How To Be A Great Investor, Part 5: Think Probabilistically

by Yuval TaylorSummary

- Outlines how to think probabilistically about the chances of a new factor’s or a new strategy’s success.

- Discusses the problems of optimization.

- Explains why it’s a mistake to estimate an “expected return” of an individual stock.

This article is the fifth in a 10-part series loosely based on Michael J. Mauboussin's white paper "Thirty Years: Reflections on the Ten Attributes of Great Investors." See "Part One: Be Numerate," "Part Two: Understand Value," "Part Three: Properly Assess Strategy," and "Part Four: Compare Effectively" for previous installments. And please keep in mind that although I'm basing my work on Mauboussin's, I am departing from his ideas on occasion.

Thinking Probabilistically

Whenever you come up with a new investment idea - whether it's a new security to buy, a new factor to consider, or a new strategy to implement - you naturally ask yourself whether this new idea will increase your portfolio returns or cause you to lose money (and, of course, how much). Thinking probabilistically involves assessing the probabilities and coming up with a reasoned answer. In this article I'll tackle strategies and factors first before dealing with individual securities.

Assessing the Odds of a New Factor or Strategy

If you're assessing the new factor or strategy on the basis of past performance, this involves three steps: assessing how well it would have worked in the past; assessing how correlative past results are to future (out-of-sample) results in general; and assessing whether the new factor or strategy will have better odds than the factor or strategy it is replacing (assuming you have to take the money from one in order to implement another).

If, on the other hand, you think that past performance is irrelevant to assessing future success, or that the correlation between past performance and future performance is unknowable, negative, or minimal, then you have to come up with another way of assessing future performance. But even in this case, you should also factor in your estimate of the correlation between your ideas and their future performance.

So let's take a concrete example. Let's say I want to replace a microcap-only strategy with a similar strategy that invests in stocks of all sizes, and that I believe that backtesting its past performance will give me some relevant results.

The first step is to test using robust methods. Test both systems on subsets of the universes you're going to be investing in and on subsets of the time period you're backtesting. Try to make the tests as similar as possible to each other.

So, for this example, I'm going to backtest my strategies using Portfolio123. I'm going to make the two strategies as similar to each other as possible except that one will emphasize microcaps and the other won't. In addition, I'll program my slippage costs for the microcap model to be more than double my costs for the other.

It turns out that in 14 out of 16 tests, my new strategy (all caps) gives worse results than my old one (microcaps). That gives me only a 12.5% chance that my new strategy is an improvement.

Now I estimate that the correlation between past performance and out-of-sample performance of stock strategies is around 0.2 (using Kendall's tau; 0.3 using Pearson's r). To get at that number I took 50 strategies that I had not backtested that were loosely based on screening rules that were written by others. I did so in order to minimize the chance of using factors that I had already developed or tested, since those might contaminate the experiment. I tested and compared these strategies' performance over various time periods.

This 0.2 correlation translates to a 40% chance that the past relative performance of any two strategies will reverse. (Here's the math, if you're interested; if not skip to the next paragraph. Kendall's tau is calculated by looking at every possible pair in the two series and classifying them as concordant or discordant, depending on whether they're in the same order or not. You then take the number of concordant pairs, subtract the number of discordant pairs, and divide by the total number of pairs. For example, let's calculate the correlation between 1 2 3 4 5 and 1 3 5 2 4. Each series has 10 pairs. 1 2 is concordant, 1 3 is concordant, 1 4 is concordant, 1 5 is concordant, 2 3 is discordant, 2 4 is concordant, 2 5 is discordant, 3 4 is concordant, 3 5 is concordant, and 4 5 is discordant. The correlation is thus (7 - 3)/10 = 0.4, and the chance that the relative position of a pair will reverse - a discordant pair, in other words - is three out of ten, or 30%. If the correlation had been 0.2, that would have been the result of (6 - 4)/10, and the chance of a discordant pair would be 40%).

To calculate the chance of an event occurring with a certain level of confidence (or a certain correlation), you multiply the chance that the event will occur by the chance that you're right, multiply the chance that it won't occur by the chance that you're wrong, and add them up. (The weird corollary is that if you're right precisely half the time - a correlation or confidence level of zero - the probability of an event occurring will always be 50%, no matter how likely or unlikely it is).

The probability that my new system will work better than my old one, then, is actually 42.5%. (The formula is 12.5%*60%+87.5%*40%.) This is still not high enough to bank on...

Now let's say you consider past performance a completely unreliable measure of the success of a strategy. And let's say you think your new strategy has a 70% chance of performing better than your old strategy. Well, the other number to take into account is the correlation between your predictions and what actually happens in the future.

In other words, how good a strategy designer are you? Let's say you design 10 strategies, and you judge one of those to be better than another. What is the chance that if you invest in both those strategies you'll be right? Try to be as objective as you can here.

