U.S. Debt Is Piling Up

by WWS Swiss Financial Consulting SASummary

- Investors should be aware of the indebtedness of the US.

- The Fed has reversed its policy of normalization of interest rates and reducing the size of its balance.

- Low interest rates can be expected for the foreseeable future.

- Investors have to balance the low yield of high-priced stocks against the low yield of fixed income securities.

Investors should know about the debt level of the federal government and the policies of the Fed. Renewed Fed acquisitions on the bond market, lower interest rates, and repo financing mean that the stock market will be buoyed up not only by corporate stock buybacks. The low interest rate environment will result in low yields on fixed income securities. With stocks fetching ever higher prices and producing ever lower yields, investors have to weigh carefully how they position their portfolios.

A Lot of Debt

The US Debt Clock is extremely useful in keeping track of the amount of federal debt. The federal debt is now over $23 trillion, and the actual annual federal budget deficit is $1.3 trillion. The net interest on the debt is $375 billion. This works out to an interest rate paid on the debt of 1.63%, which is an extremely low interest rate.

Fed Policy Change

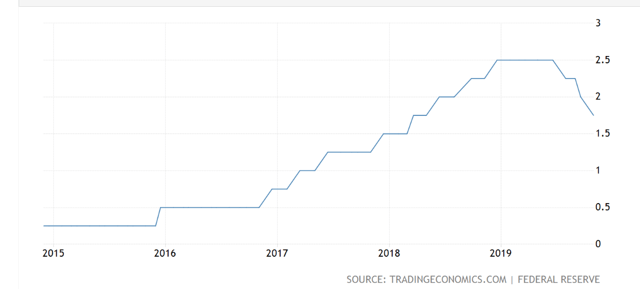

The change in Fed policy has been closely watched by the market. After the almost 20% fall in the stock market in December 2018, the Fed stopped raising interest rates and the FOMC decided to lower rates three times in 2019. Not only did the Fed lower rates, but it also stopped its QT program and started buying bonds again. In September 2019, the repo market seized up, and the Fed came to the rescue with billions of liquidity to ease the repo market and make it function. Market observers have closely watched the Fed reverse its course. It seems to be the case that higher interest rates and QT were deleterious for stock market health, and the big banks were reluctant to make funds available for repos. So, the Fed had to fill the gap in order to guarantee the smooth functioning of the system.

Low Interest Rates Forever

One can see that the federal government needs to have low interest rates so that the Treasury is able to meet its obligations to pay interest on the debt. Considering that the actual annual budget deficit is running at $1.3 trillion; if additional costs were to result from higher interest rates on the national debt, the financial situation, which is already unsustainable, would only worsen. Partial monetization of the debt has already been put into practice by the Fed, and one can expect that the Fed will save the Treasury from default by providing funds via the purchase of Treasury paper. This means that the process of monetization of the federal debt will continue. The US may follow Japan in this respect. The interest paid on the debt by the Treasury to the Fed would then be recycled by payments on the part of the Fed to the Treasury. In order to avoid runaway inflation, however, such a solution cannot be employed beyond a certain point. What that point is cannot easily be determined a priority. In any case, the Treasury can only welcome low interest rates that the Fed obligingly keeps in place. So, low interest rates can be reckoned to stay in place for some time.

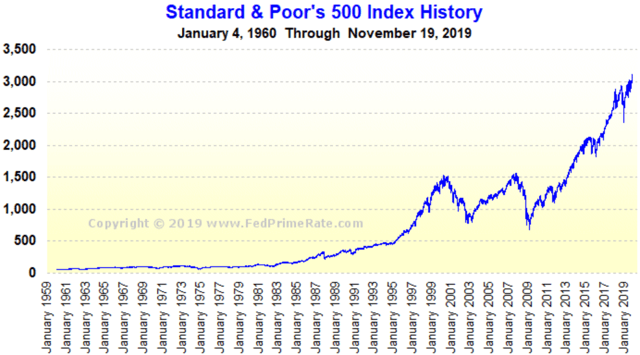

At the same time, the stock market has reached new highs thanks to the change in Fed policy and the continuation of corporate stock buybacks. Historically, the stock market has never been so high. As corporations buy more and more stock back, prices for the remaining stocks rise. Investors have to reckon that stock prices may still go higher even if the market is overbought.

Conclusion

The problem investors face in such an environment with extremely high equity prices that are not justified by company profits is that the yield on stocks goes lower and lower to the point that the low yield on fixed income securities becomes attractive. This is why high yield corporate bonds are grabbed up by investors as they have become desperate for yield. The result is a vicious circle where corporations borrow money at low interest rates to buy back shares in order to boost share prices. With interest rates so low, financial engineering promises huge rewards to executives that receive most of their pay in stock and/or stock options. Investors thus find themselves between Scylla and Charybdis. High-priced stocks offer low yields while high-yield corporate bonds are financed by excessive debt that corporations may or may not be able to sustain.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Data from third-party sources may have been used in the preparation of this material and WWS Swiss Financial Consulting SA (WWW SFC SA) has not independently verified, validated or audited such data. WWS SFC SA accepts no liability whatsoever for any loss arising from use of this information, and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Please consult your own professional adviser before taking investment decisions.

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

All investments involve risk, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments.