How China Mobile Sustains A 5% Dividend Yield, In 5 Charts

by Tariq DennisonSummary

- China Mobile is the largest mobile phone operator in the world, again trading at a 5% dividend yield backed by steady free cash flows.

- Compared with both domestic and US telecom counterparts, China Mobile sustains higher profitability ratios and cheaper valuation multiples.

- Being the top provider of 5G in the world's largest market indicates more upside than downside over the next decade.

- Being >70% owned by the Chinese government is the primary weight on shareholder returns, so this stock is better considered a junior high-yield bond than a likely multiplier.

We first bought shares of China Mobile Limited (CHL) several years ago, when its dividend yield was above 5%, and are now looking to add more now that the dividend yield is back around 5%. I have also been a China Mobile customer for many years, and have seen firsthand how the ubiquitous 4G coverage has served me across Greater China, from Tainan to Tashgurkan, from Lhasa to Liaoning, from Hong Kong to Hohhot.

This month also happens to be the time where I can decide to renew my 2-year mobile phone contract, and I could summarize my renewal choices as:

- Pay half the monthly fee for the same amount of 4G data, or

- the same monthly fee for about 3x as much 4G data, or

- switch to a competitor with similarly-priced packages, though perhaps not as good coverage in the more remote parts of China

Price cuts like these are usually a red flag on the quality side of a stock I would look to accumulate, so I found it worth sharing a few charts comparing China Mobile to its main competitors to get an idea of how safe this 5% dividend yield is.

Within China, CHL has two main competitors: China Telecom Corp. Limited (CHA) and China Unicom (Hong Kong) Limited (CHU). All three are over 70% owned by the Chinese government, and less than 27.5% by private shareholders, and all three provide some level of service across China. Many commentators have pointed out that this makes the Chinese government not only CHL's largest shareholder, but also its largest competitor. This means the interests of shareholders will often take a backseat to the priority of providing affordable data packages to more of China's 1.4 billion people, which is why I look at this stock more like a junior high-yield bond than a true stock. In order to not get back my money in dividends in a decade or two, we would need to see free cash flows on this name dwindle, or the payout rate reduced even further from its already conservative levels, neither of which I believe is likely.

Across the Pacific, the two main US telecom companies we might compare CHL to are AT&T Inc. (T) and Verizon Communications Inc. (VZ). Like CHL or other telecom companies around the world, these are considered blue-chip names main street likes to accumulate for their safe-looking dividends. I am also an AT&T customer for US coverage, and can tell from my pricing experience there that AT&T seems better able to keep prices higher at the expense of customers and for the benefit of shareholders.

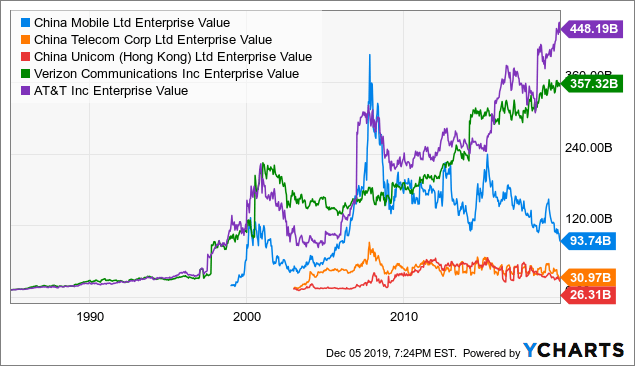

Chart 1: Market Value

The first chart compares the enterprise values of China mobile against its two domestic and two US comparables. Enterprise value (EV) is a better metric than market cap in this sector, as it includes the net value of each company's debt. In summary:

- There were two "bubbles" in 1999-2000 and in 2007-2008 which saw all these telecom shares rise dramatically before crashing.

- Since 2008, the US names have continued to increase in value while the Chinese names have broadly declined in value.

- CHL was briefly the most valuable in 2007-2008, but is now a fraction of the value of T or VZ.

- CHL remains slightly less than double the combined value of CHA and CHU.

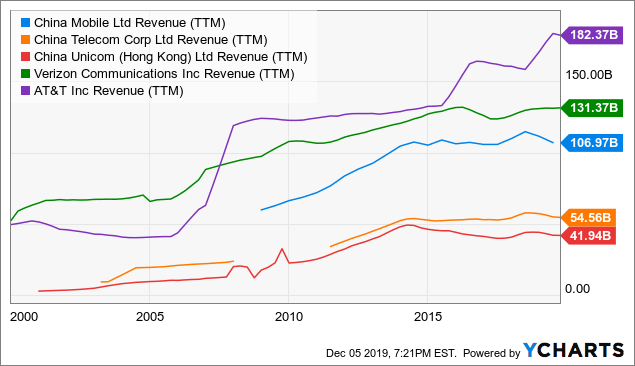

Chart #2: Revenues

One of the main draws of investing in a Chinese company is the potential for large revenues and revenue growth given China's large population. CHL's extreme bubble in 2007-2008 was due to excessive optimism about revenue growth, which rose to around US$100 billion/year by around 2015 and have been flat since then. This puts CHL revenues at slightly more than double those of CHA and CHU, and each of the Chinese names trade at an EV/Sales ratio less than 1.0. By contrast, both VZ and T trade at enterprise values more than double their recent annual revenues.

