First Trust New Opportunities MLP & Energy Fund: Our Top Pick Among MLP CEFs

by BOOX ResearchSummary

- FPL has presented a strong performance in 2019 despite continued weakness in MLPs and the midstream energy industry.

- We think the fund has value considering current discount to NAV and potential rebound in energy prices through 2020.

- Fund yields 10.8%.

The First Trust New Opportunities MLP & Energy Fund (NYSE:FPL) is a closed-end fund that invests primarily in energy sector Master Limited Partnerships (MLPs) and other midstream equities. The objective here is total return with a high level of current income considering a current yield of 10.8% achieved with the use of underlying leverage and return of capital distributions. This is a market segment that has lagged going back to the collapse in energy prices from 2014. The major players in the sector have been crushed given exposure to highly leverage and high cost producers, dragging lower the performance of funds like FPL which is down about 25% in the past five years. That being said, FPL has demonstrated a favorable outperformance to industry benchmarks in recent years and we think the fund is a quality choice for exposure to the midstream industry upside going forward. We also like the fund's wide discount to NAV which represents relative value. This article presents a recap of the fund and our view on where FLP is headed next.

(Source: Finviz.com)

FPL Background

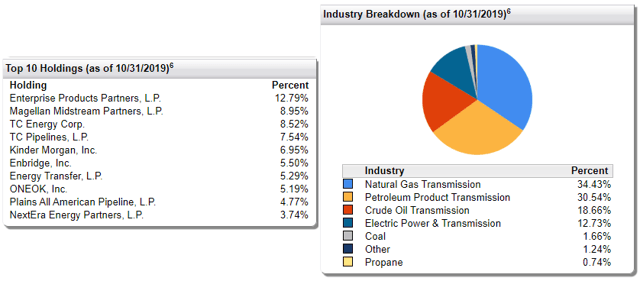

The fund with an inception date in 2014 features a diversified portfolio within different segments of midstream energy between natural gas, oil, and power transmission. The top holding of the fund is Enterprise Products Partners LP (EPD) with a 12.8% weighting, followed by Magellan Midstream Partners LP (MMP) with a 9.0% weighting. The fund's current leverage ratio at 27% considers $87 million in borrowed funds and $232 million in underlying assets comprising the total $319 of investment exposure.

(Source: First Trust)

The fund pays a $0.075 monthly distribution which represents a current yield of 10.8%. The fund's yield has ranged from as high as 16.3% to a low of 7.2% in 2015. The entirety of the fund's distribution is based on return of capital which reflects the underlying MLP investment focus. Favorably, the fund's NAV performance this year has more than covered the annualized distribution amount.

FPL Performance

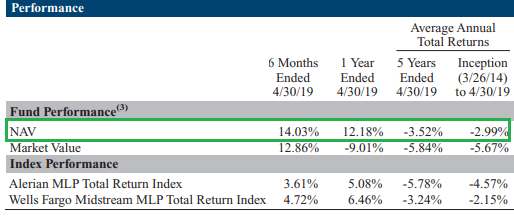

The fund's benchmark is the Alerian MLP ETF (AMLP) based on the index by the same name, and the Wells Fargo Midstream MLP TR Index. We include the Global X MLP & Energy Infrastructure ETF (NYSEARCA:MLPX) for reference purposes. FPL's NAV has favorably outperformed the Alerian MLP benchmark over different holding periods on an average annual total return since inception.

