Tracking David Abrams' Abrams Capital Management Portfolio - Q3 2019 Update

by John VincentSummary

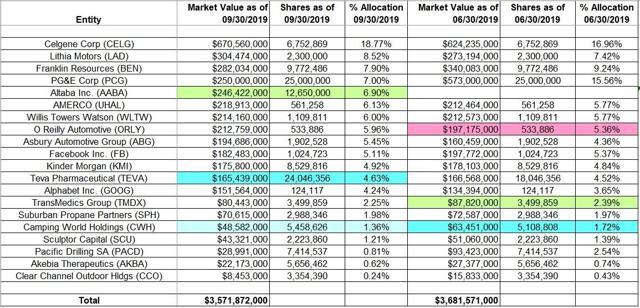

- David Abrams' 13F portfolio value decreased this quarter from $3.68B to $3.57B. The number of positions increased from 19 to 20.

- Abrams Capital Management added Altaba while increasing Teva Pharmaceutical and Camping World Holdings.

- The top three positions are Celgene Corp., Lithia Motors, and Franklin Resources, and they add up to ~35% of the portfolio.

This article is part of a series that provides an ongoing analysis of the changes made to David Abrams' 13F portfolio on a quarterly basis. It is based on Abrams' regulatory 13F Form filed on 11/14/2019. Please visit our Tracking David Abrams' Abrams Capital Management article for an idea on his investment philosophy and our last update for the fund's moves during Q2 2019.

This quarter, Abrams' 13F portfolio value decreased ~3% from $3.68B to $3.57B. The number of holdings increased from 19 to 20. The top three stakes are at ~35% of the 13F portfolio while the top five holdings are at ~49%. The largest position is Celgene Corp. and it accounts for 18.77% of the 13F portfolio.

Stake Disposals:

None.

New Stakes:

Altaba Inc.: A large (top five) ~7% Altaba stake was purchased during the quarter. Altaba made a pre-dissolution distribution of $51.50 per share in September.

Stake Decreases:

None.

Stake Increases:

Teva Pharmaceutical (TEVA): TEVA is currently a 4.63% of the portfolio stake. It was established in Q3 2017 at prices between $15.50 and $33.50. The stock currently trades at $10.45. This quarter saw a one-third stake increase at prices between $6 and $9.60.

Camping World Holdings (CWH): CWH is a 1.36% position purchased in Q3 2018 at prices between $19 and $27 and increased by two-thirds next quarter at prices between $11.25 and $22.50. Last quarter saw a ~30% stake increase at $11 and $13 per share. The stock is now near the low end of their purchase price ranges at $12.05. Abrams controls ~6% of the business.

Note: Regulatory filings since the quarter ended show them owning ~6.11M shares. This is compared to 5.46M shares in the 13F report. The increase happened at ~$7.90 per share.

Kept Steady:

Celgene Corp. (CELG) and PG&E Corp. (PCG): These large stakes were established in Q1 2019. The ~19% of the portfolio CELG stake is currently their largest position. It was a merger-arbitrage stake established at ~$90. Bristol-Myers Squibb (BMY) agreed to acquire Celgene Corp. in a cash-and-stock transaction (one share of BMY and $50 cash along with a CVR that could pay $9 based on achieving regulatory milestones for each share held) announced in January. The deal closed last week. PCG is a ~7% position purchased at ~$7 per share and it currently goes for $7.55. PG&E share price dropped sharply in mid-January as they announced plans to file for bankruptcy. Abrams along with two other hedge funds stepped in and bought 45M shares near the lows.

Lithia Motors (LAD): The large (top three) 8.52% LAD stake was established in Q2 2018 at prices between $95 and $105 and almost doubled next quarter at prices between $81 and $99. The stock is now at ~$164. Q4 2018 also saw a ~15% stake increase.

Note: Their ownership stake in Lithia Motors is at ~10%.

Franklin Resources (BEN): BEN is currently the third-largest position at ~8% of the 13F portfolio. It was established in Q4 2015 at prices between $35 and $42 and increased by ~50% the following quarter at prices between $31.50 and $39. There was another ~25% stake increase in Q3 2018 at prices between $30 and $34.50. The stock currently trades at $27.88. For investors attempting to follow, BEN is a good option to consider for further research.

