Enphase: All Cats Love Fish But Fear To Wet Their Paws

by Damir BobojanovSummary

- Enphase Energy surprised us with victories it made this year. Revenue and operating income broke all records.

- The company offers us unprecedented growth, progressive technology of solar energy inversion, and a talented team of new executives with a trustworthy background.

- But, on the other hand, the business just lacks financial reliability and historical consistency to buy our confidence.

Enphase Energy, Inc. (ENPH) is a hard nut to crack for a non-technician. The breakthrough in sales in 2019 is an obvious technological win that Enphase can translate into a full-scale success story - from zero to hero. On the other hand, the business just lacks financial reliability and historical consistency to put it plainly. If only the Management bothers to divert some of its efforts from pushing sales higher into improving the financial health, then we would have a growth stock that equally loved by investment analysts and electrical engineers. The progress the company made is certainly drawing more curiosity rather than a desire to invest at current 23 US dollars per share price. I suggest giving ENPH more time for enthusiasm and reality to settle together.

(Source: Company's website)

Getting to know Enphase

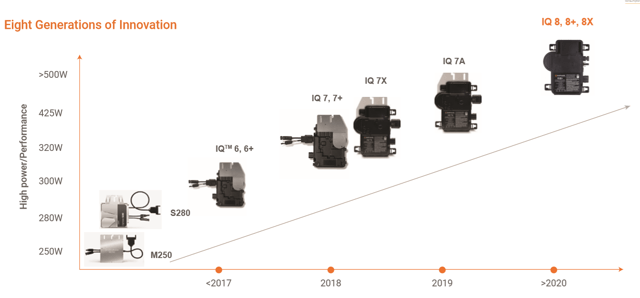

Enphase Energy, Inc. was founded in 2006, coincidentally the same year SolarEdge Technologies, Inc. (SEDG) was. Founders - Raghu Belur and Martin Fornage - pursued an idea to change the way PV-systems transform DC to AC. Indeed, why make inversion happen in central inverter when you can do it separately on each panel, thus lowering the risk of central malfunction that can bring the whole system down? Microinverters electrically isolate the panels from each other, so small amounts of shading, debris, or snow lines on any one solar module, or even a complete module failure, does not disproportionately reduce the output of the entire array. Simplicity in system design, lower amperage wires, simplified stock management, and added safety are other factors introduced with the microinverter solution. On these grounds of sound judgment, microinverters started to conquer their place in the sun. Enphase was the first to create a commercially successful microinverter, the Enphase M175 in 2008. Backed by $100 million in private equity, Enphase grew to 13% market share by mid-2010. Afterward, through good and bad, the company designed and marketed several generations of microinverters. The most recent models have been simply - bestsellers.

(Source: Company's Investor presentation)

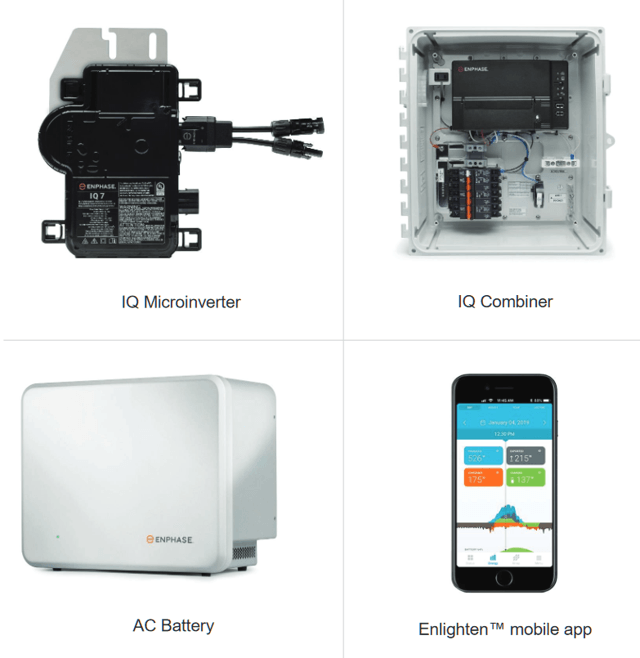

The Company also offers energy storage and solutions to monitor, manage, and maintain the whole PV-energy system.

