Lukoil: Solid Q3 Results Ensure High Yields

by Danil KolyakoSummary

- Lukoil performed better than expected in Q3 2019.

- I expect Lukoil to generate strong FCF in the medium term.

- Lukoil is one of the best quality stocks in the Russian stock market.

In the third quarter of 2019, Lukoil (OTCPK:LUKOY) (OTCPK:LUKFY) (OTC:LUKOF) has managed to generate 83 billion rubles of adjusted FCF vs. 113 billion rubles in H1 2019, which is an outstanding result. The outlook for 2019 seems stable, though I have some concerns about increased capex in 2020. Despite this, I remain bullish on Lukoil with its excellent track record of sustainable dividend growth, strong balance sheet and solid FCF generation.

Q3 Results

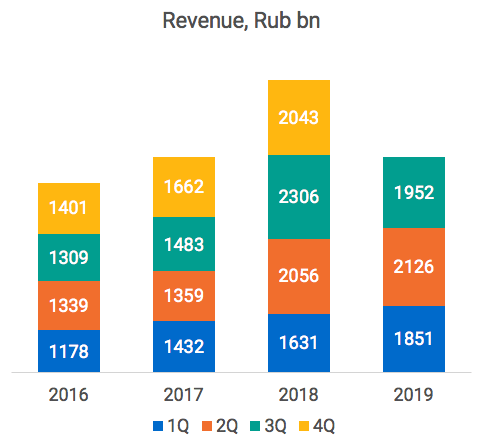

Lukoil's revenue fell by 15.3% in annual terms to 1.95 trillion rubles due to a decrease in oil and gas prices, as well as a strengthening of the ruble.

Source: Company data, Author's spreadsheet

EBITDA is down by 1.3% Q-o-Q to 27.8 billion rubles (1.9% Y-o-Y). At the same time, EBITDA from the refining & sales segment increased by 25%, almost completely compensating for the decrease in EBITDA from the exploration and production segment.

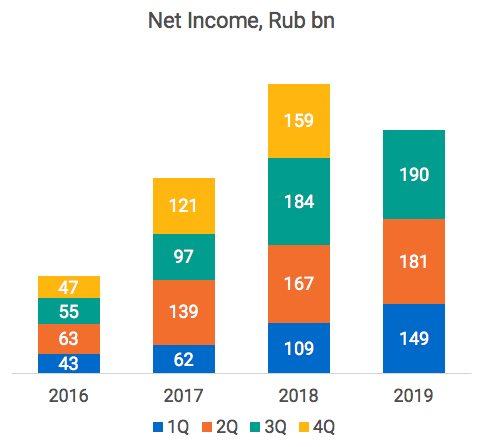

Net profit grew by 3.6% to 190.4 billion rubles. The profit growth is associated with the introduction of the IFRS 16 (Leases) standard from the beginning of 2019 while the negative effect came from a foreign exchange loss of 4.6 billion rubles.

Source: Company data, Author's spreadsheet

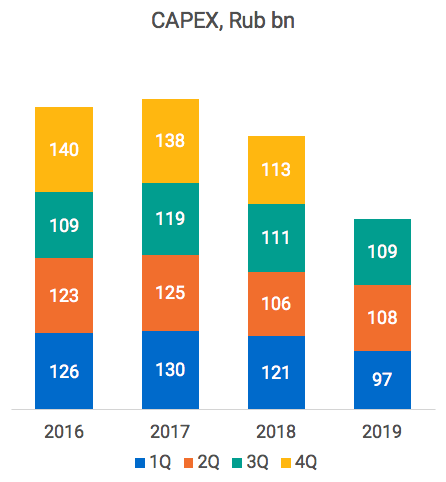

Capital expenditures increased by 1.4% compared to the previous quarter (-2.1% Y-o-Y) and amounted to 109.1 billion rubles. Higher capex is tied with the development of Caspian projects, as well as the implementation of projects at oil refineries in Russia. The management also mentioned that although it expects an increase in capital expenditures in Q4 2019 on a quarterly basis, the total capex for the year may be lower than the most recent management forecast of 470-490 billion rubles. This is a clear positive in the short term, as the company will use any unspent investments to pay more dividends.

Nonetheless, the management forecasts 550 billion rubles as the likely amount of capex for 2020. This number is yet to be approved by the Board of Directors but sets the bar high anyway for the operational performance of the company.

Source: Company data, Author's spreadsheet

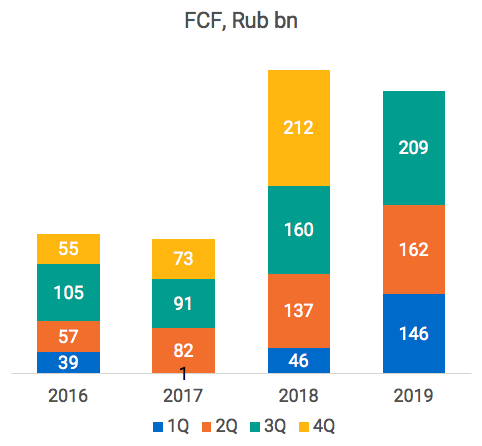

Non-adjusted free cash flow amounted to 208.9 billion rubles, which is 28.6% more compared to the second quarter of 2019 (30.7% Y-o-Y).

Source: Company data, Author's spreadsheet

As for Lukoil's debt load, the cash on the company's balance sheet almost completely covers the size of the debt, therefore, the Net Debt/EBITDA ratio is at a near-zero level.

I consider the Q3 results as moderately positive. The company shows its ability to adapt to lower oil prices, even though Brent prices below $50 are still dangerous for Lukoil as it won't be able to offer an attractive dividend yield.

Dividends

According to Lukoil’s presentation, dividends in Q3 2019 may amount to 120 rubles per share calculated in line with the new dividend policy I discussed in my previous article. As I mentioned earlier, the adjusted FCF amounted to 83 billion against 113 billion for the first half of the year. This gives us 117 rubles per share of dividends just for one quarter and I don’t think that the fourth quarter will be worse in terms of financial performance. A rough and conservative estimate of 100 rubles of dividends in Q4 gives us at least 409 (192 in H1 2019 + 217 in H2 2019) rubles per share for 2019. My estimate of 500 rubles for 2019 in my previous article was quite optimistic, though I still believe that with stable oil prices, the company can deliver a sufficient amount of FCF to pay that many dividends.

Thus, the dividend payment schedule for Lukoil is as follows:

- 192 rubles per share for 6 months of 2019 - payable in December 2019.

- 200-300 rubles of final dividends for 2019 - payable in July 2020.

- 300-320 rubles for the first half of 2020 - payable in December 2020.

After Q3 results, investment banks began enthusiastically evaluating Lukoil's total dividends for 2019, and many of these forecasts turned out to be in the range from 430 to 500 rubles per share, which means that the dividend yield can be roughly estimated from 6.5% to 8.5% (10-12% with the effect of buybacks) for 2019. The record date for the next dividend will be December 20, 2019. If you want to receive the dividend, the last day to buy the stock is December 18th.

For reference, in mid-October, the Board of Directors approved new principles of the company's dividend policy, according to which Lukoil will pay at least 100% of its adjusted free cash flow in dividends twice a year. The Board of Directors will approve the new dividend policy at a meeting on December 12, 2019.

Final Thoughts

The company's dividends for 2019 are more or less predictable. However, the capex increase up to 550 billion roubles in 2020 brings some risks as this may reduce FCF while maintaining current oil prices and production levels. To pay higher dividends in 2020 compared to 2019, Lukoil needs to show a substantial increase in operating cash flow, otherwise, the investment case will look a little bit less attractive.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.