Keysight Reports A Strong Quarter

by Lukas WolgramSummary

- Keysight Technologies reported a fiscal fourth quarter that beat analyst expectations.

- Fiscal 2019 saw adjusted operating income more than double from 2018.

- The valuation is attractive as the company's shares have a combination of growth and value.

Introduction

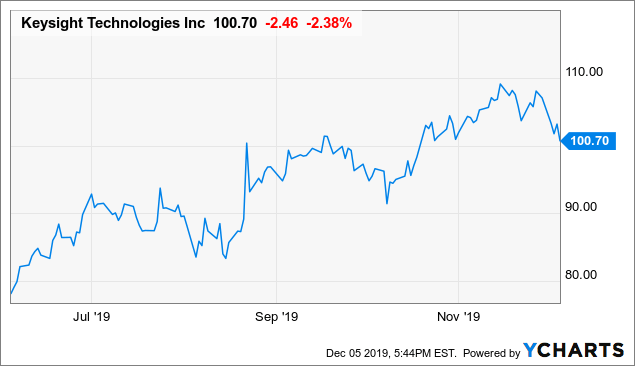

In my last article on Keysight Technologies (KEYS), I gave readers four reasons why Keysight could climb over $100 per share. Since that article, the company reported earnings and the stock climbed as high as $110, but has now pulled back to $100. Virtually the same level the stock was at when I wrote that first article a few months ago. In this article, I take readers through a look at the fiscal Q4 and fiscal 2019 results, which exceeded expectations, and discuss if I think there is still more upside for shares from here.

Data by YCharts

FQ4 2019 Earnings Review

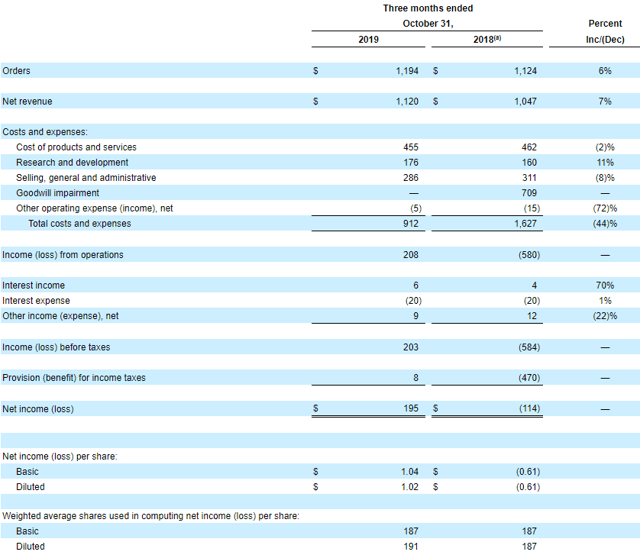

The fiscal fourth quarter of 2019 saw a respectable 7% increase in overall revenue with a profit of $195M, or EPS of $1.02 per diluted share. This result beat analyst revenue expectations by $30M and GAAP EPS expectations by $0.17.

