The Frugal REIT Investor

by Brad ThomasSummary

- "Wealth is not the same as income. Wealth is what you accumulate, not what you spend." Thomas Stanley.

- "The foundation stone of wealth accumulation is defense." Thomas Stanley.

- Investors must select stocks with a significant margin of safety, and that means that he or she must always behave like a "frugal REIT investor."

Did you catch my article from earlier this week? The one titled "Beware of Fool's Gold: 3 REITs to Avoid."

In it, I did some notable quoting, such as the following three:

- "A REIT that yields 10% almost always means that investors perceive very low growth - or even worse - a potential dividend cut." - Ralph Block

- "I am not impressed with what people own. But I'm impressed with what they achieve." - Thomas Stanley

- "Allocating time and money in the pursuit of looking superior often has a predictable outcome: inferior economic achievement." - Thomas Stanley

For those of you who don't know the two individuals "quotees" above, Ralph Block was a late REIT expert and still a great one. His published advice, particularly in his book Investing in REITs, is phenomenally detailed and extremely useful for any well-rounded investor.

Then there's Thomas Stanley, also a well-respected author. Stanley, who passed away in 2015, co-wrote The Millionaire Next Door with his fellow Ph.D.-holder William D. Danko.

Author of seven award-winning books total, in his day, he was considered to be the foremost authority on the affluent - and how they became that way. That might sound like a shallow focus for someone of his elevated education and academic reach.

However, that perspective is missing the mark. By far.

Valuable Overarching Lessons

In reality, Stanley's focus did a lot of people a lot of good. He taught his readers, students, and speech attendees intensely valuable lessons on how to build a better life.

Obviously, yes, that was from a financial angle. But well-taught financial lessons can impact us in every other way possible as well.

Take one of the many wise sayings from The Millionaire Next Door:

"Wealth is not the same as income. If you make a good income each year and spend it all, you are not getting wealthier. You are just living high. Wealth is what you accumulate, not what you spend."

Accepting and adopting that kind of mentality doesn't just help you save up for a more financially secure future - though it's hard to understate the value of that outcome. It also encourages an emotional, psychological and perhaps even spiritual maturity - an independence from material or mental clutter.

Just because something is "shiny" doesn't mean it's going to fulfil us in more than the mere moment, after all. It might bring short-term riches, but there's more to life than the short term.

Much, much more.

That's why, in that "Beware of Fool's Gold" article, I mentioned people who like to live it up: The ones who make sure to drive the most expensive cars that they then park at the most expensive houses where they then throw the most expensive parties.

Unless they have the money to cover all that while still setting themselves up for a secure, sustainable retirement, those kinds of people are headed toward certain disaster.

Companies Do It Too

It's the same thing with companies that spend money like there's no tomorrow. Look no further than WeWork for proof of that. The real estate-ish company went wild with its success… and lost perhaps everything as a result.

Forbes wrote an article earlier this month about it: "WeWork Was a $47 Billion Unicorn - Now It Plans to Layoff Up to 6,000 Employees."

We're still waiting to see how that story completely unfolds, of course. But right now, it's not looking good and apparently, it hasn't for a while:

"The company rapidly expanded all across the U.S. and abroad. Along with the growth, cracks started to show in the façade. WeWork was accused of financial self dealings (on the part of the former CEO)… questionable trophy acquisitions (such as a wave pool operator), and a disturbingly high burn rate of cash. "(CEO Adam) Neumann told reporters that he'd like to become leader of the world, live forever and amass more than $1 trillion in wealth. He allegedly engaged in over-the-top behavior. He reportedly left a cereal box filled with pot on a private jet. Crew members found it and contracted the plane's owner, fearing that this was part of an international drug-trafficking ring. The plane's owner demanded it returned, which left Neumann stranded in another country."

In short, WeWork and its leadership tried to "live it up." They speculated big. And they lost big in return.

We don't want to put our money into businesses with that kind of mentality. No matter how well it seems they're succeeding in the moment, they're never really going to come out ahead.

Which means neither will their investors.

