November Portfolio Update - Prefs And Finance

by Wolf ReportSummary

- This month saw a smaller amount of overall investments, mostly going into finance, some oil/energy, preferred stock, and other debt instruments.

- FX is somewhat improved, but still at prohibitive levels for the long term.

- November was an excellent month in terms of dividend payouts and growth, and my received dividends compared to last year grew.

Summary

During November, I invested the dividends coming in, as well as a sizable amount of cash (~$6000) into a variety of stocks, mostly related to finance. The month has seen some interesting news items which have provided investment opportunities into certain banks, finance stocks and preferred stock options.

As a result of these investments, my projected annual income from dividends alone has increased, breaking the 130% of avg. dividend income/avg. monthly expenses ratio. The strategy continues to provide ever-increasing and growing dividends, which makes daily life a pleasant and liberating experience, giving ever-growing rates of "freedom" (in terms of money).

Let's take a look.

This month's update of the international dividend investor's portfolio

As a value-oriented dividend investor with a very long-term perspective, I believe that investing in a diversified portfolio of dividend stocks and related shares/securities is a better option in the long term than investing in index funds or most ETFs. In addition to receiving growth in stock/portfolio value, I also receive annual, quarterly, and monthly dividend payments without paying a fee, which enables me to live my life as I see fit.

In adopting a dividend investor's mindset, I've stopped caring about short-term stock movements, and in so doing, I avoid the principle of loss aversion. I consider my investment portfolio a functioning business, and the business's goal is simple - to ensure my financial independence. I'll do this through any means at my disposal.

My prerequisites

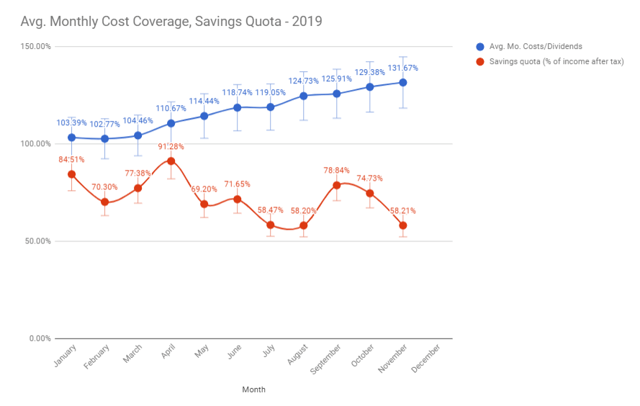

I'm a young (34-year-old) Swedish dividend investor who holds a large variety of national and international stocks. I reached financial independence in 2018 when my average monthly dividends for the first time exceeded my average monthly costs/expenses + savings goal. Since then, my average dividend income from my private account has gone on to grow in relation to my average expenses on a monthly basis, where they currently stand at ~131.67% of expenses. This is respectable, 2%-increase to the previous month, representing the capital invested in what I consider to be good companies at fair prices, as well as securing some cash in what I consider to be good, conservative debt instruments (Swedish preferred stocks).

In my life, I work independently and run several businesses. These days, I work mostly as a consultant and take contracts at leisure and as I like, while my businesses mostly run "themselves."

Living in Sweden means that my economic requirements may be (very likely are) different from what someone in the US would require to comfortably retire. Due to a government-financed healthcare system and extensive state minimum pensions and available benefits, many of the concerns and considerations investors in other nations may have don't apply to me.

I doubt I'll want to live in Sweden my entire life, so I'm also looking into appealing nations for living, from a climate, socioeconomic, and future demographic perspective. Thus far, the USA, Canada, Australia, and New Zealand are on the list (with various pros and cons). This is very long-term planning, however, and won't be relevant until 5-7 years in the future. I've estimated that I need about $50000-80000/year to live at the standard I'm used to - though this is currently a ballpark number and likely subject to change in the future.

November 2019 news update

November saw me reducing overall purchases compared to October, while still maintaining an above-average purchase activity due to some undervaluation and fair-value opportunities. The big difference here was that over 85% of my purchases this month were done in Swedish companies and/or Swedish debt.

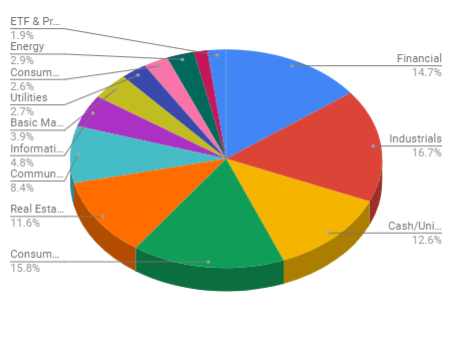

I continue to focus on a mix of high-yielding dividend stocks as well as qualitative, more low-yielding companies. These days I'm looking at a target overall yield of about 4-5.5%. My portfolio's total yield is at a current 5.1921%, though this includes a still-sizable chunk (around 12.5%) of liquid capital currently held in a 0.65% interest savings account. Were I to put this to work even conservatively, this number would go up to around 5.3% at the very least.

