Black Friday Sale: Tanger Is A Bargain

by Arturo Neto, CFASummary

- Only pure-play outlet REIT and the second-largest owner and operator or outlet centers in the U.S. Diversified tenant base with no single tenant accounting for more than 7%.

- Operating performance weighed down by continued store closings and lack of expansion.

- Slower dividend growth expected over the next two years on lower AFFO but current dividend yield on SKT is 10%, well above the peer average of 6%.

Investment Thesis

Shares of pure play outlet REIT Tanger Factory Outlet Centers, Inc. (SKT) have been on a downward spiral since mid-2016 and currently trade near a 10-year low as rental income and AFFO (adjusted funds from operations) growth has slowed down to low single digits on continued store closings. Although the company’s strategy of filling up the vacancies through temporary pop stores has helped to shore up occupancy, they are hurting near-term rental spreads and same-store NOI. Any meaningful pickup in operating performance is some time away as store closings are expected to continue into 2020. Additionally, lack of major expansion until 2021/2022 also could limit any meaningful pickup. But shares are extremely beaten down and the dividend seems safe for the time being. Buying in now at a 10% dividend yield while waiting for growth out 2-3 years isn't such a bad idea.

Outlet industry leader

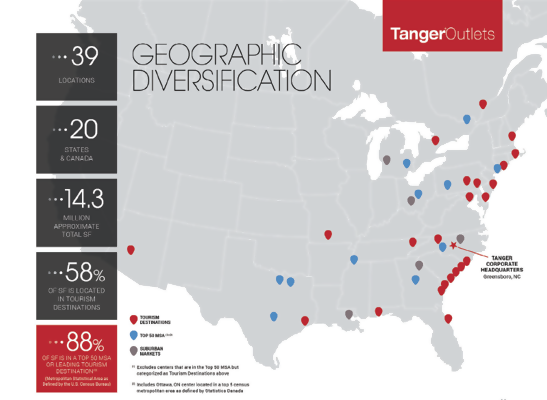

Tanger Factory Outlet Centers is the only pure-play outlet REIT and the second-largest owner and operator or outlet centers (behind Simon Property Group) in the U.S. with a portfolio of 39 upscale outlet shopping centers located in 20 states and in Canada, spanning 14.3 million square feet.

Source: SKT Presentation July 2019

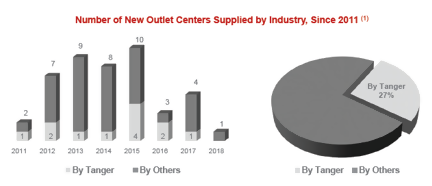

For nearly four decades, the company has been delivering quality outlet centers and has been a dependable developer for various tenants. Since 2011, SKT has supplied 27% or 12 of the total 44 new outlet centers across the U.S. Most of these outlets are located near or outside major metropolitan areas or in popular tourist destinations. In addition to focusing on strategic locations, the company also conducts a variety of marketing programs to drive traffic, which stands at more than 180 million visitors annually.

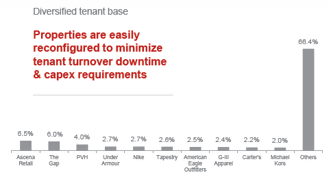

SKT has a diversified tenant base with no single tenant accounting for more than 7%. Tenants can easily move in with low capex as the company’s properties are easily configurable to suit their specific requirements.

Source: SKT Presentation July 2019

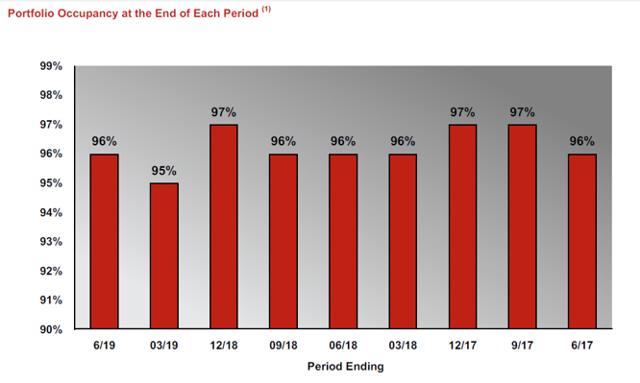

Continued store closings and lack of expansion put pressure on financial performance

Following vacancies of 126,000 sq. ft. in 2018 and 201,000 sq. ft. in 2017, SKT expects 225,000 sq. ft. in 2019 driven by continued store closures. These vacancies could drag into 2020 as 20 Dress Barn (part of SKT’s largest tenant Ascena) totaling ~190,000 sq. ft. or ~2.0% of base rent are expected to close in early 2020. SKT has been able to recoup some of these vacancies (occupancy improving to 96% in 2Q19) primarily through lower-rent short-term leases, which are hurting near-term rental spreads and same store NOI. Following two years of decline, same-store NOI is expected to decline 1.5-2.25% for full-year 2019 suggesting worsening declines in 2H19, after improvement (lower declines) in the past four quarters.