A Much Better Way

To quote The Millionaire Next Door again - since it truly does have a wide range of mental wealth ready and waiting to be turned into financial wealth - "The foundation stone of wealth accumulation is defense. And this defense should be anchored by budgeting and planning."

Not party planning. Not yield chasing. Long-term planning. Analyzing the present and preparing for the future as best as possible. Understanding that life throws curveballs at businesses and individual investors alike and that the best way to be ready for those occurrences is to save up as much of your resources as reasonably possible.

Companies that recognize those facts are the kind we want to invest in. Because those are the kinds of companies that are going to take our portfolios all the way into the kind of retirement worth preparing for.

4 REITs for the Frugal REIT Investor

We purposely developed a rating tool call R.I.N.O. (stands for REIT Indicator Numerically Optimized) so we could screen for the highest quality companies. By carefully analyzing a company's income statement, balance sheet, and management team, we can assign a numerical score to each REIT in our coverage spectrum.

Then we screen for the companies that are the most advantageously valued or simply the REITs with the widest margin of safety. Our marketplace services - iREIT on Alpha and The Dividend Kings - are designed with the value investor in mind, as our primary goal is to preserve capital at all costs.

Simply put, whenever Mr. Market fails to fully incorporate fundamental values into a stock price, the investor's margin of safety is high. We read articles daily on many financial sites (including Seeking Alpha) where greed leads investors to speculate, and this means they base their decisions on high-risk alternatives while ignoring risk.

As a frugal REIT investor, we must be the voices of reason, paying very close attention to risk minimization. Much of the power of the margin of safety concept is rooted in principal preservation in which the value investor looks to capitalize upon "a favorable difference between price on the one hand and indicated or appraised value on the other."

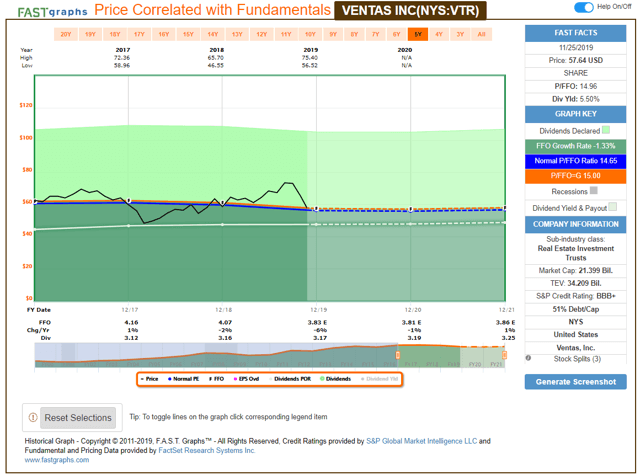

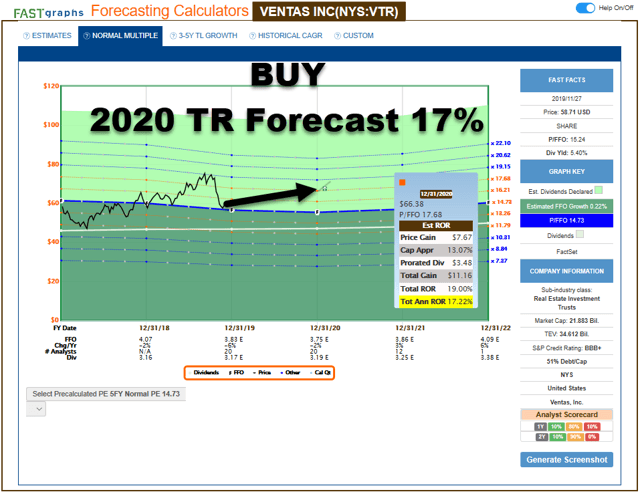

Ventas Inc. (VTR) shares have fallen on hard times, down by over 20% since Q3-19 earnings. While much of the selloff can be explained by weakness in the company's U.S. SHOP portfolio (-5% NOI declines), the biggest overhang can be attributed to the lack of clarity related to VTR's 2020 earnings growth.