So let's say that you think that this chance is about 60% (again, this represents a correlation of 0.2). Do the math again (70%*60%+30%*40%). It turns out you have a 54% chance of outperforming, not a 70% chance. So you might want to balance your investment between the two strategies, or combine them into one somehow.

So far, we've been discussing new strategies, but we can apply the same line of thinking to new factors. With factors, we have additional tools at our disposal because we can combine them using ranking and weighting. (We can combine strategies too, of course, but it's not as easy to do).

There are lots of ways to assess the effectiveness of a factor. The most traditional is to rank stocks in terms of the factor and see how well each quantile performed in the past. Many scholars simulate shorting the bottom quintile or decile and going long the top quintile or decile, but with some factors the middle quantiles may have performed the best.

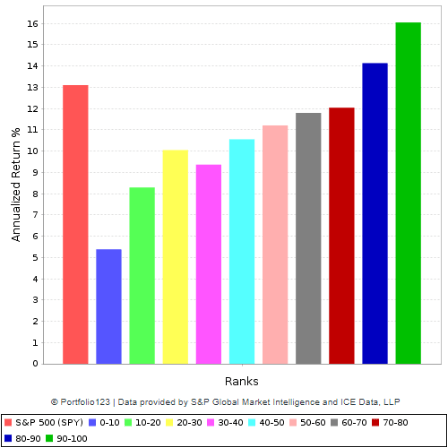

Let's look, once again, at a concrete example. I have a four-factor ranking system and I'm considering adding a fifth factor to it. The decile returns for my four-factor system over the universe of stocks that I invest in, with a one-month holding period over the last 10 years, looks like this:

If I add my new factor, I get a chart like this:

Clearly, the second system, with five factors, works better than the first.

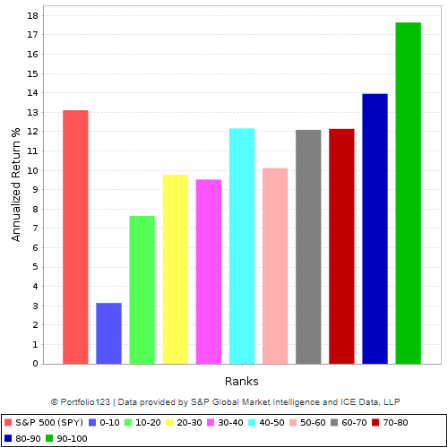

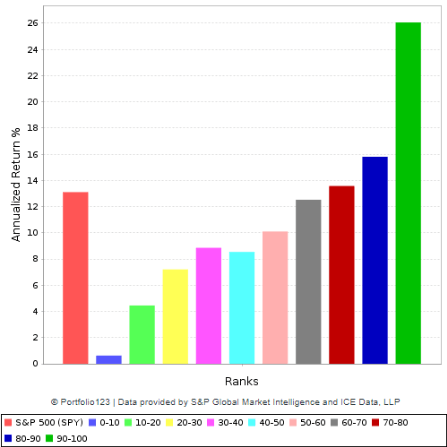

But if you look at probability, there's a problem with this way of thinking. You could keep adding factors and varying their weights ad infinitum until you had a system that was perfectly optimized according to the tests that you run on it. Your system will look something like this:

Or, taking a more granular view with 30 quantiles rather than 10:

Your system will be optimized precisely for the time period that you are testing it for.

What is the probability that a system optimized for a specific period of time will outperform a non-optimized system in a different time period?

I'm not sure. But I want to offer an analogy.

Let's say you're designing a robot to play poker. In order to do so, you want the robot to play against real poker players so that it can learn from practicing the game. So you collect the five best poker players in your hometown and the robot plays poker with them. It soon gets so good that it can beat them at any game any time. Now what would happen if you sat it down with five different poker players? It would probably fail miserably. Why? Because it would have learned how to beat the first five players based on their reactions to the cards and to each other, on their tells and on their strategies. On the other hand, if you had simply taught the robot the rules of playing poker and had fed it a variety of different examples and made it think about things more abstractly, it probably wouldn't have won nearly as handily against the first five players, but would probably have performed better against the second five.

The analogy is imperfect, I admit. Poker doesn't change as much as the stock market. A stock-market strategy or factor that worked really well in the 1960s may not have as much relevance in the 2020s as one that worked well in the 2010s.

At any rate, I recently ran an experiment. Remember those 50 strategies I told you about earlier? I took the ones that had performed best over a certain time period and tested them over a subsequent time period. Some of them did well, others did not. When I combined the ones that had done best in the first period into one comprehensive system, it did quite well in the second-better than most of those that had performed best in the first. When I optimized the one that had done best in the first period, fiddling with the factor weights until its performance was greatly improved, it didn't do as well as the combined system in the second period. When I optimized the combined system to improve its performance in the first period, its performance in the second period got worse. Now this is a very small and limited experiment, and my results are hardly representative. It would take me many months to optimize dozens of systems over different time periods and test them all. But this does indicate that optimization may not be the best idea.