I am usually no good at forecasting revenues, but feel fairly confident that with 5G over the coming decade, CHL's revenues are more likely to rise than decline.

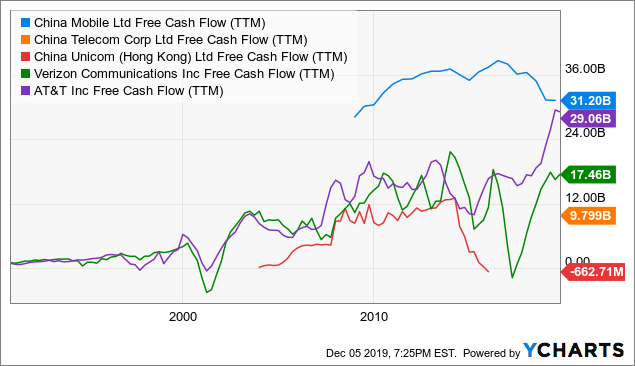

Chart #3: Free Cash Flows

As a boring old school "cash on cash return" investor, solid free cash flows are one of the main factors I look for when buying an investment. Here, CHL is the clear leader, with TTM free cash flow consistently higher and steadier than those of VZ or T. The main threats to CHL's free cash flows would be excessive or wasteful spending on 5G in the coming years, or the government setting 5G rates below cost, neither of which seems likely given CHL's track record with 2-4G and my perception of the Chinese consumer's purchasing power the next decade.

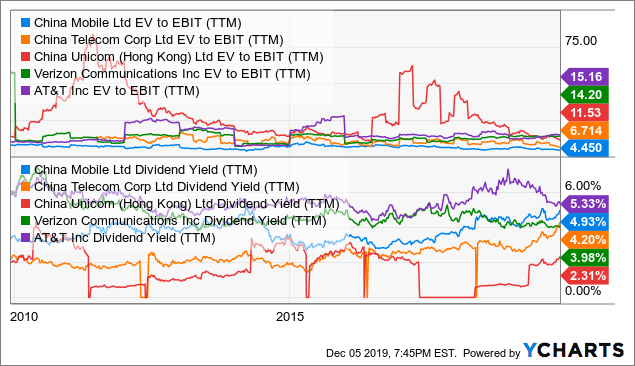

Chart #4: Valuation

In addition to the above two ratios of enterprise value to sales and enterprise value to free cash flow, this next chart provides a historical view of one similar valuation metric (enterprise value to earnings before interest and taxes) and one simpler valuation metric (dividend yield). By the first metric, as shown earlier, CHL's whole business trades at significantly cheaper multiples to pre-tax earnings than the other names, and it has become even cheaper as the price has fallen faster than any true fundamentals. The dividend yield chart shows that CHL's dividend yield is still slightly lower than that of T, though seems likely to crossover soon. AT&T shareholders may consider diversifying some holdings into CHL as this happens, especially as CHL's dividend may be considered "higher quality" due to the lower use of debt.

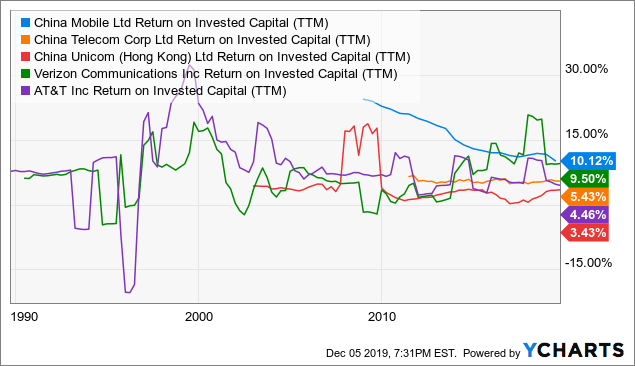

Chart #5: Return On Invested Capital - Quality Metric

As one more check of the long-term quality of a business, I like to check long-term averages of return on invested capital (ROIC), to see how good sustainably profitable one business is versus others in its industry. This chart seems to show some bad news in CHL's ROIC declining from ~20% levels a decade ago to likely ~7-10% levels over the next few years, closer to VZ's ROIC rates. A declining ROIC deserves some discount, but I would argue CHL's discount is already too deep given how the ROIC outlook remains over the next few years.

A Note On China Mobile And 5G

Although CHL, CHA and CHU all started an initial rollout of 5G just six weeks ago, 5G is still in very early stages, and it is very speculative to guess how much money any carrier or equipment maker will make on 5G. That said, there is a 5G-themed ETF named the Defiance Next Gen Connectivity ETF (FIVG) whose ticker symbol implies a focus on 5G, which I don't believe it will do well with less than 1% allocated to China. Any sizable bet on 5G over the next decade would have to include a more sizable view on the Chinese carriers, as well as some allocation to Huawei bonds. China's technology and customer base is simply too important a part of 5G to be overlooked by anyone interested in this sector.

Conclusion

As stated in the introduction, we continue to see China Mobile as a value dividend play worth accumulating, with the understanding that the upside may be limited to that of a high-yield bond. This name is weighed down by the usual capital intensity and competitive pressures of telecom companies, combined with competing priorities of its majority shareholder, but seems to have less downside than upside from these valuations. There may be a "cheap option" on some 5G upside, but I expect most upside to come from the sustainable 5% dividend, backed by one of the world's largest subscriber bases.

Disclosure: I am/we are long CHL, T, VZ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.