Space as a service takes root at RBC Signals

by Debra WernerRBC Signals sees ground infrastructure business following path forged by cellular network expansion

Ron Faith is well acquainted with high-tech startups. Before becoming president and chief operating officer of RBC Signals in 2018, Faith co-founded and served as chief operating officer of Clonefone, a mobile web services company. He was also the CEO of enterprise software vendor Datacastle Corp. when it was acquired in 2017 by the data protection company Carbonite.

Now, Faith and Christopher Richins, RBC Signals, CEO and co-founder, are leading the Seattle company that provides satellite communications infrastructure as a service. RBC Signals is expanding its global network of ground stations by combining excess capacity in existing antenna networks with its own antennas.

In August, the company unveiled RBC Signals Xpress, a product aimed primarily at Earth observation satellite operators hungry for data downlink capacity. Customers pay $19.95 per pass for the X-band downlink service with a monthly minimum of $595.

RBC Signals also is beginning to work with U.S. government customers. The firm announced its first Small Business Innovation Research (SBIR) contract in June for the Air Force Research Laboratory Space Vehicles Directorate. RBC Signals announced a second Space Vehicles Directorate SBIR in September to prepare ground stations to handle both commercial and government demand.

Faith spoke with SpaceNews about RBC Signals and the lessons he sees in the growth of cellular networks at the World Satellite Business Week conference in September.

Why are startups turning to companies like RBC to supply ground infrastructure for their satellites?

The business is maturing. It wasn’t dissimilar in the cellular industry in the early days where wireless carriers felt they had to do everything, including building their own towers. Over time as they looked at scale and what they wanted to invest their capital in, they ultimately decided to go with companies like American Tower or Crown Castle to host and operate the cellphone tower infrastructure. They now do that for all the carriers. We believe you’re going to see something similar happen in the ground segment for all the satellite operators, whether they’re in communications, Internet of Things, Earth observation constellations. Increasingly, what will differentiate them is something other than building out a bunch of ground infrastructure.

What’s unique about RBC Signals?

We are dedicated to creating multi-tenant, multi-mission, flexible ground infrastructure that can be provided on a service basis. That allows the satellite operator to push out a capital expenditures associated with that. It’s more efficient for them overall. When somebody builds their own ground station, they may only be utilizing that ground station a few tens of minutes a day. The vast majority of the time it is sitting there idle. We’ve partnered with folks that own ground station infrastructure to sell their unused capacity. We pass that savings on to end customers. One of the things we announced recently was RBC Signals Xpress, which is an X-band downlink service targeted toward existing Earth observation satellite operators who want to augment what they’re already doing for command and control with the ability to bring more data down to the ground.

Is lack of downlink capacity an issue?

Satellite operators are trying to find more commercial customers. While the cost of launch has come down significantly and the cost of manufacturing satellites has come down significantly, we believe that the same price disruption needs to happen in the ground segment. Because we’re able to have such a cost-efficient ground infrastructure with our partners, we’re able to pass some of that savings along. This new X-band downlink service is $20 per pass, which we think is groundbreaking, pun intended.

How has the reception been far?

It’s brand-new and we’ve been flooded with inquiries about it. There is this thirst for ways to bring more data down to the ground and to do it more cost effectively so the satellite operators can bring new data products and services and solutions to market that hit the right economic price points for their customers.

You’ve been flooded with inquiries. Do you have enough capacity to take on a flood of customers?