We take comfort in the fact that VTR maintains an impressive balance sheet (BBB+) that allows the company to grow through acquisitions and development. In addition, fundamentals are weak for the US SHOP business, but the operators that VTR has hand-picked are best in class.

The sum of these parts is that VTR has an attractive dividend yield of 5.5% with a safe payout ratio (of 82%). While the latest earnings news was not favorable for the SHOP business, we expect VTR to generate modest growth in 2020. In other words, this is no strong buy, but shares have definitely moved into the buy category. We maintain a Buy.

Source: FAST Graphs

RINO Score: 4.223

P/FFO Variance: 2.12%

Dividend Yield: 5.50%

Payout Ratio: 82.77%

S&P Rating: BBB+

2020 FFO/Shr Estimate: $3.91

Source: FAST Graphs

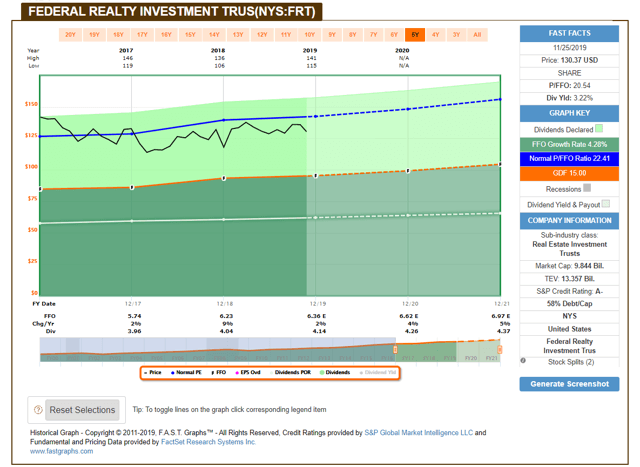

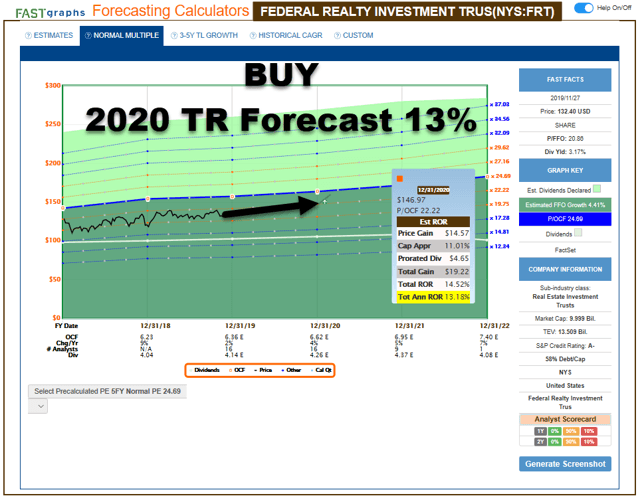

Federal Realty (FRT) shares have under performed peers year-to-date, providing value investors with an opportunity to capitalize on the mis-pricing. Keep in mind that FRT is the only A-rated shopping center REIT and one of just six A-rated REITs in America, courtesy of its fortress balance sheet.

Also, FRT has one of the highest quality portfolios in the sector with an impressive portfolio that consists of 105 shopping centers, totaling 24 million square feet of leasable space, leased to 3,000 tenants, in some of the most densely populated, fastest-growing and most affluent cities in America. It also owns nearly 2,700 apartment units as part of its increasingly mix-use portfolio.

As a true "Dividend King" FRT has paid and increased annual dividends for more than 50 years in a row, and based upon the payout ratio (of 66%) the company should have no problem maintaining that impressive record. FRT can retain $75 to $100 million per year in cash flow after dividends and is one of the few REITs that can self-fund its growth plans. We forecast growth of 4% in 2020 and 5% in 2021. We maintain a Buy.

