PIMCO Enhanced Short Maturity Active ETF: A 'Better Than Cash' Alternative

by BOOX ResearchSummary

- MINT is a low-risk bond-based exchange-traded fund with a focus on capital preservation and liquidity while offering yields above Treasuries through a monthly dividend.

- Actively managed strategy is unique among other short-maturity/low-duration ETFs offering management flexibility to seek incremental return based on market outlook.

- Fund can be used to reduce risk and add to the income component of a diversified portfolio.

The PIMCO Enhanced Short Maturity Active ETF (NYSE:MINT) focuses on short-duration investment-grade debt securities with a goal of achieving a higher yield and total return potential compared to traditional cash investments. This fund is for investors seeking a combination of capital preservation and high liquidity while also offering an income component through a monthly dividend. The risk profile here is in the very conservative range, but a step above simply holding Treasuries or money market funds. What makes MINT unique is the actively managed strategy by the team at PIMCO which has some flexibility to either extend or reduce the duration of the fund within short maturity parameters to better manage risk and seek an incremental return. This article presents our view of why we think MINT is a better alternative to simply holding cash and how it can serve a number of roles within a diversified portfolio.

MINT ETF Strategy

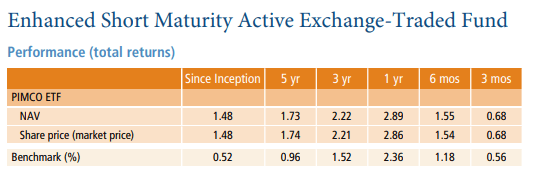

The benchmark for the MINT ETF is the "FTSE Treasury Bill 3 Month USD" Index which effectively tracks the total return from holding three-month Treasury bills and continuously reinvesting the proceeds. MINT has a similar risk profile as the benchmark index with the fund's current effective maturity at 0.20 implying a tenure of about 2.4 months. Favorably, the data through September 30th shows MINT has outperformed its benchmark pretty convincingly since its inception going back to 2009 with an average annual total return of 1.48% compared to 0.52% for the three-month Treasury Bill index.

(Source: PIMCO)

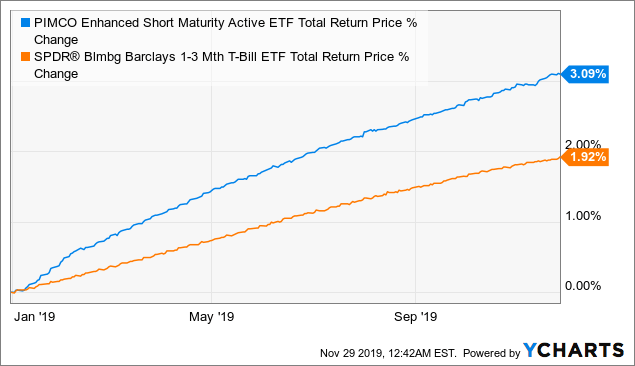

These returns aren't the most exciting figures in the market, but the point is the low-risk, liquidity and capital preservation aspects. Year to date, MINT has returned 3.09% which looks a lot better than an uninvested cash position in a brokerage account earning zero. The total return graph comes out like a straight line climbing steadily higher. We include the "risk free" SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL) which invests only in ultrashort term Treasury bills as a reference, which in our opinion is unnecessarily too conservative.

Data by YCharts

The advantage of MINT to Treasuries and a Treasuries-based ETF like BIL comes down the composition of the MINT portfolio which is based on investment-grade corporate securities which offer a yield advantage based on the credit spread. In this case, investors willing to accept an underlying level of credit risk are rewarded with a higher return. While investors naturally gravitate towards Treasuries precisely to avoid credit risk, we argue that in practicality given the short maturity and short duration profile of the fund, there is effectively no risk of loss in holding MINT beyond what would be a doomsday apocalyptic scenario. Across 808 holdings in the fund, 75% of the credit is rated in the "A" range or better.

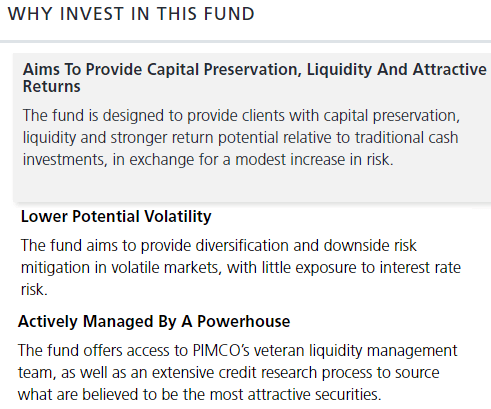

(Source: PIMCO)

According to PIMCO there are various reasons to invest in MINT including the higher return relative to cash and capital preservation. The fund can also be used to lower the interest rate risk of a larger bond allocation over period of volatility to reduce overall risk. During periods of rising short-term rates, the short-duration profile offers downside protection. Investors who take a bearish view on the market could also consider moving into MINT to avoid risk assets.