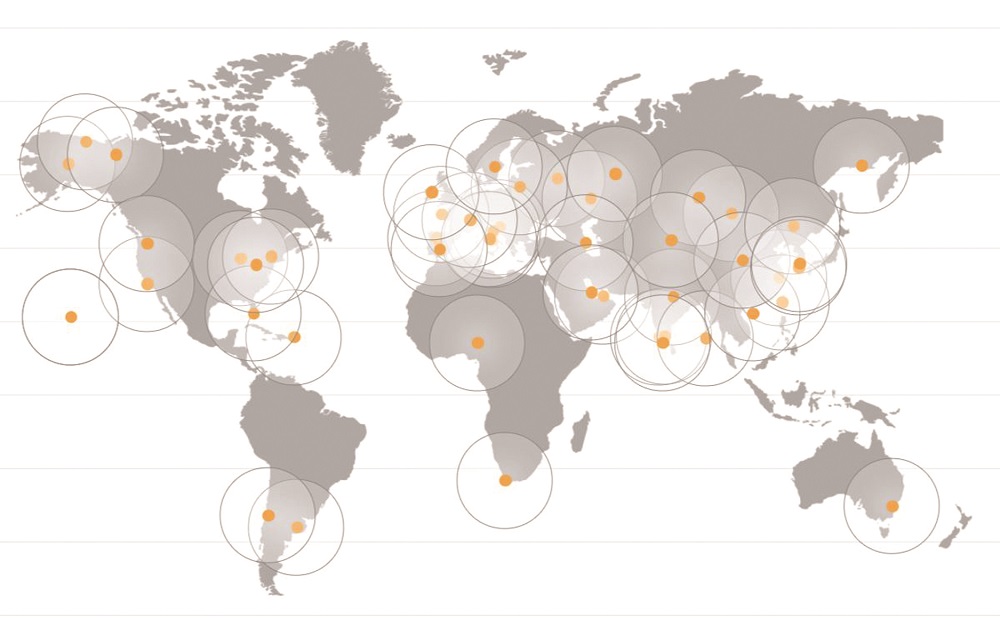

For this we do, because we have over 70 antennas in over 50 locations around the world. There is a large amount of excess capacity from our partners and most of the X-band downlink services travel through our partner network.

Who are your customers?

We’ve done a good job over the past year diversifying our customer base. It’s not just commercial customers looking for a ground stations as a service. It’s also government customers looking to augment their existing capabilities with commercial partners such as ourselves.

You recently announced an Air Force Small Business Innovative Research award.

Yes. That’s our second phase one SBIR award. Our first phase one SBIR was for adding cloud compute infrastructure into the ground station so that you could do compute as a service at the ground station very quickly. We believe in a distributed computing architecture going forward where there’s some processing onboard on the satellite. Obviously, a lot of processing is going on in the cloud, but there’s also some processing that makes sense to do at the ground station. By putting an Amazon Web Services outposts or a Microsoft Azure stack or even virtual server capabilities on the ground station that allows you to process some things there effectively.

Now you won a second SBIR.

This one is for dual use, where ground stations being used commercially can also be used by the Air Force. There’s the scheduling aspect. You have to integrate with their existing ways of doing command and control, scheduling and things of that nature. They want to leverage what we already do, but they still have to do it in a way that works for them and works for them at scale.

With these SBIR programs, they want to bring in innovation because traditionally that has been challenging for them. By working with smaller companies such as ourselves, they can bring in that innovation.

Many government agencies are talking about the need for innovation.

That’s because they recognize space as a contested domain. There are large nation states that they’re competing with in that domain. For them to continue to have superiority, they need to bring in innovation. My guess as to how this plays out is that the innovative companies that are bringing the innovation are going to ultimately must work with the primes, who know how to work with that customer at scale.

Why will they work with primes?

Primes know how to run the programs at scale and deal with all the paperwork, red tape and everything else, while still bringing in innovation. The government customer doesn’t want that innovation stifled.

Is hiring an issue for RBC?

