The Quality Of Its Microtransactions Will Decide Ubisoft's Fate

by Edgar Torres HSummary

- Ubisoft has had a terrible 2019 so far, which I feel has been accurately priced into the share price.

- In my view, going forward, Ubisoft's success will depend on its ability to implement microtransactions that players accept.

- I believe Ghost Recon Breakpoint is an excellent example of a terrible microtransaction system. On the other hand, Rainbow Six Siege is a successful microtransaction model that Ubisoft should aim to replicate.

- My valuation for the shares shows that Ubisoft has a modest upside of 7.7% from current levels.

- In my opinion, Ubisoft is a viable long-term investment at these prices, but not yet a deep-value play.

Ubisoft (OTCPK:UBSFY) is a gaming company that has very well-known gaming titles such as Rainbow Six Siege and Assassin's Creed. I think Ubisoft has the potential to become the next Take-Two Interactive (TTWO) or even Activision (ATVI) at some point. However, they still have to overcome some hurdles before they get to that level. After all, UBSFY has recently had some missteps with titles like Ghost Recon Breakpoint and, to some extent, The Division 2. Finally, my valuation for the shares suggests that there's minimal upside that these levels. So, all in all, Ubisoft is still a viable long-term hold, but not yet a deep-value investment.

Overview

To begin, let's talk about the elephant in the room: Ubisoft has been having an incredibly challenging 2019. This has been mostly due to a couple of factors. First, UBSFY has had to take some impairment charges for Ghost Recon Breakpoint and The Division 2. Also, this has caused a sharp downward revision in the expected revenues for the year. As you might expect, this alone is enough to make 2019 a very tough year for the company.

In terms of impairment charges for Ghost Recon Breakpoint, it's meaningful, but we don't give the exact amount of this.

- Frederick Duguet, Ubisoft (see link above)

However, on top of that, Ubisoft has decided to push back the release of Gods and Monsters, Rainbow Six Quarantine, and Watch Dogs Legion into 2020. Thus, taking a step back, it's clear that 2019 has been without a doubt an awful year for the company. And unfortunately, this has been reflected in UBSFY's share price. For context, during 2019, the stock has declined by 18%, which is terrible on its own. But this performance is dismal when compared to the S&P 500, which is up 24%.

Source: Yahoo Finance

Microtransactions will decide Ubisoft’s fate

Furthermore, the year's results have shed light on Ubisoft's core risks, and opportunities boil down to one variable: successful implementation of microtransactions. Let me explain: the recent disappointment of Ghost Recon Breakpoint is a clear result of a game being built around and for microtransactions. This is a concept that gamers are instinctively starting to reject, so Ubisoft had to tread very carefully. Unfortunately, this wasn't the case. Ghost Recon Breakpoint incorporated microtransactions into every aspect of the game, while at the same time neglecting its replay value. Thus, it's no wonder that the game has been compared to an online shop rather than an actual game with solid gameplay. And naturally, if gamers don't have a solid reason to keep coming back to the game (i.e., fun gameplay), then they won't have a reason to keep spending on the game either.

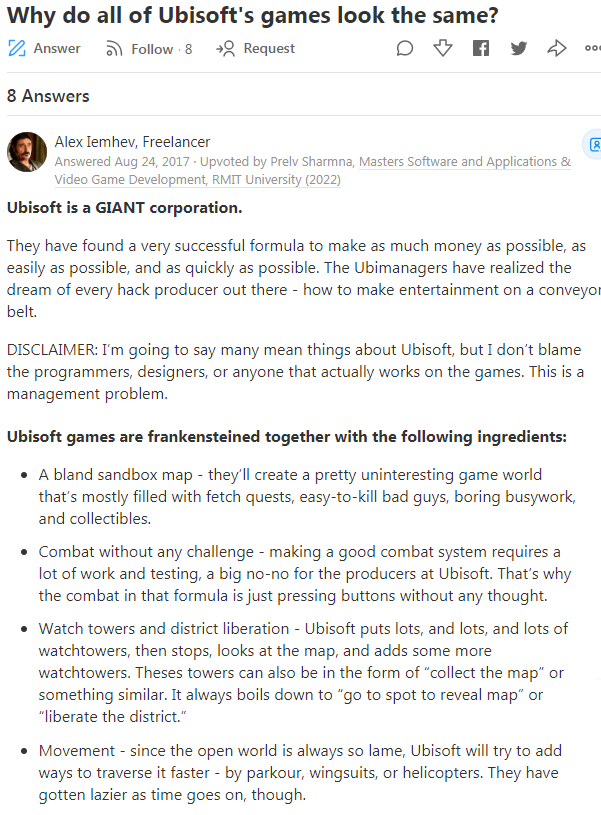

As you might expect, this was a double whammy for UBSFY, because there were very high expectations for Ghost Recon Breakpoint. You see, Ghost Recon is a cherished franchise and has been successful in the past. However, Ghost Recon Breakpoint took an open-world spin on the franchise, which might also be part of the problem. Unfortunately, it seems that the open-world formula that Ubisoft is well-known for is starting to show cracks. In fact, in the latest earnings call, analysts started asking management whether or not the open-world formula is beginning to fall out of style. And if this is the case, it would probably translate into a further downside for the company's results. After all, Assassin's Creed and Watch Dogs are also open-world games and significant revenue contributors for UBSFY.

Source: Quora. Players are starting to notice that Ubisoft recycles much of its open-world content.