(Source: First Trust)

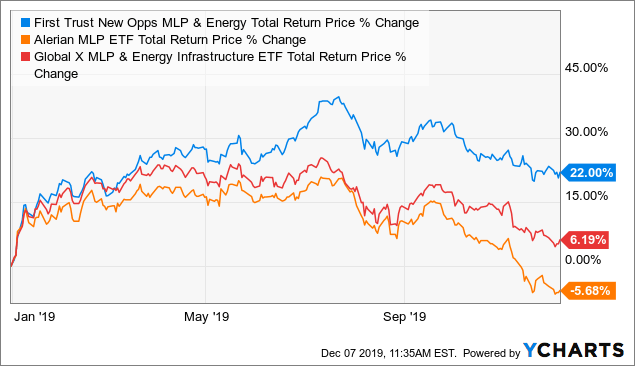

Notably, FPL is a higher risk fund with greater volatility. FPL features a similar exposure to AMLP but based on a different portfolio holdings composition and with FPL being actively managed. Investors will prefer the FPL for its high distribution rate which provides flexibility when choosing between the monthly cash payout for income purposes, dripping for more shares, or investing into other market opportunities. These options are generally the alluring characteristics of high yield CEFs in general. Impressively, FPL is up 22% year to date in 2019 compared to a 5.7% decline in AMLP and 6.2% gain in MLPX. The net asset value has also presented a positive return and is up 17% year to date on a total return basis.

Data by YCharts

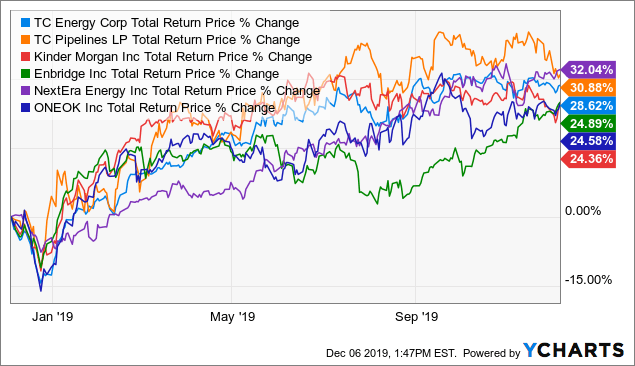

The outperformance of FPL this year is simply a reflection of the fund manager's portfolio allocations effectively over-weighting some big winners. Taking a look at some of the biggest gainers among the fund's top 10 holdings, solid returns this year from NextEra Energy, Inc. (NEE) up 32%, and Enbridge Inc. (ENB) up 25%, and TC PipeLines LP (TCP) up 31% highlight the main performance contribution. Again, the portfolio has a wide discrepancy from the Alerian benchmark, and the results here demonstrate the fund manager's "stock picking" abilities and the value of FPL as an investment vehicle.

Data by YCharts

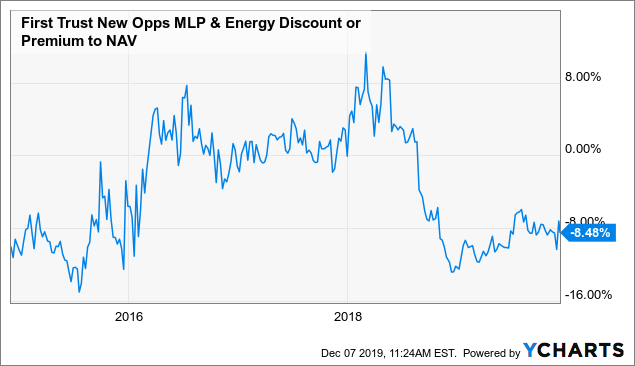

Discount to NAV

What brought our attention to FPL is the fund's current discount to NAV at 8.5% which is wider than its historical averages. This compares to a 3-year discount of just 2.6% and 5-year discount of 3.4%, suggesting the fund is relatively inexpensive at current levels. While it is sometimes difficult to quantify or explain why the discount (or premium) of a CEF is trading at a particular level, this current discount is in the context of the strong NAV and market price performance of FPL relative to its benchmarks.

Data by YCharts

We believe improved sentiment in the MLP sector in the future would drive a narrowing of the discount as more investors seek out FPL as an outperforming CEF and bid up its shares. All else equal, a narrowing of the discount to NAV from current levels would add to shareholder returns, or at least supports a higher margin of safety.