(Source: Company's website)

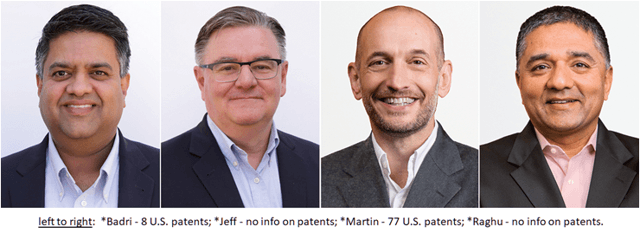

Enphase has strong leadership

Mr. Badri Kothandaraman joined Enphase in April 2017 as a chief operating officer and, in September 2017, was appointed president and CEO. I guess the commercial success IQ series are having now has a lot to do with the advent of Badri and his team. Here is a brief bio compilation on Mr. Kothandaraman:

He began his career with Cypress Semiconductor in 1995 and worked in process technology development and chip design before becoming vice president of the Asynchronous SRAM Business in 2008. From 2008 to 2011, he was responsible for the Non-Volatile, Dual-Port, Timing and Automotive Businesses in Cypress's Memory Products Division. Mr. Kothandaraman was promoted to executive vice president of Cypress's Data Communications Division in 2011 and spent the next five years building the USB 3.0, USB-C and the Internet of Things businesses.

Before joining Enphase, Badri served as executive vice president at Cypress Semiconductor, quadrupling revenue of the data communications division over four years and establishing Cypress as a market leader in USB-C and Internet-of-Things technologies.

During a 21-year career at Cypress, Badri also headed Cypress Semiconductor India, a 700-person business unit responsible for all aspects of the business in India.

Badri received his Bachelor of Technology degree from the Indian Institute of Technology Madras and master's degree in materials science from the University of California, Berkeley. He has also attended the Stanford Executive Program and holds eight US patents.

Jeff McNeil - a chief operating officer - was brought to the party in 2018, following Badri's arrival in 2017, 21 years of experience at Cypress Semiconductor, where he looked after worldwide operations, subcon manufacturing, FA, planning, and logistics. Jeff also served in various management roles in the company's supply chain, wafer fabs, and engineering organizations. I think Badri and Jeff's team can be a good example of the right combination of talent, knowledge, and entrepreneurship.

Worth mentioning that both co-founders of Enphase are still playing significant roles in the business, with Martin Fornage serving as chief technology officer and Raghu Belur as chief product officer.

(Source: Company's website)

What is really attractive about ENPH

There are two ways to look at this company. It can either be an outstanding story of tech superiority leading to a financial breakthrough, or it can be a classic story of how a great company is not always a great investment by the fault of precarious financial management. At this part of the article, I want to focus on the bright side and recent results.

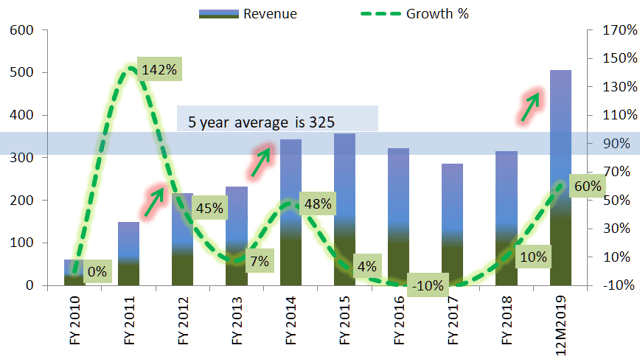

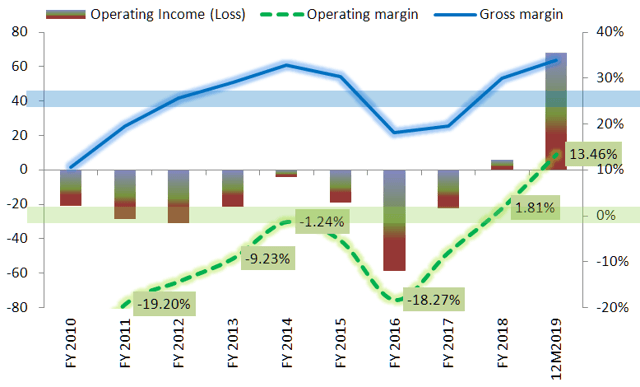

2019 is not the first year ENPH boosted sales close to 50% YoY, but it really counts this time because it is going to be well over 60% and 2019's FY results exceed more than half a billion US dollars. Two following charts vividly illustrate how stunning 2019 has been so far for the business. All metrics went straight into the space compared to 5-year averages (transparent highlighted areas on the charts).

