The Aramco IPO And The OPEC Meeting Could Support The Price Of Crude Oil

by Andrew HechtSummary

- The Saudis want to sell a piece of Aramco.

- Watch the OPEC meeting for clues.

- Iran provides support for the energy commodity.

- U.S. energy policy could shift.

- UCO and SCO are tools for those who do not trade futures but want to take risk in the oil market.

Saudi Aramco is the crown jewel of the Saudi Royal Family. It is also one of the world's most profitable businesses and would likely have the highest market capitalization of any company around the world. Oil production in Saudi Arabia is like turning on a hose; the vast amount of the energy commodity flows like water.

Saudi Arabia may have the eighteenth largest economy in the world, but it is one of the top three producers of petroleum.

On December 5 and 6, the international oil cartel will hold its biannual meeting in Vienna, Austria. OPEC will decide on production policy for the first six months of 2020. While Russia has an expanding influence over the cartel, Saudi Arabia is still the leading member when it comes to output. The most prominent member of OPEC would like to see the price of oil move to the upside in 2020 as it would make the value of Aramco higher.

We could see an increase in volatility in the global oil market over the coming weeks and into 2020. The ProShares Ultra Bloomberg Crude Oil ETF product (UCO) is a double-leveraged product that moves higher and lower with the price of the energy commodity. SCO is UCO's bearish counterpart.

The Saudis want to sell a piece of Aramco

In early 2018, the Saudis were all-in when it came to an initial public offering of Aramco shares. Crown Prince Mohammed bin Salman's Vision 2030 calls for social reforms, and a diversification of the Saudi economy away from dependence on crude oil revenues. The Crown Prince and heir to the Saudi throne hoped to sell 5% of the oil company and raise $100 billion for the nation's sovereign wealth fund. The proceeds would allow Saudi Arabia to make investments around the globe to diversify the economy.

The Aramco IPO fell apart in 2018 for many significant reasons. First, bankers around the world disagreed with the Saudi valuation. The Crown Prince had stated he believed Aramco should have a market cap of at least $2 billion. While some financial institutions agreed that Aramco should receive the highest valuation of any publicly-traded company in the world, almost none put the market cap above the $1.5 trillion level. The gulf between the Saudi's expectations and the reality of what the international banking community believed was a fair value for the company caused the IPO to fall apart.

The second and third reasons went to the heart of investing in a Saudi company. In October 2018, the murder of Washington Post journalist Jamal Khashoggi in Turkey created more than a few problems for the Crown Prince and Royal Family. Khashoggi had criticized the leadership of the nation, and he wound up dead and dismembered at the Saudi embassy in Turkey. Many governments around the world continue to believe that the journalist's blood is on the hands of the Crown Prince.

Shortly after the Khashoggi murder, the five-star Ritz Carlton hotel in Riyadh became a prison for some of the wealthiest Saudis, some of who were members of the Royal Family. The arrests, in most cases, led to settlements where vast amounts of wealth were returned to the Saudi government and the Royal Family. The world viewed the arrests and return of fortunes in exchange for freedom as extortion. The move to shake down the wealthiest Saudis was another warning for financial institutions that backed away from the Aramco IPO.

On September 14, the drone attack on Saudi oilfields that temporarily knocked out 50% of the nation's production and 6% of world supplies, was a reminder of the risk involved in investments in Saudi oil production and refining. While Aramco returned the output to the pre-attack level by the end of September, the Middle East remains the world's most turbulent and dangerous region. The risk is another factor that weighs on the potential valuation of Aramco.

Meanwhile, at the end of November 2019, the IPO is back on the table, with a potential valuation of $1.6 to $1.7 trillion. With Brent crude oil at $63.65 per barrel on November 25, it is in the Saudi's best interest to push the price of crude oil higher. The next opportunity will come on December 5 and 6.

Watch the OPEC meeting for clues

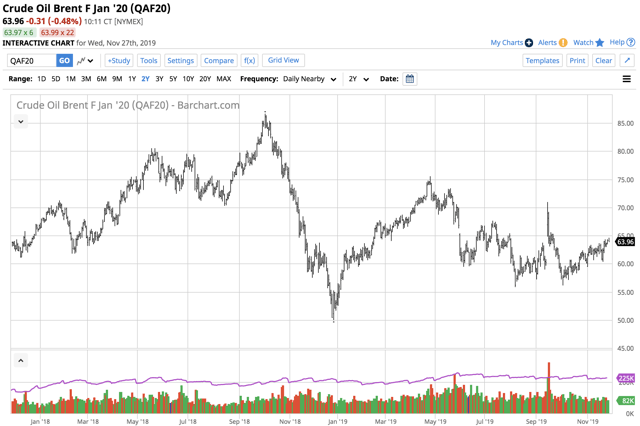

The sweet spot for the price of crude oil, according to the Saudis and the leading members of OPEC before the last meeting in early July, was between $60 and $70 per barrel.