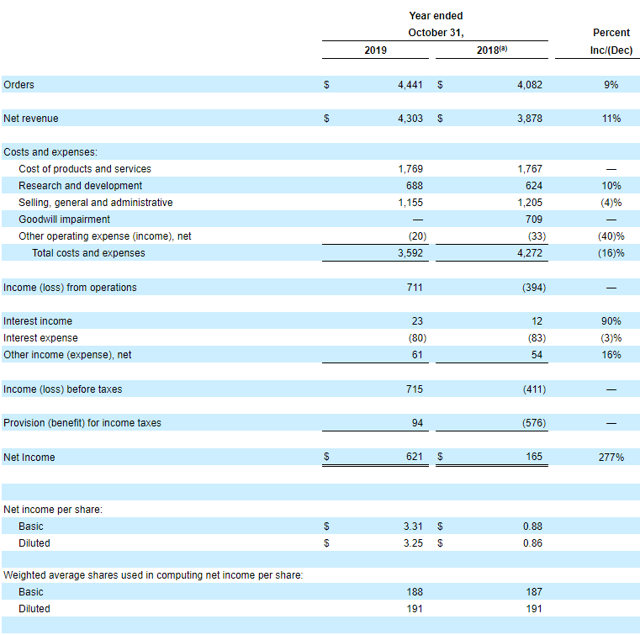

Source: Keysight Technologies Fourth Quarter 2019 Results Filing

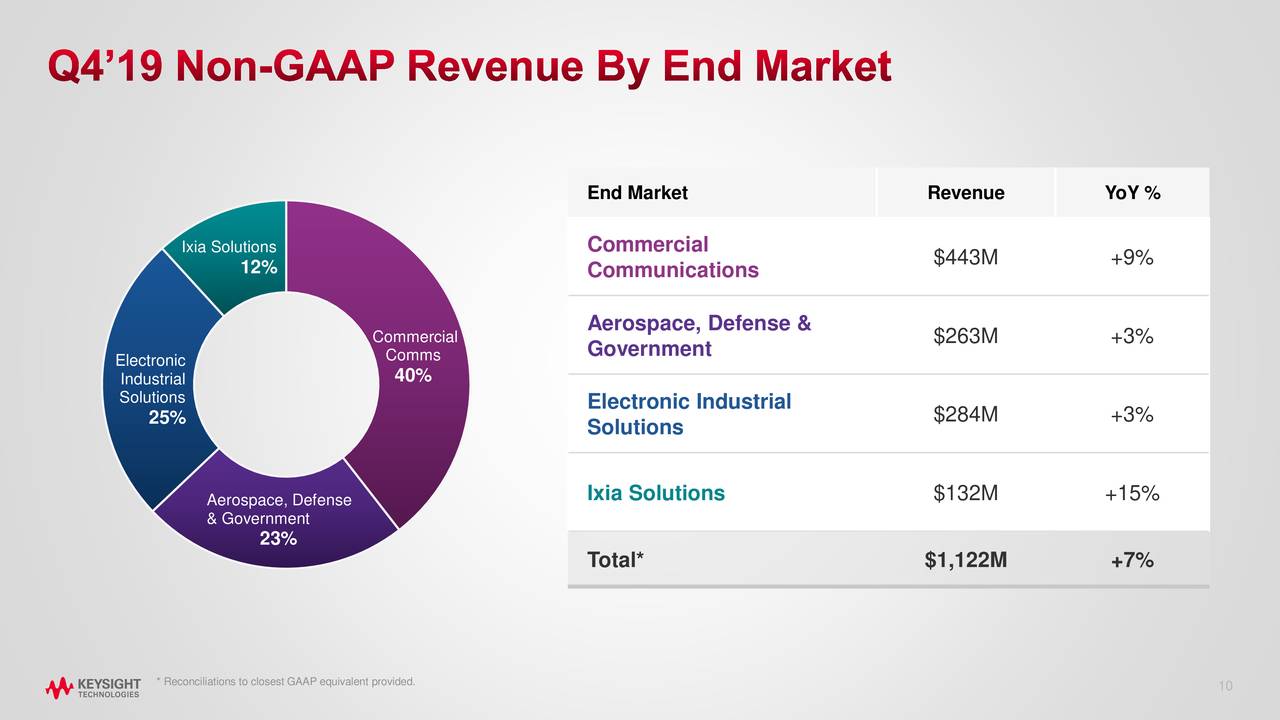

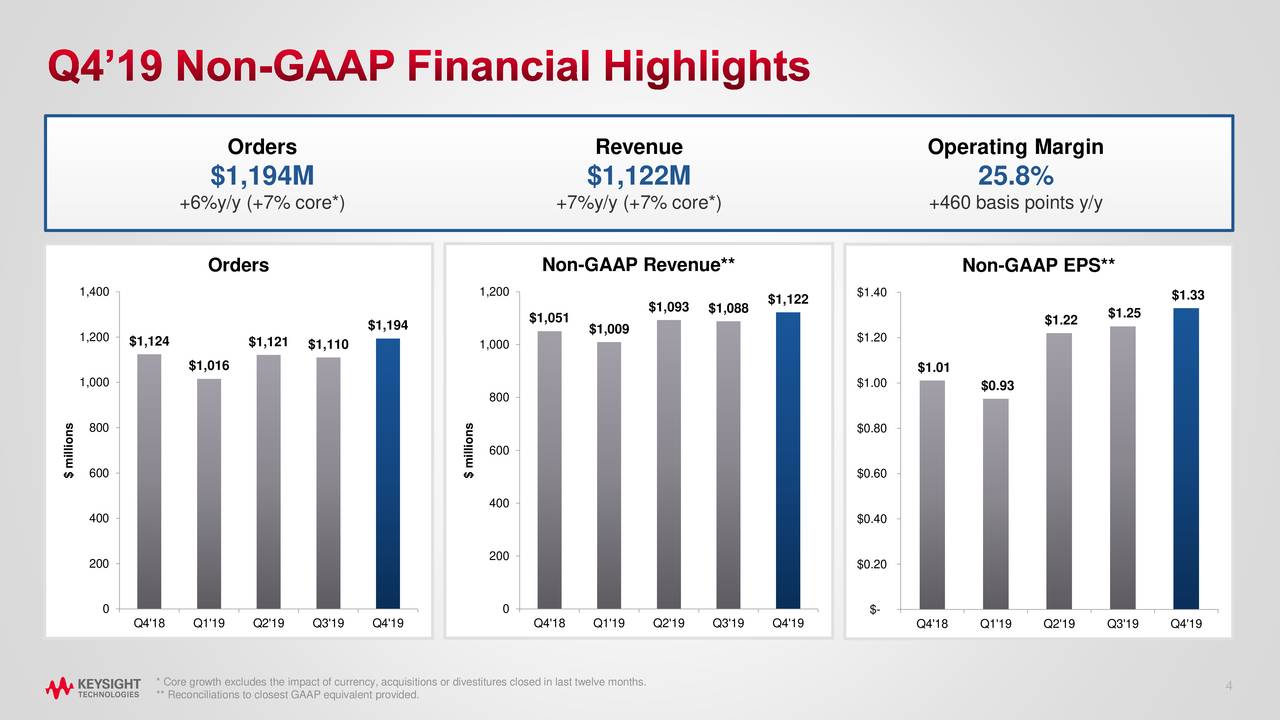

Q4 non-GAAP revenue saw growth in every segment of the business. While none of the segments posted astonishing growth numbers, they all maintained a steady trend.