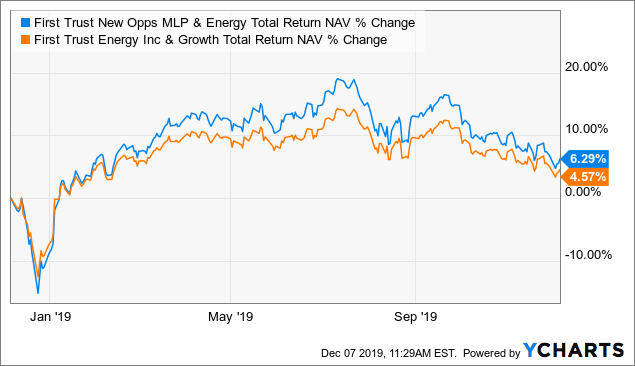

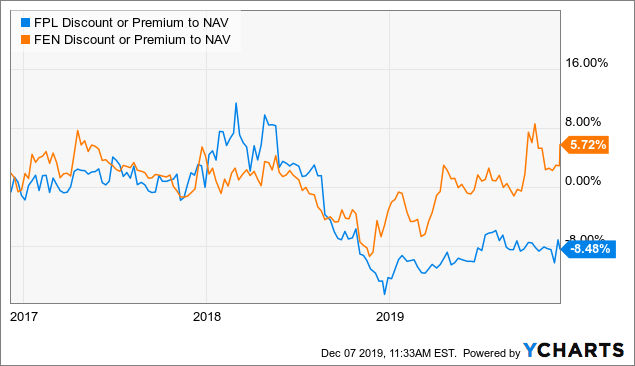

Why FPL over FEN?

It's worth mentioning that the First Trust fund manager offers the separate First Trust Energy Income & Growth Fund (NYSEMKT:FEN) with a similar investment strategy and MLP exposure. There is a significant overlap among the top holdings of each fund while the actual composition and weightings are different. FPL has also favorably outperformed over the past year, up 6.3% compared to 4.6% from FEN on a Net Asset Total total return basis. FEN features a distribution yield currently at 11.1%, which is 30 basis points higher than FPL's at 10.8%.

Data by YCharts

We also prefer FPL as its discount to NAV of 8.5% compares to FEN which currently trades at a premium to NAV of 5.7%. This large spread suggests FEN is relatively expensive. Both funds are quality options for energy and MLP exposure through the CEF structure, but in our view FPL offers more upside potential should the discount spread converge.

Data by YCharts

FPL Analysis and Forward-Looking Commentary

For energy investors, there are some reasons to be optimistic for 2020 considering what is currently overall positive sentiment in broader financial markets. The S&P 500 (SPY) is trading at an all-time high based on what has been a resilient economic growth and better-than-expected corporate earnings. The expectation for a U.S.-China trade deal, or at least some type of preliminary agreement, would likely be positive in removing one layer of uncertainty that has pressured global growth over the past year.

Of course, this set-up is just one of many possible scenarios for next year but has wide-ranging implications for various market segments. We propose that a resurgence of global growth expectations would likely be bullish for commodities including energy and inflation expectations. FPL is well-positioned to benefit from these trends and improved investor sentiment towards the midstream industry. To the downside, a deterioration of the global growth outlook pressuring energy prices and inflation expectations lower is the main risk to the outlook.

Takeaway

FPL with an inception date in 2014 has been able to favorably outperform MLP and midstream energy sector benchmarks in recent years under a very challenging industry environment. We think the performance reflects the fund's quality and asset allocation ability of the management team. We also like the current discount to NAV at 85% which is wider than the 3-year average. The fund's expense ratio at 2.81% includes the interest expense and is about average for MLP focused CEFs. Overall, we can recommend this fund as the current price level represents a favorable risk-adjusted return potential in our opinion. Take a look at the fund's last annual report for a full list of risks and disclosures.

Disclosure: I am/we are long FPL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Investing includes risks, including loss of principal.