Monthly Dividend

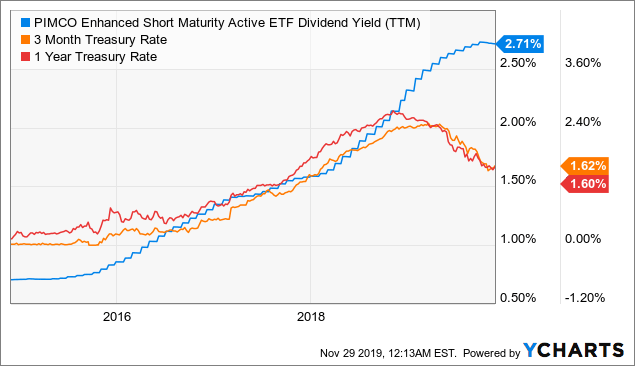

The current dividend yield on MINT is stated as 2.71% on a trailing-twelve-month basis. Given the Fed rate cuts this year and a trend lower in short-term rates, it's expected that the realized or forward yield for the fund moves lower. MINT's dividend distribution reflects the underlying interest income from holdings. Essentially, as the existing portfolio turns over and bonds purchased over the past year mature, the capital now gets reinvested into lower yield-to-maturity bond issuance. In this regard, the yield reflects higher or lower interest income from the holdings in combination to the short maturities draws a comparison to how a floating rate fund behaves.

Data by YCharts

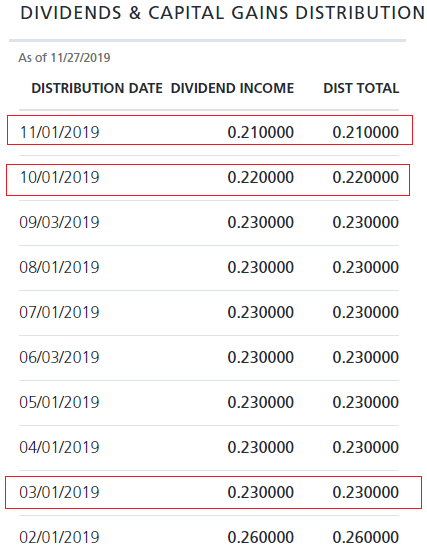

From the chart above, we can observe that the dividend yield of MINT climbed over the past five years as the three-month and one-year Treasury rate trended higher. Note that while the "Y-Axis" on the chart does not line-up, MINT has always yielded more than the one-year and three-month Treasury rate. Fast forward to late 2018, when interest rates began to move lower approximately one year ago with anticipation of the Fed rate cuts, the dividend yield of MINT is just now starting to "roll over". Indeed, the monthly per share dividend amount of MINT has declined from $0.26 back in February to the most recent $0.21 based on the move lower in the entire yield curve.

(Source: PIMCO)

The bonds MINT is investing into today reflect yields based on the current interest rate environment of investment grade corporate credits and related securities. That eventual interest income will comprise the future dividends of MINT when those bonds mature going out a few months. Based on the latest dividend amount of $0.21 per share, the annualized forward yield on MINT is 2.5%. We expect that the forward dividend yield on MINT to trend lower towards but it's impossible to precisely forecast as it will depend on how interest rates move.

Forward-Looking Commentary

It's a delicate period in the market particularly as it relates to Fed policy and uncertainty over the direction of interest rates. In a scenario where interest rates climb sharply higher with a yield curve steepening, MINT would be well positioned to offer downside protection to a broader fixed income portfolio. On the other hand, an expectation that the interest rates collapse lower from here implies a deterioration in the macro outlook which could lead to volatility in risk assets overall. MINT could serve as a refuge from a bearish outlook on the overall market.

While there is still an expectation that the Fed will cut rates into next year, the latest macro developments including a growing anticipation of a potential U.S.-China trade deal could result in a rebound to global growth expectations diluting the case for more rate cuts. By this measure, we view risks tilted towards a move in interest rates higher adding to the attractiveness in short-duration funds.

Takeaway

MINT with a 10-year history and $13.4 billion in total assets is one of the largest "cash alternative" short-maturity-type funds from a well-respected manager. We like the performance history and risk-adjusted total return profile in what is an overall quality fund for the purposes of capital preservation and low-risk monthly income. In many ways, MINT can be viewed as a risk management tool offering a lot of flexibility for how investors can utilize it. Take a look at the fund's prospectus for a full list of risks and disclosures.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.