With that said, let's review some numbers for the month.

Reviewing November 2019 dividends and projecting future dividends

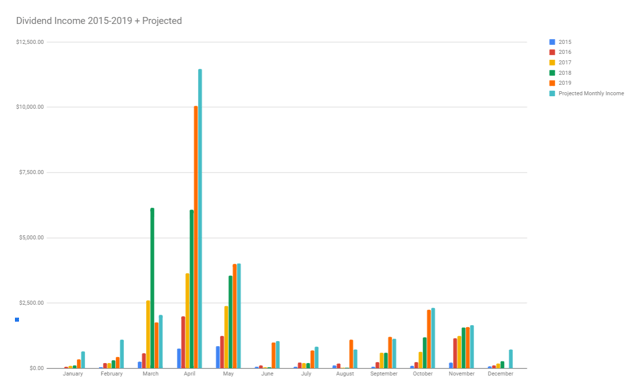

(Source: Google Finance, Author's own calculations)

Dividends during the month of November 2019 came in from the following companies in my private portfolio:

Monthly Dividends

- TransAlta Renewables Inc. (OTC:TRSWF)

- Boston Pizza Royalties Income Fund (OTC:BPZZF)

- Inter Pipeline Ltd. (OTCPK:IPPLF)

- Exchange Income Corporation (OTCPK:EIFZF)

- Pizza Pizza Royalty Corp. (OTC:PZRIF)

- American Hotel Income Properties REIT (OTC:AHOTF)

- NorthWest Healthcare Properties Real Estate Investment Trust (OTC:NWHUF)

- Freehold Royalties Ltd. (OTCPK:FRHLF)

- Morguard Real Estate Investment Trust (OTC:MGRUF)

- Artis Real Estate Investment Trust (OTCPK:ARESF)

- Medical Facilities Corporation (OTCPK:MFCSF)

- Northview Apartment REIT (OTC:NPRUF)

- Alaris Royalty Income Fund (OTC:ALARF)

- Vanguard USD Treasury Bond UCITS ETF (IVDTYUSD)

- Vanguard USD Corporate 1-3 Year Bond UCITS ETF (IVDUCUSD)

Quarterly Dividends

- General Mills (GIS)

- WPP Plc (WPP)

- CVS Health (CVS)

- Thor Industries (THO)

- Ocean Yield (OTCQX:OYIEF)

- Knot Offshore Partners LP (KNOP)

- MPLX LP (MPLX)

- AbbVie (ABBV)

- Ameriprise Financial (AMP)

- British American Tobacco (BTI)

- Energy Transfer (ET)

- Caterpillar (CAT)

- JPMorgan (JPM)

- AT&T (T)

- Equinor (EQNR)

Annual/Bi-Annual Dividends

- BillerudKorsnäs (OTC:BLRDF)

- Investor AB (OTCPK:IVSXF)

- NCC (OTC:NCCBF)

- Atea (OTC:ATAZF)

The total amount of dividends paid out from my private portfolio this month, in combination with interest income from my savings, was $1585.60. This has been reinvested.

The current average monthly dividend income from my private portfolio, based on the calculation of annual dividends/12, is $2316.60. This increase is due to investments made as well as some FX with the SEK retrieving some strength toward other currencies.

Below, you can view my average income from dividends in relation to expenses (in SEK) as well as my savings ratio from my total income in relation to expenses (including dividends) for the year of 2019. The savings ratio this month took a dive due to a one-time car repair bill.

(Source: Google Finance, Author's own calculations)

Dividends during the month of November 2019 came in from the following companies in my corporate portfolio:

Monthly Dividends

- NorthWest Healthcare Properties Real Estate Investment Trust

- Pizza Pizza Royalty Corp.

- American Hotel Income Properties REIT

- Morguard Real Estate Investment Trust

- Artis Real Estate Investment Trust

Quarterly Dividends

- AT&T

- CVS Health

- Ocean Yield

- Enterprise Products Partners L.P. (EPD)

- MPLX LP

- Energy Transfer

- Magellan Midstream Partners L.P. (NYSE:MMP)

- AbbVie

- British American Tobacco

The total amount of dividends paid out from my corporate portfolio this month is $92.93. This cash will be reinvested.

The current average monthly dividend income from my corporate portfolio, based on the calculation of annual dividends/12, is $74.07.

Transactions during November 2019

I only purchase stocks I consider fairly valued or undervalued. I don't mind sitting with some (or a lot) of cash on hand, as my goal of financial independence from dividend stocks is reached, and I am in no position where I feel I "have" to invest in anything or keep any certain amount of money in or outside of the market. This month's purchases were few and relatively small in scope.

This month, the following transactions were made in my private investment account:

- Purchased stock/increased exposure to Resurs Holding (OTC:RSRSF). This purchase was in response to the stock's undervaluation, and the sector's undervaluation in general in the light of recent headwinds/troubles, as well as the article "Resurs Holding - Mostly Fairly Valued Financials At 6% Yield".