(Source: Company financial reports)

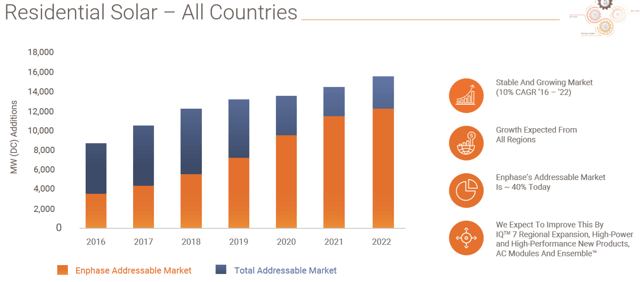

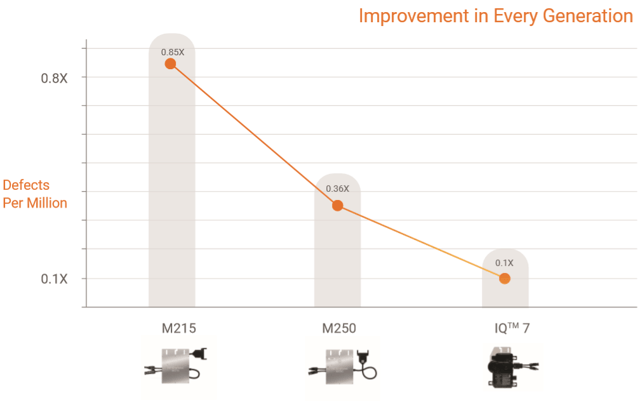

The company commands a great portion of the residential solar market, especially in the US. It is only getting started given how big solar energy deployment in the US gets; according to Renewables Global Status Report 2019, US installs more than 10 GW of solar energy capacity each year, the 3-year CAGR surpasses 30%. At the end of 2018, the US had around 61 GW of solar power deployed, it should exceed 70 GW this year. I think some of those 70+ GW would require maintenance and inverter changes because they wear out much faster than solar panels. A lot of string inverters may be replaced with ENPH's microinverters at some point in the future. The more reliable microinverters get, the more likely they will replace many central ones. Enphase is a winner here because it made huge progress diminishing defect rate per million units.

(Source: Company's investor presentation)

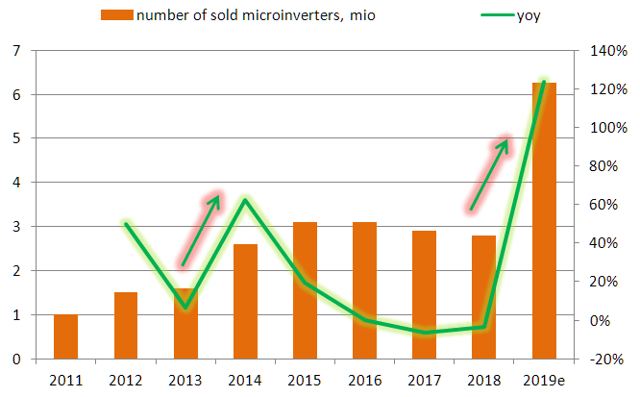

A confluence of a growing market, strong leadership, and suitable products lead to the burst in demand for Enphase's microinverters in 2019.

(Source: Company financial reports and earning calls)