Source: SKT 2Q19 Earnings Supplement

Lack of development or redevelopment projects also are expected to weigh on rental income growth. After opening 13 outlet centers over the period 2010-2017, no new outlets are planned until at least 2021/2022 when the recently-announced Nashville outlet is expected to be completed. SKT announced plans to build a 280,000 sq.ft. outlet in Nashville, but construction will only start when at least 60% is leased. Even if the work begins over the coming months (assuming it achieves 60% lease requirement), the outlet could be completed only in late 2021 since construction alone could take at least 12-18 months.

Source: SKT Presentation July 2019

Marketing programs driving traffic

Amid continued vacancy pressure, SKT has focused on enhancing its marketing efforts through a variety of ways (media, direct mail, digital) to reach customers and craft promotional programs with its tenants. Of significance were the ~200 experiential events (block parties, festivals, food trucks) conducted during the first six months of the year on key holidays. These efforts have been fruitful, driving 2.3% growth in traffic at consolidated centers in 2Q19. Additionally, sales productivity rose $12/ sq. ft. to $395/sq.ft. for the trailing 12 months ended June 30, 2019, while same-center tenant sales performance increased 150 bps. The company also had success (+12% YoY in 2Q) with the Tanger Club loyalty program, which should drive sales as Tanger Club members spend ~63% more annually than non-club members.

Dividend growth could slow in 2019 and 2020

Lower adjusted funds from operations (AFFO) for 2019 and 2020 on continued store closings and no expansion plans could result in slower dividend growth. SKT has had a track record of increasing dividends since its IPO, including five-year CAGR of 10% and 10-year CAGR of 6%. Although the dividend increased 1.4% to an annualized $1.42 per share year to date in 2019, it's about half of 2018’s 3% growth. The dividend growth also could be muted in 2020. That said, SKT has enough room to increase dividends as the payout ratio is just about 60% of funds from operations (FFO). The current dividend yield is above 9% - well above industry peers.

With low leverage (5.8x vs mall REITs average of 8.0x) coupled with limited portfolio expansion, SKT also could reward investors with share repurchases. In 1H19, the company repurchased $10 million worth of shares, which could continue in the second half as well in 2019/ 2020 as the company has another $90 million authorized through May 2021.

Outlook

Although the company’s operating performance is showing signs of recovery on improved occupancy due to popup and temporary stores, a complete turnaround could take time as store closures are expected to continue well into 2020. Additionally, lack of major expansion until 2021/2022 also could limit any meaningful pickup. That said, dividend growth could continue, albeit at a slower pace, in 2019 and 2020, as the payout ratio is only ~60% of funds from operations (FFO). Additionally, the dividend yield of 9%-plus on SKT is amongst the highest in the peer group - which is not a bad way to sit and wait for a turnaround in the stock price.

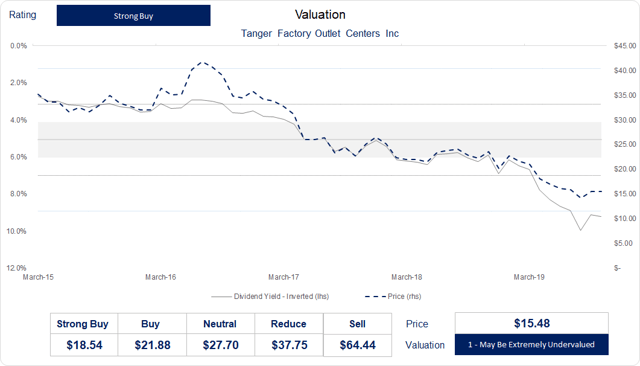

From a valuation perspective, the shares are extremely undervalued. The stock has been beaten up due to store closings and overall pressure on retailers, but I think this is way overdone. The company already is showing signs of stabilization and management's out of the box thinking and their ability to moderate the same store NOI declines with innovative strategies goes a long way toward making me a long-term investor.

Generate Better Returns with my Five Income Strategies

Get access to my 5 Unique Income Portfolios or use my Model Portfolio that combines four out of the five income objectives listed below and includes recommended allocations.

- Stable Monthly Income

- Dividend Growth

- High Income

- Tax-Exempt Income

- Income Safety

My name is Arturo Neto, a CFA charterholder and a Certified Private Wealth Advisor, and I put together a team of Chartered Financial Analysts and seasoned investment professionals to guide you with your income investing.

As a member, you also get 20% discounts on Financial Planning and Portfolio Guidance offered through NFG Wealth.

Join Now

Disclosure: I am/we are long SKT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is meant to identify an idea for further research and analysis and should not be taken as a recommendation to invest. It does not provide individualized advice or recommendations for any specific reader. Also note that we may not cover all relevant risks related to the ideas presented in this article. Readers should conduct their own due diligence and carefully consider their own investment objectives, risk tolerance, time horizon, tax situation, liquidity needs, and concentration levels, or contact their advisor to determine if any ideas presented here are appropriate for their unique circumstances. Furthermore, none of the ideas presented here are necessarily related to NFG Wealth Advisors or any portfolio managed by NFG.