Source: FAST Graphs

RINO Score: 4.558

P/FFO Variance: -8.34%

Dividend Yield: 3.22%

Payout Ratio: 65.09%

S&P Rating: A-

2020 FFO/Shr Estimate: $6.62

Source: FAST Graphs

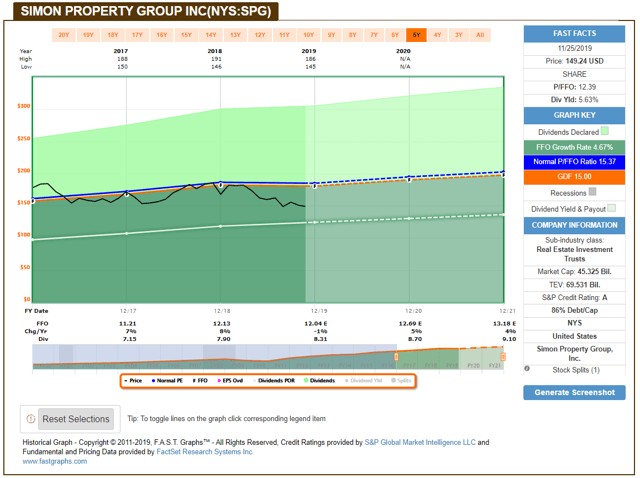

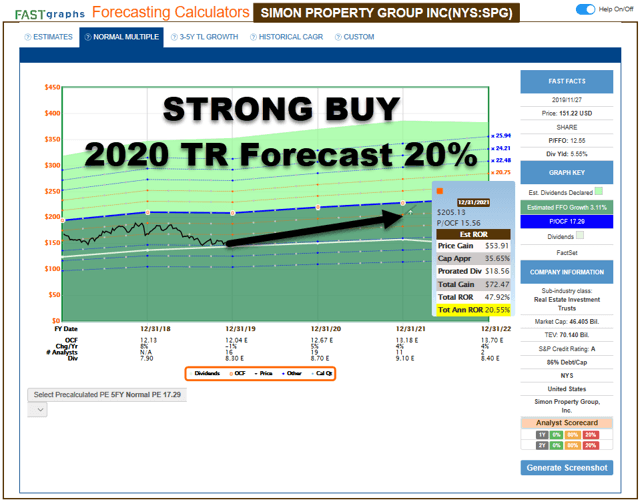

Simon Property Group (SPG) is another juggernaut (like FRT) with a fortress balance sheet capable of generating around $1.5 billion of free cash flow after dividends. The stalwart REIT has more than $6.8 billion of liquidity that provides investors with ample confidence related to expected redevelopment of more than $5 billion.

In 2020 SPG is expected to grow cash flow by about 4% per share, much better than the lower-quality names we are less enthusiastic about (i.e. MAC, WPG, CBL, and PEI). As soon as the company's 2020/2021 redevelopment pipeline kicks in ($1.8B active pipeline, including seven anchor redevelopments) we expect SPG to deliver normalized returns, closer to 6% to 8% annually.

In hindsight, we're glad we picked SPG to be the top mall REIT performer, based upon the company's low cost of capital and scale advantages. The management team has impressed us, and continues to do so, based upon the risk management practices that have guided the company through a decade of dividend growth.

The dividend yield is attractive, and shares now yield 5.6% with a safe payout ratio of 69%. As we enter 2020, we have become much more conservative in the mall sector and we believe the winners and losers will be differentiated by their defensive risk management practices. There's no doubt on our mind that when it comes to mall investing, SPG is the best. We maintain a Strong Buy.