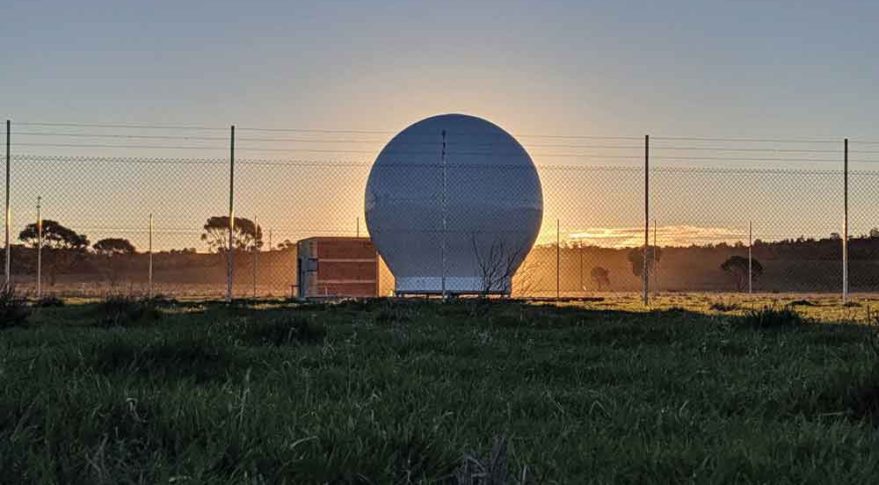

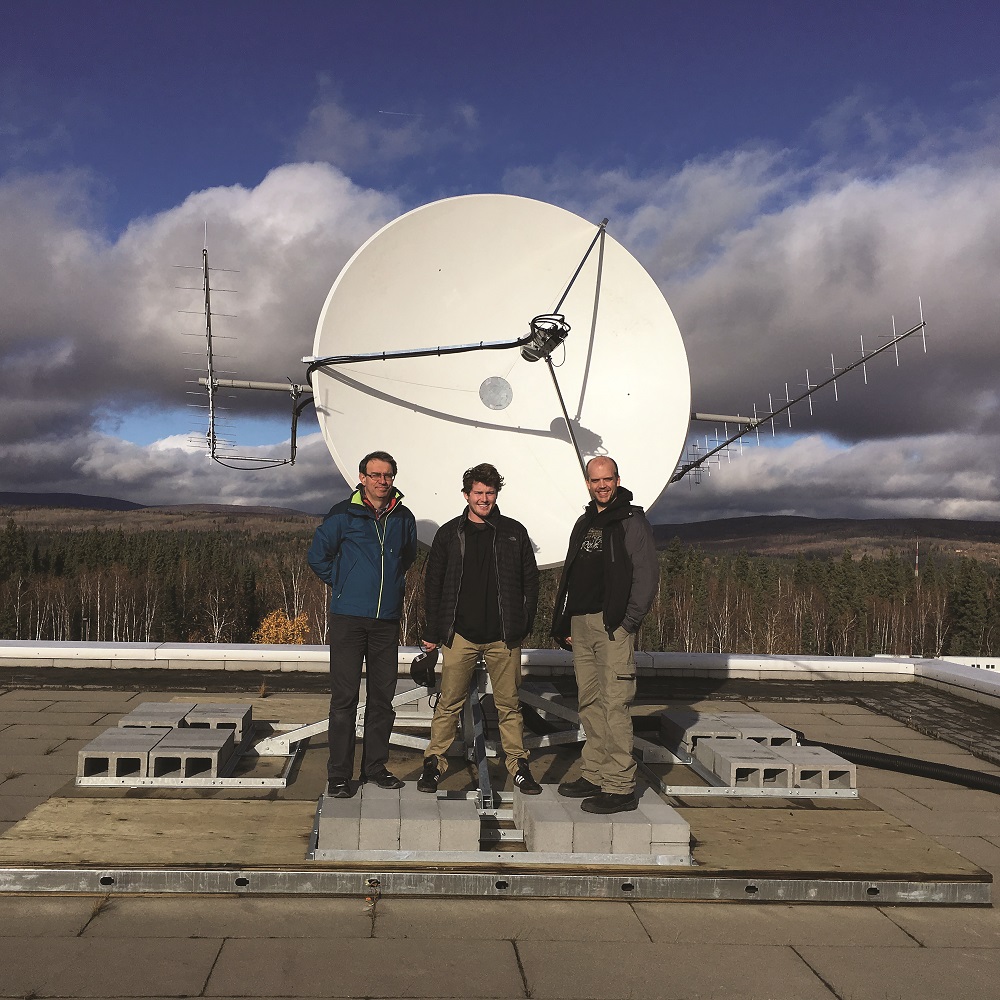

We made a couple hires recently. A lot of the hires we’re doing right now are on the execution side of things. We’re deploying a lot of ground stations around the world. You want certain expertise in being able to place ground stations in very remote locations that sometimes are weather challenged. We’ve got ground stations we’ve deployed in northern Alaska on the North Slope.

