000 dwt ice-class vessels on index-linked time charters.

- The company reached an agreement with SFL Corporation (SFL) whereby the latter pays for the installation of exhaust scrubbers on seven Capesize vessels in exchange for higher charter rates from Golden Ocean.

- Net income was $36.699 million in the third quarter of 2019. This represents a fairly mild increase over the $35.285 million in the third quarter of 2018.

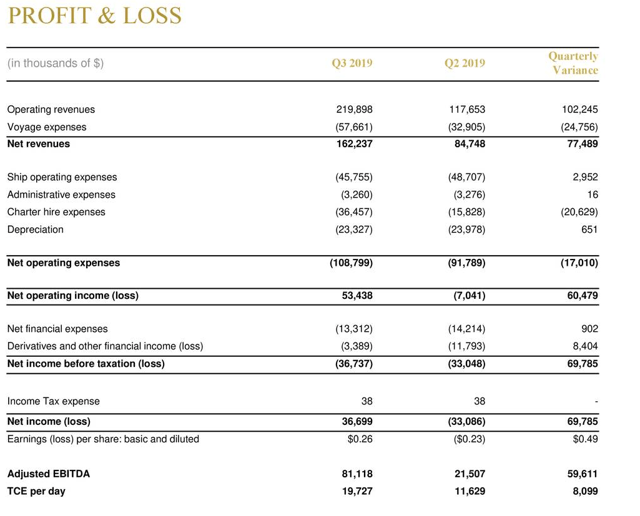

It seems certain that the first thing that anyone reviewing these highlights is likely to notice is that essentially every measure of financial performance showed improvement compared to the prior year quarter. It also saw considerable improvement compared to the second quarter of this year. We can see that quite clearly here:

Source: Golden Ocean Group

The biggest reason for this is that the market for dry bulk charters was substantially stronger in the third quarter of this year than in the second. Golden Ocean Group notes that it saw the number of single voyage charters increase significantly. As I have explained in various past articles, there are two ways that the company's customers can hire a ship - time charter and voyage charter. A time charter is exactly what it sounds like in that the customer commits to hire the ship for an extended period of time at a contractually agreed upon rate. This is often used when the customer needs to send regular cargo shipments between points and wishes to lock in a price and ensure that it has a ship available as needed. The other way that a ship can be chartered is for a single voyage. This is essentially used when the customer needs to send cargo between points on a one-time basis. These single voyages are performed at a market-based price that is set at the time that the vessel is chartered. The fact that voyages picked up during the quarter appears to indicate that global trade picked up significantly in the third quarter compared to the second. This increased activity caused the company's TCE (time charter equivalent) to increase to $19,727 per day in the most recent quarter compared to $11,629 in the second quarter.

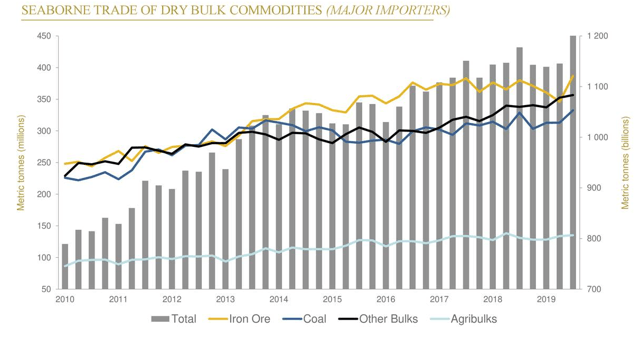

It may come as a surprise that dry bulk shipments picked up in the third quarter when we consider that, despite many erroneous reports of a trade deal, the tensions between the United States and China were running quite high during that period. Nevertheless, the total volume of dry bulk goods shipping during the quarter reached a new record. We can see that here:

Source: Maritime Analytics, Golden Ocean Group

One of the necessary things to understand this in light of the trade tensions is that the United States and China are not the only two countries in the world involved in the trade of dry bulk goods. For example, despite the fact that its steel production growth slowed to 5.5% by the end of the third quarter, China continues to import iron ore from Australia. There is the possibility that Chinese steel production began to contract in October but the country's iron ore stockpiles are still lower than a year ago so it may keep iron ore imports at a high level as it rebuilds its stockpiles. The Chinese also increased their imports of coal to record levels in the third quarter while South Korea and Japan also increased their coal imports. Unfortunately though, the Chinese import restrictions are in effect during November and December so the country will import less during these two months. Thus, there is the very real possibility that the fourth quarter will prove to be worse for the industry than the third one was.

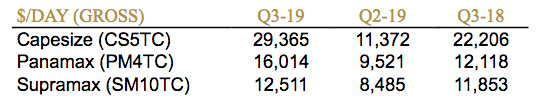

As might be expected, this strength in the dry bulk market had a positive impact on day rates. We can see that here:

Source: Golden Ocean Group

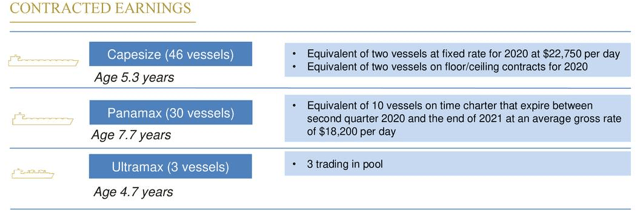

As we can see above, the average spot day rate for every class of ship in Golden Ocean Group's fleet was higher than in either the previous or the prior year quarters. The biggest improvement though was in Capesize (the largest type) and to a lesser extent Panamax classes. This greatly benefited Golden Ocean Group as Capesize vessels make up the overwhelming majority of its fleet. The company also has a substantial number of Panamax class vessels. We can see that here:

Source: Golden Ocean Group

The company only has a limited number of Capesize vessels on time charter agreements though so the majority of them are trading in the spot market. Thus, any improvement in spot rates for these vessels, particularly one as large as we saw this quarter, will have a significant impact on the company's revenues and cash flows. That is exactly what we saw in this quarter.

As mentioned in the highlights, Golden Ocean Group recently acquired two 2019-built 103,000 ice-class Capesize vessels. This expands the company's fleet and potentially provides it with some forward growth potential. Only one of these ships was actually delivered in the third quarter, however. This was the MV Admiral Schmidt, which was acquired in September. The second vessel, MV Vitus Bering, was delivered in October. The nice thing about this acquisition is that both of these ships came with three-year charters. Therefore, the company can have confidence that it will be receiving steady amounts of both revenue and cash flows from both of these vessels over the next few years. In addition, each of these charters has an index-linked dayrate, which could prove to be a double-edged sword. If the spot market average price for these vessels increases, then Golden Ocean Group will see its revenues from the vessels increase, but the reverse is also true and the company could very easily see its revenues go down. Regardless though, the two vessels will still produce a more reliable revenue stream than the other vessels in its fleet because they will have steady employment.

In conclusion, this was a very solid quarter for Golden Ocean Group due to the exceptionally strong market for dry bulk shipping. Unfortunately though, there may be some reasons to believe that this is as good as it is going to get, at least for the remainder of this year. The company did see a few positive developments outside of the strong market though such as the recent acquisition of two Capesize vessels with three-year time charters. Overall then, there was a lot for investors to be pleased with here.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. We are currently offering a two-week free trial for the service, so check us out!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.