Evolution Mining's Red Lake Mine Acquisition - A Bet On Exploration Success

by Peter ArendasSummary

- Newmont Goldcorp will sell the Red Lake mine to Evolution Mining for $375 million, plus contingency payments of up to $100 million.

- Evolution will invest $100 million to improve the mine operations and $50 million to drill around 300,000 meters over the next three years.

- As the mine is losing money, Newmont looks like the winner here, however, if Evolution's efforts are successful, the situation may change rapidly.

Evolution Mining (OTCPK:CAHPF) decided to purchase the Red Lake mine from Newmont Goldcorp (NEM). Evolution, one of the biggest Australian gold producers, will pay $375 million to acquire the Canadian mine. Up to further $100 million could be paid in contingency payments, if further resources are discovered. Evolution will pay $20 million for each million newly discovered toz gold (or $20/toz). However, the contingency payments are capped at $100 million. In other words, any discoveries above 5 million toz gold are for free.

Given the reputation of Red Lake, where the production started back in 1949 and 25 million toz gold at a gold grade over 20 g/t were produced, and also the fact that the mine still contains reserves of 2.1 million toz gold and resources of 7 million toz gold (although the estimates are 1.5 years old, an update will provide lower numbers), the acquisition price looks quite good for Evolution. Moreover, Evolution also acquires a huge land package with great exploration potential, and also two mills with a total capacity of 1.1 million tpa. However, the reality is more complex.

There are sizeable reserves and especially resources, however, the gold grades lag behind the historical ones significantly. The resource grade stands at 11.2 g/t gold and reserve grade even at 7 g/t gold. Right now, the mine is not profitable. Although last year the Red Lake mine produced 276,000 toz gold at an AISC of $988/toz, this year, the production should be only 150,000-160,000 toz gold, at an AISC of $1,600/toz. And it should be even worse next year, with a production of 30,000-35,000 toz gold at an AISC of $1,525-1,625.

Evolution's management believes that Red Lake's main problem is a significant undercapitalization. They intend to invest $100 million in the mine alone and further $50 million in a vast exploration campaign. It is expected that a turnaround plan will take 3 years to realize. During this time, Evolution will not only invest $100 million directly in the mine, but the mine alone will also be probably operating at a loss which will further boost the total costs of acquiring this project. However, if Evolution succeeds, the Red Lake mine production should be more than 200,000 toz gold per year at an AISC of less than $1,000/toz.

Evolution wants to rationalize material movements, improve fleet efficiency, improve gold recoveries and decrease ore dilution, consolidate and optimize processing plants, optimize the process flowsheet and install an Acacia reactor. If everything goes well and the production grows to 200,000 toz gold per year at an AISC of $1,000, the mine should be able to generate around $90 million in cash flows per year at the current gold price.

It means that it will take almost 6 years before Evolution recovers the $525 million in expenses related to the project ($375 million the mine acquisition, $100 million the mine optimization, $50 million the exploration program). Not to talk about the interests of the A$600 million term loan used to finance the acquisition. Although the exact terms of the loan were not released, even at a very low 5% interest rate, the interest payments would equal A$30 million ($20 million) per year.

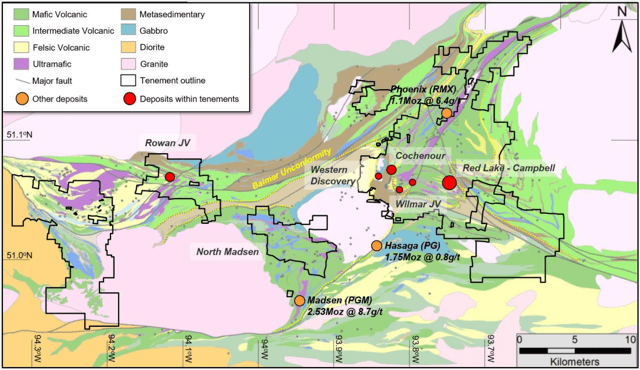

In other words, Evolution must reach a substantial exploration success for the acquisition to pay-off. This is why it plans an aggressive $50 million exploration program with 100,000 meters of drilling per year, or together 300,000 meters over a 3-year period. As can be seen in the map below, Evolution will acquire a very nice land package of approximately 460 km2 in the Red Lake area, including several known deposits and high-priority exploration targets.

Source: Evolution Mining

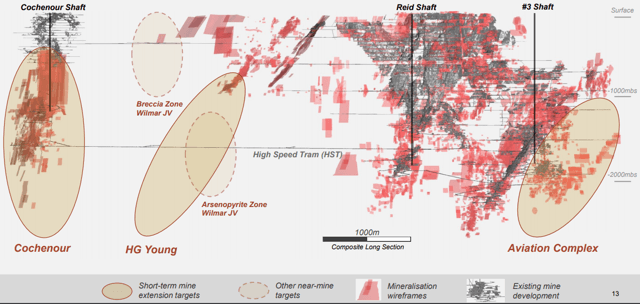

Also the Red Lake mine alone provides a substantial exploration potential. As can be seen in the picture below, there are several exploration targets in close proximity to the current mine workings. The resources and reserves identified in these areas can be added to the current mine plan pretty quickly.

Source: Evolution Mining

Moreover, if Evolution's exploration program turns out to be less successful than expected, there are still some additional options. There are several interesting development-stage projects situated in close proximity to the Red Lake Mine. Namely Rubicon Minerals' (OTCQX:RBYCF) Phoenix Project, Pure Gold's (OTCPK:LRTNF) Madsen Project and Premier Gold Mines' (OTCPK:PIRGF) Hasaga Project. All three companies, or at least their projects, can become Evolution's next acquisition targets.

To sum it up, Evolution will pay $375 million (+$100 million in contingency payments) to acquire a money-losing mining operation. However, the mine is located in a safe jurisdiction, it has sizeable resources and what is important a really big exploration potential, and the exploration potential is the key. Evolution will need a substantial exploration success for the transaction to pay-off.

And what's in it for Newmont Goldcorp? Newmont Goldcorp will receive $375 million (and maybe further $100 million) for a currently unprofitable asset. It will improve its balance sheet, moreover, it will get rid of a non-core asset that requires sizeable capital investments and lots of exploration effort. The sale of Red Lake is in line with Newmont Goldcorp's post-merger strategy to divest some non-core assets. The aim is to raise $1-1.5 billion.

As Newmont Goldcorp wants to focus only on world-class assets, the sale of Red Lake seems to be reasonable. On the other hand, the fact that the mine doesn't fit the criteria today doesn't mean that it won't fit it tomorrow. Evolution Mining seems to be pretty confident that it will be able to increase production, decrease costs and discover more gold. If Evolution's efforts are successful, Newmont can end up kicking itself for selling the mine.

Conclusion

The Red Lake mine sale is an interesting transaction. Evolution will pay $375 million (plus up to $100 million in contingency payments) to acquire a mine that will be losing money at least over the next 2-3 years. On the other hand, it will acquire two mills and a huge land package in a highly prospective location. As a bonus, there are sizeable reserves and resources of 2 million toz and 7 million toz gold respectively (although the estimates are 1.5 years old, an update will provide lower numbers).

From a short-term point of view, Newmont looks like the winner. It will get rid of one of its unwanted non-core assets originally (before the merger) owned by Goldcorp, and it will get a nice cash infusion. Evolution will increase its indebtedness significantly. Moreover, it should take at least 2-3 years of investments, optimizations, and explorations, before the mine gets into the desired shape. But if Evolution's efforts are successful, it may emerge as the real winner of this deal.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.