Source: Keysight Q4 2019 slide presentation

Source: Keysight Q4 2019 slide presentation

The company also bought back around 300,000 shares of stock in the quarter, bringing the total share repurchases for fiscal 2019 up to 2.1 million shares for around $160M ($76.32 per share average). Considering shares are trading at around $100 now, this is looking like a solid way to return capital to shareholders.

Full Fiscal 2019 Year Results

CEO Ron Nersesian summed it up well (referring to non-GAAP numbers) early in the Q4 2019 conference call, saying:

In Q4 and in fiscal year 2019, in total we achieved record orders, record revenue, record gross margin, record operating margin, and record EPS. For the full year, revenue grew 10% to reach $4.3 billion. We achieved 11% core revenue growth while generating 63% gross margin, 24% operating margin, and delivering a record 46% year-over-year EPS growth.

Source: Keysight Technologies Fourth Quarter 2019 Results Filing

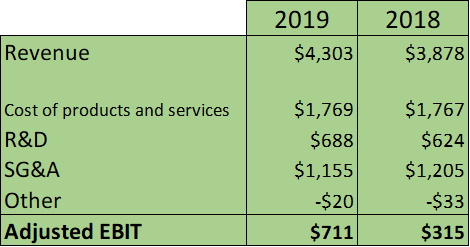

While at first glance, the numbers appear phenomenal, I think the proper assessment on the health of the business would involve removing the one-time impairment charge from 2018 and looking at adjusted EBIT. This removes the effects of interest expenses and tax fluctuations (such as 2018's $576M tax benefit) and thus results in a more apples-to-apples comparison.

Adjusted EBIT more than doubled from $315M in 2018 to $711M in 2019. Still very impressive, but not quite the several hundred percent in EPS on the GAAP income statement. Regardless, this doesn't take away from the company's value, and if anything illustrates that management has done an excellent job at controlling costs while growing the business. It managed to increase R&D spending, while decreasing SG&A expenses and keeping cost of products and services around the same. This bodes well for the future of the company.

Valuation and Conclusion

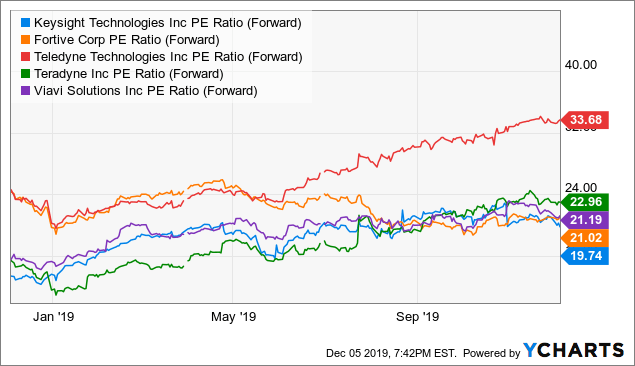

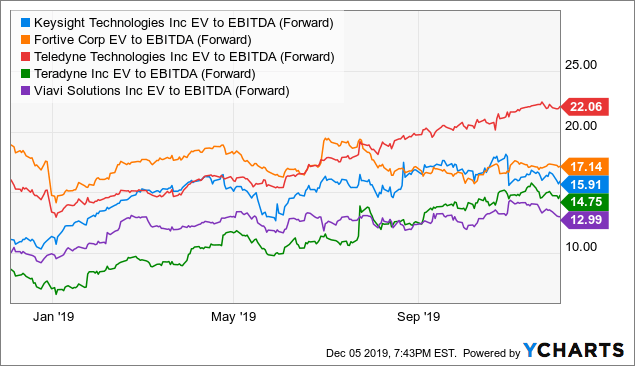

Keysight's shares were trading at a valuation in the midpoint compared to competitors in my previous article but now the stock trades at the low end on a forward P/E basis. The forward PE ratio is now down to 19.74 from 21.56 a few months ago (my last article published September 11, 2019). Forward EV to EBITDA is also down to 15.91 from 16.96, although remains in the middle of the pack.

Data by YChartsData by YCharts

Keysight guided for fiscal Q1 2020 revenue to come in between $1.045B and $1.065B, up from actual non-GAAP Q1 2019 revenue of $1.009B. This was in line with analysts' expectations. Given this solid guidance number, a lower valuation, and the fact that Keysight reported a great Q4 and fiscal 2019, I continue to think the shares have more upside from here. 5G continues to play out well for the company, and revenue streams remain strong and diversified. I am maintaining my bullish rating on Keysight Technologies.

Be sure to follow me and turn on email notifications to get notified every time a new article goes and ensure you never miss another article!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in KEYS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.