Dubai Financial Services Authority and Luxembourg’s Commission de Surveillance du Secteur Financier to Work on Developing Fintech Platforms

by Omar Faridi

The Dubai Financial Services Authority (DFSA) and the Commission de Surveillance du Secteur Financier (CSSF) Luxembourg have made an agreement to work cooperatively to develop Fintech-related platforms.

The cooperation framework shows that both regulators have made an effort to encourage the development of innovative technologies in the Dubai International Financial Centre (DIFC) and in Luxembourg’s markets.

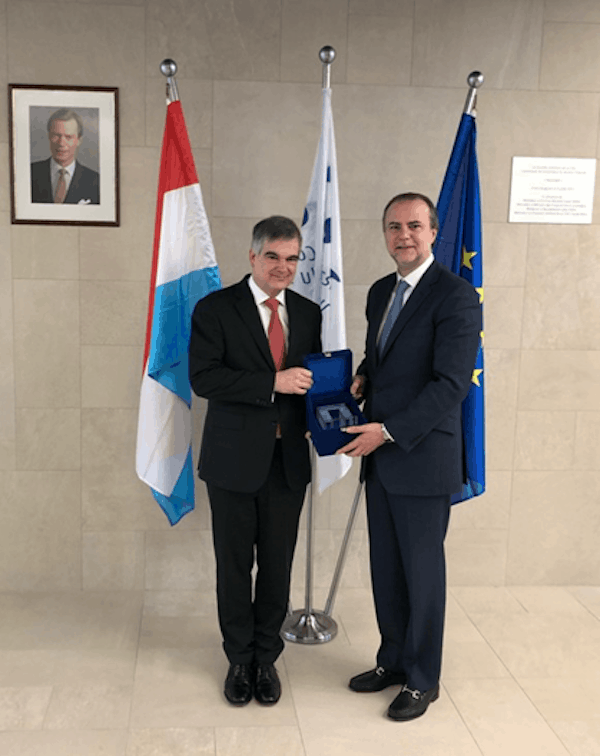

The agreement between the two authorities was signed by Saeb Eigner, chairman at the DFSA, and Claude Marx, director general at the CSSF in Luxembourg.

According to the terms of agreement, both regulatory agencies (subject to relevant laws and guidelines) will be sharing information about emerging innovations in their respective financial services markets. The DFSA and CSSF will share developments related to the latest technology trends and regulatory challenges and requirements involving innovative projects.

The agreement between the regulatory bodies offers a framework for cooperation and referrals. It also specifies a mechanism, which will allow both parties to refer startup businesses between their Innovation Functions and offer them regulatory support as needed. The latest agreement appears to be an extension of the DFSA’s previous memorandum-of-understanding (MoU) with the CSSF, which was finalized in 2007.

Eigner stated:

“We are proud to be strengthening our relationship with the CSSF. The DFSA and the CSSF are actively engaged in the development of FinTech giving the market confidence through fair and proportionate regulation. We firmly believe that cooperation with the CSSF is paramount to creating more stable and innovative financial services.”

Eigner added:

“This is testament to our commitment to foster effective agreements with peer regulators across the globe and engage on emerging FinTech sectors and issues. We look forward to working with the CSSF to develop our Fintech proposition and contribute to the efficiency and further enhancements of our respective financial markets.”

This latest agreement is reportedly the DFSA’s eighth Fintech-related cooperation and forms a key part of the DFSA’s technology innovation strategy, which aims to support the National Innovation Strategy, as outlined by His Highness Sheikh Mohammed bin Rashid Al Maktoum, VP and prime minister of the United Arab Emirates (UAE) and Ruler of Dubai, to transform the UAE into a major international innovation hub.

In May 2017, the DFSA introduced its Innovation Testing License, a new class of financial services licenses that allows Fintech companies to create and trial emerging Fintech ideas and concepts from the DIFC.

In August 2017, the DFSA introduced a new regulatory scheme for loan and investment crowdfunding platforms in the GCC region. The DFSA has also previously launched a property crowdfunding regime.