The Looming Calendar Anomaly In Junk Bonds

by PloutosSummary

- A seasonal supply/demand imbalance in high-yield bond markets has traditionally led to strong performance in December and January.

- This has led to a historically bankable strategy to capture alpha from this unique calendar effect.

- High yield corporate bonds could deliver solid risk-adjusted carry for credit investors over the next two months.

In this article, I am going to suggest that structural elements of the high yield calendar market drive seasonally higher returns in December and January. Your first instinct will be to correctly remember that most risky assets sold off sharply last December. This article will discuss the historic seasonal performance of high yield bonds, including a look at last year's performance, and a look forward towards this year's potential outcome.

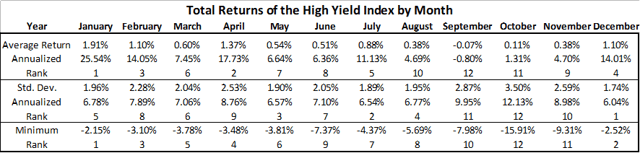

This calendar effect is one of my favorite market anomalies, and it likely has meaningful implications for Seeking Alpha's fixed income investors. Since the advent of the modern high-yield debt market in the early 1980s, there has been a bankable calendar trade that has persisted. In the table below, readers can see that the highest total returns in the high-yield market have historically been experienced in January (1.91%). December has also delivered above-trend returns at 1.10%. The two months have produced the best risk-adjusted returns and have been the most likely months to produce positive total returns at 86% and 83% of the time respectively. These two months, which make up one-sixth of the calendar year, have historically generated around one-third of the returns of the high-yield bond market.

Source: Bloomberg, Barclays

This reliable calendar effect is likely driven by a confluence of factors. Unlike equity markets, which will produce only several dozen domestic IPOs in even the most bullish of years, multiple, new high-yield bond issues will come to market each day when credit investors are receptive. Credit markets will slow down around the Christmas holiday and early in the new year. In a dealer-driven market, as opposed to the exchange-traded equity markets, market participants need to be at their desks to support deal flow. Issuers will obviously not bring deals if a market holiday slackens demand, increasing yield, and interest expense on term debt that will be outstanding for many years. On the flip side, September is the seasonally weakest month for HY bond returns as bond market participants come back from the summer holiday and the market sees a seasonal uptick in supply.

This is an especially acute issue for more levered high-yield borrowers who must remain focused on financing costs. This temporary absence of supply, combined with a re-setting of return objectives at high-yield buyers at the beginning of the calendar year, could lead to a favorable demand/supply imbalance that increases prices early in the new year. In my recent article "A Segment of Junk Bonds Signals Stress", I demonstrated that CCC rated bonds are currently at multi-year wides despite a positive tone in many other risky assets. Absent fundamental-driven stress in the market over the next two months, this favorable technical from seasonally light issuance could help this downtrodden part of the market perform.

At the end of this article, I have appended the total returns by month. While from the first table, you can see that December has had the lowest volatility among calendar months historically, we have seen three negative returns for December in the past five years - two commodity-driven corrections in 2014 and 2015 and last year's macro sell-off. These down Decembers for high yield bonds followed a stretch where high yield bonds has posted positive total returns for 25 of 26 years in the final month of the year! After last December's sell-off, we did see a sharp bounceback in January as that month produced the best monthly returns for high yield in more than seven years. While low liquidity typically leads to a melt-up in prices in December, last year it led to a meltdown that was ultimately more than corrected in January.

Summary

Each of the last three negative Decembers have been preceded by a negative November. For November 2019, high yield bond returns were modestly positive (+0.3%). I would expect that favorable tone to continue into year-end, and the high yield bond market to see its typical seasonally strong returns into the end of the year. While the High Yield Corporate market is offering fair value (5.61% yield-to-worst; 373 spread over Treasuries; $99.5 average price), that index average absconds the bifurcation currently occurring in the market. The highest quality, BB-rated junk bonds (3.8% YTW, 220 spread, $103.9) are trading with limited upside while the lowest quality, CCC-rated part of market (11.5% YTW, 991 spread, $84.5) offers the potential for strong performance if credit conditions among stressed issuers - primarily in the Energy space - ease. I would expect the two leading high yield ETFs - the iShares iBoxx High Yield Corporate Bond ETF (HYG) and the SPDR Bloomberg Barclays High Yield Bond ETF (JNK) - to generate positive returns over the next two months, repeating the seasonal success of this asset class.

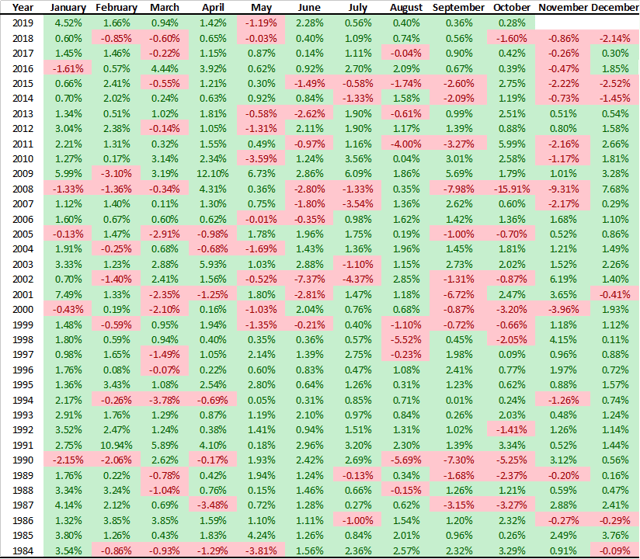

Appendix: High Yield Total Returns by Month

Additional disclosure: My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.