I do think gamers might start getting tired of open-world games and their recycled elements. However, I don't feel that this is Ubisoft's main problem. Instead, I believe that the recent failure of GBR was mostly due to microtransactions being implemented the wrong way. Thus, Ubisoft should aim to duplicate its successful implementation of microtransactions (like Rainbow Six Siege) in its future releases. As you know, Rainbow Six Siege has a very prominent microtransactions component to its gameplay. Still, it is implemented in a very non-invasive and respectful way to gamers. Not only is it purely cosmetic, but it's entirely optional and doesn't affect gameplay in any unfair way.

But most importantly, R6's microtransactions are only a second layer for gamers, rather than the focus of the game itself. You see, what keeps players engaged in Rainbow Six Siege is its very addictive first-person shooter gameplay. R6's charm also resonates with the eSports gaming niche, which further amplifies revenues for UBSFY. Microtransactions allow gamers to keep investing themselves in the game, which only strengthens the loyalty of its player base. Yet, this is not required for casual players. I believe this strikes the perfect balance and manages to appeals to a broader crowd. In my opinion, Rainbow Six Siege should be a case study of successful microtransactions implementation for UBSFY.

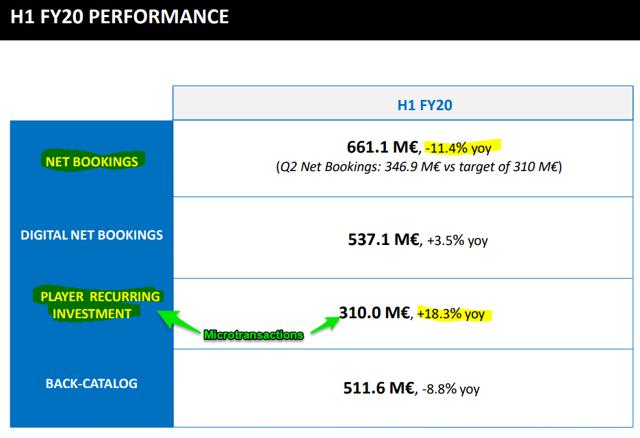

Source: Ubisoft’s investor presentation

Moreover, you can tell that other publishers, like Activision, have taken a cue from R6's success. For example, the latest Call of Duty has a somewhat similar approach to microtransactions. Its microtransactions are mostly cosmetic, plus there's a "seasons" angle to it too (just like R6). So far, the newest Call of Duty has been well-received, but most importantly, it has been able to avoid the typical backlash from microtransactions. In my view, this is a testament that microtransactions can be done in a way that builds a loyal fan base instead of backlash and write-downs.

Valuation

Hence, Ubisoft still can redeem itself in 2020. However, it would all depend on the company's ability to learn from its mistakes on Ghost Recon Breakpoint. Management said that in 2020, it is expected to release five notable titles, and micro-transactions will be a significant part of them.

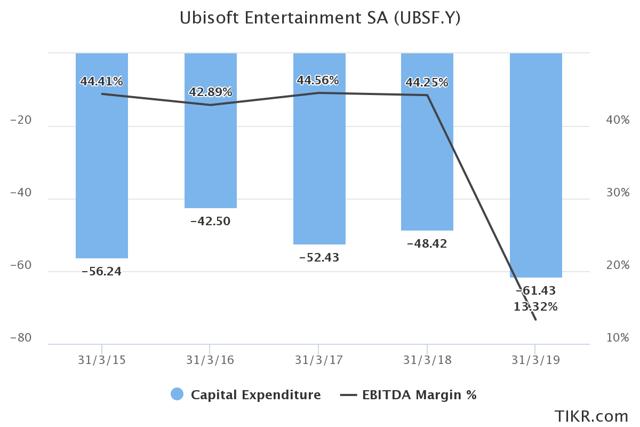

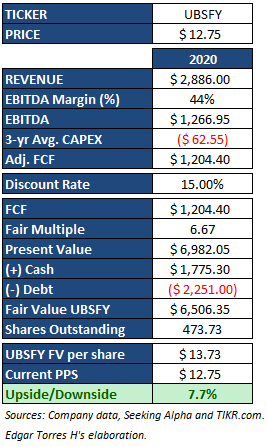

I believe that if UBSFY can hit its $2.88 billion revenue target for 2020, then its valuation does have some upside at this point. Also, I assume that the company will be able to regain its previous average EBITDA margins, while keeping CAPEX under control. I consider these are fair assumptions given that UBSFY continues to benefit from digital revenues, which have better margins. Also, Uplay and subscriptions are becoming more significant revenue contributors over time. Thus, I think we can make a reasonable estimate of UBSFY's fair value.

As you can see, my valuation model suggests that UBSFY still has a slight upside of 7.7%. This might not seem like too much, but it is worth keeping in mind that the discount rate is 15%. So, in my opinion, investors will likely be well-compensated over the long term while holding Ubisoft. Still, I wouldn't consider Ubisoft a value play at these levels, either.

Conclusion

There's no denying that 1H 2019 has been incredibly challenging for Ubisoft. This is mostly explained by fewer games being published this year, plus apparent mistakes in the implementation of microtransactions. Nevertheless, during their last earnings call, management seemed to be aware of these mistakes. So, I remain optimistic about management's ability to not repeat these blunders.

Furthermore, this is evidenced by UBSFY pushing the release of a couple of major titles into 2020 for more development time. This shows the company's commitment to "getting it right" this time. Also, management seems to be willing to keep supporting and improving Ghost Recon Breakpoint. So, over the long term, it might become a revenue contributor as well. But more importantly, my valuation shows that the shares have some upside at these levels. Thus, as a whole, I think Ubisoft is a viable long-term investment in the gaming sector despite its recent missteps.

Thank you for reading, and good luck.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.