AMERCO (UHAL): UHAL is a ~6% position purchased in Q4 2016 at prices between $314 and $374 and increased by ~160% the following quarter at prices between $367 and $391. There was a ~45% increase in Q2 2017 at prices between $341 and $393 and that was followed with a similar increase in H1 2018 at prices between $323 and $384. The stock is now at ~$365.

Willis Towers Watson plc (WLTW): WLTW is a fairly large ~6% position purchased in Q1 2017 at prices between $117 and $133. The stock is now well above that range at ~$196. There was a ~6% trimming in Q4 2018.

O'Reilly Automotive (ORLY): The fairly large ~6% ORLY stake was purchased in Q3 2017 at prices between $173 and $220. The stock has doubled and it currently trades at ~$446. Q4 2018 saw a minor ~3% selling and that was followed with a ~13% trimming next quarter at prices between $335 and $392. Last quarter saw another ~30% selling at prices between $353 and $409. Abrams is harvesting gains.

Asbury Automotive (ABG): ABG is a 5.45% position established in Q3 2017 at prices between $50 and $62 and increased by ~45% in Q3 2018 at prices between $67 and $77.50. Q4 2018 saw another 20% stake increase at prices between $59 and $72. The stock currently trades at ~$113.

Note: Their ownership stake in the business is ~10%.

Facebook (FB): FB is a 5.11% portfolio position purchased in Q4 2018 at prices between $124 and $163 and the stock currently trades well above that at ~$202. There was a marginal stake increase in Q1 2019.

Kinder Morgan (KMI): KMI is a 4.92% of the portfolio position purchased in Q1 2018 at prices between $14.75 and $19.75, and the stock is currently at $19.73.

Alphabet Inc. (GOOG): GOOG is a 4.24% position purchased in Q2 2018 at prices between $1,005 and $1,175 and the stock is now well above that range at $1,313.

TransMedics Group (TMDX): TMDX is a 2.25% of the 13F portfolio stake that came about as a result of its IPO in May. Abrams was an early investor who led funding rounds going back to 2012. The stock started trading at ~$25 and currently goes for $18.97.

Suburban Propane Partners (SPH): SPH is a ~2% portfolio stake established in Q2 2017 at prices between $22.75 and $27 and increased by ~75% next quarter at prices between $23.50 and $26. The position was more than doubled in Q4 2017 at prices between $23.20 and $26.70 and that was followed with a ~87% increase over the next two quarters at prices between $22 and $27. The stock is currently at $22.38.

Sculptor Capital (SCU) previously Och-Ziff Capital Management (OZM): SCU is a 1.21% portfolio stake established in Q2 2016 at prices between $33 and $43.50 and increased by ~11% in the following quarter at prices between $33.50 and $44.90. There was another ~11% increase in Q4 2016 at a cost-basis around $32. Q1 2017 also saw a ~17% increase at prices between $22 and $36.30. The stock is now at $19.50.

Note: The prices quoted above are adjusted for the 1 for 10 reverse stock split in January.

Pacific Drilling S.A. (PACD): The 0.81% PACD stake got established in Q4 2018 as the company emerged from Chapter 11 bankruptcy last November. The stock is now at $2.91. Abrams Capital's ownership stake in Pacific Drilling is ~10%. They had ~$200M in Pacific Drilling debt when the company filed for bankruptcy in November 2017.

Akebia Therapeutics (AKBA): AKBA was a minutely small 0.74% portfolio stake as of Q3 2018. They merged with Keryx Biopharmaceuticals (KERX) in a transaction that closed in December. KERX shareholders received 0.37433 common shares of AKBA for each share held. Abrams had ~9.1M shares of Keryx for which he received 3.4M shares. Abrams also increased the overall position by ~20% during Q4 2018 at prices between $5.40 and $9.15. AKBA currently trades at $5.55.

Note: Their ownership stake in Akebia is at ~5%.

Clear Channel Outdoor Holdings (CCO): CCO is a very small 0.43% of the 13F portfolio stake. It is a very long-term position that has been in the portfolio since 2009. The stake has been kept almost steady since. In March 2012, CCO paid a special-dividend of $6.08 per share and that recouped almost the entire outlay on this investment. The stock currently trades at $2.52.

The spreadsheet below highlights changes to Abrams' 13F stock holdings in Q3 2019:

Disclosure: I am/we are long AKBA, KMI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.