Could the U.S. government be an important customer for RBC Signals?

It’s one of the areas that’s growing very rapidly because they have great needs in this area. We’ve only entered the U.S. government business in the last year. We are already seeing a lot of traction. All sides of the business are growing. Whether its Kongsberg Satellite Services, Swedish Space Corp. or ourselves, all of us are seeing dramatic growth. When you go from 1,500 satellites in orbit to what’s going to be 15,000 plus and all those satellites have to talk to the ground, there just isn’t enough ground infrastructure for all that. You need to more efficiently manage the ground infrastructure that’s there and you need to add capacity. We’re doing both.

I understand you also build dedicated antennas for customers.

Yes. If they need the full capacity of the antenna, we will build a dedicated antenna. It’s also for scheduling. By having a guaranteed or dedicated antenna, they can schedule activity any time they want to. Whereas in the network, access is on more of a first-come first-serve basis. Increasingly, we see hybrid deals. A customer may want one dedicated or guaranteed antenna for telemetry, tracking and control. They can schedule it anytime they need it. But they are also taking advantage of the network of shared antennas for data download. They get the price advantages associated with that and the flexibility to expand and contract. This is like what we saw in cloud computing, where if you needed committed compute capacity, you could get that from Amazon Web Services (AWS) or Microsoft. If you want on-demand capacity, you can get that as well. There are different price points and different service level agreements associated with that.

You’re drawing a lot of comparisons to cloud computing.

Many of the lessons learned from the cloud computing world are applicable here. Especially for Earth observation or internet of things, most the value is in the data that’s coming down and what you are going to do with the data. Then, you can utilize similar methodologies that have been used in cloud computing and make them applicable in this model. It’s a natural extension. We’ve seen Amazon come into the market as well. We announced our collaboration with Amazon Ground.

What is your relationship with Amazon Ground?

We can add their antennas to our network. Just as we work with the Indian Space Agency and AWS as a network partner, we work with Amazon Ground. It is also the case that our network locations are complimentary to theirs. They’re going to build out primarily on their data centers, which are in mid-latitude locations. We have lots of locations that are conducive to customers in sun synchronous orbits. Customers shouldn’t have to choose between them. Customers should be able to come to us and say, “I want to use these stations,” because they may be an AWS customer and want to do low-latency compute for some jobs. But then they also want to use our ground stations in northern Alaska, for example. We can provide them both.

Anything else you want to say?

We think it’s an exciting time. If traditional players continue down the old path, building specialized one-off systems for one satellite or one mission, the industry is not going to grow and scale. Quite frankly, one of the other reasons for doing ground infrastructure as a service is you get higher resiliency and lower latency. You can quickly and easily reschedule on a different antenna within the network.

Are people concerned that not operating their ground network could slow the flow of data?

I don’t think that’s a perception. For some of the more established players, it’s like what has been happening to enterprise data centers. Big banks were concerned about owning their data centers. They had security concerns and access concerns. But they have learned over time that going to AWS or to Microsoft Azure is a much better decision for them. You’ve seen all the banks and all the folks who used to have big data centers move large amounts of their workloads into the cloud. We’re going to see something similar happen here. Some players might want to own one ground station. But as they are putting up constellations and needing more access to more ground stations around the world, it’s just going to be too capital intensive for them to do it all themselves. They are going to turn to the equivalent of an American Tower or Crown Castle from the cellular industry, to somebody who’s providing ground stations as a service in the new market.

This article originally appeared in the Oct. 7, 2019 issue of SpaceNews magazine.