What discourages long-term investing

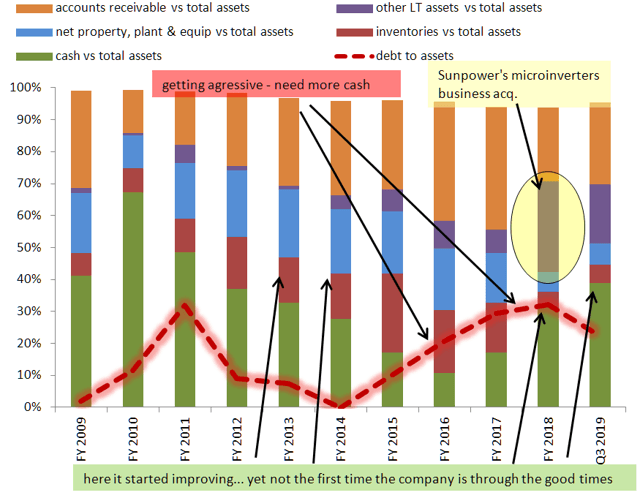

The business looks sweet and desirable unless an analyst bumps into the balance sheet, rate of change of shares outstanding, instability of income statement, and cash flows. Starting with the balance sheet, if you look closer, you will see not a balance sheet of a fast-growing company that earns cash and piles it up, then buys something unworthy or just keeps growing the pile. Instead, you will see a balance sheet of a struggling business, that sometimes sells its products good but other times doesn't and it leaves no other option but to get a debt to finance marketing and R&D. Enphase has gone through favorable periods several times, but in a year or two, it stumbles. To get through really challenging 2016 and 2017, the company had to borrow the money, which it can pay-off now for the best. The acquisition of SunPower's (SPWR) microinverters business was a good decision at the right time. I hope that Enphase won't go for a shopping spree with the arrival of cash after a very good year. But heavy spending may follow soon due to a couple of reasons: a) Management of the company has a very ambitious plan to use all the latest technology (AI, machine learning, cloud computing, etc...) to empower Enphase, which sounds really good but has a lot to do with simple marketing catches, plus those technologies aren't cheap; b) Eric Branderiz (CFO) has worked for Tesla (TSLA) previously, so don't expect him saying "No" to more spending, more debt, and shares dilutions, in my opinion.

(Source: Company's financial reports)

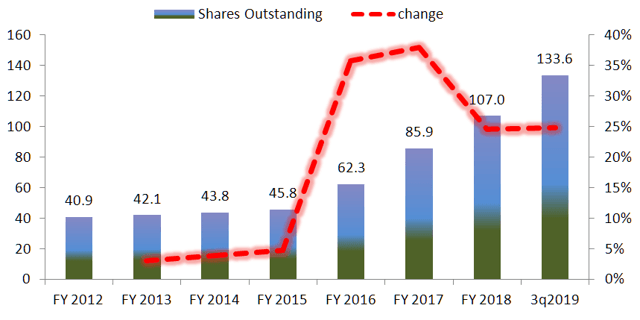

What is painful here is their attitude toward using own shares as a payment method for acquisitions, as they did in the deal with SunPower, or using shares to attract money. Sometimes, in certain circumstances, some good businesses can be forgiven for making a single SPO to stay alive and continue their mission. But not this time, ENPH has been diluting, thus deceiving its shareholders 4 years in a row. It is an enormous red flag! It doesn't matter how splendid EPS arrives for FY2019, it could have been 3 times better if not for those dilutions.

(Source: Company financial reports)

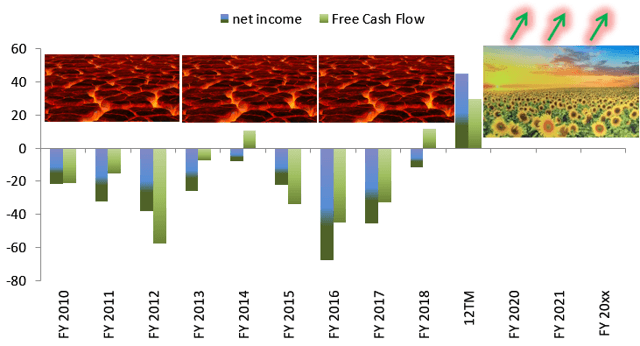

And, the last bit is, why we suddenly decided that everything is going to be rosy from now on? History is not a perfect tool to make predictions about the future, yet it is the best we have, so the way a company bears with its ups and downs is the way it would probably continue to. The probability of long-term success is simply much lower than of failure. No judgment, just a cautiousness.

(Source: Company financial reports)

Risks

1. The company is famous for making investors feel like they ride a roller coaster. Long-term price volatility can be wild, today's two-digit price figure can be tomorrow's low single-digit and vice versa.

2. The solar energy industry is prone to cyclicity that can keep even the best names at depressed price levels.

3. The current financial success of the company should pass a time-test because it is not the first time the future looks bright for Enphase.

4. Mismanagement of the number of shares outstanding is simply outrageous, it diminishes the value the company is trying to create.

Investment thesis

Enphase Energy is a very controversial investment idea. On the one hand, it offers us a fantastic break-through in sales, progressive technology of solar energy inversion, talented team of new executives with credible background, and finally, the price went up almost five times YTD. So compelling to participate. But on the other hand, it threatens us with incoherent financial history, heavy reliance on additional shares offering, uncertain financial policy in the future, and shameful practice of diluting shareholders' value. I suggest waiting out several quarters before stepping in, and risk only with an insignificant portion of a portfolio, below 5%. Current price is far from favorable for long-term investment, I plan to give it time to settle down during 2020. I hope the management of Enphase will start to care more about financial health beyond terms of the income statement.

Disclosure: I am/we are long SEDG, SMTGF, YNDX, CTMLF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.