Source: FAST Graphs

RINO Score: 4.318

P/FFO Variance: -19.39%

Dividend Yield: 5.63%

Payout Ratio: 69.02%

S&P Rating: A

2020 FFO/Shr Estimate: $12.69

Source: FAST Graphs

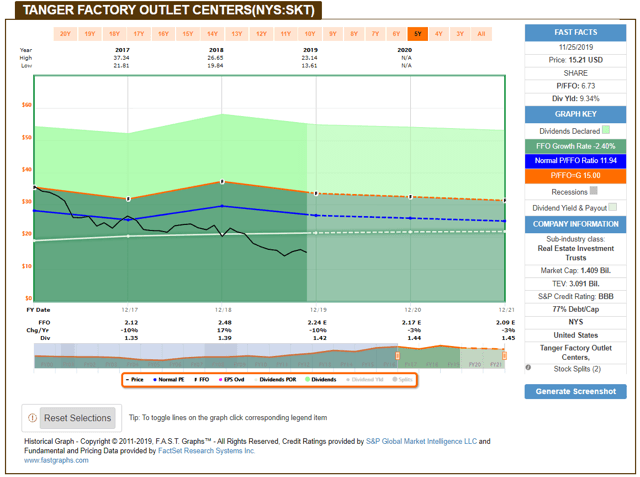

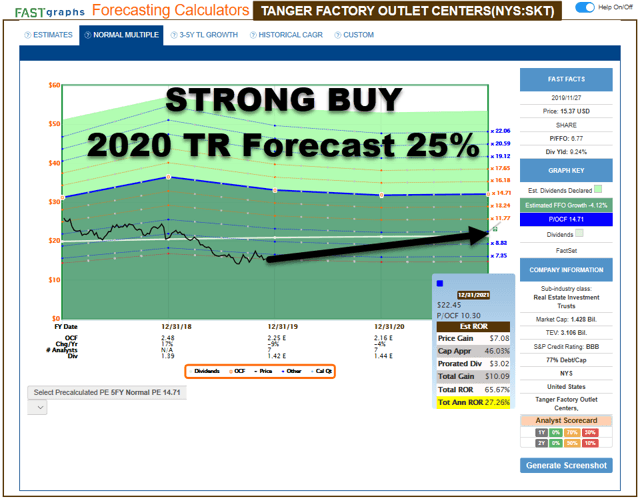

Tanger Outlets (SKT) is our final "frugal" REIT pick and it seems ironic that this REITs' business model is designed for the "frugal" shopper. Outlets are designed to attract budget conscience consumers, and while Amazon (NASDAQ:AMZN) provides a terrific medium for "shopping on the cheap," we believe outlets will continue to gain the attention of retailers looking to add brick and mortar exposure.

As I have often said, the game is all about supply and demand, and while there's no question that traditional malls are overbuilt in the US, they aren't in the outlet sector. With around 1,400 malls standing, we believe that during the next decade, the list could be shortened by 500-600 malls.

Malls were designed with department stores in mind, so as the rationalization of space unfolds, we believe that outlets will increase in popularity, and, of course, that puts Tanger in the catbird seat.

That's not to say outlets will not continue to experience angst, as more retailers close or minimize store counts. It means that the best outlet landlords will continue to find ways to differentiate in order to attract customers.

Needless to say, our bullish sentiment is based upon Tanger's strong risk management profile that includes a BBB-rated balance sheet, high portfolio occupancy, and highly disciplined capital management. This translates into an attractive dividend yield of 9.3% well-covered by FFO (payout ratio is 64%). We maintain a Strong Buy.

Source: FAST Graphs

RINO Score: 3.873

P/FFO Variance: -43.63%

Dividend Yield: 9.34%

Payout Ratio: 63.39%

S&P Rating: BBB

2020 FFO/Shr Estimate: $2.17

Source: FAST Graphs

In Closing

I want to remind you (as see in my disclaimer), I'm a Wall Street writer, which means that I'm not always right with my predictions or recommendations." While I spend countless hours surveying the list of vetted opportunities, "it must never be forgotten, that a stockholder is an owner of the business and an employer of its officers." (Ben Graham in Securities Analysis).

This means that I spend considerable time meeting with management teams, analysts, and other industry experts. It's these collective interactions that ultimately drive my recommendations, but the critical piece of the puzzle is that investors must select stocks with a significant margin of safety, and that means that he or she must always behave like a "frugal REIT investor."

By paying close attention to the margin of safety concept, you won't have to worry about market timing, and you can instead enjoy a stress-free lifestyle that means you can sleep well at night. Happy Holidays.

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Managing Risk Is What We Do Best

iREIT on Alpha is one of the fastest-growing marketplace services with a team of five of the most experienced REIT analysts. We offer unparalleled services including five customized portfolios that are doing extremely well in the moment - but are built to stand the test of time too.

Disclosure: I am/we are long VTR, SKT, SPG, FRT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.