Source: CQG

As the chart illustrates, nearby Brent futures have traded in a range from $55.88 to $71 since July 1. While the price moved above the range on September 16, the move to the upside was a short-term event that occurred in the aftermath of the drone attack on Saudi oilfields. The price spent a lot more time below the bottom end of the desired price band than the top over the past six months.

Balancing the Saudi budget requires a price of $80 per barrel, and the valuation of the Aramco IPO would benefit from a higher price of the energy commodity in 2020. Therefore, OPEC is likely to continue its current production cut of 1.2 million barrels per day into next year at the early December meeting. The Saudi oil minister may push for an even higher production quota to support the price of the energy commodity at the biannual gathering.

Iran provides support for the energy commodity

The September 14 drone attack was a reminder that Iran continues to underpin the price of crude oil. US sanctions continue to choke the Iranian economy. At the same time, the Saudis and Iranians remain mortal enemies with proxy wars on multiple fronts in the Middle East.

According to reports, Iran is enriching uranium at above the levels called for in the 2015 agreement because the US walked away from the deal. The potential for other incidents that could cause the price of oil to spike to the upside remains high.

The Middle East is home to over half the world's crude oil reserves. Any hostilities that impact production, refining, or logistical routes in the region could cause the price of crude oil futures to move appreciably higher in the blink of an eye.

U.S. energy policy could shift

The 2020 Presidential election in the United States could turn out to also be a referendum on energy production. Technological advances in fracking and a friendly regulatory environment under the Trump administration has pushed the United States to the head of the pack when it comes to oil production. As of the most recent data from the Energy Information Administration, the US produces 12.9 million barrels of crude oil each day. Daily output in the US exceeds Russia and Saudi Arabia.

Meanwhile, the growing support for the progressive wing of the opposition party and its support of the "Green New Deal" has the potential to cause a substantial change when it comes to oil and gas production. One of the leading candidates for the Democrats, Senator Elizabeth Warren, pledged to end fracking on day one of her administration if she becomes President. Any Democrat that faces President Trump will likely support the "Green New Deal," which could cause significant declines in US oil and gas output.

With a potentially dramatic shift in US energy policy on the horizon, we could see increased volatility in the oil and gas futures markets in 2020. The prices of oil and gas could begin to move higher and lower with the political polls and reach a crescendo of price variance on Election Day in November 2020.

UCO and SCO are tools for those who do not trade futures but want to take risk in the oil market

The price range in the NYMEX crude oil market in 2019 narrowed from $42.36 to $76.90 in 2018 to $44.35 to $66.60 this year. I expect that the price range will be a lot wider next year given the US election, the state of the Iranian economy, and the desire of the Saudis to push the price of crude oil higher in the face of an Aramco IPO.