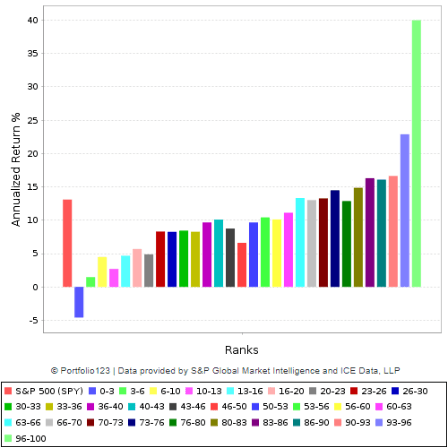

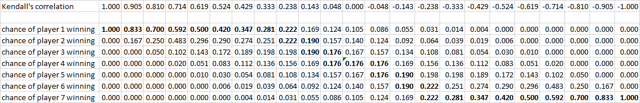

The other reason to be wary of optimization is the fact that with low correlations, what outperforms in one period is likely to suffer from mean regression and underperform in another period. In my previous article, "How to Bet," I published the following correlation table.

Let's say seven players play a tournament and player 1 wins, player 2 comes in second, and so on. The top row lists Kendall's correlation; the other rows list the chance of each player winning in a second tournament. (I created the table by taking every possible order of seven players and grouping them according to their correlation with the first order). You'll see that with a correlation of 0.333 or higher, the top player has the best chance of winning; with a correlation of 0.238, the top two players have an equal chance of winning; with a correlation of 0.143, the top player has a lower chance of winning than the second- and third-place winners; and with a correlation of 0.048, the top player has an equal chance of winning as the sixth player, with the second, third, fourth, and fifth all having a better chance. This is due to the fact that absent a perfect correlation, there will always be some element of mean regression.

Assessing the Odds of a Security's Future Price Increase

Let me start out by saying forthrightly that I believe that there is no way to do this. If there were, stock picking would be simple and profitable. And it's definitely not. Instead, your best bet is to think about your strategy's odds rather than the odds of an individual stock or ETF.

Mauboussin has a few pointed words about this:

"When probability plays a large role in outcomes, it makes sense to focus on the process of making decisions rather than the outcome alone. The reason is that a particular outcome may not be indicative of the quality of the decision. Good decisions sometimes result in bad outcomes and bad decisions lead to good outcomes. Over the long haul, however, good decisions portend favorable outcomes even if you will be wrong from time to time. ... Learning to focus on process and accept the periodic and inevitable bad outcomes is crucial."

Allow me to add a few words about stock-return odds in general.

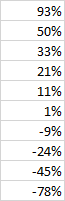

I recently took tens of thousands of random samples of one-year returns of stocks over the last 20 years (with a minimum market cap of $50 million and a minimum price of $1.00, and with no survivor bias). For such stocks, here are the decile median returns:

In other words, a randomly chosen stock out of this group will have a 10% chance of a 93% gain, a 10% chance of a 78% loss, and a 10% chance of each of the other numbers in between.

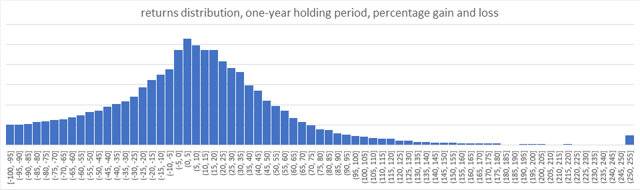

Here is a graph of the returns distribution (the rightmost bar represents stocks with a return greater than 250%).

The median stock gets a 5.35% return and the average stock gets an 8.12% return. If you were to randomly choose 20 stocks a year and then do so again and again thousands of times, your compounded annualized return would likely be between 3.9% and 8.7%. (This is significantly lower than what you'd get from simply investing in the S&P 500, since that index is made up of large-cap stocks with positive earnings, and those stocks are usually the least risky ones). On the other hand, if you were to randomly choose just one stock a year and then do so again and again thousands of times, your compounded annualized return would likely be a 100% loss, because at some point you're going to choose a stock that goes bankrupt. (This is the key to understanding why some small amount of diversification is essential: you need to minimize the probability of losing all your money. Because of this risk, I would advise you to never put all your money into fewer than four stocks).

The best you can hope for when you choose a stock is a returns distribution that is somewhat better than that of the average stock. Some writers, when they talk about choosing stocks, discuss "expected return." But doing so without considering the entirety of the returns distribution can lead to gross errors such as the one Harry Markowitz made at the outset of his seminal 1952 paper "Portfolio Selection," the foundation of Modern Portfolio Theory, in which he incorrectly "proved" that to maximize the expected return of a portfolio you should put all your money into the one security with the highest expected return. Markowitz ignored the laws of probability, as does MPT in general.

But that will be the subject of a future article...

My marketplace service, The Stock Evaluator, takes dozens of sensible factors into account in its weekly comprehensive ranking of over 4,000 stocks. It will definitely help you build a strong portfolio.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.