- Purchased stock/increased exposure to SEB (OTCPK:SKVKY). This purchase was in response to the stock's undervaluation, and the sector's undervaluation in general in the light of recent headwinds/troubles, as well as the article "SEB - Money Laundering Allegations May Give An 8%+ Yield".

- Purchased stock/increased exposure to Thor Industries. This purchase was in response to the stock's undervaluation, and the sector's undervaluation in general in the light of recent headwinds/troubles, as well as the article "Thor - This Ugly Duckling Is Still A 'Buy'".

- Purchased stock/increased exposure to Ocean Yield. This purchase was in response to the stock's undervaluation, and the sector's undervaluation in general in the light of recent headwinds/troubles, as well as the article " Ocean Yield: 10.2% Yield After Dividend Cut".

- Purchased stock/increased exposure to Hemfosa Fastigheter Pref (No Symbol). This purchase was part of wanting to increase my exposure to Swedish debt instruments and comes at a 5.3% Yield-to-call.

- Purchased stock/increased exposure to Amasten Pref (No Symbol). This purchase was part of wanting to increase my exposure to Swedish debt instruments and comes at a 5.2% Yield-to-call.

- Purchased stock/increased exposure to Heimstaden Pref (No Symbol). This purchase was part of wanting to increase my exposure to Swedish debt instruments and comes at a 5.4% Yield-to-call.

- Purchased stock/increased exposure to Energy Transfer. This purchase was in response to the stock's undervaluation, and the sector's undervaluation in general in the light of continuing headwinds/troubles and a disconnect from what I see as the actual value of the company.

- Purchased stock/increased exposure to CoreCivic (CXW). This purchase was in response to the stock's undervaluation, and the sector's undervaluation in general in the light of continuing headwinds/troubles and recent articles, such as this excellent one from Brad Thomas.

This month, the following transactions were made in my corporate investment account:

- Purchased stock/increased exposure to SEB. This purchase was in response to the stock's undervaluation, and the sector's undervaluation in general in the light of recent headwinds/troubles, as well as the article "SEB - Money Laundering Allegations May Give An 8%+ Yield".

- Purchased stock/increased exposure to Resurs Holding. This purchase was in response to the stock's undervaluation, and the sector's undervaluation in general in the light of recent headwinds/troubles, as well as the article "Resurs Holding - Mostly Fairly Valued Financials At 6% Yield".

Looking forward

My current private portfolio composition sector-wise looks something like this.

(Source: Google Finance, Author's own calculations)

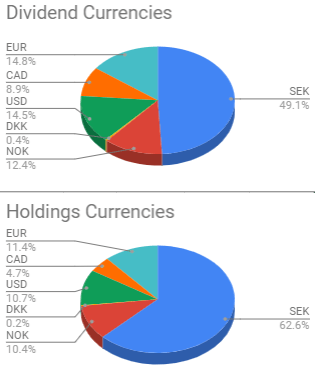

We also have the current currencies and dividend currency mix.

(Source: Google Finance, Author's own calculations)

The reason for the large spread in SEK is the liquid capital position, which is at an incredibly small interest. This is obviously not where I want to be long term - a share of 20-30% in USD and 20-30% in EUR would be closer to my goal, but doing so will take significant time.

For the next month, I've decided to keep an eye on the following companies, and may extend my position in one or several of them, depending on which offer particularly appealing valuations at the time:

- Energy Transfer

- Ocean Yield

- CoreCivic

- Albermarle (ALB)

- CVS Health

- Enterprise Products Partners L.P.

My goal is to invest at least $2500 in December 2019 - if particularly good opportunities arise I may increase this to ~$5000. The question marks on these lists are the oil stocks/MLPs. My position in these holdings is relatively small, but I'm still looking to increase them. There are also multiple opportunities in the REIT sector I may look to take advantage of, both in more traditional leasing models and sectors, but in specialty sectors such as prison REITs as well.

Wrapping up

These monthly updates are meant as examples of portfolio allocation and potential investment strategy. It's meant partly as a view into my investment thinking, and how one can go about thinking regarding investments - and the results of doing so.

I no longer have any specific goal with my investments - my independence is reached. Instead, the goal, for now, is "get more." A few years ago, I might've said that I'd stop working and relax somewhere when I reached this point, but it has become increasingly clear to me that I'm a better, more balanced individual when active and working in something - and I've not yet decided what I want to do more long term.

Because of this, I'm simply doing what I'm used to doing at the moment - which is running my businesses and continuing to invest conservatively. My goal is a strong and healthy mix of balanced stock/investment allocations that can serve as a guidepost for others to construct their own portfolios - and rather than specific stocks (beyond my articles), I'm more about sector-specific allocation and risk balance.

Thank you for reading.

Disclosure: I am/we are long ALL STOCKS MENTIONED. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment.

All European-listed companies are owned via their European/Scandinavian tickers.