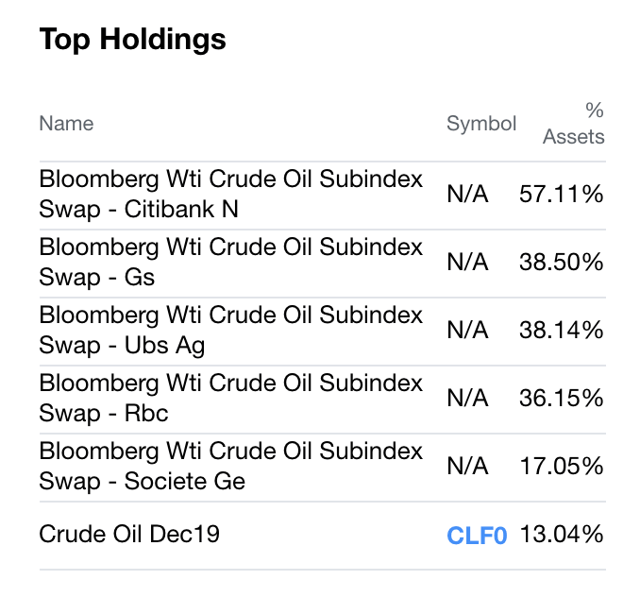

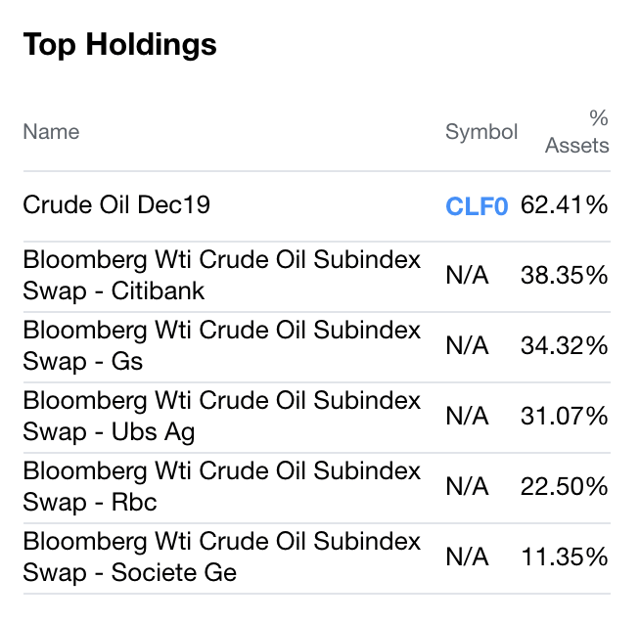

Volatility can be a nightmare for investors, but it creates a paradise for nimble traders with their fingers on the pulse of markets. The ProShares Ultra Bloomberg Crude Oil ETF product and its bearish counterpart ProShares UltraShort Bloomberg Crude Oil ETF (SCO) hold swaps and futures contracts to create double leverage based on the price movements in the NYMEX WTI crude oil contract.

UCO has net assets of $334.51 million and trades an average of over 3.4 million shares each day. SCO, the bearish product, has net assets of $75.18 million, and an average of over 2.6 million shares change hands each day. Both products charge an expense ratio of 0.95%.

The most recent top holdings of UCO include:

Source: Yahoo Finance

The most recent top holdings of SCO include:

Source: Yahoo Finance

UCO and SCO are products for those who do not venture into the crude oil futures arena but wish to take risk on the long or short side of the crude oil market.

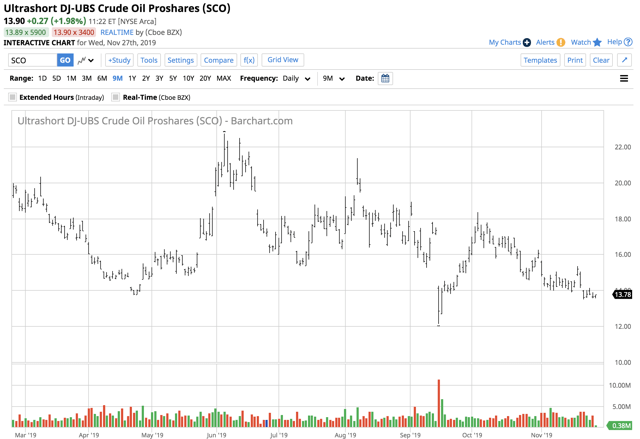

The price of January NYMEX futures moved from $61.48 on September 16 to $50.69 per barrel on October 3, a decline of 17.55%.

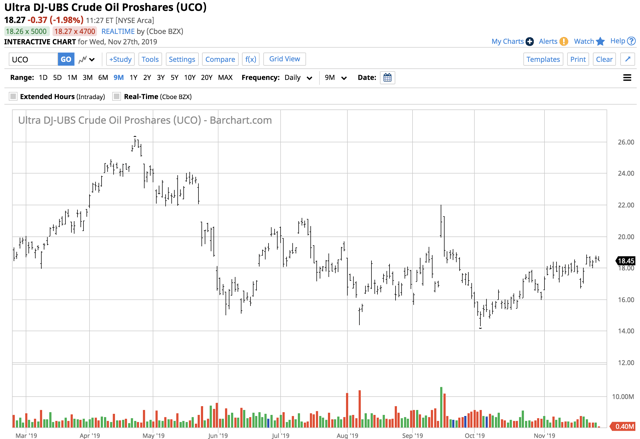

Source: Yahoo Finance

Over the same period, SCO, the bearish product, rose from $12.12 to $18.35 per share or 51.4%, which was just under triple the percentage move in the futures market for the double leveraged product.

The price of January NYMEX oil futures rose from $50.69 on October 3 to a high at $58.74 on November 22, or 13.70%.

Source: Yahoo Finance

The chart shows that the UCO product moved from $14.28 to $18.83 per share or 31.90% over the same period. The move to the upside was more than double the percentage gain in the oil futures market.

UCO and SCO are tools that are appropriate for short or medium-term risk positions on the long and short side of the oil markets. When it comes to the long-term, the leverage offered by the products causes time decay that can eat away at returns. I never hold UCO or SCO for periods longer than two months.

The potential for lots of price volatility over the coming year is high. Keep an eye on the early December OPEC meeting and the oil market's reaction to the decision and statement from the cartel. We could be in for a wild ride in the oil market in 2020. I believe that any price weakness over the coming weeks will be a buying opportunity for next year.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.